Category Archive: 1) SNB and CHF

Ueli Maurer gegen Thomas Jordan

Finanzminister Ueli Maurer hat völlig überraschend den Notenbank-Chef in die Pflicht genommen. Der solle sofort aufhören, weiter Euro zu kaufen und so die Bilanz seiner SNB immer noch mehr aufzublähen. Laut Bankenprofessor Hans Geiger könnte Maurer damit bezwecken, Jordan auf den Pfad der Tugend zurückzuführen – ohne Hunderte von Milliarden in Euro und Dollar. Die …

Read More »

Read More »

Ueli Maurer hat recht: Der Erste, der einsieht, dass die SNB sich hoffnungslos verrannt hat

„An der Grenze des Erträglichen“ – so beurteilt Bundesrat und Finanzminister Ueli Maurer die Bilanz der Schweizerischen Nationalbank (SNB). Als ehemaliger Präsident des Zürcher Bauernverbandes ist Maurer zu einer Milchbüchlein-Rechnung fähig. Als Inhaber des eidgenössischen Buchhalter-Diplomes kann er auch eine Bilanz beurteilen.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 21.06.2018

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 21.06.2018

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas Jordan,...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 21.06.2018

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 21.06.2018 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

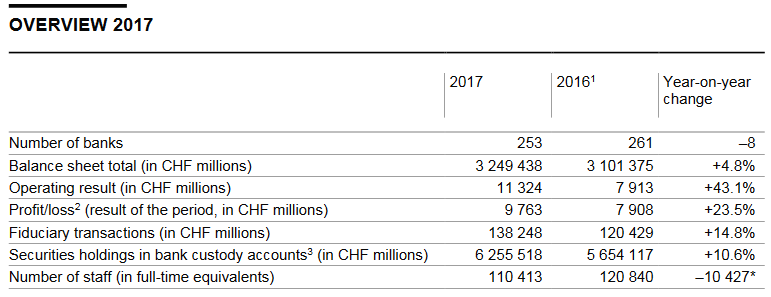

Banks in Switzerland 2017, Results from the Swiss National Bank’s data collection

Summary of the 2017 banking year. Of the 253 banks in Switzerland, 229 recorded a profit in 2017, posting a total profit of CHF 10.3 billion. The remaining 24 institutions recorded an aggregate loss of CHF 0.5 billion. The result of the period for all banks was CHF 9.8 billion. The aggregate balance sheet total rose by 4.8% to CHF 3,249.4 billion.

Read More »

Read More »

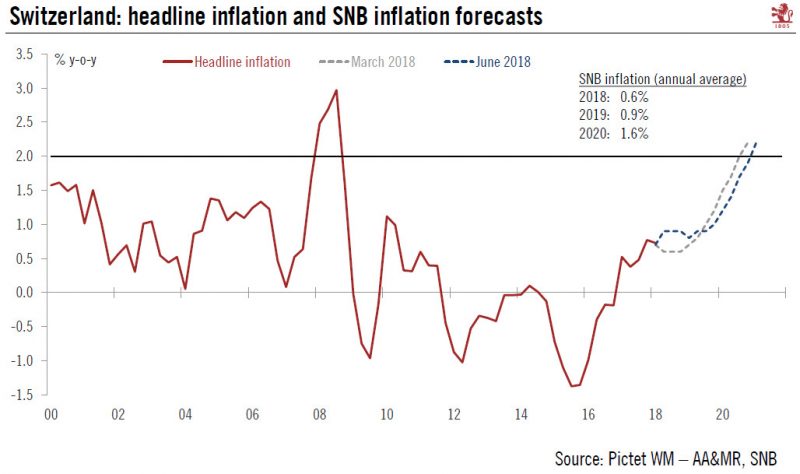

Buying more time

At its quarterly monetary policy assessment last week, the Swiss National Bank (SNB) kept unchanged the target range for the three-month Libor at between -1.25% and -0.25% and the interest rate on sight deposits at a record low of -0.75%. The SNB reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

Swiss residential property risks growing in buy to let, according to Swiss National Bank

On 21 June 2018, the Swiss National Bank (SNB) announced its decision on interest rates, which it left unchanged. Switzerland’s economy has been sailing into the headwinds of a strong currency since the SNB scrapped its exchange rate cap in January 2015 and the Swiss franc briefly went beyond parity with the euro.

Read More »

Read More »

22.06.18 | INSIDE PARADEPLATZ | LUKAS HÄSSIG | DON PIERIN UND DIE FINMA

Homepage: http://www.startv.ch Facebook: https://www.facebook.com/StarTVswitzerland Twitter: https://twitter.com/startvch Instagram: https://www.instagram.com/startv_schweiz Youtube: https://www.youtube.com/user/startv Vimeo: https://vimeo.com/startvswitzerland Google+: http://tinyurl.com/StarTV-Schweiz

Read More »

Read More »

Don Pierin und die Finma

Die Aufsicht hätte längst die Privatgeschäfte des Ex-Raiffeisen-Chefs unter die Lupe nehmen können. Stattdessen blieb sie lange still. Ihr jetzt erschienener Bericht ist nur dem Schein nach hart. Tatsächlich half die Finma beim Verschweigen der Affäre.

Read More »

Read More »

SNB Monetary Assessment June 2018, Introduction

I will begin my remarks with an overview of the situation on the financial markets, before giving an update on the status of the reforms regarding reference interest rates. And in closing I would like to say a few words about our branch office in Singapore, which is celebrating its fifth anniversary. Situation on the financial markets Let me start with the developments on the financial markets.

Read More »

Read More »

Introductory remarks by Fritz Zurbrügg

In my remarks today, I will present the key findings from this year’s Financial Stability Report, published by the Swiss National Bank this morning. In the first part of my speech, I will talk about the big banks, before going on, in the second part, to outline our current assessment of the situation at domestically focused banks.

Read More »

Read More »

Thomas Jordan: Introductory remarks, news conference

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I would also like to briefly touch on the rejection of the sovereign money initiative by the people and the cantons as well as a publication marking the tenth anniversary of the SNB’s educational programme, Iconomix.

Read More »

Read More »

Differenza tra Security vs utility vs payment tokens, come fare ico in svizzera (finma guidelines)

Videocorsi — https://filippoangeloni.com/academy/ Diamo un occhiata alla classificazione dei vari tokens ed alle loro differenze: payment tokens utility tokens security tokens e alle varie linee guida su come fare un ico in Svizzera. vuoi fare un ICO, ma non sai come fare? contattami su [email protected] Utility vs security token, e normativa su come fare un …

Read More »

Read More »

FT expertise in FT | IE Corporate Learning Alliance programmes: Izabella Kaminska

In a volatile world, business leaders need a deeper understanding of the issues behind the headlines. You’re looking for answers to complex questions on the major topics of the day that are having an impact on your business. Financial Times journalists have the knowledge, clear thinking and insights to help you develop better leaders. In …

Read More »

Read More »

Finma-Sprecher: “Mängel bei Raiffeisen waren echt gravierend”

Für die Finanzmarktaufsicht (Finma) ist klar: die Mängel bei der Corporate Governance der Raiffeisen-Gruppe waren “echt gravierend”. “Sie betreffen das weitausladende Beteiligungsgeflecht der Gruppe”, erklärt Finma-Mediensprecher Tobias Lux im Interview mit AWP Video am Donnerstag in Bern. Somit stellen die Aufseher dem Raiffeisen-Verwaltungsrat ein miserables Zeugnis aus – und dies nur einen Tag, nachdem der …...

Read More »

Read More »

Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct.

Read More »

Read More »

Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘.

Read More »

Read More »

SNB Statement on the outcome of the popular vote of 10 June 2018

The Swiss National Bank (SNB) has acknowledged the outcome of the popular vote on the sovereign money initiative. The SNB has a constitutional and statutory mandate to pursue a monetary policy serving the interests of the country as a whole. It is charged with ensuring price stability while taking due account of economic developments.

Read More »

Read More »

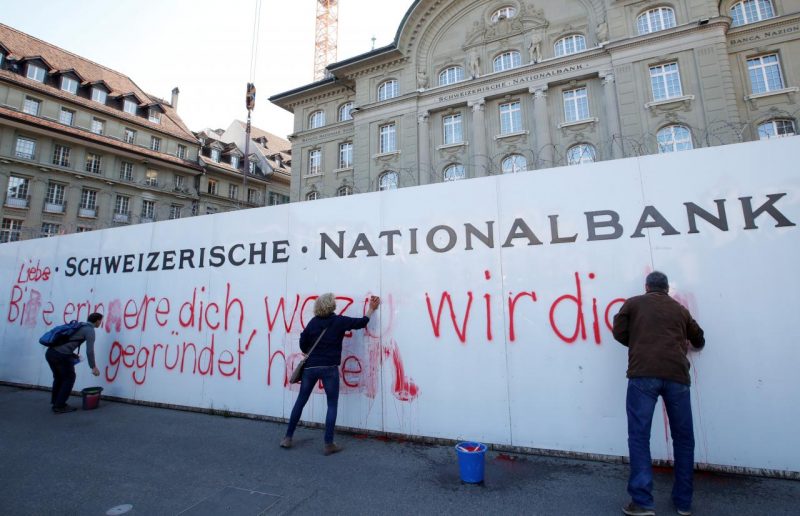

Nach Vollgeld-Schlacht: Wir Schweizer dürfen nie mehr zum Spielball ausländischer Ideologen werden

Wer sich intensiv mit der fachlichen Materie „Vollgeld-Initiative“ auseinandergesetzt hat, kann aufatmen. Wäre diese Initiative angenommen worden, hätte deren Umsetzung unser Land in ein wirtschaftliches und politisches Chaos gestürzt.

Read More »

Read More »

‘Much too early’ to lift interest rates, says SNB chairman

The continued volatility surrounding the Italian elections and the threat of global trade wars make it far too early for the Swiss National Bank (SNB) to consider raising rock bottom interest rates, says chairman Thomas Jordan.

Read More »

Read More »