The balance of payments leads to many confusions because definitions vary. For example, the IMF’s definition is different from the usual or historical definition. Secondly, the relationship between the balance of payments and reserve assets is difficult to grasp, especially in the IMF definition. Thirdly the origin of “errors and omissions” is often unclear. Therefore …

Read More »

Category Archive: 4.) FX Theory

Ist der Franken überbewertet? Kaufkraftparitäten

Nach dem starken Anstieg des Frankens in den letzten Jahren, sagten Ökonomen wie O’Neilly von Goldman Sachs oder die der Schweizerischen Nationalbank (SNB), dass die Schweizer Währung überbewertet wäre. Einige benutzen den “Big Mac Index”, den OECD-Kaufkraftsparitätsindex oder Kaufkraftparitäten auf der Basis von Konsumentenpreisen als Beweis. Wir zeigen, dass aber nur die Kaufkraftparität aufgrund von …

Read More »

Read More »

5) FX Theory

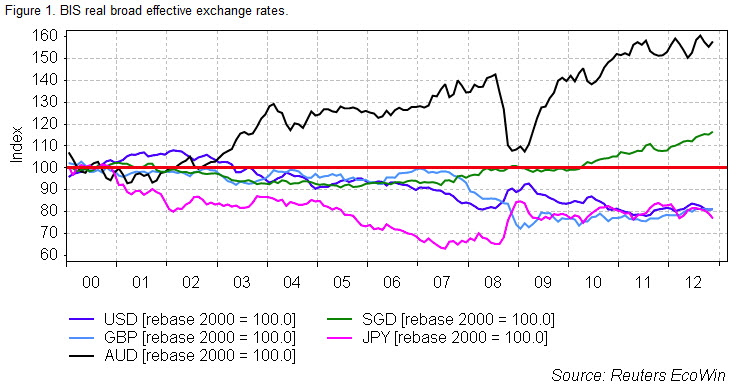

Content : What Determines FX Rates? Purchasing Power Parity, Real Effective Exchange Rate, Balance of Payments Model, (Reverse) Carry Trade, Asset Market Model, Real Mean Reversion, lots more

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »