Category Archive: 6b.) Debt and the Fallacies of Paper Money

Crony Socialism and Failed CEOs

Whenever a failed CEO is fired with a cushy payoff, the outrage is swift and voluminous. The liberal press usually misrepresents this as a hypocritical “jobs for the boys” program within the capitalist class. In reality, the payoffs are almost always contractual obligations, often for deferred compensation, that the companies vigorously try to avoid.

Read More »

Read More »

Trump’s Trade Catastrophe?

It is worse than “voodoo economics,” says former Treasury Secretary Larry Summers. It is the “economic equivalent of creationism.” Wait a minute – Larry Summers is wrong about almost everything. Could he be right about this?

Read More »

Read More »

Trump’s Plan to Close the Trade Deficit with China

Jack Ma is an amiable fellow. Back in 1994, while visiting the United States he decided to give that newfangled internet thing a whirl. At a moment of peak inspiration, he executed his first search engine request by typing in the word beer.

Read More »

Read More »

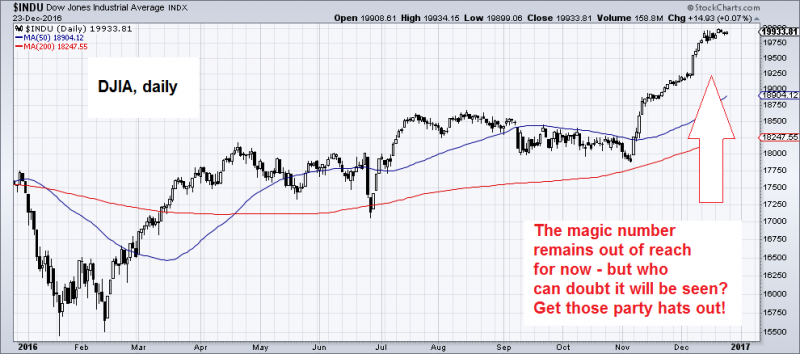

Regime Change: The Effect of Trump’s Victory on Stock Prices

On January 20 2017 Donald Trump will be sworn in as the new president of the United States. On the stock market his victory has triggered a lot of advance cheer already: the Dow Jones Industrial Average rose by a sizable 7.80 percent between the election and the turn of the year.

Read More »

Read More »

A Trade Deal Trump Cannot Improve

BALTIMORE – People can believe whatever they want. But sooner or later, real life intervenes. We just like to see the looks on their faces when it does. By that measure, 2017 may be our best year ever. Rarely have so many people believed so many impossible things.

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

Global Recession and Other Visions for 2017

Today’s a day for considering new hopes, new dreams, and new hallucinations. The New Year is here, after all. Now is the time to turn over a new leaf and start afresh. Naturally, 2017 will be the year you get exactly what’s coming to you. Both good and bad. But what else will happen?

Read More »

Read More »

Why the Fed Destroyed the Market Economy

Swing voters are a fickle bunch. One election they vote Democrat. The next they vote Republican. For they have no particular ideology or political philosophy to base their judgment upon.

Read More »

Read More »

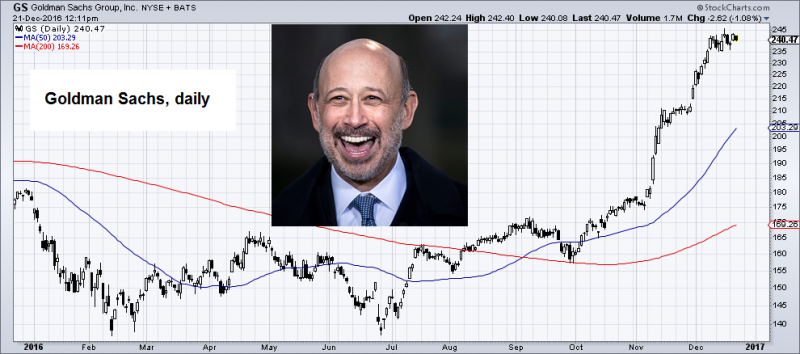

How You Become a Crony

BALTIMORE – Who’s the biggest winner so far? “Government Sachs!” Fortune magazine reports that the winningest person since Trump’s election is Goldman Sachs CEO Lloyd Blankfein.

Read More »

Read More »

Wreck the Halls

Despite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time.

Read More »

Read More »

Fake News? It’s All Fake!

