Category Archive: 6b) Austrian Economics

Peak Data: When Not Enough Is Already Too Much

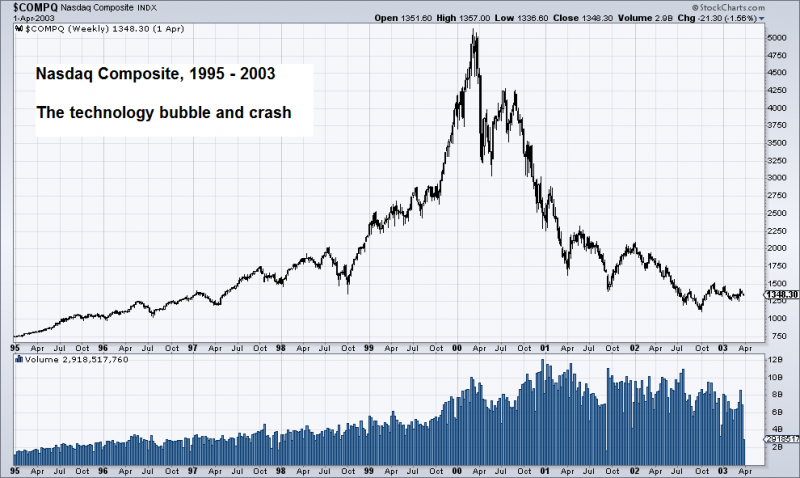

The Wild 1990s Not so long ago, during 1990’s, the connecting world of the connected world we now know was literally and comprehensively in the development stage during those wild crazy go go years before the crash in technology stocks in 2000. T...

Read More »

Read More »

Political Pundits, or Getting Paid for Wishful Thinking

Bill Kristol – the Gartman of Politics? It has become a popular sport at Zerohedge to make fun of financial pundits who appear regularly on TV and tend to be consistently wrong with their market calls. While this Schadenfreude type reportage may st...

Read More »

Read More »

Old School Investment Lessons

Laughing at Blue Monday On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929. Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell...

Read More »

Read More »

US Economy – Gross Output Continues to Slump

The Cracks in the Economy’s Foundation Become Bigger Last week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but th...

Read More »

Read More »

The “Canary in the Coal Mine” for Chinese Stocks

The Largest Online Marketplace in the World This company is twice the size of Enron at its peak ($100 billion). Pharmaceutical giant Valeant, which blew up in the last year, was only $90 billion at its peak. Before I get to what the stock is, let m...

Read More »

Read More »

Affairs of State: Erdogan and Böhmermann

Insulting Mr. Erdoğan Can Be Dangerous Most of our readers are probably aware by now that the German government finds itself in a rather awkward situation over its relations with Turkey’s government again – with which the EU has just struck a widel...

Read More »

Read More »

Chinese Dragon: Breathing Credit Fumes

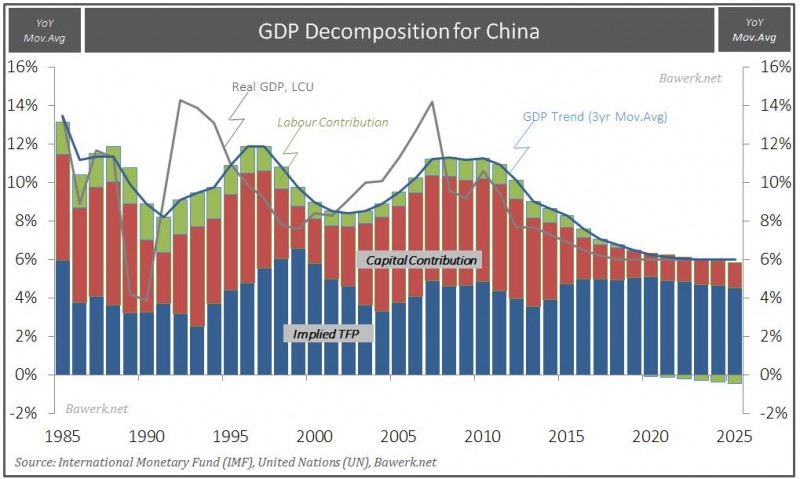

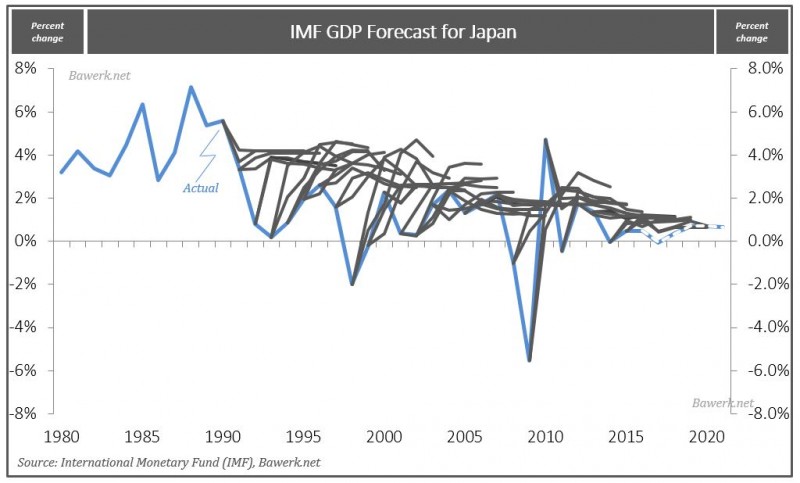

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate.

Read More »

Read More »

Russian Aggression Unmasked (Sort Of)

Provocative Fighter Jocks Back in 2014, a Russian jet made headlines when it passed several times close to the USS Donald Cook in the Black Sea. As CBS reported at the time: “A Pentagon spokesperson told CBS Radio that a Russian SU-24 fighter jet...

Read More »

Read More »

Rational Insanity

Intel Employees Get RIF’d Dark storm clouds gather along the economic horizon. They multiply ominously with each passing day. The recovery, weak as it has been, has run for nearly seven years. Now it appears to be sputtering and stalling out. ...

Read More »

Read More »

100 Years of Mismanagement

Lost From the Get-Go There must be some dark corner of Hell warming up for modern, mainstream economists. They helped bring on the worst bubble ever… with their theories of efficient markets and modern portfolio management. They failed to see it fo...

Read More »

Read More »

Is the Stock Market Overvalued?

Dismal Earnings, Extreme Valuations The current earnings season hasn’t been very good so far. Companies continue to “beat expectations” of course, but this is just a silly game. The stock market’s valuation is already between the highest and third ...

Read More »

Read More »

Fighting Recessions with Hot Air

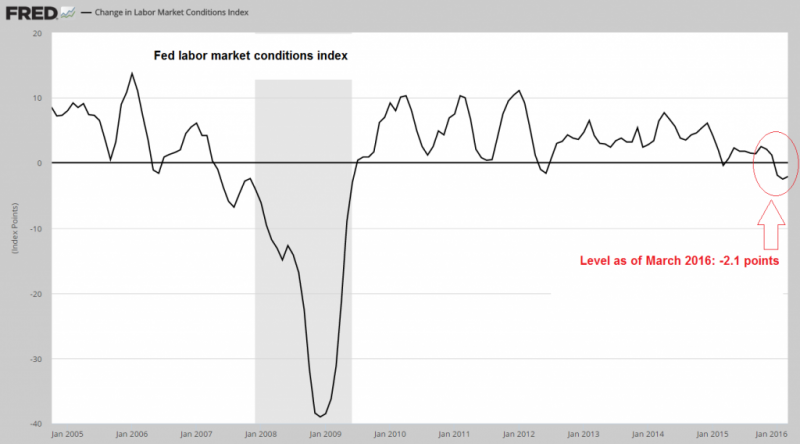

“Prepping” for Recession GUALFIN, Argentina – Stocks are going up all over the world. Meanwhile, it appears to us that the U.S. economy is going down. Go figure. For instance, a labor-market index created by Fed economists… and closely watched by ...

Read More »

Read More »

A Morally Sound Tax Reform Proposal

The Oppressed U.S. Taxpayer This year, Americans’ day of tribute to their federal overlords falls on April 18. As calculated by the Tax Foundation, the average American will work from January 1 to April 24 (Tax Freedom Day) to pay his share of tax...

