Category Archive: 6b.) Debt and the Fallacies of Paper Money

Business Cycles and Inflation, Part II

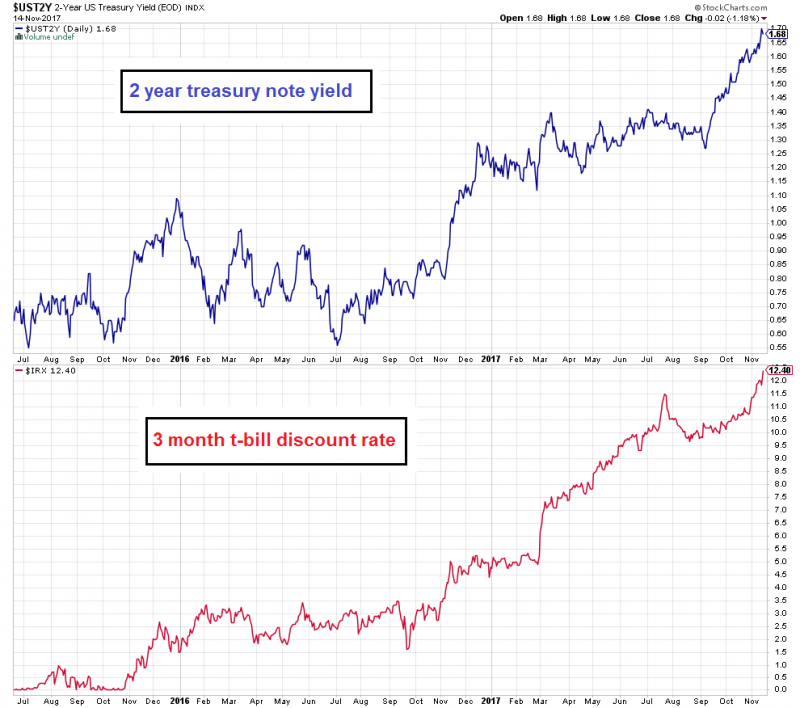

We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18 – 24 months were quite large, even if their absolute levels remain historically low.

Read More »

Read More »

Markets, Gold – Ross Clark. Fed, Cyrptos – Bill Bonner. Real Estate – Robert Campbell. AMY.V, CCD.V

Air Date: November 18, 2017 Ross Clark – Stock Markets and Gold email: [email protected] Bill Bonner – Will The Dow Top 40 Thousand? US Fed, Cyrptocurrenies Guest’s website: https://bonnerandpartners.com/ Robert Campbell – For the First Time Real Estate, Stocks and Bonds are all Going Up Together Guest’s website: https://www.realestatetiming.com/ Larry Reaugh, President & CEO of …

Read More »

Read More »

Business Cycles and Inflation – Part I

Incrementum Advisory Board Meeting Q4 2017 – Special Guest Ben Hunt, Author and Editor of Epsilon Theory. The quarterly meeting of the Incrementum Fund’s Advisory Board took place on October 10 and we had the great pleasure to be joined by special guest Ben Hunt this time, who is probably known to many of our readers as the main author and editor of Epsilon Theory.

Read More »

Read More »

What President Trump and the West Can Learn from China

Expensive Politics. Instead of a demonstration of its overwhelming military might intended to intimidate tiny North Korea and pressure China to lean on its defiant communist neighbor, President Trump and the West should try to learn a few things from China.

Read More »

Read More »

Heat Death of the Economic Universe

Physicists say that the universe is expanding. However, they hotly debate (OK, pun intended as a foreshadowing device) if the rate of expansion is sufficient to overcome gravity—called escape velocity. It may seem like an arcane topic, but the consequences are dire either way.

Read More »

Read More »

The Downright Sinister Rearrangement of Riches

Simple Classifications. Let’s begin with facts. Cold hard unadorned facts. Water boils at 212 degrees Fahrenheit at standard atmospheric pressure. Squaring the circle using a compass and straightedge is impossible. The sun is a star.

Read More »

Read More »

Credit Spreads: The Coming Resurrection of Polly

Suspicion isn’t Merely Asleep – It is in a Coma (or Dead). There is an old Monty Python skit about a parrot whose lack of movement and refusal to respond to prodding leads to an intense debate over what state it is in. Is it just sleeping, as the proprietor of the shop that sold it insists? A very tired parrot taking a really deep rest?

