Category Archive: 1) SNB and CHF

Philipp Hildebrands Coup: Gratisgeld für EU-Bürger

Vergangene Woche stellte Philipp Hildebrand, der frühere Präsident des Direktoriums der Schweizerischen Nationalbank (SNB), nun Vize-Präsident von Blackrock, auf Bloomberg ein Positionspapier vor.

Read More »

Read More »

SNB sicher&solvent? Ja, meint Bern, und verweist auf Fussnote von Fussnote

Der Bundesrat behauptet, es bestehe bei der SNB kein Solvenz-Risiko. Er begründet das in seiner Botschaft an das Parlament mit einer Fussnote zu einer anderen Fussnote, die es in einer Festschrift so gar nicht gibt. Das ist liederliche Arbeit in Bundesbern; und das zu einem Thema, das staatspolitisch von grösster Tragweite ist.

Read More »

Read More »

Nationalbank unter Interventionsdruck

Der Schweizer Franken wurde zuletzt deutlich stärker gegenüber dem Euro. (Bild: Pixeljoy/Shutterstock.com)Die Zinssenkunkung der US-Notenbank Fed und die von der EZB angekündigten Massnahmen zur Lockerung der Geldpolitik sowie die jüngsten Ereignisse im Handelskonflikt zwischen den USA und China haben den Druck auf den Franken erhöht. Die Schweizer Währung wurde zuletzt deutlich stärker.

Read More »

Read More »

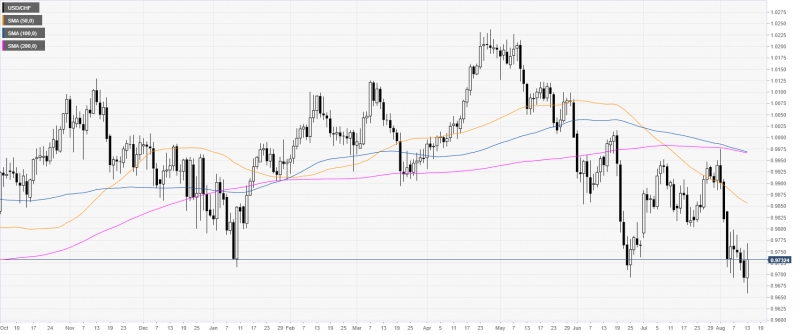

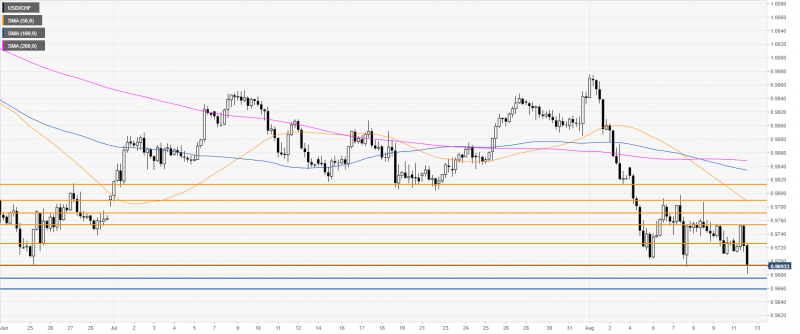

USD/CHF technical analysis: Greenback jumps and settles above 0.9726 as tariffs gets delayed

USD/CHF is trading off 2-month lows below the main daily simple moving averages (DSMAs). US equity markets are rising sharply as US tariffs are to be delayed to December 15. The news was perceived as risk-on, sending safe-haven CHF, JPY and gold down.

Read More »

Read More »

USD/CHF technical analysis: Greenback under pressure below 0.9700 as sellers challenge June lows

CHF is up as Wall Street indices start the week in the red. The level to beat for bears are at the 0.9675 and 0.9660 levels.

Read More »

Read More »

Nationalbank dürfte erneut interveniert haben

Darauf deuten die Sichtguthaben bei SNB hin, die als Indiz für solche Interventionen gelten und in der vergangenen Woche deutlich gestiegen sind. Die Einlagen von Bund und Banken lagen am 9. August bei 585,5 Milliarden Franken, wie die SNB am Montag mitteilte. Das ist ein Anstieg von rund 2,8 Milliarden gegenüber der Vorwoche.

Read More »

Read More »

USD/CHF technical analysis: Greenback stable near 0.9755 as US stocks recover

The demand for the Swiss franc decreases as Wall Street indices are gaining strength. The level to beat for bulls are at 0.9790 and 0.9815 level.

Read More »

Read More »

Un père outré dénonce une banque à la FINMA

vendredi, 9 août 2019 Un père outré dénonce une banque à la FINMA | Sky Suisse News Son fils de 15 ans a ouvert un compte bancaire. En s'adressant à l'établissement pour en connaître les conditions, la banque a exigé une procuration du mineur! Le père est scandalisé par la méthode. #Sky_Suisse_News

Read More »

Read More »

SNB erhält Lektion von der neuen Stoosbahn

Quizfrage: Was kurbelt den Schweizer Tourismus mehr an? Der Kauf von Hanf-Aktien in den USA für 80 Millionen Franken oder der Bau der Stoosbahn für 80 Millionen Franken? Welches ist Ihre Antwort, verehrte Leserin, verehrter Leser?

Read More »

Read More »

Pound to Swiss Franc forecast: Investors flock to the CHF, will the Swiss National Bank curb demand for the Franc?

Sterling slides against the Swiss Franc as Brexit and the global economic outlook weigh on the Pound. The pound to Swiss franc exchange rate has fallen lower below 1.20 for the GBP vs CHF pair with interbank rates currently sitting at 1.189. The slide in the pound against the Swiss franc has presented those looking to sell Swiss francs with an opportunity to convert when compared to recent months.

Read More »

Read More »

Pressure returns on Swiss franc amid global uncertainty

One knock-on effect of the escalating trade war between the United States and China is that the Swiss franc is becoming more attractive for investors – putting pressure on the Swiss National Bank (SNB) to come to the defence of the safe haven currency. For much of July a euro bought at least CHF1.10.

Read More »

Read More »

Quant Network Token Utilities / Are they FINMA Compliant? / Binance X Quant / Overleder Gateways

Hello, My name is Amos Thomas, Owner of Chill Zone International. Please LIKE, SHARE, & Subscribe for more videos! Support The Chill Zone (ELA ONLY ADDRESS) – EexWCtt77AH97wd9kaFCFU1SpnAueLtsqp Join my Chill Zone Telegram to chat with me directly at – https://t.me/ChillZoneInt Follow me on Chill Zone Twitter at – https://twitter.com/ChillZoneInt Quant Telegram – https://t.me/QuantOverledger Quant …

Read More »

Read More »

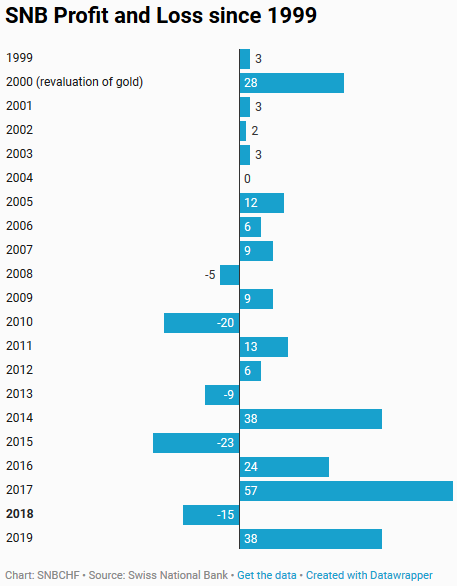

SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The Swiss National Bank reports a profit of CHF 38.5 billion for the first half of 2019. The profit on foreign currency positions amounted to CHF 33.8 billion. A valuation gain of CHF 3.8 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.1 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets.

Read More »

Read More »

Uptick in site deposits puts the spotlight on SNB intervention in the franc

Has the SNB started to intervene. The weekly site deposit data from the Swiss National Bank showed a small uptick but with some perspective, it's a notable turn. Bloomberg highlights the bump and what looks like a bid to keep EUR/CHF above 1.10.

Read More »

Read More »

Swiss Central Bank under Pressure as Franc Rises

Yesterday, the Swiss franc reached its highest level against the euro in two years. The EUR/CHF exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and typically rises when global risk perceptions rise.

Read More »

Read More »

BNS, les taux vont encore être baissés

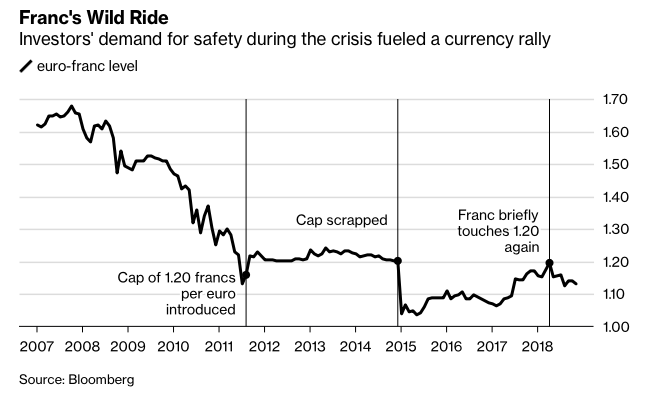

De son bilan démesuré supérieur au PIB suisse. De ne pas avoir vendu les euros achetés quand elle le pouvait. D’avoir dû abandonner le taux plancher de 1.2 CHF pour 1 EUR sous la pression du marché (je l’avais prévu, mais la BNS a quand même tenu 3 ans et demi). Qu’avec les taux négatifs, les caisses de pensions (donc les retraites) subissent des ponctions anormales.

Read More »

Read More »

Pound to Swiss Franc exchange rates remain docile despite yesterday’s UK political developments

Movement for the Pound to Swiss Franc pair limited. Pound to Swiss franc exchange rates have remained relatively rangebound this week, despite yesterday’s political developments inside the UK. Whilst the GBP/CHF pair is historically less volatile than GBP/EUR for an example, a range of only two cents movement over the past month is testament to the current market uncertainty.

Read More »

Read More »

Hildebrand hatte SNB nicht verstanden: Sie muss zugunsten eigener Wirtschaft investieren

Bilderberg, Gerzensee und „Franken-Rütli“ – das sind alles Geschwister im Geiste: undurchschaubar, informell, nicht greifbar, gegen aussen, eine Versammlung der Macht, mit dem Vorspuren von Entscheiden grösster wirtschaftlicher und politischer Tragweite.

Read More »

Read More »

Pound to Swiss Franc forecast: Will GBP/CHF rates fall below 1.20?

The pound to Swiss Franc exchange rate has been on steady decline since May when it peaked at 1.3397. Since then, it has fallen to 1.2245 as Brexit uncertainties continue to weigh on sterling, with the market feeling the prospect of a no-deal Brexit has increased. The franc has also risen in value owing to its status as a safe haven currency, and the continued fears over the global economy.

Read More »

Read More »

eicker.TV – Google AdSense ohne Apps, Fake News, Libra will Finma, Galileo – Frisch aus dem Netz.

eicker.TV – Google AdSense ohne Apps, Fake News, Libra mit Finma, Galileo – Frisch aus dem Netz. Google AdSense ohne Apps: “Nearly 70% of AdSense audiences experience the web on mobile devices. With new mobile web technologies such as responsive mobile sites, Accelerated Mobile Pages (AMP) and Progressive Web Apps (PWA) the mobile web works …

Read More »

Read More »