Category Archive: 4.) Marc to Market

Great Graphic: Growth in Federal Spending

Federal spending growth under Obama is lower than under the previous four presidents. Subsequent to the chart, US federal spending has increased. It will likely increase more under the next President.

Read More »

Read More »

An English Breakfast Causes Less Indigestion than the British Brexit

Prime Minister May is appealing the High Court decision and preparing to present broad guidelines of her strategy. An early election; even if it could be arranged, it is not clear which wing of the Tories would win. May missed the opportunity to provide strong leadership when it was most needed.

Read More »

Read More »

Great Graphic: Shifting Trade-Weighted Exchange Rates

The dollar's trade-weighted index is firming and a couple percentage points from the year's high set in January. The yen's trade-weighted index is at several month lows, but remains dramatically higher ear-to-date. The euro's trade-weighted index has begun falling amid concerns that it is the next focus for the anti-globalization/nationalism movement. Sterling's trade-weighted index is extending its recovery as a softer Brexit is anticipated, the...

Read More »

Read More »

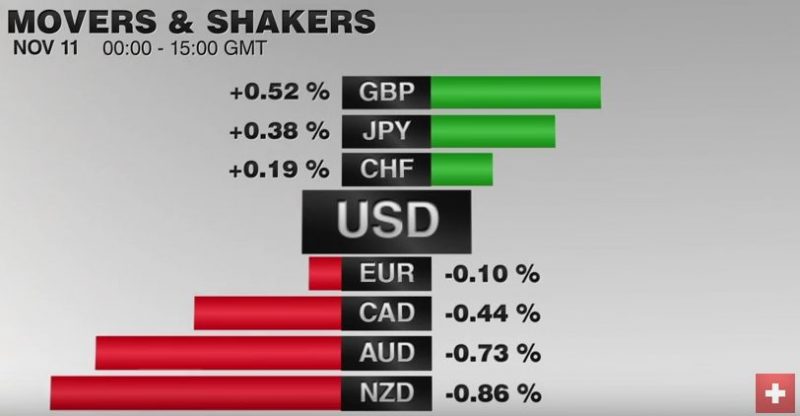

FX Daily, November 11: Ramifications of Trump’s Election Continue to Drive Markets

The forces unleashed by the US election results continue to drive the capitals markets. The combination of nationalism, reflation and deregulation are seen as good for US equities and the US dollar. It has not been so kind to US Treasuries, where the 10- and 30-year yield has risen about 32 bp this week coming into today's federal holiday that closes the bond market, while the stock market is open.

Read More »

Read More »

Rising US Premium Lifts Dollar-Yen

US 10-year rate premium is the largest in 2.5 years. US 2-year premium is the most since Q4 2008. Japanese investors likely will be buying foreign bonds, while foreigners may see opportunities in Japanese stocks after being large sellers in the first 9 months of the year.

Read More »

Read More »

Cool Video: Chat with the FT’s John Authers

I was just as surprised as anyone by the election outcome. The initial market reaction was not as surprising, but the dramatic reversal was. About a dozen hours after the election was called, John Authers from the Financial Times came to my office and we chatted. Check out the cool video here.

Read More »

Read More »

FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better...

Read More »

Read More »

China Update

The evolving political situation in China is worth monitoring. China's trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so.

Read More »

Read More »

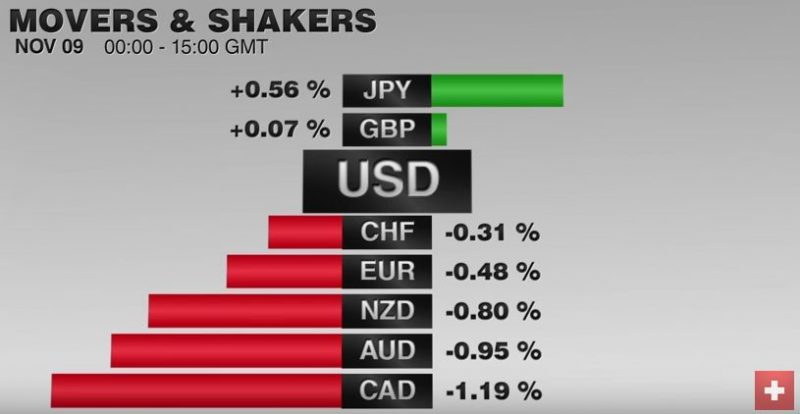

FX Daily, November 09: Mourning in America?

Global capital markets have been roiled by Trump's stunning victory Swiss National Bank's Andrea Maechler promised interventions for the case that Trump wins the elections. It was probably not necessary. Only the EUR/CHF fell to 1.0753. Strangely the dollar and markets recovered.

Read More »

Read More »

Cool Video: Bloomberg Interview – Peso, Equities, Yuan

Even before the my polling station opened today, I had the privilege of being on Bloomberg Surveillance today with Gina Cervetti and Tom Keene. We talk about a wide range of issues directly and tangentially related to the US election. We discuss the outcome the market appears to be discounting.

Read More »

Read More »

Romanticizing the Gig

Gigs are part of the new lexicon for a long existing phenomenon. It is largely but not solely a capital offensive to lower labor input costs. There may be short-run advantages but long-term challenges from the growth of the gig or contingent workforce.

