Category Archive: 6b.) Acting Man

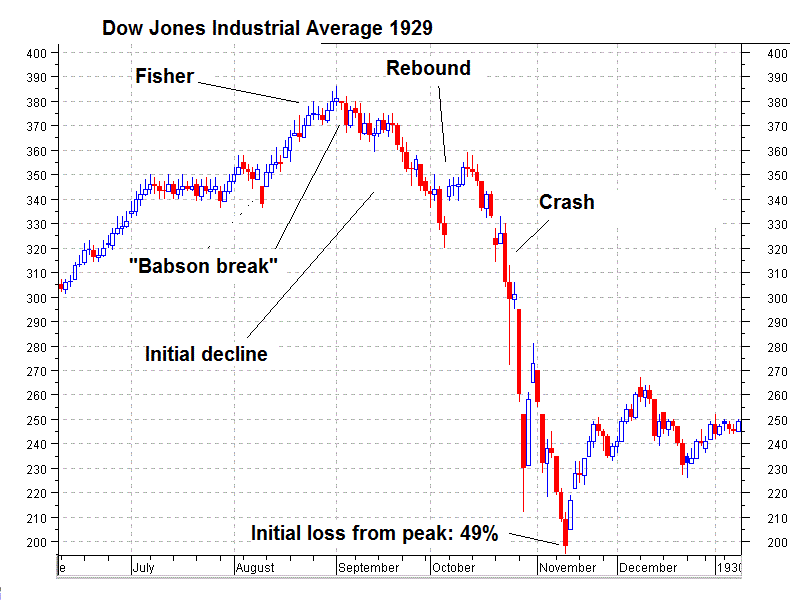

Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. Moreover, if the market goes up for long enough, the opinions become so engrained they seek to explain why stock prices...

Read More »

Read More »

What Went Wrong With the 21st Century?

POITOU, FRANCE – “So how much did you make last night?” “We made about $15,000,” came the reply from our eldest son, a keen cryptocurrency investor. “Bitcoin briefly pierced the $3,500 mark – an all-time high. The market cap of the entire crypto market shot up, too… with daily trading volume also rising.

Read More »

Read More »

This Is Why Shrinkflation Is Impacting Your Financial Wellbeing

Shrinkflation has hit 2,500 products in five years. Not just chocolate bars that are shrinking. Toilet rolls, coffee, fruit juice and many other goods. Effects of shrinkflation been seen for “good number of years”. Consumer Association of Ireland. Shrinkflation is stealth inflation, form of financial fraud. Punishes vulnerable working and middle classes. Gold is hedge against inflation and shrinkflation.

Read More »

Read More »

Views From the Top of the Skyscraper Index

On a warm Friday Los Angeles morning in spring of 2016, we found ourselves standing at the busy corner of Wilshire Boulevard and South Figueroa Street. We were walking back to our office following a client wire brushing for events beyond our control. But we had other thoughts on our mind.

Read More »

Read More »

Incrementum Advisory Board Meeting, Q3 2017

The quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to find the link again later, we have recently added it to our...

Read More »

Read More »

The Myth of India’s Information Technology Industry

When I was studying in the UK in early 90s, I was often asked about cows, elephants and snake-charmers on the roads in India. A shift in public perception— not in the associated reality — was however starting to happen. India would soon become known for its vibran

Read More »

Read More »

The Student Loan Bubble and Economic Collapse

The inevitable collapse of the student loan “market” and with it the take-down of many higher educational institutions will be one of the happiest and much needed events to look forward to in the coming months/years.

Read More »

Read More »

Congress’s Radical Plan to End Illegal Money

What Constitution? One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money.

Read More »

Read More »

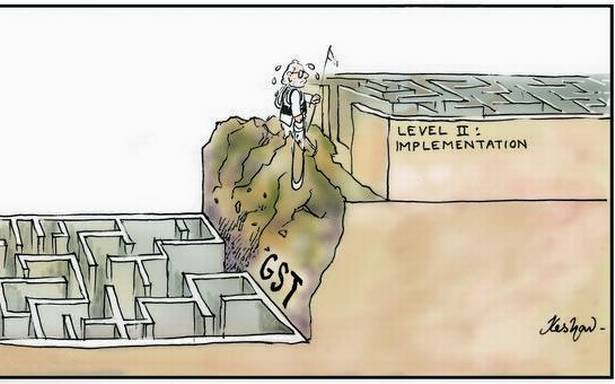

India: The Lunatics Have Taken Over the Asylum

Goods and Services Tax, and Gold (Part XV) Below is a scene from anti-GST protests by traders in the Indian city of Surat. On 1st July 2017, India changed the way it imposes indirect taxes. As a result, there has been massive chaos around the country. Many businesses are closed for they don’t know what taxes apply to them, or how to do the paperwork. Factories are shut, and businesses are protesting.

Read More »

Read More »

Russell 2000: The Dangerous Season Begins Now

Readers are surely aware of the saying “sell in May and go away”. It is one of the best-known and oldest stock market truisms. And the saying is justified. In my article “Sell in May and Go Away – in 9 out of 11 Countries it Makes Sense to Do So” in the May 01 2017 issue of Seasonal Insights I examined the so-called Halloween effect in great detail.

Read More »

Read More »

Adventures in Quantitative Tightening

All remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that:

Read More »

Read More »

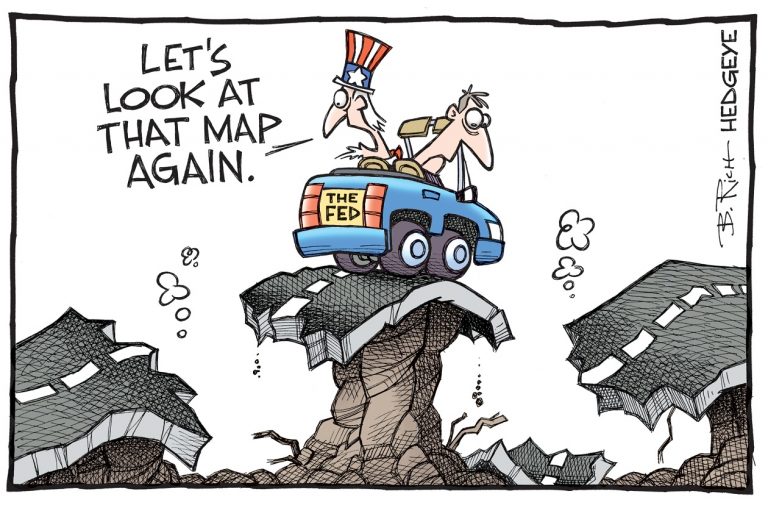

How Dumb Is the Fed?

Bent and Distorted. POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

Read More »

Read More »

No “Trump Bump” for the Economy

POITOU, FRANCE – “Nothing really changes.” Sitting next to us at breakfast, a companion was reading an article written by the No. 2 man in France, Édouard Philippe, in Le Monde. The headline promised to tell us how the country was going to “deblock” itself.

Read More »

Read More »

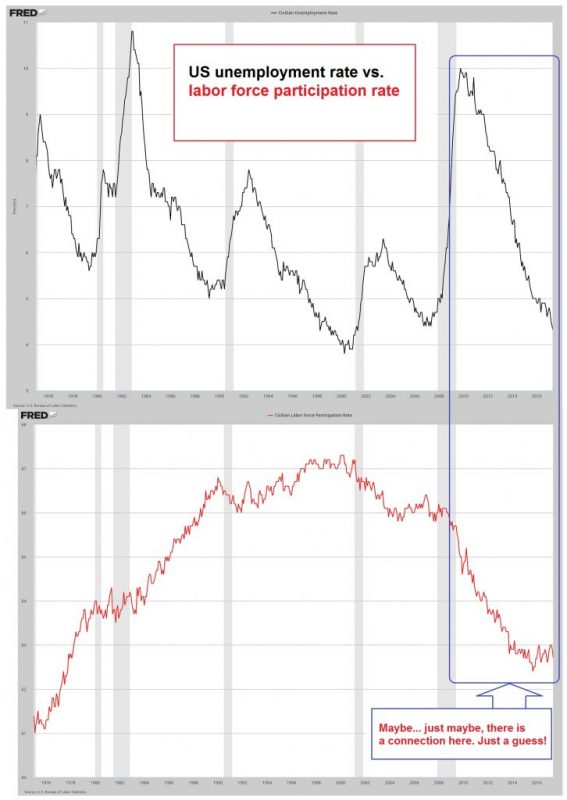

Tales from the FOMC Underground

Many of today’s economic troubles are due to a fantastic guess. That the wealth effect of inflated asset prices would stimulate demand in the economy. The premise, as we understand it, was that as stock portfolios bubbled up investors would feel better about their lot in life.

Read More »

Read More »

Nikki Haley – Warmonger Extraordinaire

Beating the War Drums at the UN. It must now be a prerequisite of those who become an American ambassador to the UN to possess certain characteristics and traits, the most important of which are rabid warmonger, child killer, and outright liar.

Read More »

Read More »

Work is for Idiots

Disproportionate Rewards. The International Monetary Fund reported an unpleasant outlook for the U.S. economy on Wednesday. The IMF, as part of its annual review, believes the U.S. economic model isn’t working as well as it could to generate shared income growth.

Read More »

Read More »

The Ultimate Regulatory Reform: Abolish Fractional Reserve Banking!

The Trump Administration has presented the first part of its plan to overhaul a number of Wall Street financial regulations, many of which were enacted in the wake of the 2008 financial crisis. The report is in response to Executive Order 13772 in which the US Treasury Department is to provide findings “examining the United States’ financial regulatory system and detailing executive actions and regulatory changes that can be immediately undertaken...

Read More »

Read More »

Dudley in a Good Place

Dear Mr. Dudley, Your recent remarks in the wake of last week’s FOMC statement were notably unhelpful. In particular, your explanation that further rate hikes are needed to prevent crashing unemployment and rising inflation stunk of rotten eggs.

Read More »

Read More »

Pope Francis and Angela Merkel: Enemies of European Civilization

Two of Europe’s greatest contemporary enemies recently got together to compare notes and discuss how they were going to further undermine and destabilize what remains of the Continent’s civilization. Pope Francis and German Chancellor Angela Merkel met on June 17, in the Vatican’s Apostolic Palace to discuss the issues which will be raised at a Group of 20 summit meeting in Hamburg, from July 7-8.

Read More »

Read More »