Carry Trades, Central Bank Interventions, Fundamental Data, mean reversion, Momentum Trades, Overshooting, trend following

Read More »

Category Archive: 4.) FX Theory

(5) The Balance of Payments Model

The Balance of Payments is the sum of current and capital account. The Balance of Payments model states that a currency appreciate when the Balance of Payments is positive. We give an explanation in around 400 words, that clarifies the relationships.

Read More »

Read More »

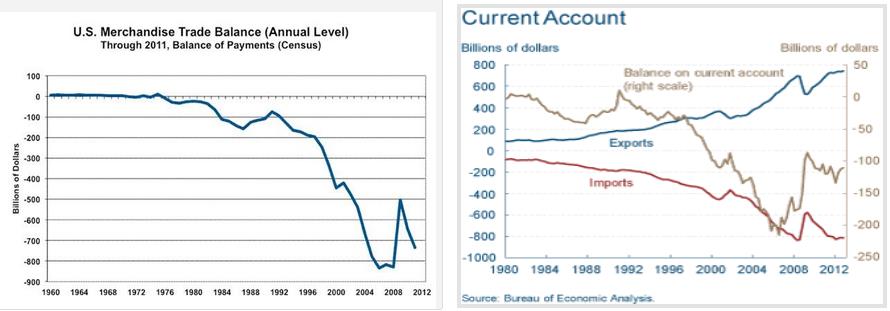

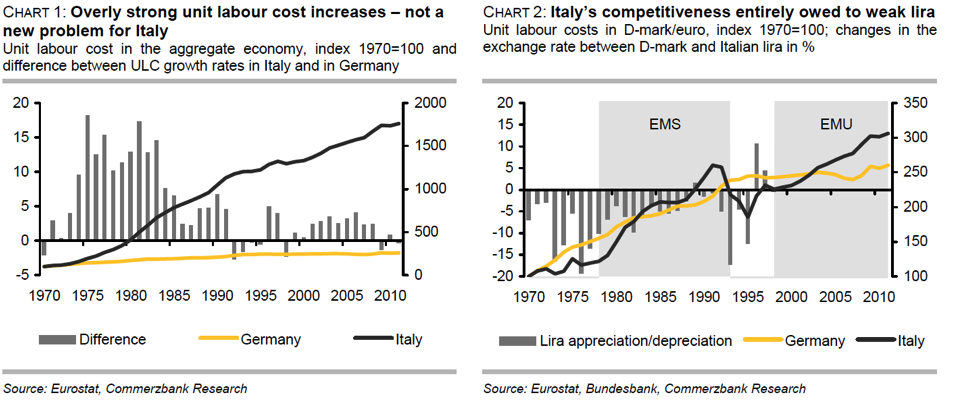

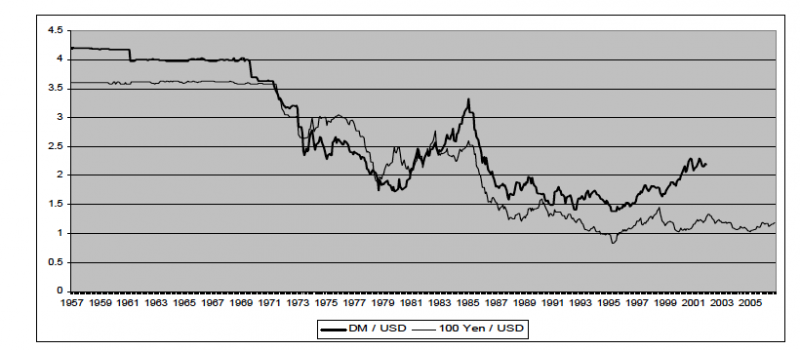

(5.1) FX Theory: The Trade Surplus and the Real Exchange Rate Mean Reversion

George Dorgan explains why currencies of countries with trade surpluses must appreciate over the long-term. Thanks to these surpluses, inflation and costs of companies rise more slowly than in other countries. In Forex a mean reversion does not exist, but only an inflation-adjusted reversion to the mean: a real exchange rate mean reversion or in short the "real mean reversion."

