Category Archive: 4.) Marc to Market

And the Dollar Bounces Back, While BOE is in Focus

Overview: The Federal Reserve announced tapering and, like the Reserve Bank of Australia earlier in the week, did not validate expectations for an aggressive rate hike. Now the focus is on the Bank of England, where several officials seemed to goad the market into lifting short-term rates. The S&P 500 and NASDAQ rallied to new record highs yesterday and helped raise global shares today. Among the large markets in the Asia Pacific region,...

Read More »

Read More »

What Might it Take for the Fed to Deliver a Hawkish Tapering Announcement?

Overview: With the FOMC's decision several hours away, the dollar is trading lower against nearly all the major currencies. The Antipodeans and Norwegian krone are leading. The euro, yen, and sterling are posting minor gains (less than 0.1%). Most of the freely liquid and accessible emerging market currencies are also firmer. The Turkish lira is a notable exception. The decline in the core inflation and a smaller than expected rise in the...

Read More »

Read More »

RBA Jettisons Yield Curve Control but Continues to Resist Market Pressure

Overview: The third record close of the S&P 500 failed to lift Asia Pacific and European shares today. In Asia, the large bourses fell, except South Korea, which rallied a little more than 1%. Europe's Stoxx 600 is threatening to snap a three-day advance, while US index futures are soft. The US 10-year yield is firm, around 1.56%. European bonds are rallying. Peripheral yields are off 8-9 bp, while core rates are 3-5 lower. The Reserve...

Read More »

Read More »

November Monthly

Three main forces are shaping the business and investment climate: Surging energy prices, a dramatic backing up of short-term interest rates in Anglo-American countries, and the persistence of supply chain disruptions. The US and Europe have likely passed peak growth. Fiscal policy will be less accommodative, and financial conditions have tightened. Japan appears to be getting a handle on Covid and after a slow start. Its vaccination rate has...

Read More »

Read More »

US-EU Rapprochement, Can France and UK Do the Same?

Overview: It is mostly a quiet start to the new month. Most of Europe is closed for the All -Saints holiday and the week's key events start tomorrow with the Reserve Bank of Australia meeting. News that the Liberal Democrats retained a majority in the lower chamber of the Diet helped lift Japanese indices by 2%. Most of the large regional markets gained, though China and Hong Kong markets fell. US index futures are trading with a higher bias...

Read More »

Read More »

Greenback has Legs Ahead of the Fed and Jobs

The US dollar turned in a mixed performance last week but ended on a solid note. The pre-weekend and month-end activity may have exaggerated the greenback's gains, but we suspect ahead of the FOMC meeting and the US jobs data that is the direction. Our understanding of the technical condition also favors a stronger dollar. The jump in Australian rates may help explain why the Aussie was the strongest of the majors (~0.75%). However, the...

Read More »

Read More »

The Week Ahead: Four Central Banks and the US Jobs Report

The Bank of England and the Federal Reserve meetings are the highlights of the week ahead. Usually, the US jobs report is the main feature of the beginning of a new month's high-frequency data cycle. However, the FOMC meeting two days earlier may take away some of its significance, even if it still possesses some headline risk. Two other major central banks meet in the first week of November. The Reserve Bank of Australia meets early on November...

Read More »

Read More »

Rate Adjustment Continues and the Greenback Pares the Week’s Losses

Overview: Disappointing Apple and Amazon earnings news after the NASDAQ set a record high set the stage of a weaker bias in the Asia Pacific region today. China and Japan still posted gains, while local developments, like an unexpected drop in South Korea's industrial output, and Australia struggling to exit its yield-curve control, saw equities lose more than 1%. Europe's Stoxx 600 is paring this week's gains but is holding on to some for the...

Read More »

Read More »

Eyes Turn to the ECB and the First Look at Q3 US GDP

Overview: The market awaits the ECB meeting and the first look at the US Q3 GDP. The pullback in US shares yesterday was a drag on the Asia Pacific equities. It is the first back-to-back loss of the MSCI Asia Pacific in a few weeks. Europe's Stoxx 600 is recovering from early weakness and US future indices are firm. The US 10-year yield is flat, around 1.55%, after falling around 15 bp over the past four sessions. European bonds are paring...

