Category Archive: 6b) Austrian Economics

Who Is Worth More: Some Hedge Funds or All our Kindergartens?

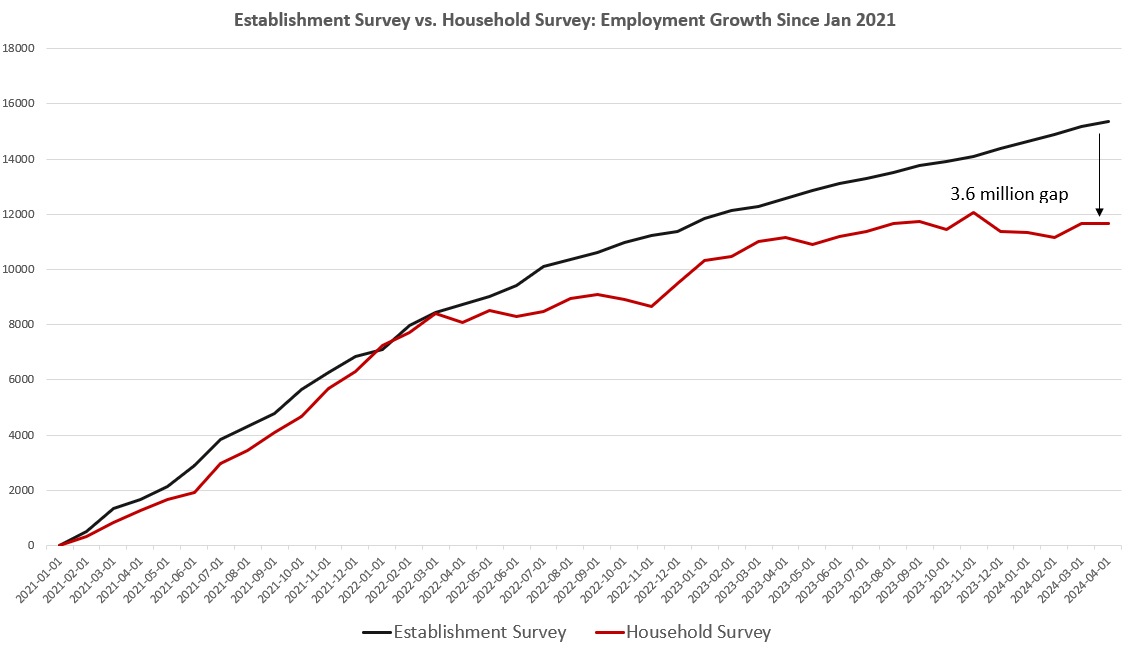

"The top 25 hedge fund managers made more than all the kindergarten teachers in the country," declared President Obama in a discussion of poverty at Georgetown University. Calling them “society’s lottery winners,” he proposed to hike their taxes. Predictably, battle lines have been formed between two polarized sides. One side is unhappy with the pay disparity. The other is quick to defend the status quo. Rather than arguing about whether hedge fund...

Read More »

Read More »

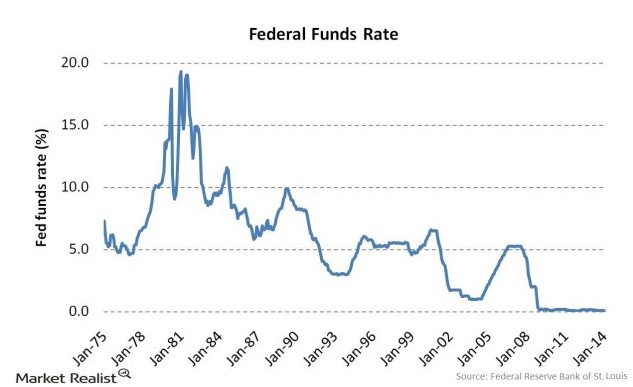

Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

Our paper currency causes falling productivity, though not in terms of bushels per acre. What falls is productivity per dollar or euro of savings. This is the real meaning of the falling interest rate. When the rate was 10 percent, $1,000 of principal produced $100 of return. When it falls to two percent, then the same capital generates a return of only $20. Now with the Swiss 10-year bond, CHF 1,000 earns only CHF 1.3. Keith Weiner argues that one...

