Category Archive: 1) SNB and CHF

Weekly Newspaper on Swiss National Bank, Edition October 28

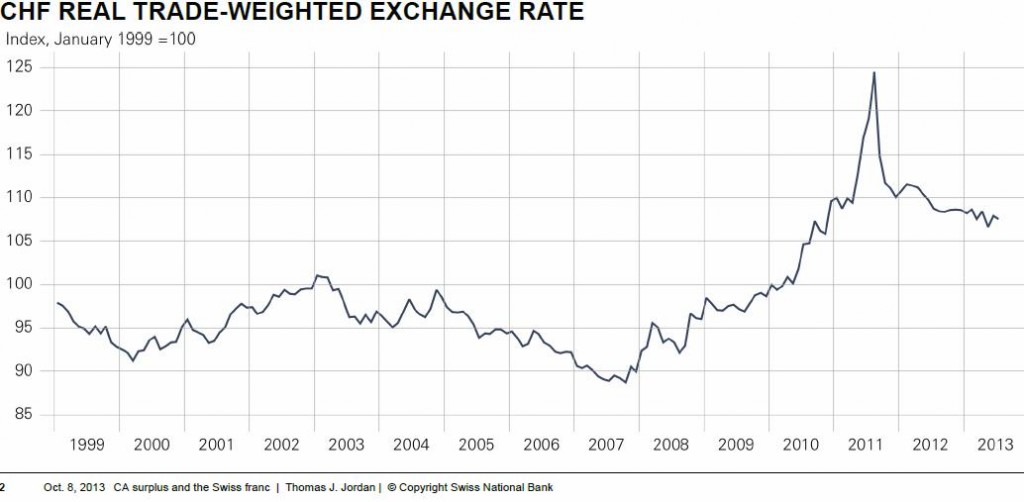

The SNB recently published the latest real effective exchange rate (REER). According to that the franc was only 7% overvalued against the base year 1999. Credit Suisse (CS) has taken some more factors than the REER under consideration: for them the fair value of the EUR/CHF is now 1.22, while the dollar was still undervalued. …

Read More »

Read More »

SNB’s Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask Him …

SNB's Jordan Responds to the Critique from the Peterson Institute: What They Forgot to Ask...

Read More »

Read More »

No SNB Intervention: Massive Swiss M0 Increase due to Post Finance Transformation into a Bank

SNB did not intervene. Deposits of Swiss Post Finance had been reclassified from other sight liabilities to deposits of domestic banks.

Read More »

Read More »

Danthine: SNB would end franc cap once it raises interest rates

It was obvious already at the latest SNB Monetary Policy Assessment, the SNB is becoming more and more hawkish. At the forefront is its ueber-hawk Jean-Pierre Danthine, the person responsible for the overheating Swiss housing market. He has now announced: SNB would end franc limit once it raises interest rates The Swiss National Bank will …

Read More »

Read More »

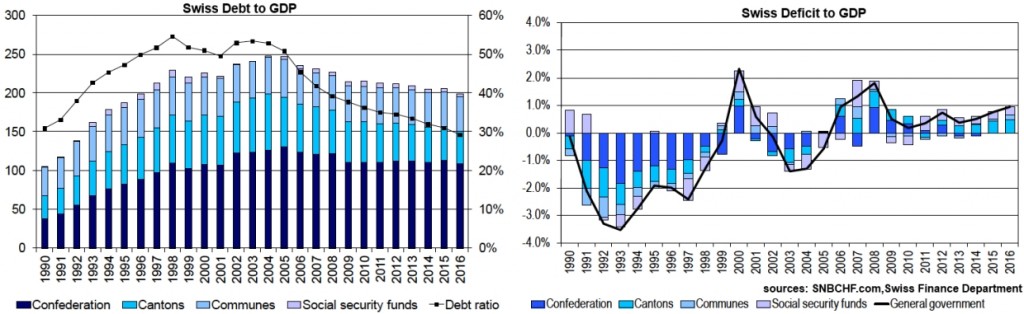

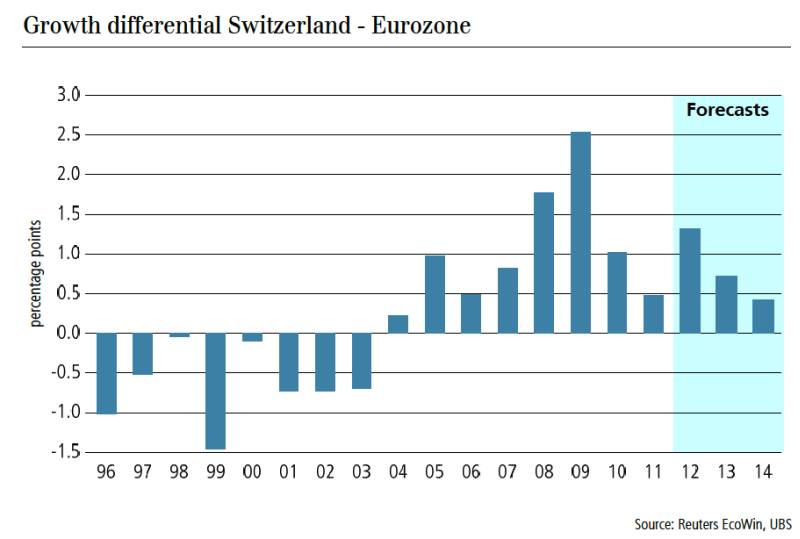

Debt Reduction, the new Financial Cycle, an Important Driver of EUR/CHF

In this analysis we describe why the long-lasting financial cycle of debt reduction is one key driver of the EUR/CHF exchange rate. We claim that EUR/CHF can rise more strongly only when the competitiveness of the European periphery increases. When this happens, then debt will be reduced and both public and private deficit spending will stop.

Read More »

Read More »

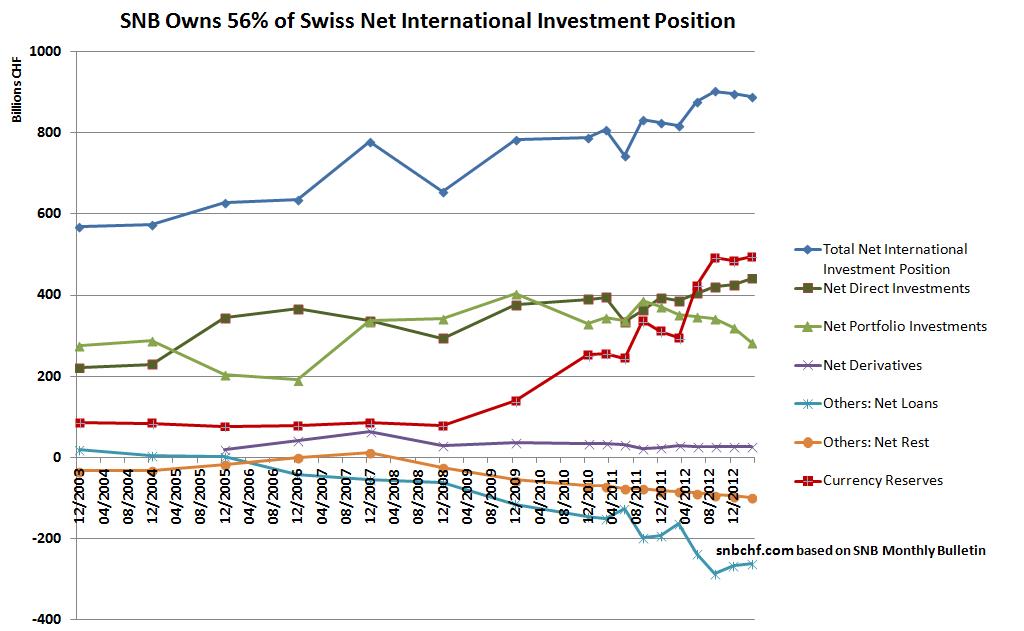

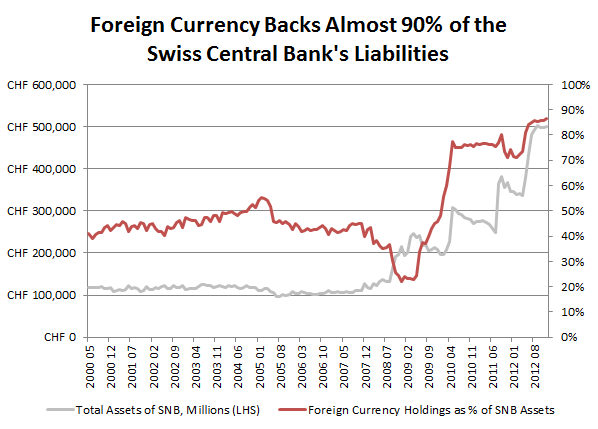

A Nationalization of Swiss Foreign Assets? SNB Owns 56% of Swiss Net International Investment Position

The SNB currently owns 56% of the Swiss net international investment position (“NIIP”). In the year 2007 this number was only 12%. Is the central bank implicitly nationalizing the Swiss international companies?

Read More »

Read More »

Our Detailed Estimate of SNB Q2 Results: 17 Billion Francs Loss, The Reality 18 Billion

UPDATE: July 30th, 2013: Our estimate for the quarterly loss missed the reality by 1 billion francs. The quarter results: 18.3 billion francs loss. The loss for H1 was 7.3 billion CHF. July 1st 2013: We estimate that the Swiss National Bank (SNB) obtained a loss of 17.3 billion francs in the second quarter 2013. … Continue reading »

Read More »

Read More »

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »

Swiss Franc History, 2012: CHF becomes a “safe” Risk-On Currency

At the end of May, SNB president Jordan admitted that the EUR/CHF floor will not raised (here also cited by Bloomberg): “We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.”

Read More »

Read More »

SNB Monetary Assessment June 2013: Very risk-averse, nearly hawkish tone

The Swiss National Bank (SNB) delivered a, for her standards, very hawkish monetary assessment with the focus on the risks in the financial sector. This does not come as a surprise for us. Each time, after the United States has recovered from a crisis – just like now – inflation and risks increased in Switzerland. …

Read More »

Read More »

Danthine’s Latest Statements Imply that SNB Might Remove Cap in 2014

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand. Danthine has perfectly understood that times for the SNB might get hard again in 2014. Jean-Pierre Danthine has made some comments recently: – Swiss franc stays …

Read More »

Read More »

SNB to Follow the Bank of Japan? Part1

Questions to George Dorgan Is there any chance that the SNB or other central banks could follow the BOJ and just depreciate the currency? George Dorgan: What did the BoJ do? Monetary easing and talk down the yen in a mercantilist style. A central bank is able to talk down a currency only if there … Continue reading »

Read More »

Read More »

How Modern Monetary Policy Changed CHF from Gold-Backed to a USD and Euro-Backed Currency

we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling.... ECB and Fed interest rates seem to be nailed to zero for years.

Read More »

Read More »