After the announcement of the floor in the EUR/CHF pair, many predicted the Swedish and the Norwegian Krone to take the place of the Swiss Franc as European save-haven against the Euro turmoil (http://on.ft.com/pKSJ1V). Both countries possess a low level of debt, positive trade balance and very competitive economies.

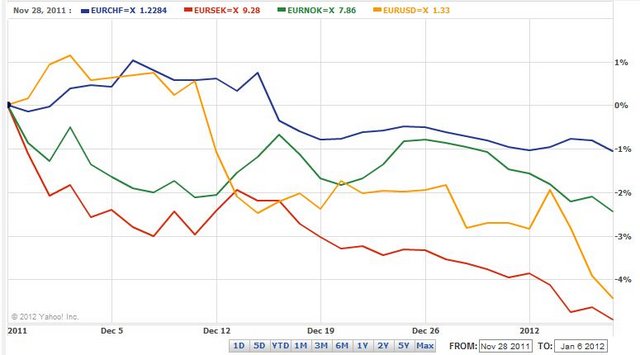

Recession fears, lower liquidity of the Scandinavian currencies and the SNB thread made the Euro rise against SEK, NOK and CHF till Black Friday, November 28th, the famous day, when the “mini recession” ended. (http://on.ft.com/A0Qxna). That the Swissie falls against the Euro in falling markets, is different from how it behaved before the SNB floor and mostly based on deflation fears and the resulting SNB intervention.

This recession scenario triggered all three currencies to fall about 2% against the Euro, whereas the USD gained 3%.

But after that the run on the new safe-havens has started: The Swedish Krona rose nearly 5% against the Euro thanks the cautious and disputed 0.25% rate cut of Swedish central bank . NOK rose 2.5% despite a 0.5% rate cut of its central bank. CHF rose 1% since Black Friday or even 2% since December 5 when the SNB did not lift the floor. The USD did worse than the SEK and rose only 4% in this period against the Euro. The run was combined with the appearance of negative interest rate in Germany and Denmark. A big rise of the Swissie was capped by 27 billion SNB Euro purchases.

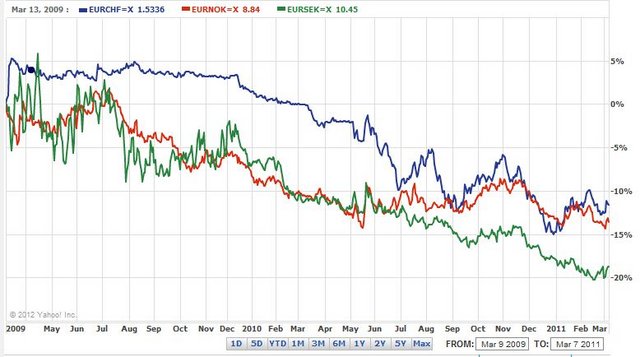

The previous recovery from March 2009 till March 2011 had similarly shown a stronger increase of the Krones (from undervalued levels in the 2009 crisis) against the Euro than the CHF against the Euro.

The rise of the Scandinavians against the Swissie was stopped after March 2011 caused by global uncertainties, the parabolic price increase of gold and the gold-related Swissie, the strong performance of the German and Swiss economy and the double hike in Euro interests rates without the corresponding hikes in Sweden and Norway.

Provided that economic data will not deteriorate it can be expected that the Norwegian and Swedish Krone will continue to rise against the Euro. An improvement of European data and especially German data will even accentuate the rise of these new European safe-havens and eventually trigger a rate hike in Sweden or Norway. There are three things that may stop the rise:

1) A hike in European rates by the ECB, which might revert flows into Euro again, like in the first half of 2011.

2) A strong improvement of data in the periphery.

3) A final solution (I insist on the word “final”) of the Euro crisis via Euro bonds or strong fiscal integration.

Since all of these points are unlikely, it seems probable to me that in the mid-term SEK and NOK will outperform the Euro. HFT Algorithms still follow the same pattern as in the graphs above and can be observed in daily movements:

1) In rising markets the CHF follows the SEK and NOK improvement against the Euro, but rises just with a lower extend.

2) In falling markets all three currencies usually fall against the Euro.

3) Due to the currently low EUR/USD level, all three have recently improved against the Euro even in falling markets.

4) Improvements in the Euro zone like a very good auction for Italy and Spain strengthens the Euro and weakens our three safe havens and vice verse.

From a fundamental perspective it is obvious that Swedish exporters will benefit from the competitive advantage of the cheap Krona against the Dollar or the Yuan. The same applies to Norwegian oil exports, which now will generate higher profits thanks the higher value of the Dollar. Both countries already enjoy a very high level of productivity, which with a stronger Dollar will even increase compared with other countries

For somebody who believes in a slow or even quicker recovery of the economy, the trades with low volatility and good expected return is the long trade in NOK/CHF and SEK/CHF:

1) Scenario slow global recovery: In the case of a slow global recovery competitive economies like Germany, Sweden, Norway or Switzerland will continue to show strength, but the periphery countries will not get out of their problems. The SNB will continue to guard the 1.20 level against the Euro. Euro interest rates will remain low.

2) Scenario strong global recovery: In this case CHF will be a funding currency of a carry trade into NOK and SEK. The ECB will not repeat the mistake it did last year and hike rates only very late.

Fundamentals:

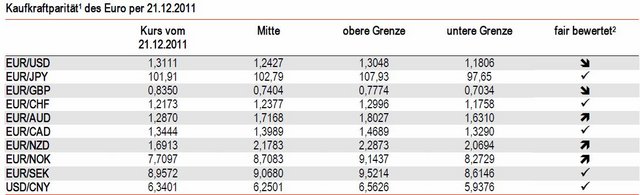

Especially the SEK is not overvalued currently as for producer prices. The Norwegian central bank is used to the overvalued NOK, due to high oil prices and the Norwegian high productivity (actually the highest in the world). Compared with the other commodity currencies AUD and NZD, the NOK is less overvalued (see the graph from HSBC Trinkaus, which currently sees the USD and the GBP undervalued against the EUR, whereas NOK, AUD, and NZD are overvalued).

Downside risks:

1) The Swiss PMI recently indicated better values than the Swedish PMI (Swiss industrial PMI 50.7 vs. 48.6 Swedish PMI http://bit.ly/zqJW7l)

2) Swedish industrial production recently fell by 3% MoM and new orders decreased by 4.8% (http://bit.ly/yaewUf).

3) The EUR/SEK pair is currently oversold: http://bit.ly/wU6LW3

4) Both SEK and NOK are not very liquid currencies:http://buswk.co/sKLX5U and http://bit.ly/sxU7Lg

5) The recent strong cut of 0.5% to 1.75% still puts the NOK under pressure.

6) The 0.25 cut of the Swedish Riksbank was controversial ), Following recent inflation data there might be space for another rate cut (http://bit.ly/zxrnUv), but some members of the council object due to high housing prices and price stability mandate.

Even if these risks exist, one have to see that everything is relative

Last but not least, what about the Swissie in two years time? In case of a slow recovery in the Euro zone there is a high probability that the EUR/CHF floor of 1.20 will be broken and the EUR tends versus parity again. Still time enough to take advantage of the described trades.

Are you the author? Previous post See more for Next postTags: Carry Trade,Deflation,ECB,Euro crisis,Gold,Krona,Norway,Norwegian Krone,PMI,Safe-haven,SEK,Swedish Krona,Swiss National Bank,Switzerland