Category Archive: 6b) Austrian Economics

Postscript: A Tale of Two Megastates: Why the EU Is Better (In Some Ways) than the US

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 1. More Choices, More Freedom, Less Monopoly Power

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 13. If America Splits Up, What Happens to the Nukes?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Foreword by Carlo Lottieri

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 3. Why Regimes Prefer Big States and Centralized Power

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 11. How Small Is Too Small?

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 2. Political Anarchy Is How the West Got Rich

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 6. Nationalism as National Liberation: Lessons from the End of the Cold War

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 14. Why “One Man, One Vote” Doesn’t Work

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 5. Secession as a Path to Self-Determination

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Chapter 9. From Taxes to Trade, More Secession Means More Freedom

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard.

Read More »

Read More »

Breaking Away: The Case for Secession, Radical Decentralization, and Smaller Polities Audiobook

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Does Libertarianism Reject Communities? Libertarianism Actually Strengthens Them

Many opponents of libertarianism claim to reject its philosophy because of its extreme individualist tendencies or because they believe it encourages selfishness. While there are libertarians who are individualistic in every sense of the word, libertarianism does not naturally reject community. Additionally, libertarianism does not encourage selfishness but recognizes that most humans are selfish and thus are wary of giving humans too much power....

Read More »

Read More »

MMT: Believe in the “Incredible Power” of the State

Jordan Klepper: You need to-- you know what you need to do? You need to take some-- some THC or some DMT and let the MMT just wash over you. Let the paradigm shift come to you, Ronny Chieng.Ronny Chieng : Yeah, I think I’m in it right now.Klepper: I think you’re in it.Stephanie Kelton appeared on The Daily Show to promote her documentary, “Finding the Money,” which is set to be released on May 3. The documentary promises to take viewers on a...

Read More »

Read More »

Cowardice, Not Courage, Led House Republicans to Side with the Democrats

Over the weekend, the House of Representatives passed four foreign aid bills that will allocate a combined $95 billion to Ukraine, Israel, Taiwan, and other “national security priorities.” House Republicans followed Speaker Mike Johnson’s (R-LA) lead and joined with Democrats to deliver all the foreign aid President Joe Biden wanted without requiring much of anything in return.The passage came after House Republicans had handed the president...

Read More »

Read More »

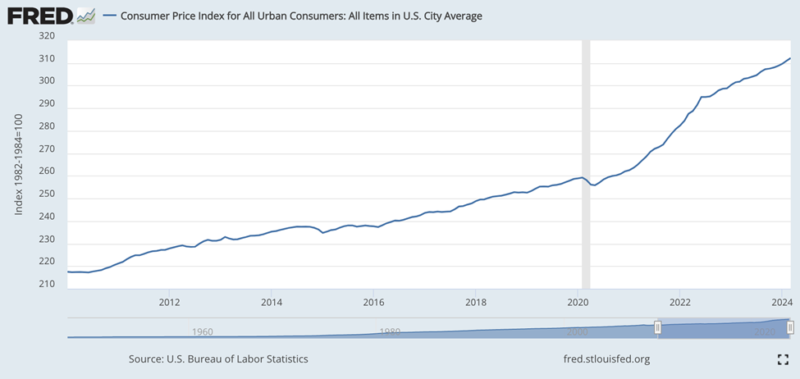

Take the Clear Pill on Inflation

On April 10th, the Bureau of Labor Statistics reported figures for the March Consumer Price Index (“CPI”). CPI purports to represent changes in the overall price level of the American economy – an obscenely vague abstraction in a country of 350 million people. Let’s pretend for a moment that it does that.In March, overall CPI grew at 3.5 percent from a year ago and so-called “core CPI,” which excludes food and energy items, increased by 3.8 percent...

Read More »

Read More »

California’s Crony Capitalist Minimum Wage Law

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Iran’s Attack on Israel Provides an Opportunity to De-escalate

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Anarchy, State and Utopia: Robustly against Redistributive Taxation for 50 Years

Robert Nozick’s classic of political philosophy Anarchy, State, and Utopia turns fifty this year. His blasting of the redistribution of wealth shook academia to its core in 1974, and its intellectual tremors are arguably still being felt to this day. Nevertheless, Nozick’s arguments are clearly lost in the “real world”; high taxes and high benefits still run amuck. Indeed, even in the heyday of neoliberalism—the 1980s—Margaret Thatcher often...

Read More »

Read More »

Ireland’s Progressives Lose Big in the Irish Family and Care Constitutional Referenda

Two constitutional referenda were held in Ireland on the 8th of March to revise the wording of the constitution, to widen the definition of family and redefine gender roles in the provision of care. The Irish government claimed that this would modernize the constitution and align it to current views and needs.The proposed changes were as follows:The Thirty-ninth Amendment would add the text between brackets to Article 41.1.1:“The State recognizes...

Read More »

Read More »