On April 10th, the Bureau of Labor Statistics reported figures for the March Consumer Price Index (“CPI”). CPI purports to represent changes in the overall price level of the American economy – an obscenely vague abstraction in a country of 350 million people. Let’s pretend for a moment that it does that.

In March, overall CPI grew at 3.5 percent from a year ago and so-called “core CPI,” which excludes food and energy items, increased by 3.8 percent from a year ago. Across the board, price inflation was higher than expected. Of more relevance, both measures increased by 0.4 percent from last month, representing a 4.9 percent annualized rate of price inflation.

In response to the report, bond yields rose, stocks dropped, and analysts in the lobotomized financial press reacted in muted shock, fearing that precious rate cuts would be pushed out a couple months farther than anticipated.

For those that might view this report as bad luck – a setback on the path to recovery for the US economy – consider that inflation is a feature, not a bug, of current monetary policy. It is supported by both political parties, viewed as a tailwind to government spending and a means by which the regime can soften the impact of swiftly accumulating debts.

Goodhart’s Law

British economist Charles Goodhart suggested that when a measure becomes a target, it ceases being a good measure. Put another way, when the hitting of numerical targets becomes a political action item, the underlying measure is subject to manipulation. Such has been the case with CPI, a government-curated metric.

Thus, the Federal Reserve in tandem with the ruling political class has a particular challenge – continue inflating the economy, to the benefit of the state and detriment of average citizens, while carefully managing related propaganda so as not to raise hackles. This is one of the reasons bubbly stock and real estate markets are so important to the state. While indicative of inflation, both contribute to the net worth and “confidence” of the voting class. Asset bubbles are effective tools of appeasement.

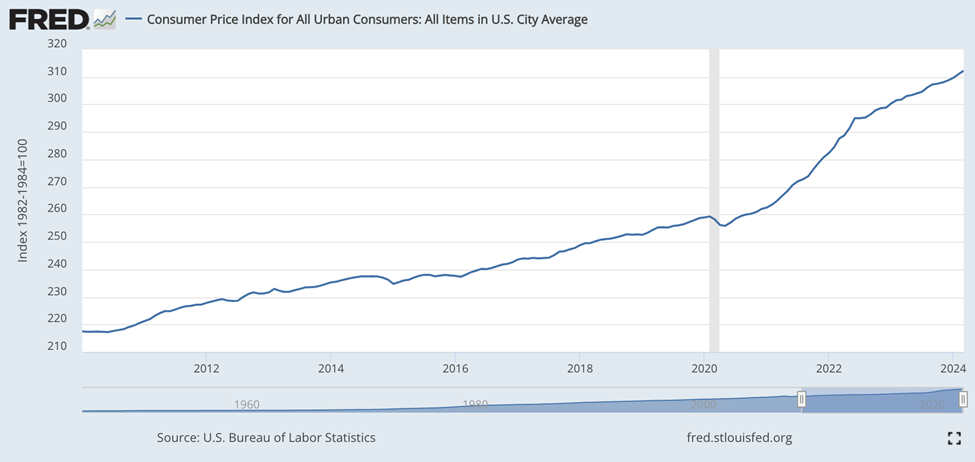

Nevertheless, appeasement is not automatic. Despite clear manipulation in the CPI metric, for example, always with the effect of understating price inflation, eventually the truth will out and unintended consequences appear. CPI shows that Americans have lost 20 percent of their purchasing power since 2020 and nearly 50 percent since 2010.

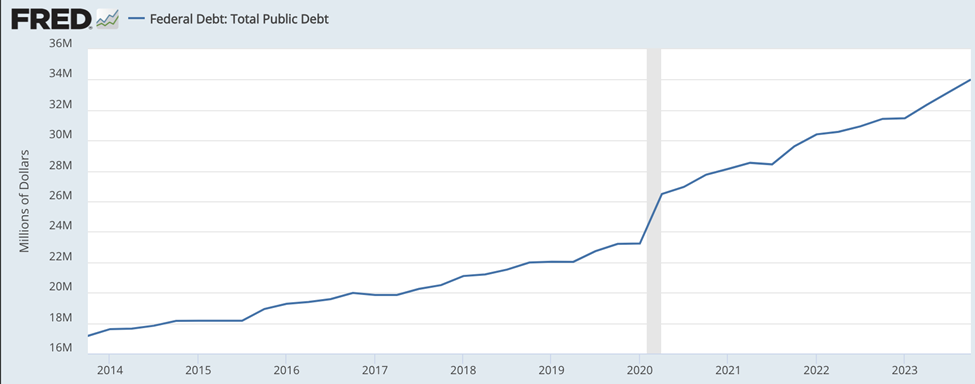

In addition, tools of appeasement require significant financial resources. The American regime has a debt balance approaching $35 trillion, and climbing rapidly. The dollar’s status as the world’s reserve currency is in more jeopardy as its financial house continues to crumble. At some point, the illusion becomes too unwieldy.

Of particular interest as our country descends into another election year is the moral impact of inflation. As inflation persists, future planning is discarded in favor of immediate gratification – what economists call an increase in time preference. This has real impact on human behavior. While the regime prefers this state of affairs, in a society that combines high time preference with compulsory redistribution of property and politically charged elections, crime and violence are more likely to ensue.

Ignore What They Say, Watch What They Do

Massive government spending supported by both political parties, the instigation of numerous wars simultaneously, unwavering commitments to financially support countries all over the world for no reason, and constant chirping from the Federal Reserve that interest rates are coming down any minute now – these are all actions that view inflation as a positive result, a goal to be achieved.

Jeff Deist once called inflation “state-sponsored terrorism.” He was right. Inflation, pursued in earnest by the state, is a war on the prosperity of the average American. Don’t convince yourself otherwise.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter