Category Archive: 6b.) Debt and the Fallacies of Paper Money

Russell 2000: The Dangerous Season Begins Now

Readers are surely aware of the saying “sell in May and go away”. It is one of the best-known and oldest stock market truisms. And the saying is justified. In my article “Sell in May and Go Away – in 9 out of 11 Countries it Makes Sense to Do So” in the May 01 2017 issue of Seasonal Insights I examined the so-called Halloween effect in great detail.

Read More »

Read More »

Adventures in Quantitative Tightening

All remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that:

Read More »

Read More »

How Dumb Is the Fed?

Bent and Distorted. POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

Read More »

Read More »

No “Trump Bump” for the Economy

POITOU, FRANCE – “Nothing really changes.” Sitting next to us at breakfast, a companion was reading an article written by the No. 2 man in France, Édouard Philippe, in Le Monde. The headline promised to tell us how the country was going to “deblock” itself.

Read More »

Read More »

Tales from the FOMC Underground

Many of today’s economic troubles are due to a fantastic guess. That the wealth effect of inflated asset prices would stimulate demand in the economy. The premise, as we understand it, was that as stock portfolios bubbled up investors would feel better about their lot in life.

Read More »

Read More »

Nikki Haley – Warmonger Extraordinaire

Beating the War Drums at the UN. It must now be a prerequisite of those who become an American ambassador to the UN to possess certain characteristics and traits, the most important of which are rabid warmonger, child killer, and outright liar.

Read More »

Read More »

The Money Velocity Myth

For most financial commentators an important factor that either reinforces or weakens the effect of changes in the money supply on economic activity and prices is the “velocity of money”.

Read More »

Read More »

Work is for Idiots

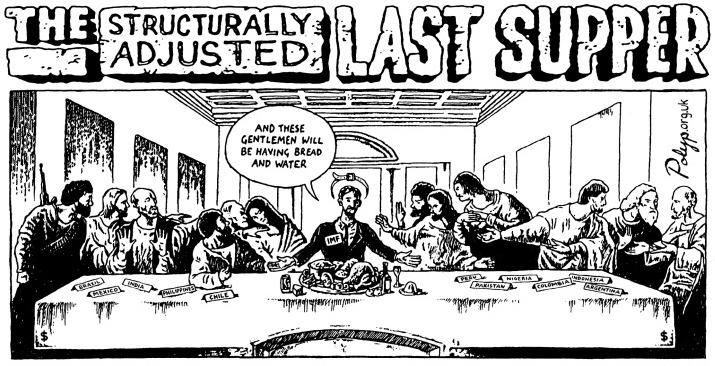

Disproportionate Rewards. The International Monetary Fund reported an unpleasant outlook for the U.S. economy on Wednesday. The IMF, as part of its annual review, believes the U.S. economic model isn’t working as well as it could to generate shared income growth.

Read More »

Read More »

The Ultimate Regulatory Reform: Abolish Fractional Reserve Banking!

The Trump Administration has presented the first part of its plan to overhaul a number of Wall Street financial regulations, many of which were enacted in the wake of the 2008 financial crisis. The report is in response to Executive Order 13772 in which the US Treasury Department is to provide findings “examining the United States’ financial regulatory system and detailing executive actions and regulatory changes that can be immediately undertaken...

Read More »

Read More »

Dudley in a Good Place

Dear Mr. Dudley, Your recent remarks in the wake of last week’s FOMC statement were notably unhelpful. In particular, your explanation that further rate hikes are needed to prevent crashing unemployment and rising inflation stunk of rotten eggs.

Read More »

Read More »

Pope Francis and Angela Merkel: Enemies of European Civilization

Two of Europe’s greatest contemporary enemies recently got together to compare notes and discuss how they were going to further undermine and destabilize what remains of the Continent’s civilization. Pope Francis and German Chancellor Angela Merkel met on June 17, in the Vatican’s Apostolic Palace to discuss the issues which will be raised at a Group of 20 summit meeting in Hamburg, from July 7-8.

Read More »

Read More »

Parabolic Coin

When writing an article about the recent move in bitcoin, one should probably not begin by preparing the chart images. Chances are one will have to do it all over again. It is a bit like ordering a cup of coffee in Weimar Germany in early November 1923. One had to pay for it right away, as a cup costing one wheelbarrow of Reichsmark may well end up costing two wheelbarrows of Reichsmark half an hour later.

Read More »

Read More »

Quantitative Easing Explained

We have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an asset swap‘ notion.

Read More »

Read More »

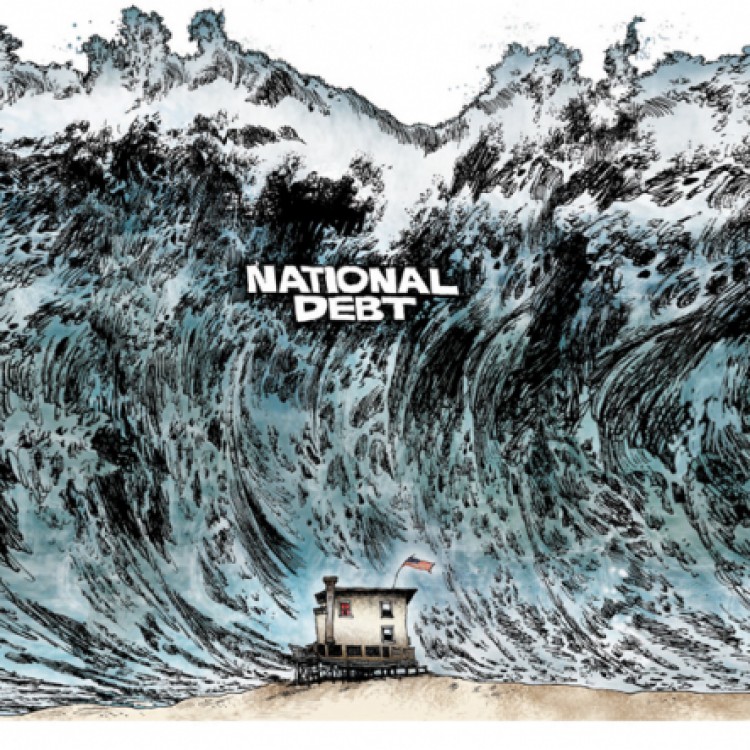

The Three Headed Debt Monster That’s Going to Ravage the Economy

Mass Infusions of New Credit. “The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.” – John Steinbeck, The Grapes of Wrath. Something strange and somewhat senseless happened this week. On Tuesday, the price of gold jumped over $13 per ounce. This, in itself, is nothing too remarkable. However, at precisely the same time gold was jumping, the yield on the 10-Year Treasury note was slip sliding...

Read More »

Read More »

Recession Watch Fall 2017

One Ear to the Ground, One Eye to the Future Treasury yields are attempting to say something. But what it is exactly is open to interpretation. What’s more, only the most curious care to ponder it. Like Southern California’s obligatory June Gloom, what Treasury yields may appear to be foreshadowing can be somewhat misleading.

Read More »

Read More »

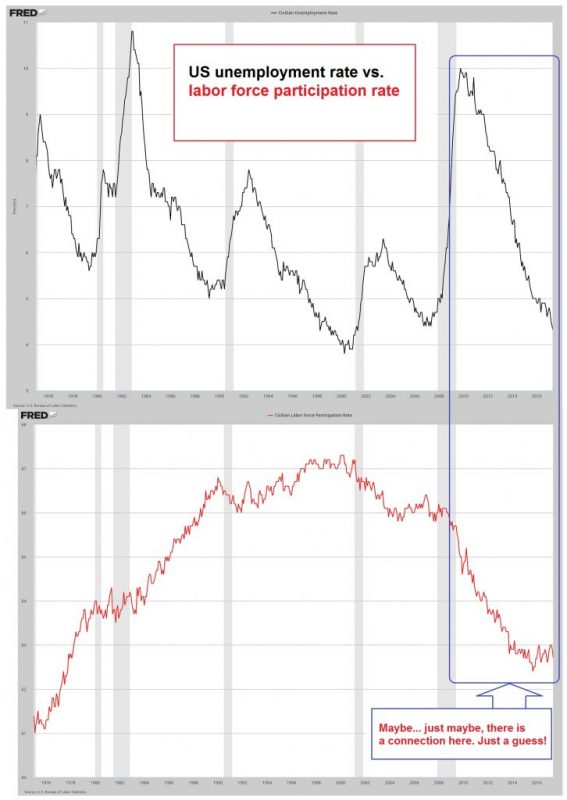

The Attack on Workers, Phase II

It’s been a long row to hoe for most workers during the first 17 years of the new millennium. The soil’s been hard and rocky. The rewards for one’s toils have been bleak.For many, laboriously dragging a push plow’s dull blade across the land has hardly scratched enough of a rut in the ground to plant a pitiful row of string beans. What’s more, any bean sprouts that broke through the stony earth were quickly strangled out by seasonal weeds....

Read More »

Read More »

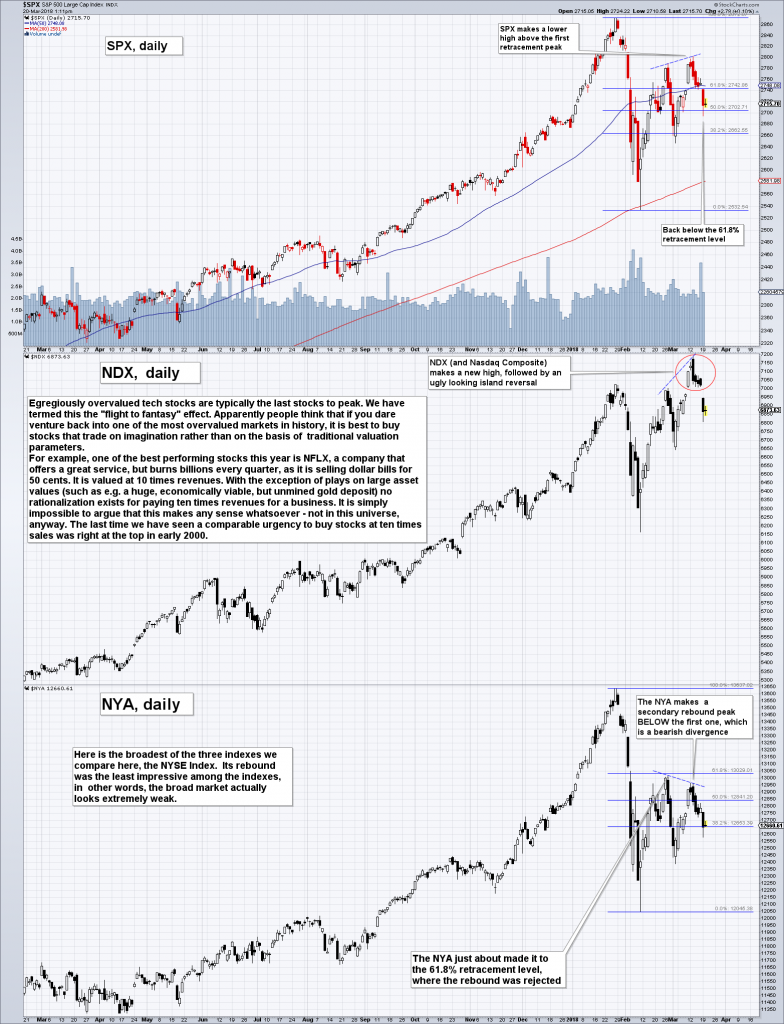

Moving Closer to the Precipice

The decline in the growth rate of the broad US money supply measure TMS-2 that started last November continues, but the momentum of the decline has slowed last month (TMS = “true money supply”). The data were recently updated to the end of April, as of which the year-on-year growth rate of TMS-2 is clocking in at 6.05%, a slight decrease from the 6.12% growth rate recorded at the end of March.

Read More »

Read More »

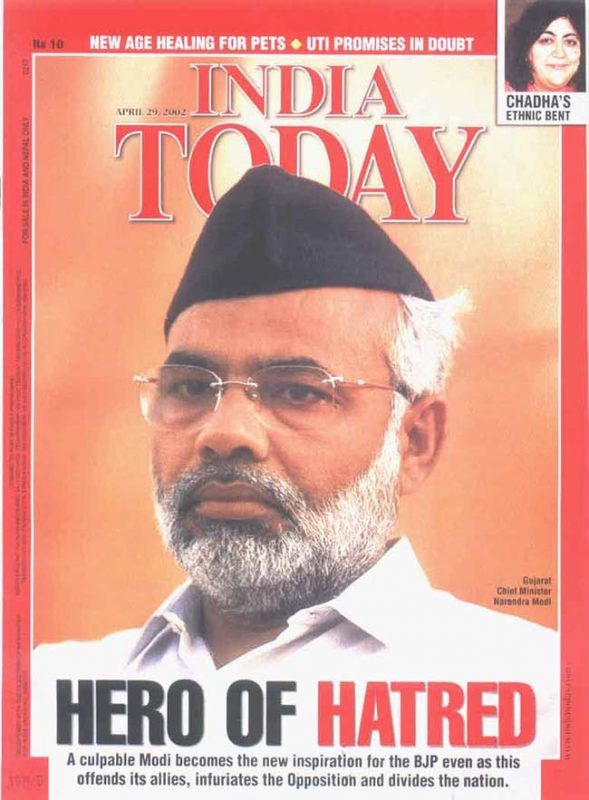

India: Why its Attempt to Go Digital Will Fail

Over the three years in which Narendra Modi has been in power, his support base has continued to increase. Indian institutions — including the courts and the media — now toe his line. The President, otherwise a ceremonial rubber-stamp post, but the last obstacle keeping Modi from implementing a police state, comes up for re-election by a vote of the legislative houses in July 2017.

Read More »

Read More »