On this page we show that

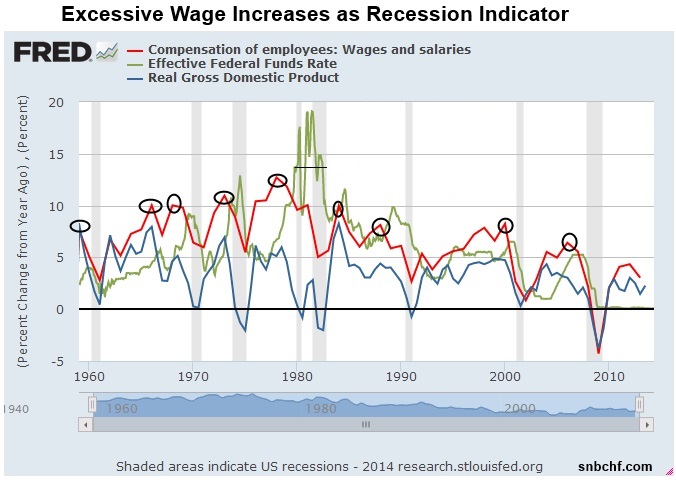

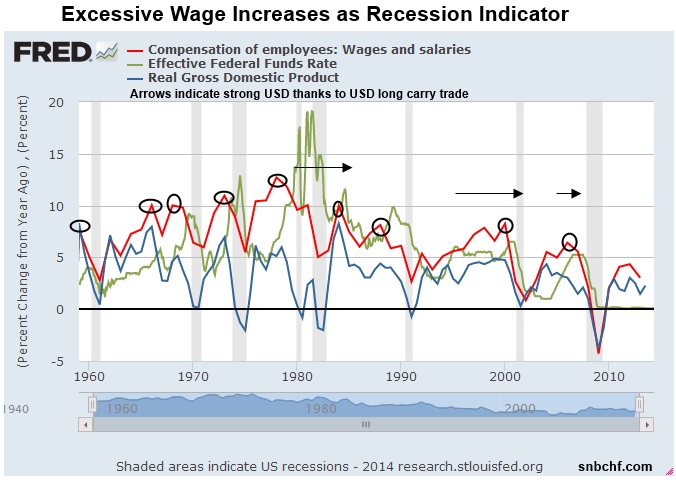

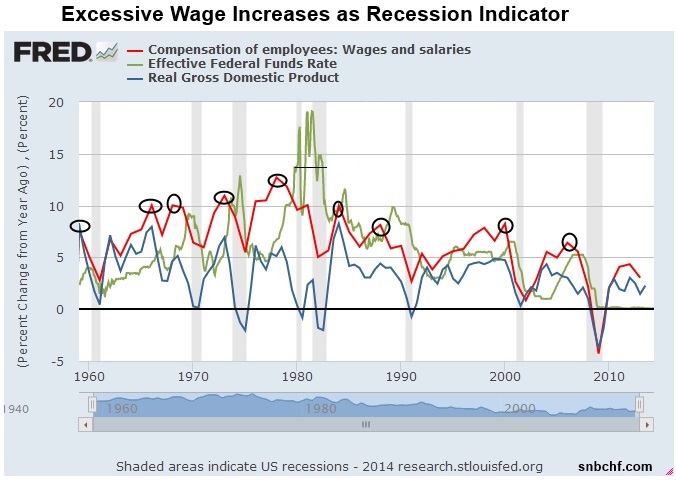

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Category Archive: 8) Economics

When Will the Renminbi Become a Reserve Currency?

We recently explained that China will overtake the United States not only for GDP but also for wealth. In this post we explain what is still missing to become a world reserve currency and how quickly this could happen.

Read More »

Read More »

Inflation Expectations = Real GDP Growth = Ten-Year Treasury Yields – 0.5%?

Inflation expectations drive the Fed's and markets behaviour. Bond yields adjust, often but not always, with an inflation premium against short-term rates.

Read More »

Read More »

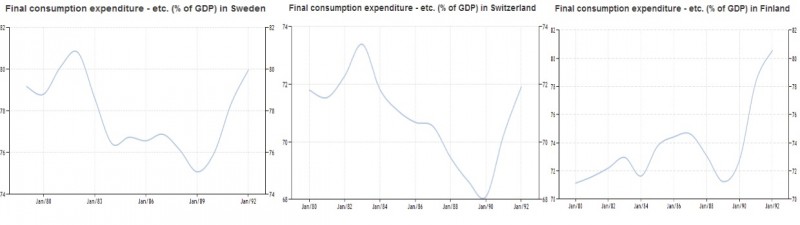

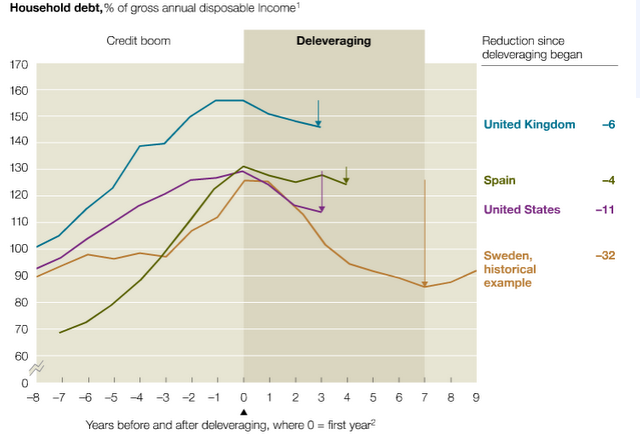

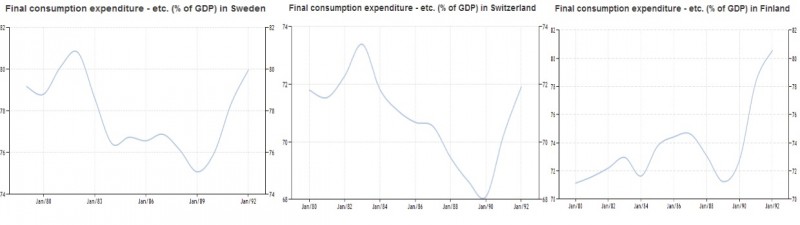

Financial Cycles History, 1991-1998: Overspending in Germany, Asia and former communist countries, Housing Busts in Japan and Northern Europe

In this post we present financial and credit cycles in the history: Due a weak credit cycle, Germany was a weak economy under many other weak ones.

Read More »

Read More »

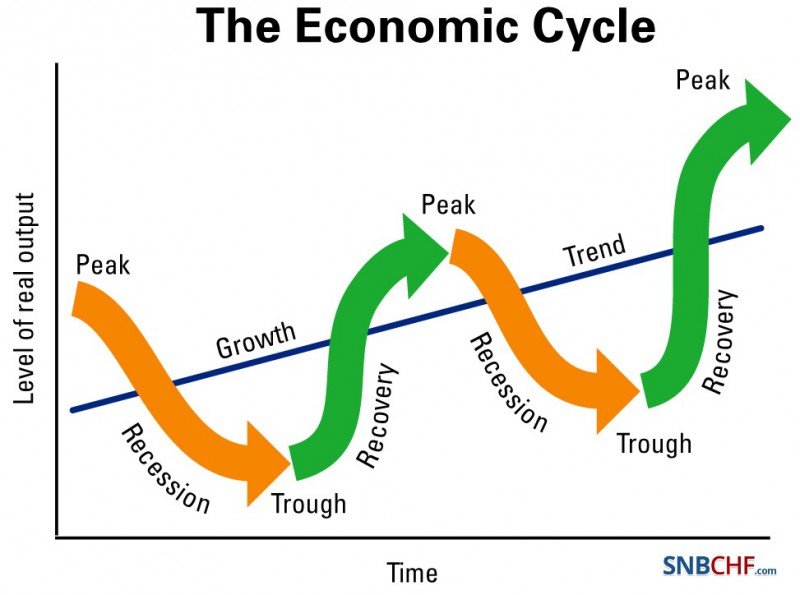

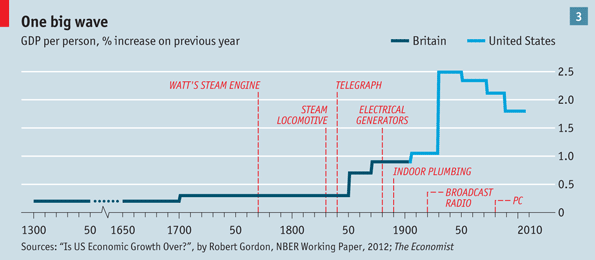

Business Cycles

The typical backstops of all improvements in business cycles are high oil prices and inflation. Inflation is mostly caused by local effects.

