Tag Archive: Banca Monte dei Paschi

FX Weekly Preview: Light Economic Calendar Week Allows New Thinking on Macro

Policy outlook is clear: ECB and BOJ review next month, FOMC still looking for opportunity. Inventory cycle making quarterly US GDP forecasting difficult, but it looks like re-acceleration still the more likely scenario than recessions.

Why didn't European bank stress tests results have more impact?

Read More »

Read More »

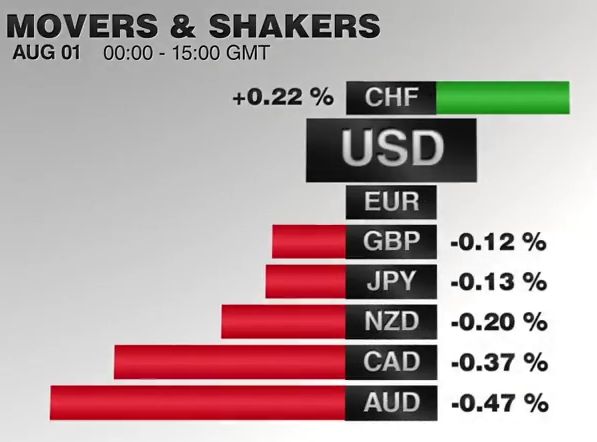

FX Daily, August 01: Dog Days of August Begin

The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week's developments. In particular the BOJ's underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP.

Read More »

Read More »

No Big Thoughts, but Several Smaller Observations

Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe.

Read More »

Read More »

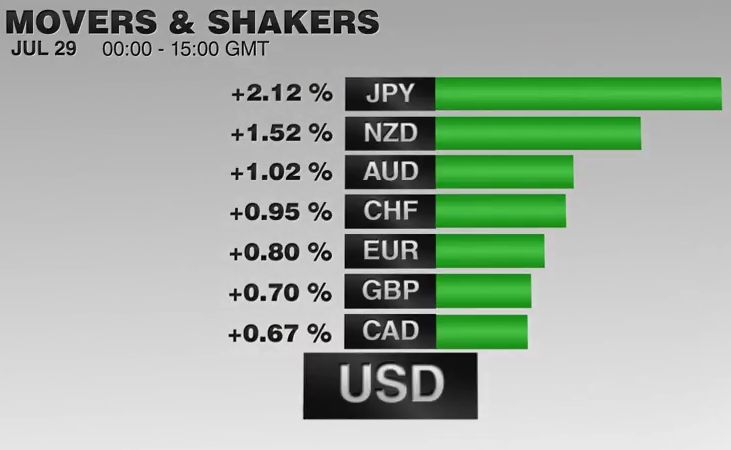

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »

Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP.

Read More »

Read More »

European Banks Bad Loans and Coverage

European banks are worrisome. EBA's stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed.

Read More »

Read More »

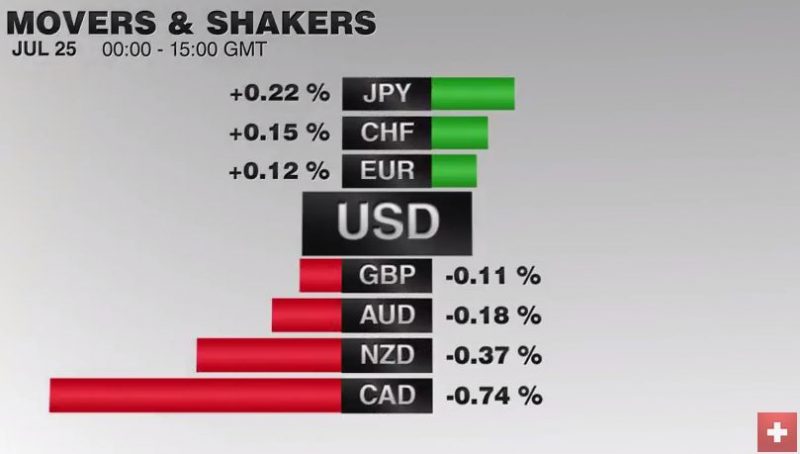

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »

European Bank Stress Test: Preview

European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries' banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules.

Read More »

Read More »

The Central Planning Virus Mutates

Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect.

Read More »

Read More »

European Court of Justice Ruling Weighs on Italian Banks

ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event.

Read More »

Read More »

FX Daily, July 12: Easing Political Uncertainty Encourages Animal Spirits

Further risk appetite means rising euro and weaker CHF. The SNB typically sustains such risk appetite phases with smaller FX interventions of around 300 million per day. Sterling is leading the new appetite for risk as one element of political uncertainty has been lifted. It is moving higher for the third consecutive session today; advancing by more than 1.5 cents to reach $1.3180.

Read More »

Read More »

Why You Should Understand What is Happening with Italian Banks

Italian banks shares have staged an impressive bounce over the past four sessions from beaten down levels. How Italy's banking crisis is resolved will shape the way the EC responds to banking resolution going forward. As you might expect, there is a German and French interpretation.

Read More »

Read More »

European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored.

Read More »

Read More »

Return of the Repressed: Europe’s Unresolved Banking Crisis

The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy's banks, and Three UK commercial real estate funds have been frozen to prevent redemptions.

Read More »

Read More »