Category Archive: 6b) Austrian Economics

Frisky Yen Upsets Japan’s GOSPLAN

It Wasn’t Supposed to Do That… When you’re a central banker in a pure fiat money system and even your ability to print your own currency into oblivion is questioned by the markets, you really have a problem. This is actually funny on quite a number...

Read More »

Read More »

Going Into Debt to Invest Into Debt…

Bankers Hate It When You Hold Cash In an extraordinary turn of events, last week we were contacted by our local bankers. Since we were turned down for a mortgage in 1982 (our business finances were thought to be “too shaky”), we have had little tru...

Read More »

Read More »

Rotten to the Core

Poison Money BALTIMORE – We live in a world of sin and sorrow, infected by a fraudulent democracy, Facebook, and a corrupt money system. Wheezing, weak, and weary from the exertion of trying to appear “normal,” the economy staggers on. Staggering...

Read More »

Read More »

A Tribute to the Jackass Money System

A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can ge...

Read More »

Read More »

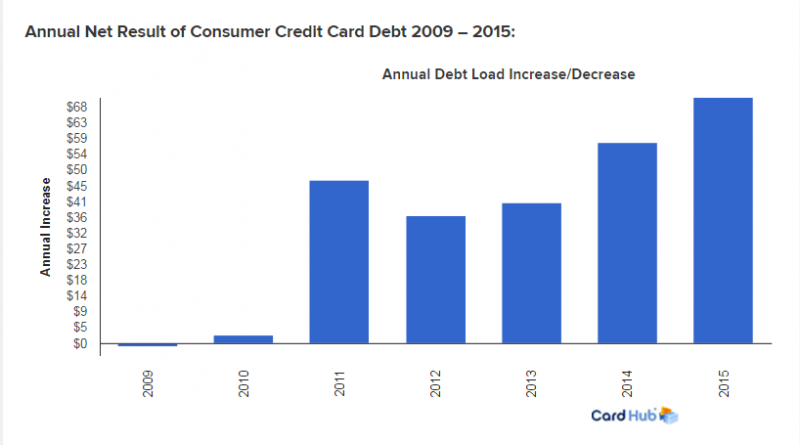

The Other Problem with Debt No One is Talking About

Faux Growth Recovery Nearly 7 years have elapsed since the official end of the Great Recession. By now it’s painfully obvious the rising tide of economic recovery has failed to lift all boats. In fact, many boats bottomed out on the rocks in earl...

Read More »

Read More »

Federal Devolution

Leaning Into the Wind BALTIMORE – During our lifetime, three Fed chiefs have faced a similar challenge. Each occupied the chairman’s seat at a time when “normalization” of interest rates was in order. Recently, we remembered William McChesney Mar...

Read More »

Read More »

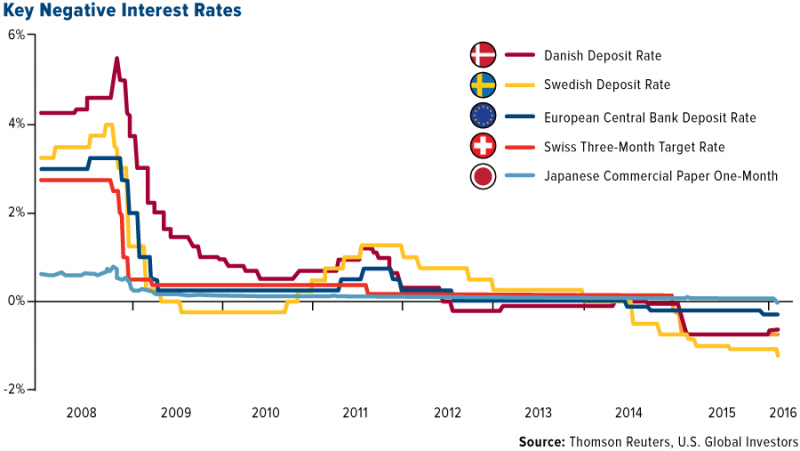

The Path to the Final Crisis and Negative Rates

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided ...

Read More »

Read More »

Are We Becoming a Nation of Silver-Haired Crooks?

A Salutary Effect BALTIMORE – “Ike and Dick Sure to Click” was an exciting election slogan. Their Democratic opponents, Adlai Stevenson and Estes Kefauver, had their snazzy campaign jingle, too: “Adlai and Estes… They’re the Bestes.” Surely, the me...

Read More »

Read More »

The Pitfalls of Currency Manipulation – A History of Interventionist Failure

The G-20 and Policy Coordination Readers may recall that the last G20 pow-wow (see “The Gasbag Gabfest” for details) featured an uncharacteristic lack of grandiose announcements, a fact we welcomed with great relief. The previously announced “900 p...

Read More »

Read More »

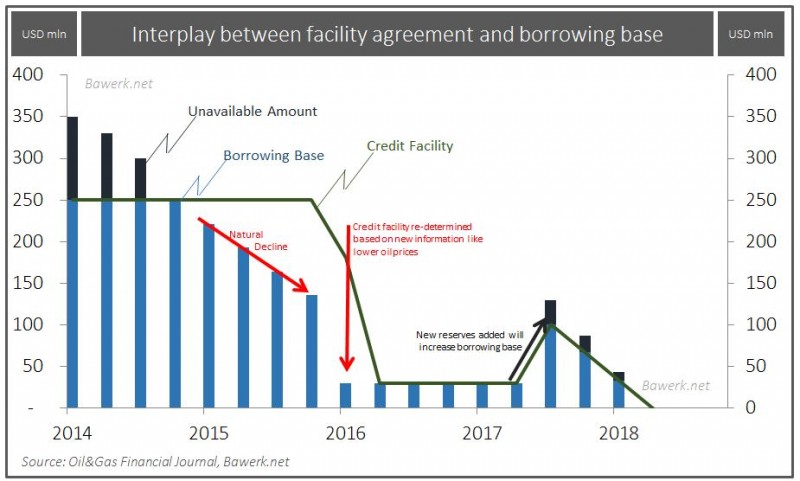

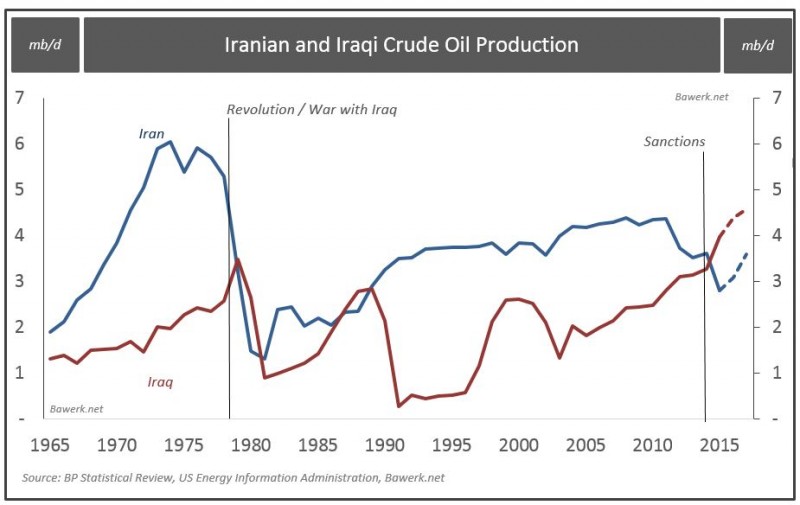

OPEC’s Doha Dilemma: 3mb/d US lock in?

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs.

Read More »

Read More »

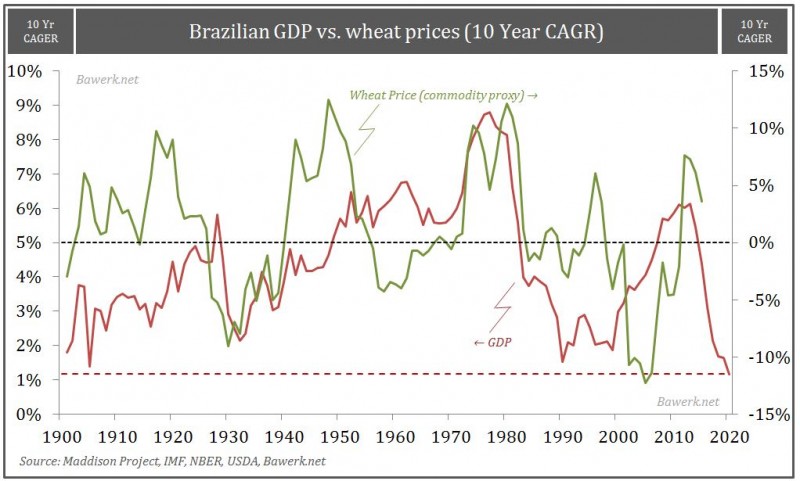

Latin America – Seven Ugly Sisters in Deep Political Trouble

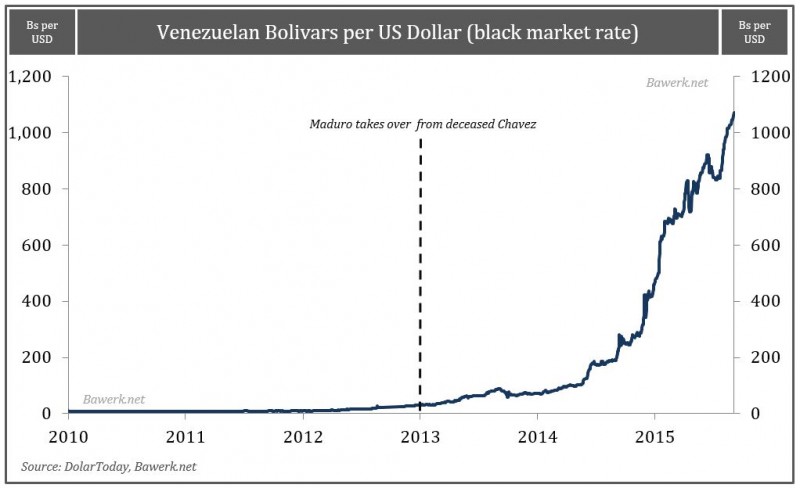

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices.

Read More »

Read More »

Is that Buzzing Sound Helicopter Money?

Helicopter money is the rage. Central banks are talking about it. Economists are debating it. The media is rife with coverage. While it sounds important, it is not precisely clear what helicopter money means. It appears to have originated with Milton Friedman. In 1969, he wrote: "Let us suppose now that one day a helicopter … Continue reading »

Read More »

Read More »

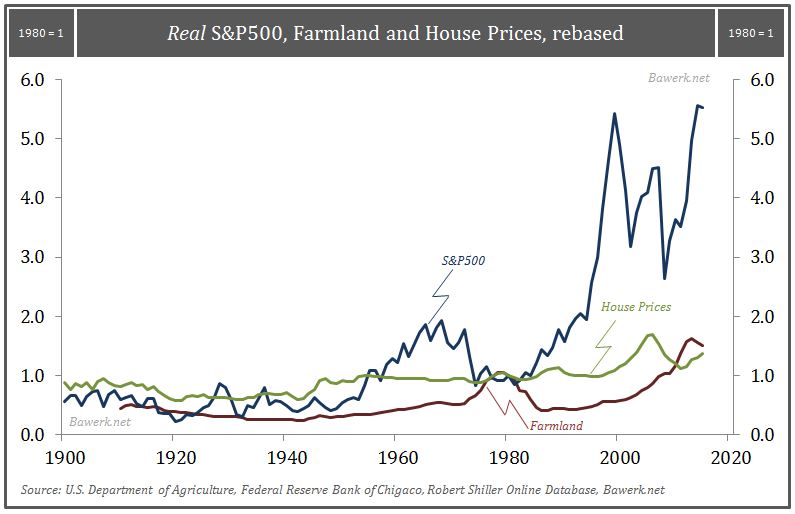

Greenspan, the Sheepherder

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated,...