Read More »

Read More »

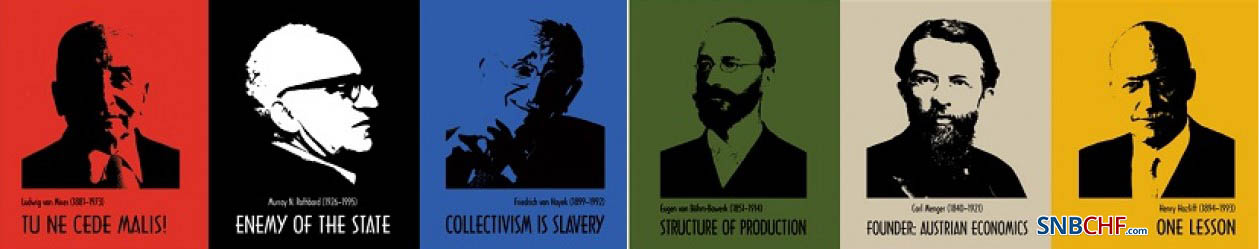

6b.) P: Mises.org 2015-05-04 17:54:02

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2015-04-29 19:37:41

When Mother Teresa used her Nobel Prize money to fund services for the poor, she was exhibiting "self-interest," but not selfishness. Like virtually everyone else, she used her property to achieve an end she valued, but which benefited others as well, writes Gary Galles.This audio Mises Daily is narrated by Robert Hale.

Read More »

Read More »

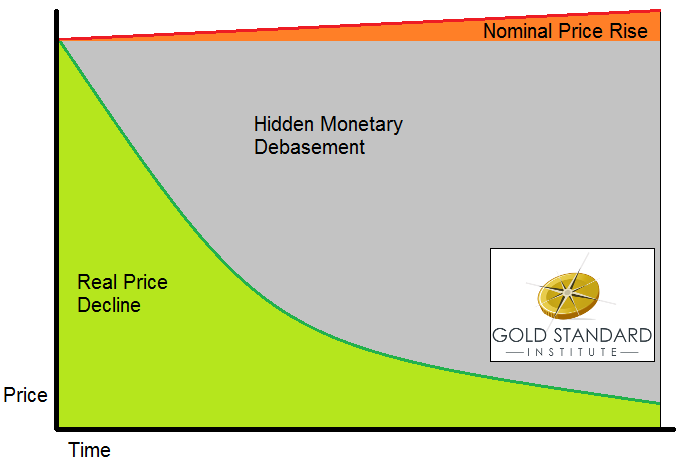

Yield Purchasing Power: Think Different About Purchasing Power

The dollar is always losing value. To measure the decline, people turn to the Consumer Price Index (CPI), or various alternative measures such as Shadow Stats or Billion Prices Project. They measure a basket of goods, and we can see how it changes every year.

However, companies are constantly cutting costs. If we see nominal—i.e. dollar—prices rising, it’s despite this relentless increase in efficiency.

At the same time, the interest rate is...

Read More »

Read More »

6b.) P: Mises.org 2015-04-22 19:59:29

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2015-04-22 19:59:08

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2015-04-10 17:51:09

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

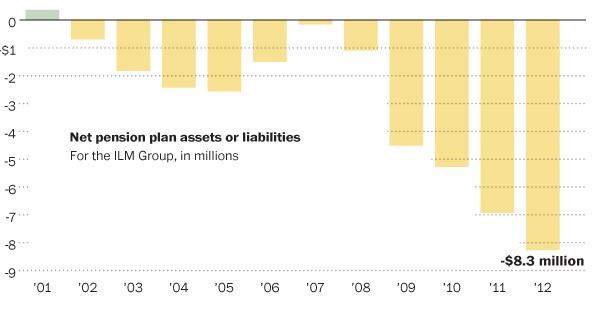

Did Ben Bernanke Call for Euthanasia of the Rentier or of the Pensioner?

Keynes called for “the euthanasia of the rentier” by government suppression of the interest rate (chapter 24 of General Theory). Bernanke did the same with pensioners, he threw them under a bus with low interest rates; still he “was concerned about those seniors as well.”

Read More »

Read More »

6b.) P: Mises.org 2015-04-06 21:25:00

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2015-04-06 21:25:00

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

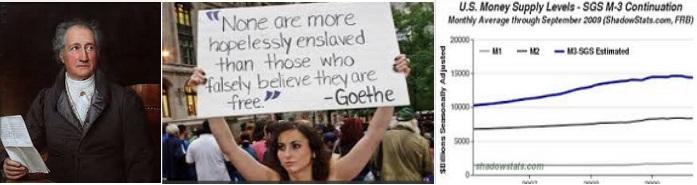

Goethe Predicted Dollar Slavery

In 1809 Goethe wrote "None are more hopelessly enslaved than those who falsely believe they are free." According to Keith Weiner, this is today's status of American workers, stuck with debt and the losing value of the dollar.

Read More »

Read More »

6b.) P: Mises.org 2015-04-02 19:00:00

The new Netflix series Marco Polo might have descended into a forgettable story of palace intrigue, but it fortunately explores far more interesting themes of family, loyalty, and how the state demands everyone sell out his values a little more every day, writes Ryan McMaken.This audio Mises Daily is narrated by Robert Hale.

Read More »

Read More »

A Gold Man In Monetarist Territory

Keith Weiner suggests that one should abstract from economic variables like CPI, U6 unemployment measure, M0 or GDP. We know that the Fed manipulates key variables of the economy; hence we live in a world of central planners, a socialist world, not much better than the period of Mao or Stalin. The gold standard is free of central bank manipulation.

Read More »

Read More »

What Happens When Credit Is Mispriced?

Keith Weiner explains what happens when credit is mispriced. The rich are privileged because they can profit on the volatility and the bubbles the cheap credit createes.

Read More »

Read More »

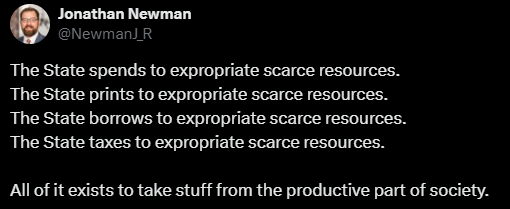

Three Unexpected Reasons Why We Use the Paper Dollar

Keith Weiner argues that there are 3 reasons why we use the dollar. One, people don't care about what money really is. Two, people are indoctrinated in the ideology of central planning. Three, many people like to get something for free and they want continue getting it for free. Endless borrowing is simply not possible in the gold standard, but only with paper money like the dollar.

Read More »

Read More »

Can The Fed Raise Interest Rates?

Keith Weiner argues that the question should be, not when the Fed will raise interest rates, but if. Before our central planners can raise rates, they must deal with a problem of their own making.

Read More »

Read More »

Why Can’t The Fed Spot Bubbles?

The topic of whether the Federal Reserve can see bubbles in advance, and what they can do about them, is hotly debated. The price of an earning asset depends directly on the interest rate. This is because of time preference. It is better to have your cash today than tomorrow. The Fed’s problem is that the calculation depends on a rate of interest that it heavily influences. Its analysis is therefore circular and self-fulfilling. It’s like taking a...

Read More »

Read More »

Inflation=Counterfeiting

Keith Weiner explains why Inflation is, at root, a monetary fraud, it is finally caused by an increase in the money supply. The Fed deceives us into accepting this bad paper as currency by making its new dollars look like real currency. This is the very essence of counterfeiting.

Read More »

Read More »