Category Archive: 1) SNB and CHF

The SNB’s Karl Brunner Distinguished Lecture Series: Raghuram Rajan announced as next speaker

The Swiss National Bank (SNB) has named Raghuram Rajan as this year’s speaker for its Karl Brunner Distinguished Lecture Series. Professor Rajan has made outstanding contributions to both economic practice and economic research on the global stage. His roles have included Governor of the Reserve Bank of India from 2013 until 2016 and Chief Economist at the IMF between 2003 and 2006.

Read More »

Read More »

Scam Alert! #Swiss-Finma is no more paying! Withdrawal pending – Hyips daily

Scam Alert! #Swiss-Finma is no more paying! Withdrawal pending – #Hyipsdaily Avoid investing in Swiss-finma.Com #Scam Now More alarm join: https://t.me/hyipsdaily Join WhatsApp group: https://chat.whatsapp.com/HOVV2TLAX0B23i7DSeC2PE #hyipsdaily #paying #paying_hyip #hyip #cryptocurrency #hyip_investor #hyip_review #hyip_monitor #hyip_news #Scam_Alert #Scam

Read More »

Read More »

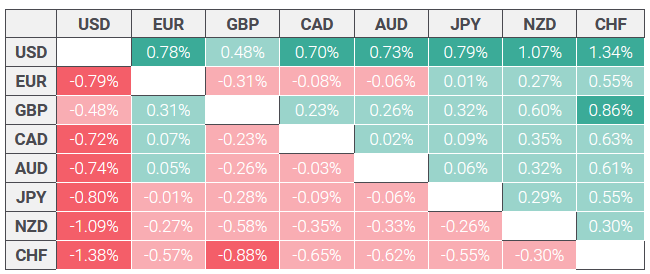

Mark Carney Steadies GBP/CHF Rates on Global Viewpoint

The pound to Swiss franc exchange rate has been steadied following comments from Mark Carney during a briefing on the global economy at the Barbican centre in London yesterday. I was fortunate to be in attendance and was struck by Carney’s confident manner, although he highlighted some major risks ahead which would be key for GBP/CHF rates.

Read More »

Read More »

Chaos-Politik der SNB mobilisiert SVP und SP: Milliarden für Vorsorge

Mit „links und rechts“ hat unsere Schweizerischen Nationalbank (SNB) ihre grosse Mühe. Da ist zunächst ihre Bilanz, bei der sie unfähig ist, „links und rechts“ voneinander zu unterscheiden. Unverstanden gerät sie nun folgerichtig auch politisch immer mehr unter Druck: konsequenterweisee von „links und rechts“.

Read More »

Read More »

Lohngleichheit @FINMA

“Lohngleichheit ist eigentlich eine Selbstverständlichkeit. Keine Organisation kann es sich leisten, per se eine diskriminierende Kultur zu haben.” Interview mit Mark Branson, Direktor der FINMA: – Warum ist Lohngleichheit wichtig für Ihre Behörde? – Wie fördern Sie die Lohngleichheit in Ihrer Behörde? – Was nehmen Sie mit aus der Lohngleichheitsanalyse mit Logib? www.finma.ch www.logib.ch...

Read More »

Read More »

GBPCHF rates hit near 3-month highs

The Pound to Swiss Franc exchange rate has soared dramatically following a series of revelations in the currency markets and global economy. A big factor is of course Sterling strength, which has arisen on the back of increased feelings that the UK will avoid a no-deal Brexit. This could manifest next week in a Parliamentary vote on whether or not to rule out a no-deal Brexit.

Read More »

Read More »

Folgt nun der umgekehrte Frankenschock?

An ihrer ersten Sitzung im neuen Jahr hat die Europäische Zentralbank (EZB) ihren Kurs bestätigt. Das Wertschriftenkaufprogramm ist definitiv beendet. Fortan kauft sie netto keine zusätzlichen Anleihen mehr zu. Sondern sie ersetzt nur noch die bestehenden Papiere, die sie in ihrem Portefeuille hält.

Read More »

Read More »

SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it: "grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks.

Read More »

Read More »

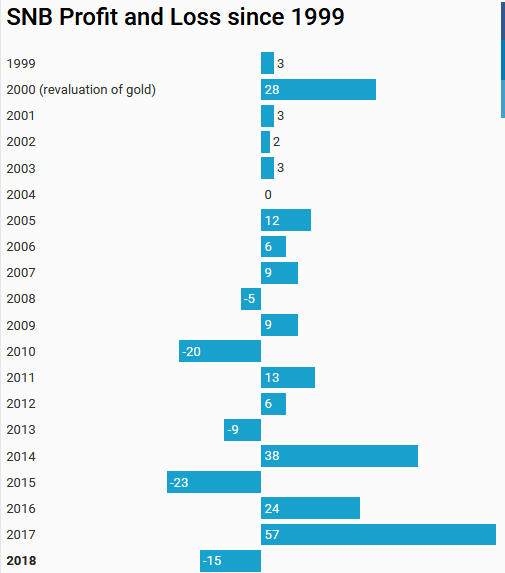

Provisional Results 2018: Will the SNB ever make profits again?

15 Billion Francs Losses in 2018. Given that the good years have finished: Will the SNB will ever make profits again? And compensate for the ever rising Swiss franc?

Read More »

Read More »

Swiss National Bank Suffers $15 Billion Loss On 2018 Market Rout

In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB's US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18 of around $6bn.

Read More »

Read More »

Brexit vote to dominate Pound to Swiss Franc exchange rates

Pound to Swiss Franc exchange rates. The value of the Pound against the Swiss Franc has remained in a fairly tight range since the start of the year. However, in the last couple of days the Pound has made some small gains after the Swiss National Bank confirmed that their currency reserves have dropped slightly.

Read More »

Read More »

GBP/CHF Forecast: Swiss Franc at Best Level against the Pound in over a year

Brexit uncertainty causes Swiss Franc to gain vs the Pound. The Pound is now trading at its lowest level to buy Swiss Francs in over twelve months as the political uncertainty surrounding the UK is continuing to negatively affect the value of Sterling exchange rates.

Read More »

Read More »

Police Warn of fake Swiss Franc Notes

Since the beginning of December 2018 more and more counterfeit 100 Swiss franc notes have been appearing in the Swiss canton of Valais in and around Sion and Conthey. The fake notes, which the local Police say can be spotted if compared to real ones, have been making their way into circulation via shopping centres, kiosks and service stations in the Sion and Conthey region.

Read More »

Read More »

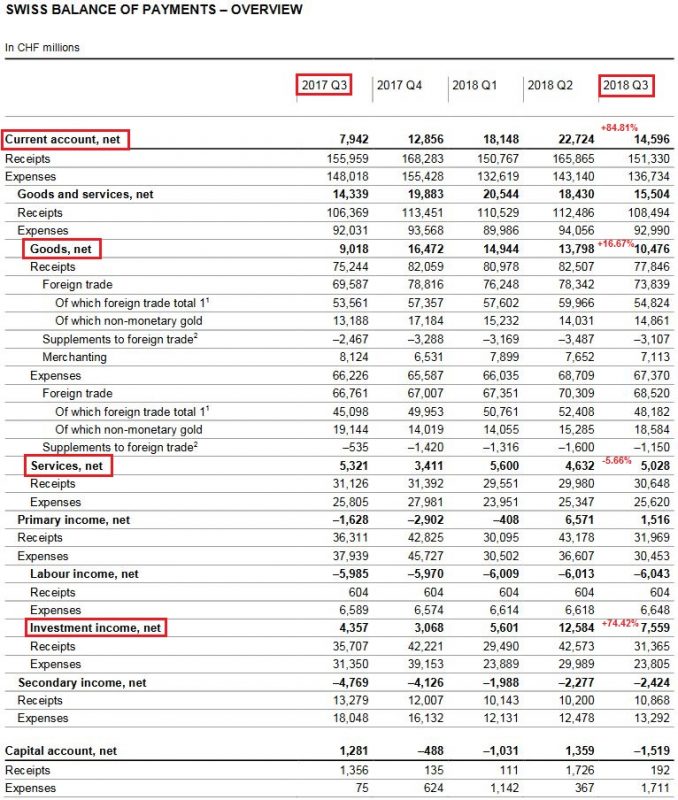

Swiss Balance of Payments and International Investment Position: Q3 2018

Current Account Key figures: Current Account: Up 85% against Q3/2017 to 14.6 bn. CHF of which Goods Trade Balance: Up 16.6% against Q3/2017 to 10.5 bn. of which the Services Balance: Minus 5.6% to 5.0 bn. of which Investment Income: Up 74.4% to 7.6 bn. CHF. Financial account Net acquisition of financial assets The … Continue reading »

Read More »

Read More »

SNB leave interest rates on hold, what next for GBP/CHF rates?

This morning the Swiss National Bank have left interest rates on hold at 0.75%, and market reaction between GBP/CHF has been limited. The Swiss Franc has rallied slightly against the US dollar and the Euro as forecasters were suggesting the SNB could cut interest rates further, however the events last night in the UK I believe outweighs the interest rate decision in Switzerland.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 13.12.2018

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 13.12.2018

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas Jordan,...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 13.12.2018

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 13.12.2018 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

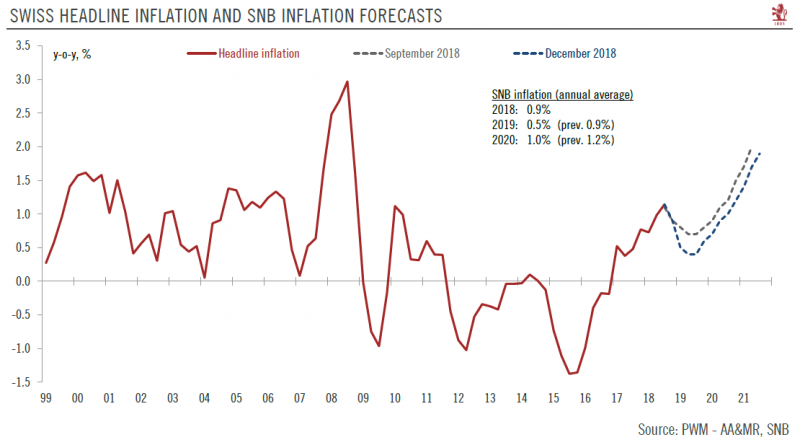

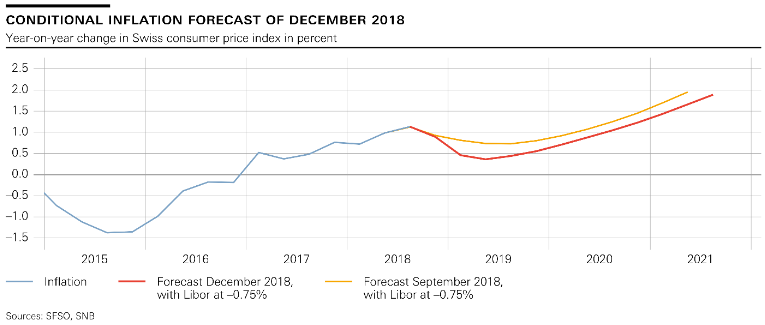

Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence.The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today.The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge.

Read More »

Read More »

Monetary Policy Assessment of 13 December 2018

The Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

-638453232816314704.png)