Read More »

Read More »

Is a Rapid Advance in the Japanese Stock Market Imminent?

The Japanese stock market is quite unique: it would need to rally by approximately 80% to reach its former historical peak. What’s more, said peak was attained on the final trading day of 1989, more than 25 years ago. In short, Japanese stocks have been anything but a good investment in recent years.

Read More »

Read More »

How to Survive the Winter

One of the fringe benefits of living in a country that’s in dire need of a political, financial, and cultural reset, is the twisted amusement that comes with bearing witness to its unraveling. Day by day we’re greeted with escalating madness. Indeed, the great fiasco must be taken lightly, so as not to be demoralized by its enormity.

Read More »

Read More »

Marc Faber, Freedom of Speech & Capitalism

Political Correctness Hampers Honest Debate. What would the world be like today had Europeans never colonized Americas, Africa, the Middle East, Australia, New Zealand, and South Asia? Most of these societies would still not have discovered the wheel. It takes a huge amount of reality-avoidance and ineptitude for outsiders who travel there not to realize that a billion or more people in the Third World still wouldn’t have discovered the wheel.

Read More »

Read More »

On the Marc Faber Controversy

By this time anyone reading this particular article on Acting Man will know about the controversy surrounding Marc Faber these last days, when a single paragraph of many from his October 2017 newsletter was published out of context.

Read More »

Read More »

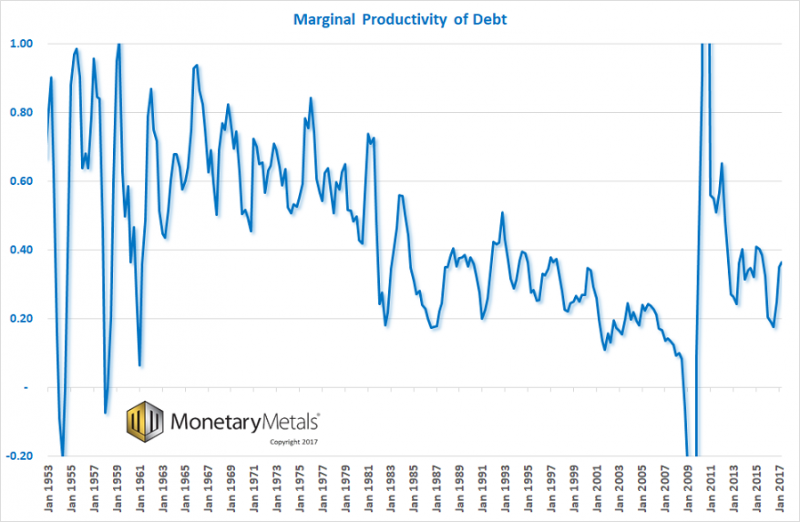

The Falling Productivity of Debt

Discounting the Present Value of Future Income. Last week, we discussed the ongoing fall of dividend, and especially earnings, yields. This Report is not a stock letter, and we make no stock market predictions. We talk about this phenomenon to make a different point. The discount rate has fallen to a very low level indeed.

Read More »

Read More »

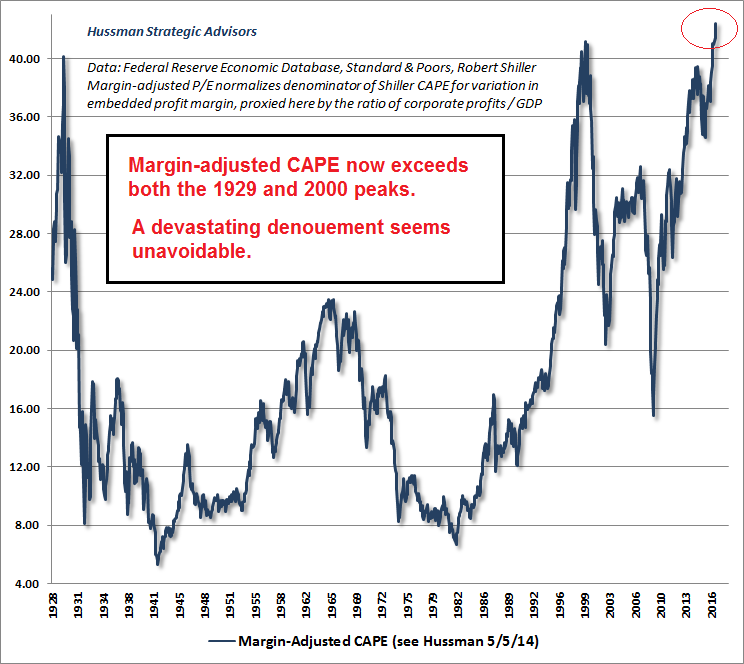

The Donald Can’t Stop It

The Dow’s march onward and upward toward 30,000 continues without a pause. New all-time highs are notched practically every day. Despite Thursday’s 31-point pullback, the Dow is up over 15.5 percent year-to-date. What a remarkable time to be alive. President Donald Trump is pumped! As Commander in Chief, he believes he possesses divine powers. He can will the stock market higher – and he knows it.

Read More »

Read More »

Le déclin de la valeur travail

Le travail: toujours une valeur? Et a-t-il encore de la valeur? Le commerce et, d’une manière générale, les échanges transfrontaliers entre nations, ont considérablement amélioré nos conditions de vie. Mais, en fait, que ferait-on sans commerce ? En d’autres termes, s’il fallait tout réaliser soi-même sans faire appel à d’autres corps de métier, à d’autres entreprises et à d’autres nations dont la spécialité n’est guère disponible dans notre pays...

Read More »

Read More »

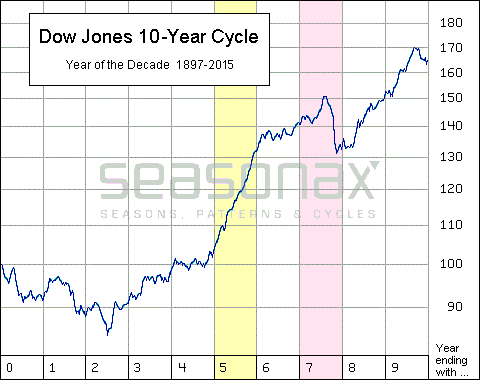

1987, 1997, 2007… Just How Crash-Prone are Years Ending in 7?

Bad Reputation. Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked the beginning of the GFC...

Read More »

Read More »

London House Prices Are Falling – Time to Buckle Up

London house prices fall in September: first time in eight years. High-end London property fell by 3.2% in year. House sales down by over a very large one-third. Global Real Estate Bubble Index – see table. Brexit, rising inflation and political uncertainty causing many buyers to back away from market. U.K. housing stock worth record £6.8 trillion, almost 1.5 times value of LSE and more than the value of all the gold in world.

Read More »

Read More »

Donald Trump: Warmonger-in-Chief

If a world conflagration, God forbid, should break out during the Trump Administration, its genesis will not be too hard to discover: the thin-skinned, immature, shallow, doofus who currently resides in the Oval Office! This past week, the Donald has continued his bellicose talk with both veiled and explicit threats against purported American adversaries throughout the world.

Read More »

Read More »

Federal Reserve President Kashkari’s Masterful Distractions

The True Believer.How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard.

Read More »

Read More »

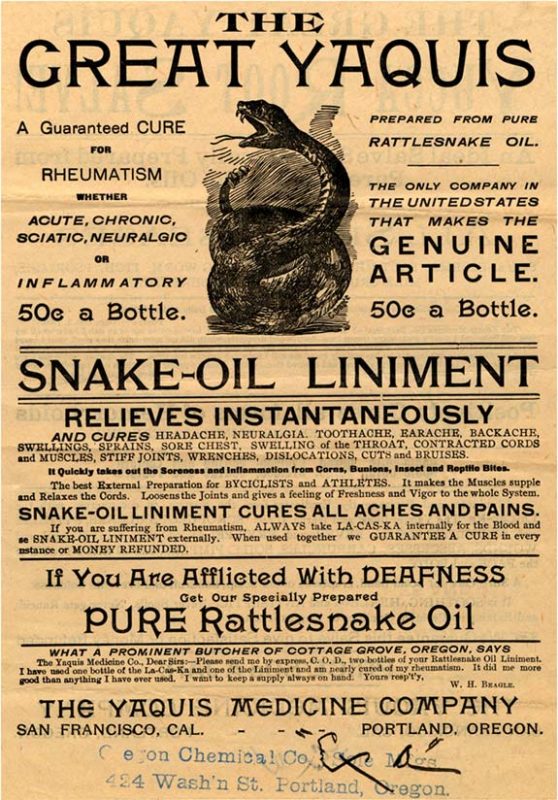

Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health. There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years.

Read More »

Read More »