Category Archive: 4.) Marc to Market

The Italian Job

Italy is the epicenter of the next potential populist "shock." A defeat of the referendum is seen as intensifying the political risk. Renzi has wavered again regarding his political future if the referendum loses.

Read More »

Read More »

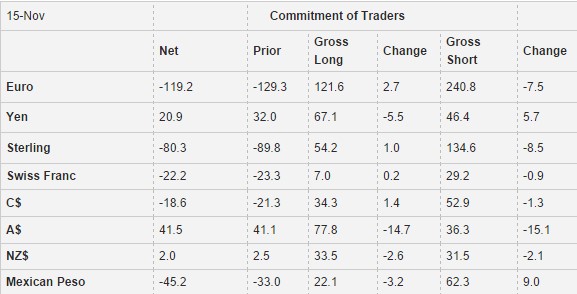

Weekly Speculative Positions: Dramatic Spot Currency Moves not Reflected

What is most noticeable about the CFTC Commitment of Traders report for the reporting week ending November 15 is what is not there: Activity. With the Australian dollar being the sole exception, we are struck by the apparent fact that dramatic spot price action and a what seemed like an impulsive trend move seemed not to be reflected in the futures position adjustments by speculators.

Given the strength of the US dollar after the election,...

Read More »

Read More »

If TPP is Dead…

TPP may be dead, but China is spearheading an alternative regional free trade deal. It is not as ambitious as the US-led TPP. China and Russia are eager to re-establish spheres of influence.

Read More »

Read More »

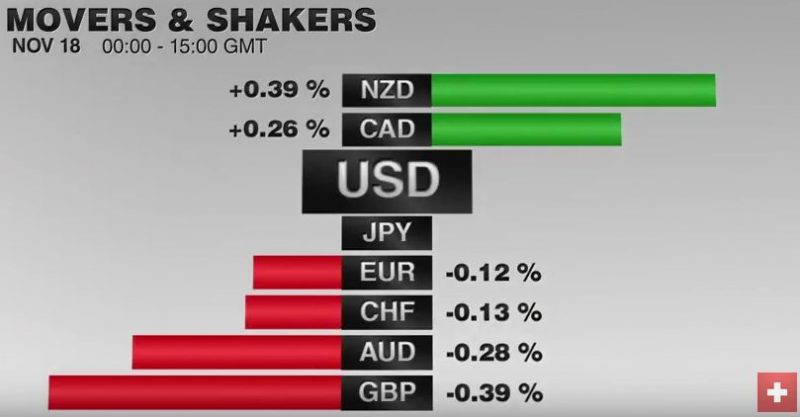

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

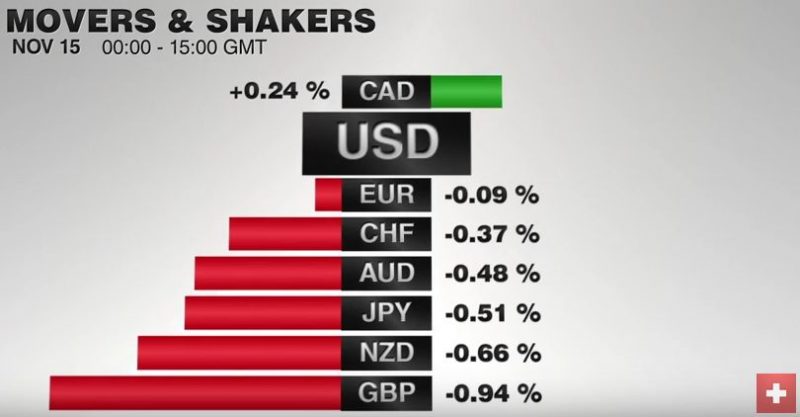

FX Daily, November 15: Investors Catch Breath, Markets Consolidate

After a dramatic run since the US election, the capital markets are consolidating today. It is a bit too restrained to such a Turn Around Tuesday is unfolding. The euro is struggling to sustain corrective upticks through $1.08, and after a pullback is, the greenback pushed back above the JPY108 level like a beach ball held under water.

Read More »

Read More »

Great Graphic: Euro-the Big Picture

Most economists are focusing on either US monetary policy or US fiscal policy. We focus on the policy mix. After the policy mix, politics is also a weigh on the euro. Our long-term call is for the euro to revisit the lows from 2000.

Read More »

Read More »

Cool Video: Reiterate Bullish Dollar Call on Bloomberg

I was on Bloomberg TV this morning to weigh in on the dollar's rally. The US Dollar Index is flirting with the 100 area that has blocked side since last year. In my work, after a big run-up form around 80 in mid 2014, the Dollar Index has been consolidating. I have long anticipated a spring board for another leg up.

Read More »

Read More »

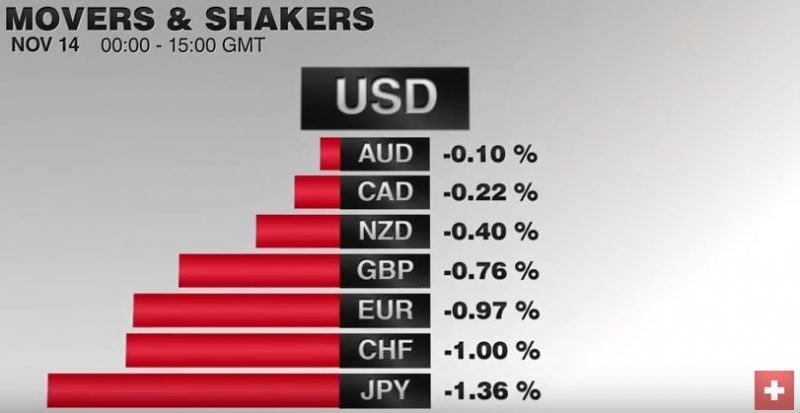

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

FX Weekly Preview: Forces of Movement

US election results accelerated forces that were already present. Interest rates have appeared to bottom, fiscal stimulus in Canada and Japan already evident, and divergence between US and EMU/Japan monetary policy. US stimuli may reach when the economy is already near trend.

Read More »

Read More »

Great Graphic: Growth in Federal Spending

Federal spending growth under Obama is lower than under the previous four presidents. Subsequent to the chart, US federal spending has increased. It will likely increase more under the next President.

Read More »

Read More »

An English Breakfast Causes Less Indigestion than the British Brexit

Prime Minister May is appealing the High Court decision and preparing to present broad guidelines of her strategy. An early election; even if it could be arranged, it is not clear which wing of the Tories would win. May missed the opportunity to provide strong leadership when it was most needed.

Read More »

Read More »

Great Graphic: Shifting Trade-Weighted Exchange Rates

The dollar's trade-weighted index is firming and a couple percentage points from the year's high set in January. The yen's trade-weighted index is at several month lows, but remains dramatically higher ear-to-date. The euro's trade-weighted index has begun falling amid concerns that it is the next focus for the anti-globalization/nationalism movement. Sterling's trade-weighted index is extending its recovery as a softer Brexit is anticipated, the...

Read More »

Read More »

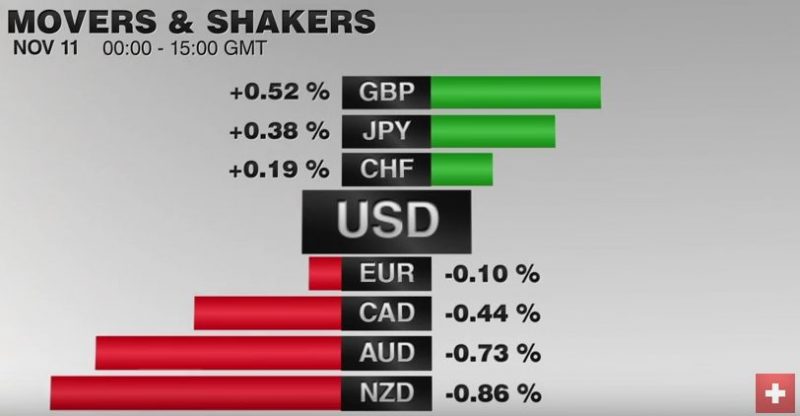

FX Daily, November 11: Ramifications of Trump’s Election Continue to Drive Markets

The forces unleashed by the US election results continue to drive the capitals markets. The combination of nationalism, reflation and deregulation are seen as good for US equities and the US dollar. It has not been so kind to US Treasuries, where the 10- and 30-year yield has risen about 32 bp this week coming into today's federal holiday that closes the bond market, while the stock market is open.

Read More »

Read More »

Rising US Premium Lifts Dollar-Yen

US 10-year rate premium is the largest in 2.5 years. US 2-year premium is the most since Q4 2008. Japanese investors likely will be buying foreign bonds, while foreigners may see opportunities in Japanese stocks after being large sellers in the first 9 months of the year.

Read More »

Read More »

Cool Video: Chat with the FT’s John Authers

I was just as surprised as anyone by the election outcome. The initial market reaction was not as surprising, but the dramatic reversal was. About a dozen hours after the election was called, John Authers from the Financial Times came to my office and we chatted. Check out the cool video here.

Read More »

Read More »

FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better...

Read More »

Read More »

China Update

The evolving political situation in China is worth monitoring. China's trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so.

Read More »

Read More »

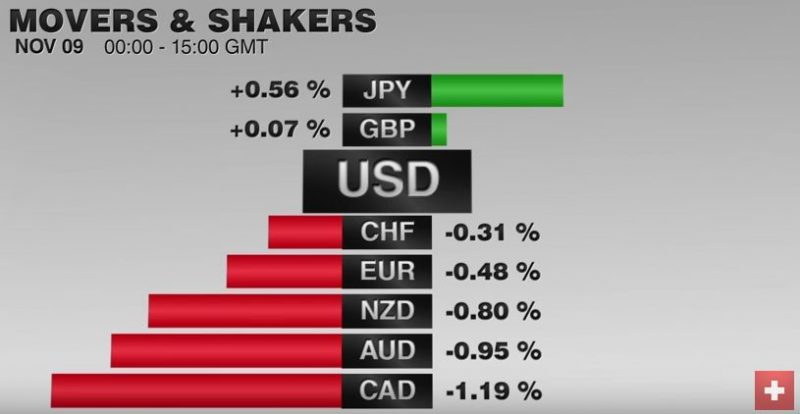

FX Daily, November 09: Mourning in America?

Global capital markets have been roiled by Trump's stunning victory Swiss National Bank's Andrea Maechler promised interventions for the case that Trump wins the elections. It was probably not necessary. Only the EUR/CHF fell to 1.0753. Strangely the dollar and markets recovered.

Read More »

Read More »