Read More »

Read More »

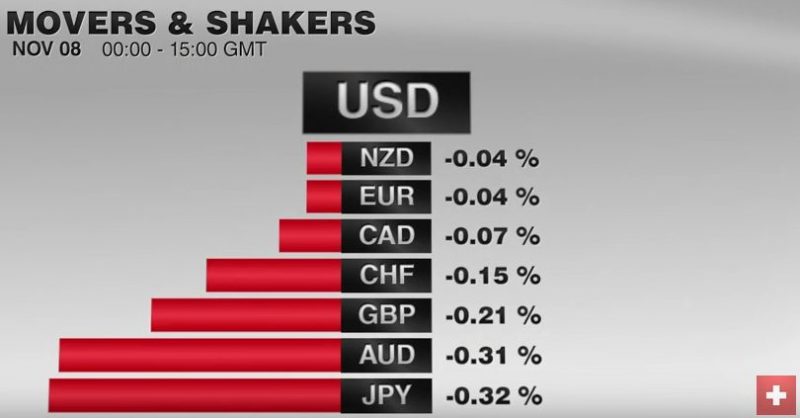

FX Daily, November 08: Consolidation Featured as Market Catches and Holds Breath

The equity markets snapped their losing streak yesterday and are consolidating today. The US dollar is narrowly mixed. The euro and sterling are slightly firmer, but well within yesterday's ranges. The dollar-bloc is a bit lower, and once again the Australian dollar is struggling to sustain moves above $0.7700.

Read More »

Read More »

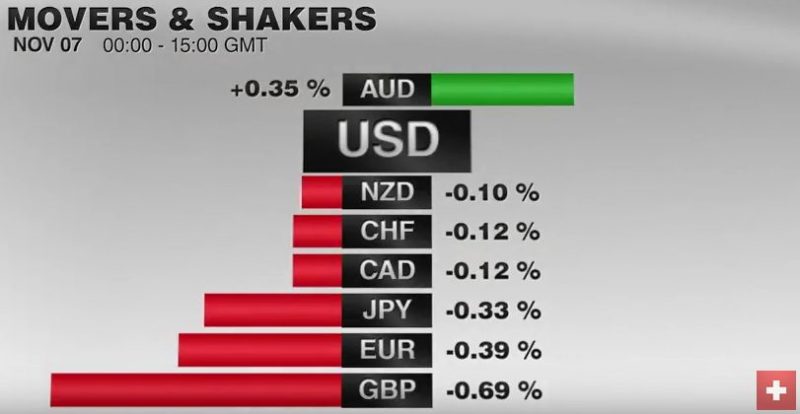

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »

FX Weekly Preview: The US Election is The Driver in the Week Ahead

Neither the Mexican peso's performance nor the fed funds futures seem to show that investors think the election is very close. Not all poll analysis showed what the Financial Times called "knife-edge". None of the poll analysis showed Trump winning, and many appear to have stabilized over the last couple of days.

Read More »

Read More »

Carney’s Tenure: Brief Thoughts

Not only is Carney not resigning, but he agreed to stay a year longer than initially agreed. He will stay for the two years that Brexit is negotiated. Sterling rallied, but did not challenge last week's highs.

Read More »

Read More »

FOMC Says Little New, December Hike Remains Likely Scenario

Fed does not expand much on Sept. statement. Bar to December hike seems low. There were two rather than three dissents.

Read More »

Read More »

Sterling High Court Decision on Parliament’s Right to Vote on Brexit

The UK High Court defends Parliament's right to vote before Article 50 is triggered. The decision will be appealed. Sterling approached an important resistance as it extended its rally for the fifth session.

Read More »

Read More »

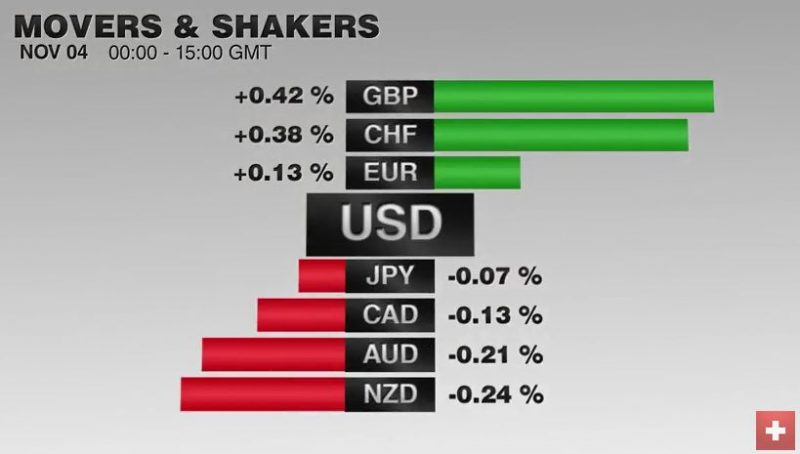

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

Did Carney Really Open the Door to a Rate Hike?

Sterling's recovery began before today and went through technical levels that accelerated the advance. The interest rate market did not change sufficiently to indicate a change in policy expectations. The High Court decision will be appealed.

Read More »

Read More »

US Jobs Data Maintains Fed Hike Expectations

US jobs data was largely in line or better than expected. The stronger earnings growth may be more important than the headline. Canada's data was mostly disappointing.

Read More »

Read More »