Read More »

Read More »

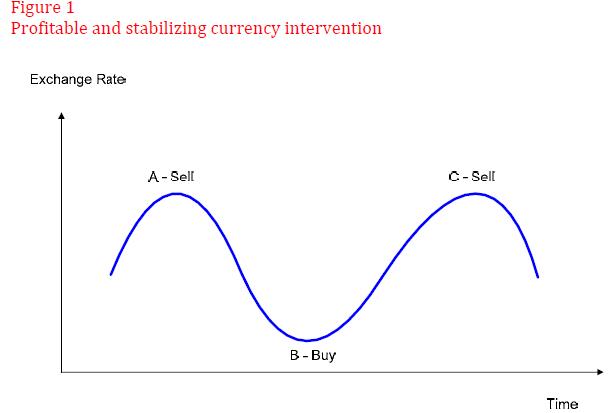

(5.2) FX Rates, the Balance of Payments Model and Central Bank Interventions

We will apply the balance of payments model for determining FX rate movements and FX interventions by central banks.

Read More »

Read More »

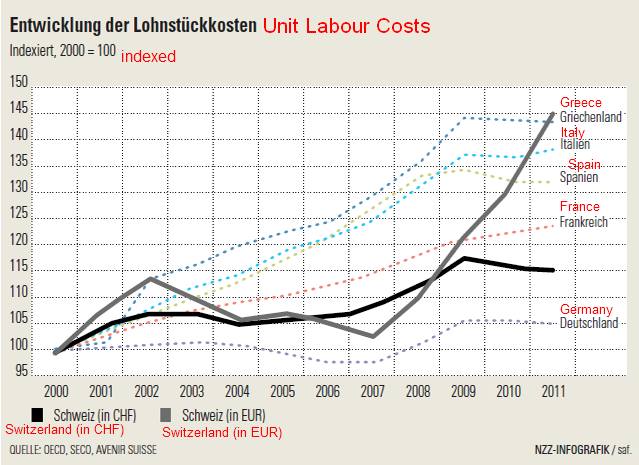

(5.3) FX Theory: Penn Effect and Balassa Samuelson Effect

George Dorgan extends the previous discussion on trade surplus countries. Now he explains the Penn and the Balassa-Samuelson Effect. He applies these principles to Germany, to Greece and to Switzerland.

Read More »

Read More »

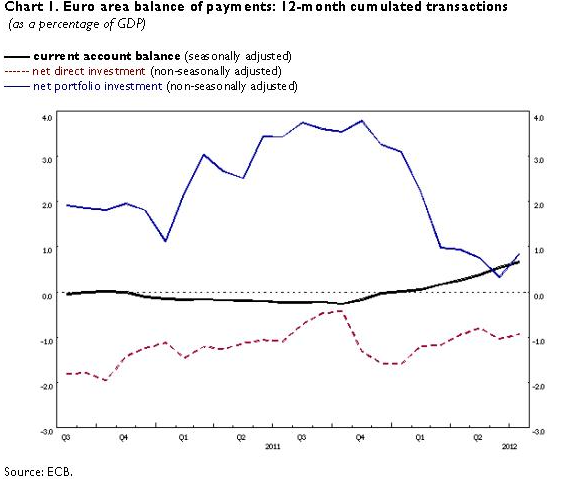

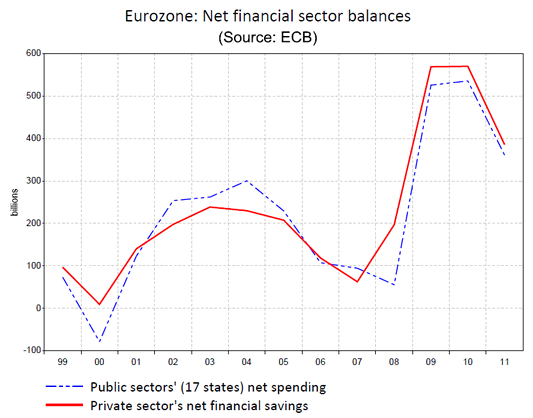

(5.4) The Relationship between Current Accounts and Savings

Private savings finance public deficit and current account surpluses. Important for understanding the euro crisis and the drivers of government bond yields.

Read More »

Read More »

(5.6) The Holy Grail of Long-Term Currency Movements: Crowther’s Balances and Imbalances of Payments

The former chief editor of "The Economist" Geoffrey Crowther published a great work on the development of balance of payments and current accounts over the long-term. It divides development into six phases, which are analogous to Shakespeare's seven phases of life.

The seven stages are:

Young debtor nation, Mature debtor nation, Debt repayment nation, Young creditor nation, Mature creditor nation, Credit disposition /Asset Liquidation nation and...

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

(6.1) FX Theory: The relationship between Current Accounts Surpluses and the Carry Trade

The EUR/USD is going on its longest winning streak for a long time. Since May 27, it has improved from 1.2850 to 1.3396 and is approaching 1.34. What are the reasons?

Read More »

Read More »

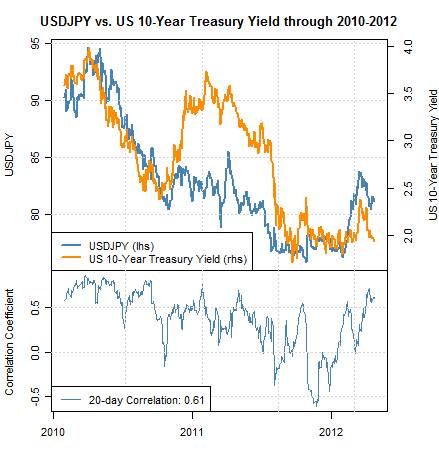

(7) FX Theory: The Asset Market Model

The Asset Market Model implies that a currency will be in higher demand and should appreciate in value, if the flow of funds into financial market of the country such as equity and bonds markets increase.

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »

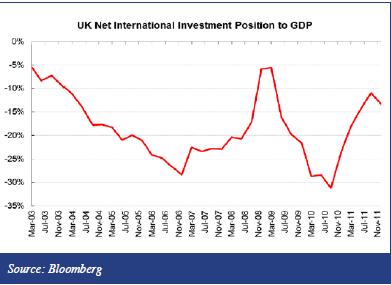

(9) FX Theory: Wealth and Net International Investment Position

Availability of funds (wealth and the international investment position): One of the 5 key indicators for FX rates. Often currencies of countries with a a lot of funds appreciate when markets decline.

Read More »

Read More »

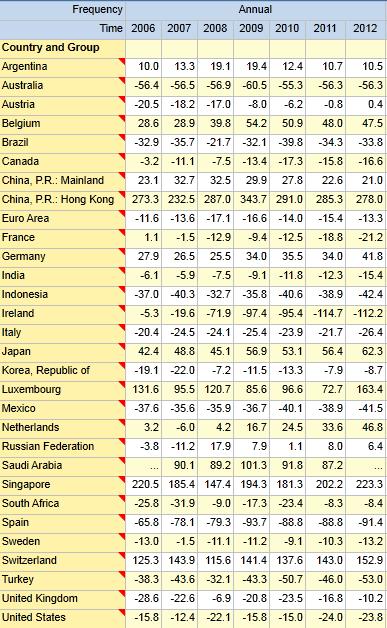

(9.1) Net International Investment Position

A comparison of the net international investment position (NIIP) of several countries. We explain why asset valuation effects this position at the example of the United States.

Read More »

Read More »

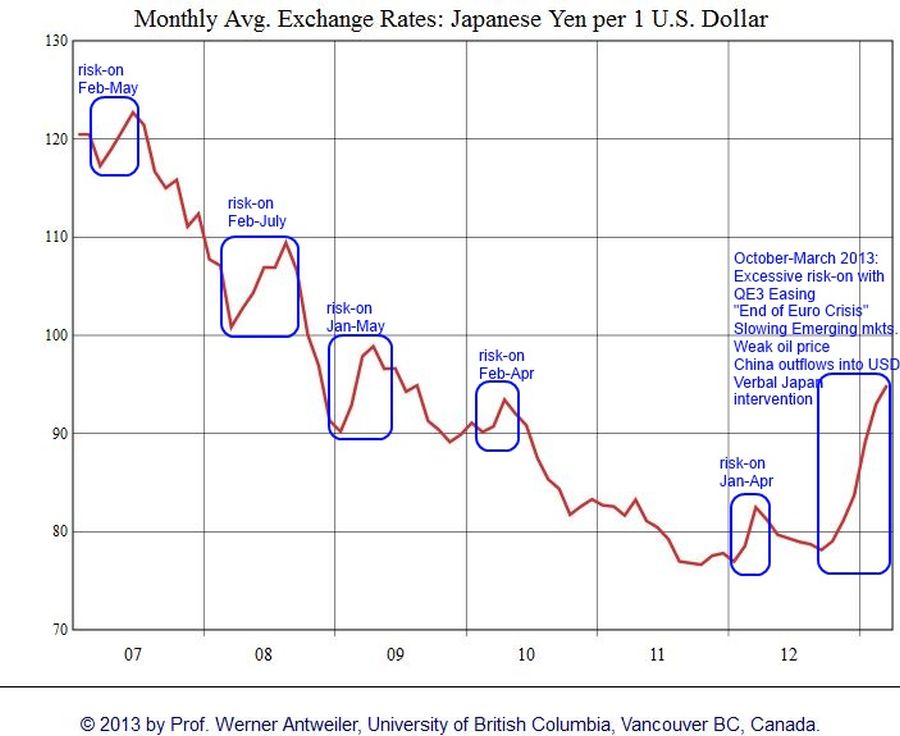

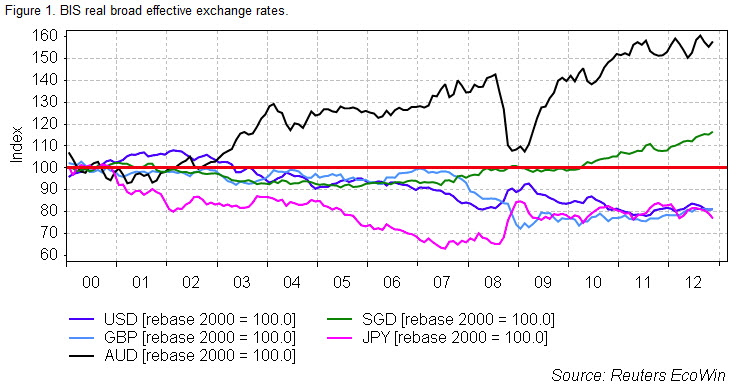

(8.1) Yen Weakness: Risk-Off Environment, Abenomics or Trade Deficit?

The yen overshot during and after the financial crisis. The USD/JPY fell from 120 in 2008 to lowest levels of 74, by 62%, but rose to 102 again. What are the reasons?

Read More »

Read More »

(12) FX Rates, Contrarian Investments and the Misleading Concept Called GDP

We extended our existing post to contrarian investing. It was published on Seeking Alpha and awarded the Editor's Pick.

Gross Domestic Product(ion) is (or has become) a measurement of activity and consumption, but not of capital accumulation and production.

In many cases, GDP growth is negatively correlated to saving. Higher savings (aka austerity) leads to lower GDP growth today, but to higher GDP in the future.

In its worst case, GDP growth...

Read More »

Read More »

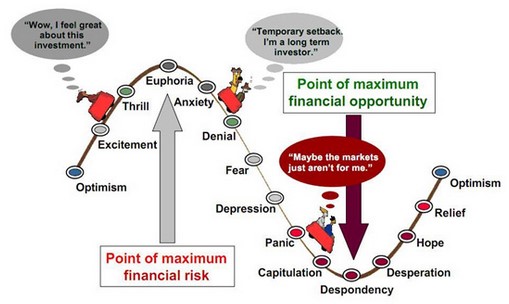

(14) Best Trading Tips

Read our contrarian insights: We provide regularly contrarian indications to technical Forex movements. Trade after work and do not look at markets during the day, third read scary facts about stops.

Read More »

Read More »

(13.1) Is the Swedish Krona a Safe-Haven?

Arguments in favor of and against the Swedish Krona,as safe-haven during the euros crisis. Extracts from tradingfloor.com

Read More »

Read More »