BALTIMORE – In January of this year, the Empire Herald reported that a “meth-addled couple” had eaten a homeless man in New York City’s Central Park. Later, Now8News reported that a can of cookie dough had “exploded in a woman’s vagina”; the woman was alleged to be shoplifting.

Read More »

Read More »

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults. Last Wednesday Moody’s reported that mortgage arrears continue to rise across Australia, particularly in the mining states of WA & NT:

Read More »

Read More »

The Reign of Bubble Finance

Financialization Genius BALTIMORE – When we left you last time, we were in the middle of describing the crooked hind leg of crony capitalism. We used billionaire businessman Wilbur Ross – Donald Trump’s pick for the Department of Commerce – for illustration purposes. Not that there is anything wrong with Mr. Ross. He plays the game, just as everyone else does. He’s particularly good at it.

Read More »

Read More »

Has the Fed Turned “Hawkish?”

Juiced, Stimulus, in a general sense, is something that causes an action or response. A ringing alarm clock may prompt someone to exit their slumber. Or a fist to the gut may force someone to gasp for breath.

Read More »

Read More »

“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro's decision to follow Indian PM Modi's playbook and announce that the nation's largest denomination bill (100-Bolivars - worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called "mafias".

Read More »

Read More »

The Exiling of Risk

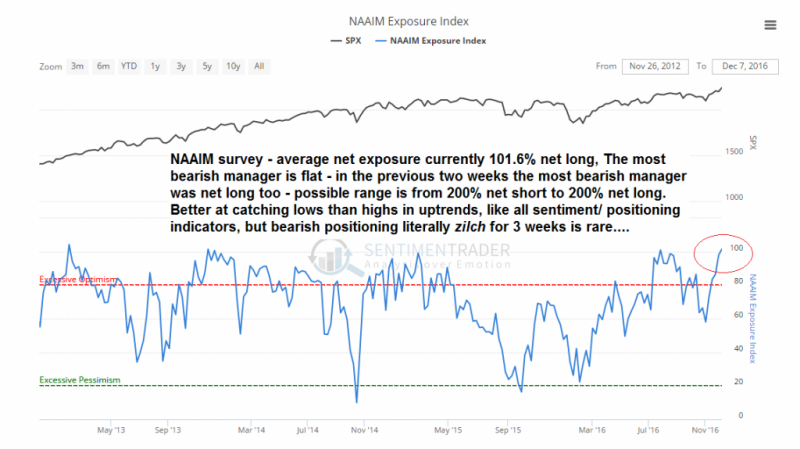

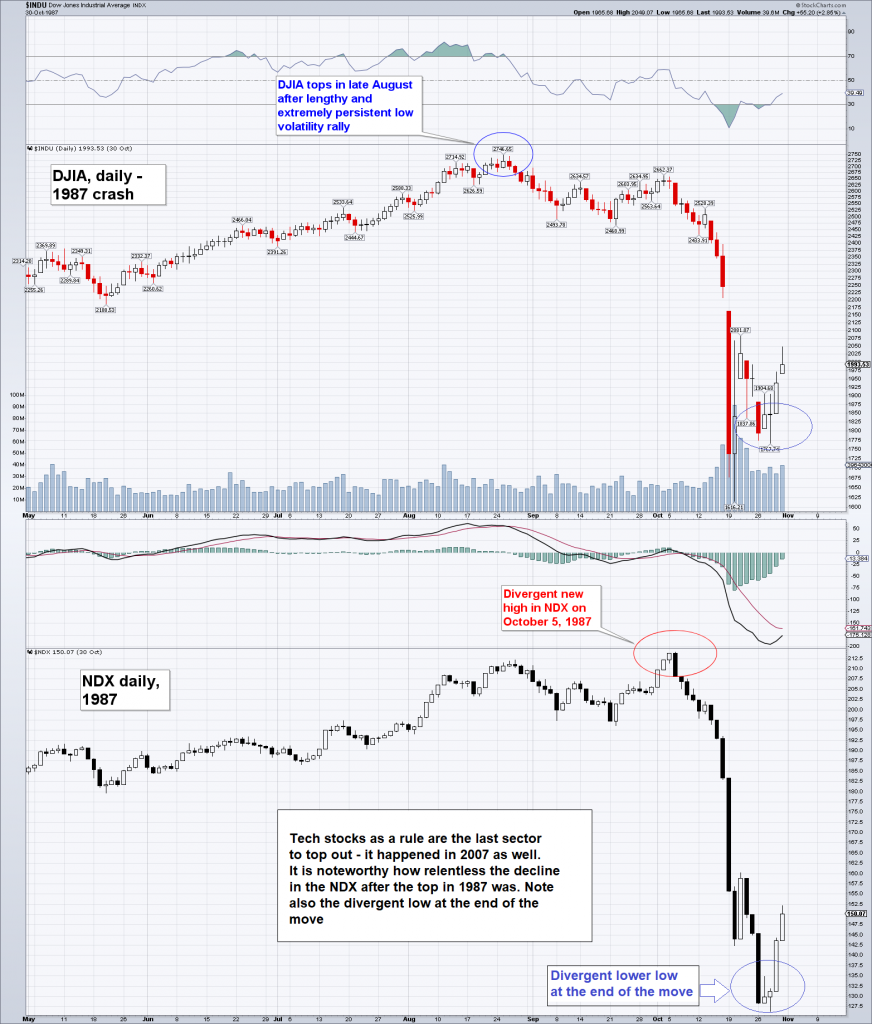

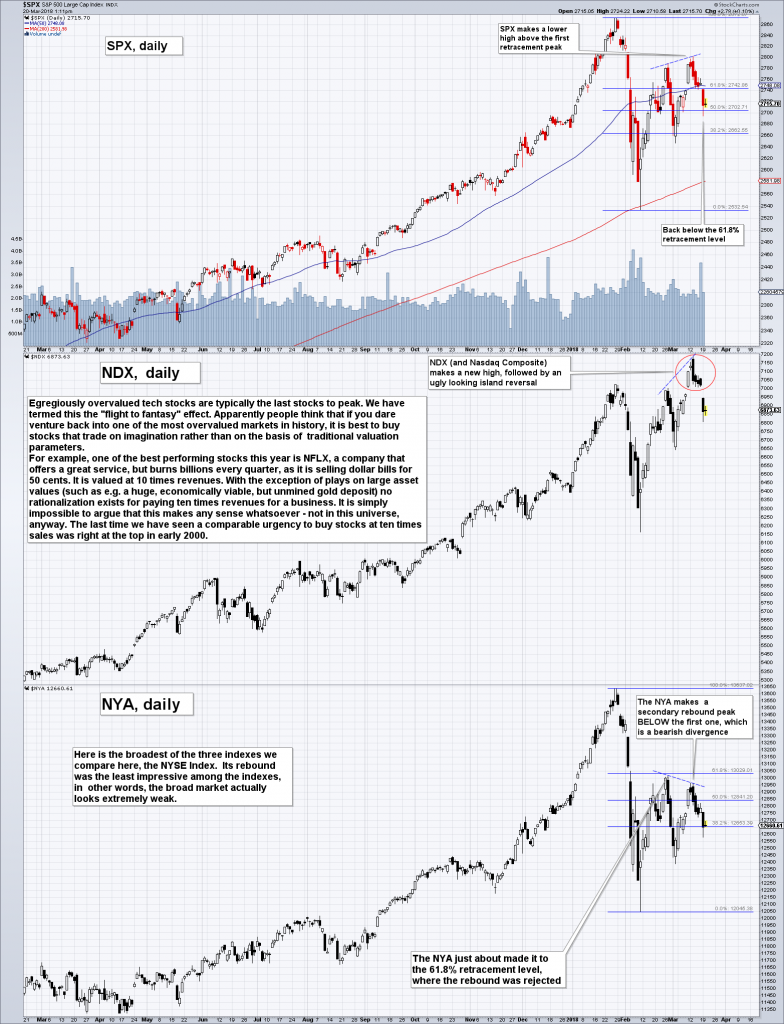

A Quick Chart Overview Below is an overview of charts we picked to illustrate the current market situation. The selection is a bit random, but not entirely so. The first set of charts concerns positioning and sentiment. As one would expect, these look fairly stretched at the moment, but there are always ways in which they could become even more stretched. First a look at the NAAIM exposure index.

Read More »

Read More »

The Climate Changes Back – What Comes Next?

Last year’s El Nino phenomenon temporarily provided succor to climate alarmists, who were increasingly bothered by the “Great Pause” – the fact that the tiny amount of warming experienced since the last cooling cycle ended in the late 1970s had apparently stopped. Despite trace amounts of CO2 in the atmosphere continuing to climb, mother nature decided to disobey alarmist models and temperatures went sideways for about 20 years (or even longer,...

Read More »

Read More »