Read More »

Read More »

Revolutionary Guards: The Way of the Iranian Future

Iranian elections have supposedly put a very nice ‘moderate’ spin on Iranian politics in parliamentary ranks, and more importantly, Assembly of Experts composition. While it would be churlish to deny, it represents a significant step forward for Pres...

Read More »

Read More »

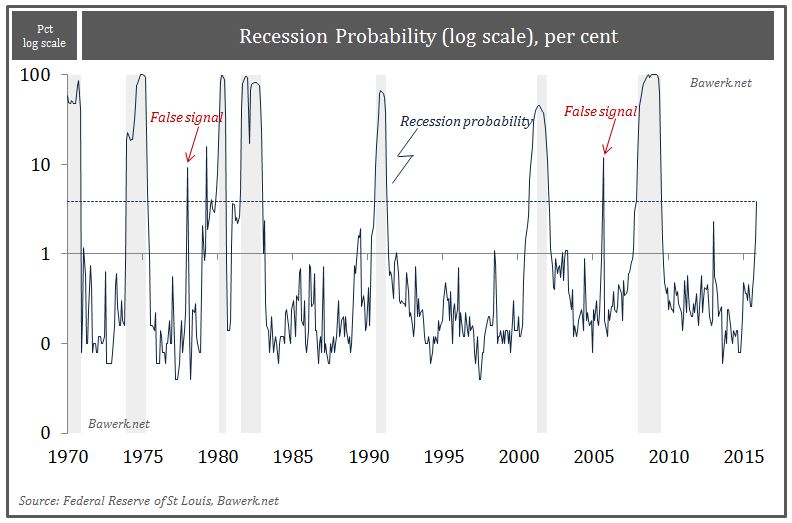

Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beg...

Read More »

Read More »

Can Maduro Mayhem Last to 2017

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legi...

Read More »

Read More »

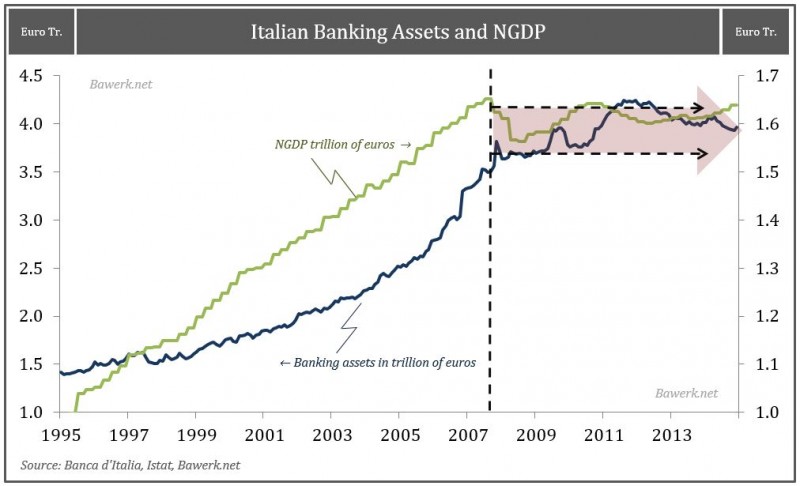

How Italy will fail and drag down the European Project

Italy is big enough to matter (it is the eight largest economy on the planet), but so uneventful that most does not pay any attention to what is going on there. We contend that Italy will, during the next year or two, be on everyone’s radar screen as it has the potential to derail the European project for real.

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:24:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:22:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »

6b.) P: Mises.org 2016-02-18 21:21:45

Tu ne cede malis, sed contra audentior ito

Website powered by Mises Institute donors

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436

Read More »

Read More »