Read More »

Read More »

Today’s Big Events Still Lie Ahead

Overview: The day’s big events lie ahead: the UK’s budget, the Bank of Canada, and the central bank of Brazil meetings. The US data on tap, especially trade and inventories, will allow economists to fine-tune their forecasts for tomorrow’s first estimate of Q3 GDP. The mixed tech earnings helped spur a bout of profit-taking in Asia Pacific equities, where most of the large markets fell. Europe’s Stoxx 600 is posting a slight loss for the first...

Read More »

Read More »

Strong Earnings and Easing of (Some) Political Tensions Bolster Sentiment

Overview: Helped by new record highs in the S&P 500 and Dow Industrials, constructive earnings, and an easing of political tensions, risk appetites are robust today. The MSCI Asia Pacific Index recouped yesterday's losses plus more as the large equity markets in the region, but China and Hong Kong rose, led by a more than 1% gain in Tokyo. European shares are rallying, and the Stoxx 600 is posting gains for the ninth session in the last 11...

Read More »

Read More »

Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached...

Read More »

Read More »

Are the Technicals Anticipating a Soft US GDP Report? Could it be a “Sell the Rumor buy the Fact?”

Rising yields and record highs in the S&P 500 and NASDAQ failed to lift the dollar. Indeed, the greenback fell against all the major currencies, even the Japanese yen, against which it had reached new four-year highs (~JPY114.70) before pulling back. On the other hand, the Antipodean currencies and the Norwegian krone continued to lead the move against the US dollar. The Aussie rose to new three-month highs, while the Kiwi, Nokkie, and...

Read More »

Read More »

Week Ahead: The First Look at US and EMU Q3 GDP and more Tapering by the Bank of Canada

The macro highlights for the week ahead fall into three categories. First are the preliminary estimates for Q3 GDP by the US and the EMU. Second, are the inflation reports by the same two. The US sees the September PCE deflator, which the Fed targets, while the eurozone releases the first estimate for October CPI. Third are the meetings of three G7 central banks, the BOJ, the ECB, and the Bank of Canada. The broad backdrop includes softening...

Read More »

Read More »

The Euro and Sterling Remain within Tuesday’s Ranges

Overview: A new record high in the S&P 500 yesterday and news that Evergrande had made an interest rate payment failed to lift most Asia Pacific bourses, though Japan and Hong Kong, among the large markets, posted modest gains. The Dow Jones Stoxx 600 is pushing higher in the European morning to put its finishing touches on its third consecutive weekly gain. US tech is trading off, and this is weighing on the NASDAQ futures while the S&P...

Read More »

Read More »

Markets Turn Cautious

Overview: After a couple of sessions of taking on more risk, investors are taking a break today. Equities are mostly lower today after the S&P 500's six-day advance took it almost to its record high, while the NASDAQ's streak was halted at five sessions.

Read More »

Read More »

Consolidative Session as Markets Await Fresh Incentives

Overview: The markets lack a clear direction today and await fresh incentives. After gaining almost 1% yesterday, the MSCI Asia Pacific Index slipped. Japan, Hong Kong, and Australia are among the few equity markets that rose.

Read More »

Read More »

Dollar Slumps

Overview: While equities and bonds are firmer, it is the dollar's sell-off that stands out today. The greenback has retreated broadly.

Read More »

Read More »

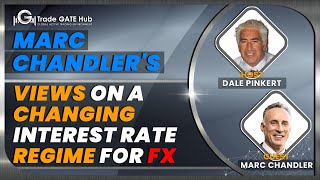

Marc Chandler’s views on a changing interest rate regime for FX

In today's live stream, Coach Dale Pinkert welcomes Marc Chandler who is a foreign exchange market analyst, writer, speaker, and professor.

Read More »

Read More »

Greenback’s Gains Pared Mostly, but Extended Against the Yen

The Antipodeans and the Scandis led last week's move against the dollar, registering more than 1% gains. The yen was the weakest of the major currencies, falling almost 1.75%, its worst week since March 2020.

Read More »

Read More »