Read More »

Read More »

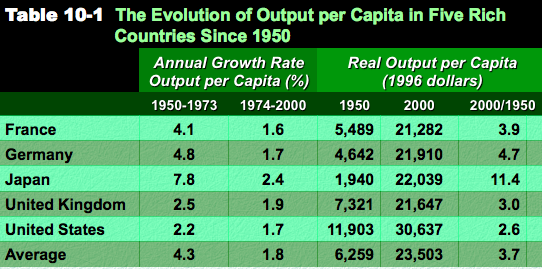

Financial Cycles History: 1945-1966: Bretton Woods, strong growth in Europe

The Bretton Woods time from 1945 to 1966 was a period of strong growth, especially in country like Germany, France, Italy and Japan.

Read More »

Read More »

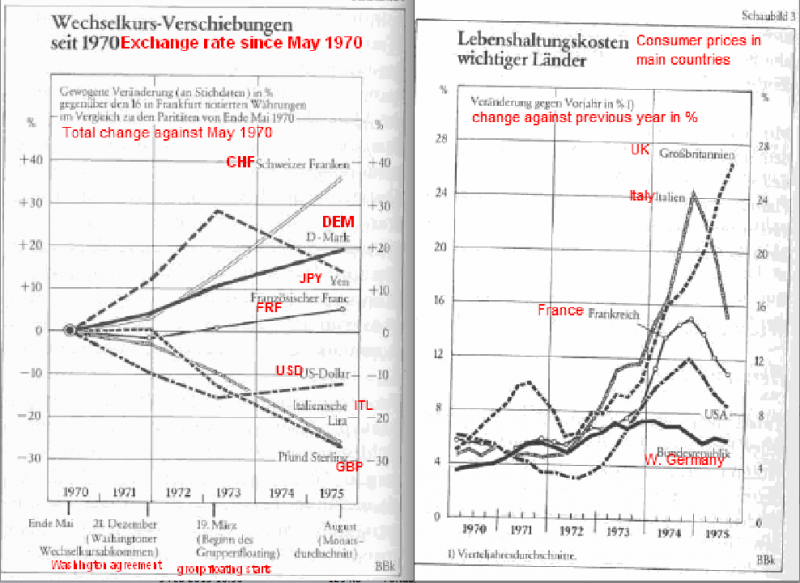

Financial Cycles History, 1978-1985: Oil Glut, Strong Dollar and the Lost Decade in Latin America

The next financial cycle takes from 1981 to 1990: The dollar was strong, Latin America lost a decade and the Japanese created their bubble.

Read More »

Read More »

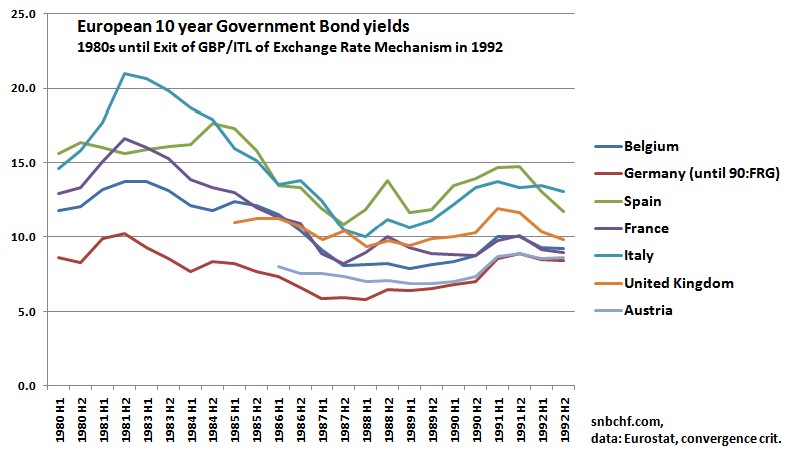

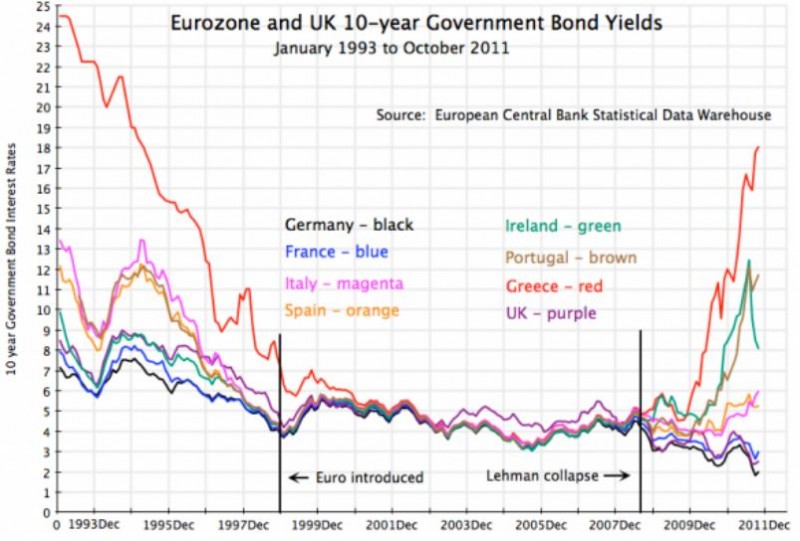

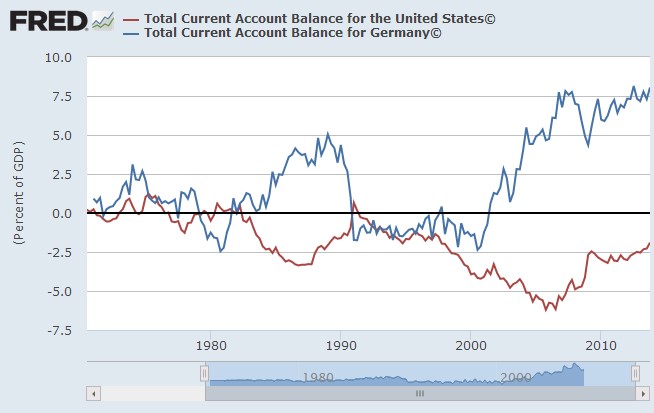

Financial Cycles History, 1990-1996: Breakdown of Communism, German Reunification, Housing Busts in Europe and Japan

A history of financial cycles: 1990-1996 the breakdown of communism leads to a boom in Germany and - due to high interest rates and inflation - to a breakdown of the European monetary system.

Read More »

Read More »

Financial Cycles History, 1998-2002: The Dotcom Bubble and Bust and European and Asian Austerity as its Enabler

In this post we present financial and credit cycles in the history: Due a weak credit cycle, Germany was a weak economy under many other weak ones.

Read More »

Read More »

Volckers Attack on Stagflation

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

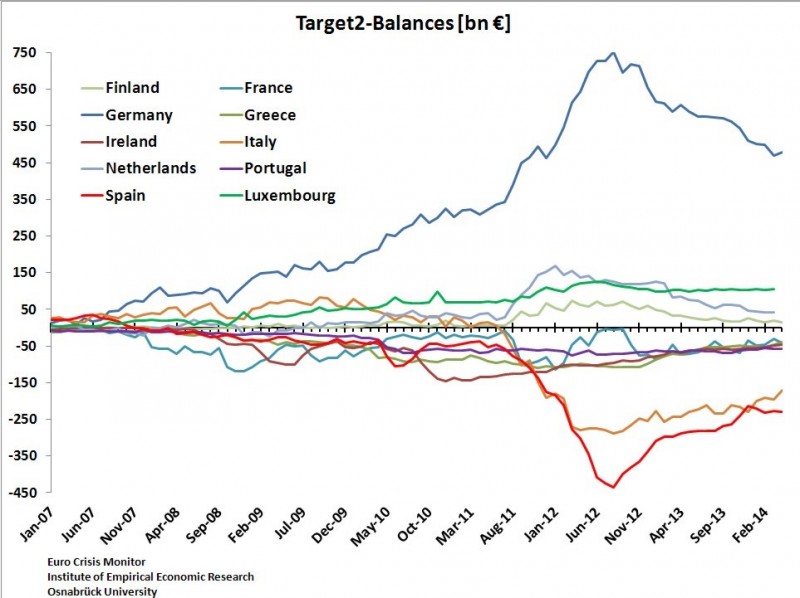

Negative Rates for Bundesbank TARGET2 Surplus?

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

Read More »

Read More »

Germany: Last European Country with Lots of Cash Under Matresses

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Read More »

Read More »