Read More »

Read More »

US Economy – Ongoing Distortions

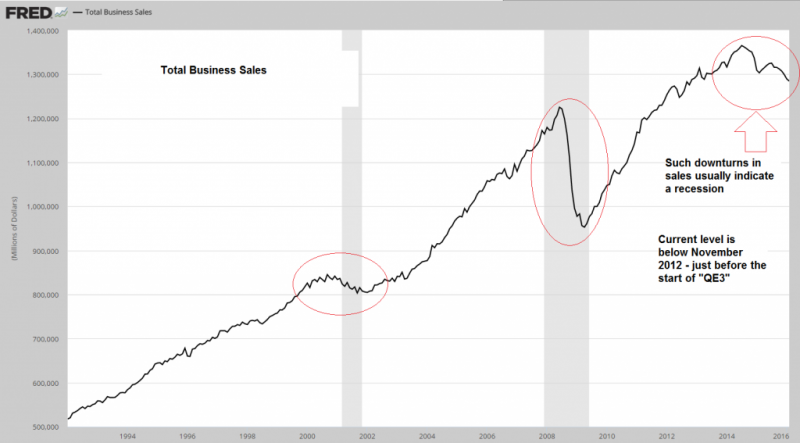

Business under Pressure A recent post by Mish points to the fact that many of the business-related data that have been released in recent months continue to point to growing weakness in many parts of the business sector. We show a few charts illust...

Read More »

Read More »

Cultural Marxism and the Birth of Modern Thought-Crime

What the Establishment Wants, the Establishment Gets If a person has no philosophical thoughts, certain questions will never cross his mind. As a young man, there were many issues and ideas that never concerned me as they do today. There is one que...

Read More »

Read More »

11 on the Nutty Scale – Banks are Paying Interest to Mortgage Borrowers

Wicked Don Giovanni GUALFIN, Argentina – Tuesday evening, we went to the main opera house in Buenos Aires, the Teatro Colón, to see Mozart’s Don Giovanni. On our way over, our taxi driver told us that Luciano Pavarotti rated it as the second best o...

Read More »

Read More »

Double Whammy Economics

What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often means...

Read More »

Read More »

Why All Central Planning Is Doomed to Fail

We’re still thinking about how so many smart people came to believe things that aren’t true. Krugman, Stiglitz, Friedman, Summers, Bernanke, Yellen – all seem to have a simpleton’s view of how the world works.

Read More »

Read More »

Circulus in probando

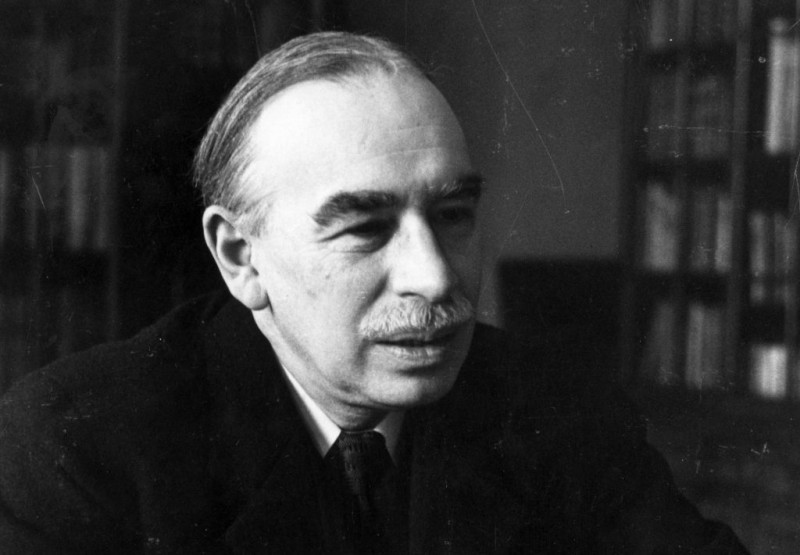

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because ...

Read More »

Read More »

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

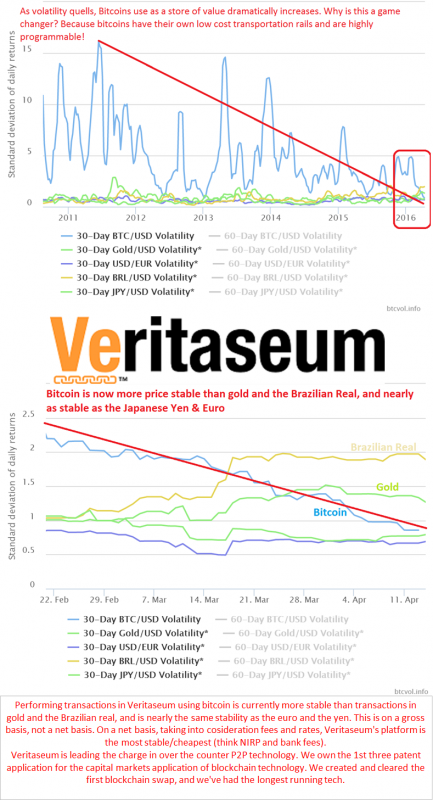

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »