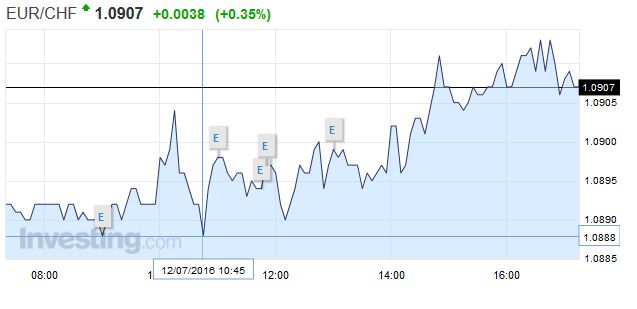

Swiss FrancFurther risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. |

|

SterlingLast night Theresa May was hailed to be the next Prime Minister as early as Wednesday evening, causing some stability to the Pound, and therefore GBP/CHF rates to re-emerge. Theresa May has made heavy hints that she will not be rushing towards a Brexit. There are a number of factors which need to be considered, such as pre-negotiations and re-assuring international business interests before going ahead. She has said this may take roughly a year. This softer approach seems to be allowing the Pound to recover after the near brick-wall which was hit with the announcement of the Brexit a few short weeks ago. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180. It staged an impressive recovery yesterday after trading down to $1.2850, nearly a retest on last week’s 30-year+ low just below $1.28. Recall last week’s high was set near $1.3340. Sterling has hardly pulled back during its run-up today, and there is scope for a further squeeze, but we are not convinced this is anything but a short-term correction. Surely to be convincing, sterling has to move outside of last week’s range, which does not look likely, at least at this juncture. The next technical target is near $1.3255.

|

Although we did not see any convincing technical sign that a recovery was imminent, we warned that after three consecutive weekly declines and dropping in five of six weeks, only a slight provocation was needed to spur a short-covering bounce. The key issue is whether this is a one-day wonder (short-term move) or whether sterling has legs (low of some importance is in place, and sustained recovery is at hand).

We had thought sterling would bounce around the BOE meeting, and we had been inclined to see a recovery after a rate cut. The Bloomberg survey was almost evenly divided between those who expect a 25 bp cut and those who don’t. The argument for waiting was that the new post-referendum forecasts would be made next month, and these would provide cover (justification/explanation) for the change in policy. However, the BOE had a thought-out risk scenario in case of Brexit, and this becomes the base case.

Japan

The UK is not the only one expected to provide more stimulus. Japan also appear to be moving toward new measures. Traditional LDP policy is loose monetary policy, fiscal stimulus, and a weaker yen. Abenomics was that but on steroids. Abe appears to want to go to the well again and has been encouraged to do so by recent visits by Bernanke, Stiglitz, and Krugman.

Abe does not need a super-majority to implement his economic program. Given the low levels of public support for Abenomics, it is a stretch to claim that weekend election was an economic mandate. The super-majority is needed for constitutional changes. These are divisive issues, even within the ruling coalition.

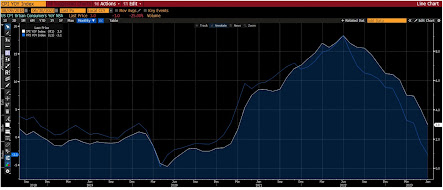

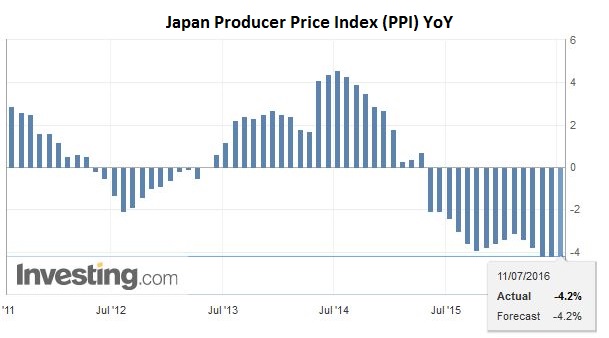

Japan Producer Price Index

|

Click to enlarge. Source Investing.com |

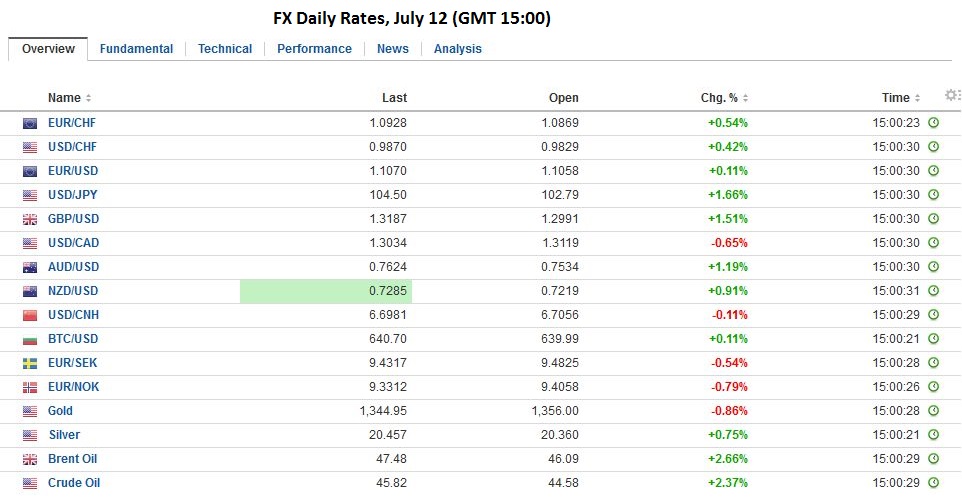

FX RatesThe dollar is extended its against the yen. The greenback is at its highest level against the yen since June 24, poking through the JPY103.60 area briefly. We recognized a break of JPY101.50 could propel a move to JPY103. The JPY103 area should offer initial support. There is much talk today about sterling-yen crosses being unwound by levered participants. Sterling had been the weakest of the majors, and the yen the strongest. |

Eurozone

European bourses are following suit. The Dow Jones Stoxx 600 is up 1% near midday in London, led by consumer discretionary and financials. Of note, the FTSE Italian bank index is extended its advancing streak into a fourth session with a 5.3% gain today, after recovering yesterday to close 1.2% higher. The ban on short sales has been extended until early October.

Italy and the EU appear to be moving toward an agreement that could see new state funds. Some creditors will be bailed-in, as required, but the latest reports suggest that investors in a particular instrument could be exempt. Monte Paschi issued subordinated debt in 2008 for an acquisition, and those bonds were sold marketed and sold to retail investors in 1000 euro increments. They are selling for about 50 cents on euro now. Exempting those bonds may make good politics and economics, but it is crucial that in exchange for new funds that the bad loan.

China

The Permanent Court of Arbitration has ruled that China’s claim on nearly 80% of the South China Sea is not valid. China has refused to recognize the legitimacy of the proceedings, and the Court lack enforcement mechanisms. However, the case should be regarded another move in a long chess game rather than checkmate. It is not clear what is the next move. Other countries may bring similar cases against China. China could retaliate in various ways in the region. Even though China is an old civilization, in its new incarnation it is relatively new on the international stage. Its relationship with international law is not always clear, and as with other large countries, it may not always be consistent. Still, its response will be closely scrutinized for insight to get a measure of President Xi.

United States

The main feature from the US today are the two Fed officials (Tarullo and Bullard) who speak while in the North American morning, while Kashkari and Mester speak after the close. Also, the market is waiting for the EU finance ministers’ decision on whether to sanction Spain and/or Portugal over excess deficits.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: Banca Monte dei Paschi,Ben Bernanke,Brexit,British Pound,FX Daily,Italy,Japan Producer Price Index,Japanese yen,newslettersent,Paul Krugman