How the SNB Chairman Jordan has invited hedge funds and smart investors to a risk-free, high-return guaranteed investment in Swiss francs

A wrap-up of Swiss newspapers for non-German literates

In parallel to the start of the UEFA Euro 2012, the Swiss National Bank and its policy towards the EUR/CHF exchange rate has become a political football.

Back in September 2011, when the EUR/USD was trading over 1.40 and former SNB chairman Hildebrand spoke of a Swiss recession, the complete Swiss political spectrum was in favor of the EUR/CHF floor of 1.20. But with the unfolding Euro crisis the USD/CHF rate is approaching parity despite Swiss deflation and US inflation after 73 cents in August 2011. The Swiss exporters do not have a competitive disadvantage any more given that about 40% of Swiss exports depend on the dollar and dollar-correlated currencies like the CNY, the GBP and the JPY (source). A purchasing power parity calculation of UBS indicates that the EUR/CHF has now a fair value of 0.93.

The Swiss discussions about the floor started when SNB president Jordan admitted two weeks ago that the floor will not raised (here also cited by Bloomberg):

“We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.”

This stance was surprisingly different to the strong commitment to the floor he uttered before: For months the SNB continued to vow that it might take further measures to weaken the franc, even if wording changed from the “massively overvalued franc” in August 2011 over “significantly overvalued franc” in January 2012 to “overvalued franc ” in April.

Based on the IMF Code of Good Practices on Transparency in Monetary and Financial Policies, Jordan has actually given such a clear and transparent message, which we translate into: The SNB will not raise the floor. Investors can be sure not to lose money. There is only win, no loss, we all know that the franc will appreciate over time. The investors just have to wait till big inflows into Switzerland have made politicians really worry about their wallets. Sooner or later the floor will break.

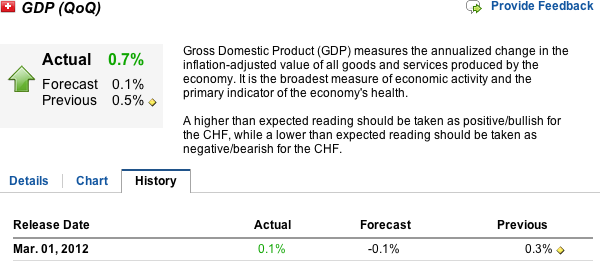

Three days later the Swiss GDP was released and we learned why Jordan has changed his mind. GDP Q1/2012 beat the forecasts of +0.1% with an increase of 0.7% (source Forexpros). Smart investors and hedge funds gratefully responded to Jordan’s invitation with inflows between 35 bln. and 50 bln. CHF into risk-free, high-return guaranteed Swiss francs. The former SNB chief economist Ulrich Kohli raised a similar critic in January 2011, that the SNB only fills the pockets of hedge funds and currency traders.

Even more interestingly was that the GDP growth for Q4/2011 was revised upwards from 0.1% to 0.5%. In Q4/2011 even Germany experienced a 0.2% decline. Exactly in that quarter most Swiss politicians and leading economists wanted the SNB to hike the floor to 1.30; in the strong belief that the Swiss economy only consists of exporters (and that Swiss exporters must only compete with Germany, a country that follows an even more protectionist, but dangerous approach). They ignored that inside the Swiss economy there are also strongly confident consumers that are happy about cheaper imports. That there is a huge government spending multiplier based on a 2% QoQ increase in state spending financed with zero or negative yields. That Swiss banks that have massive capital inflows of the wealthy who escape the euro zone and the beginning Chinese house price contraction and South American turmoils. And that Switzerland has still an overheating housing market thanks to foreign capital inflows and the implicit subsidy the SNB gives to foreign real estate investors via the EUR/CHF floor. For more details see our essay, that already in February judged that the EUR/CHF will never rise over 1.22 again and that the floor of 1.20 was too high and ill-formed.

An economist supporting our arguments, namely that Switzerland strongly takes profit of the Euro crisis, is the researcher Jan-Egbert Sturm from the main important Swiss university, the ETH Zurich.

The Swiss discussion about the floor started one week after Jordan’s comments, after the release of the Swiss GDP and after the biggest weekly inflow of 17 billions CHF. Some papers erroneously argue that only the missing public commitment to the floor and these discussions made the smart money come to Switzerland.

The first loud (German) voice to argue that the floor should be dropped was the former UBS CEO Oswald Grübel. Grübel said: “When a relatively small, healthy economy with low public debt, such as Switzerland, couples its currency to a larger business network with an artificial currency transfers and high public debt, it also assumes the risks. In other words, the Swiss franc is now a euro. The economic base of the Swiss franc is fundamentally better than that of the euro and will not degrade themselves by the fixed exchange rate as fast. It is only a matter of time and of the speed of the development of the Euro crisis that this strategy must be abandoned. One thing we know for sure, is that the longer we hold on to it, the higher the price is we all pay for it. ”

The strategist of the right-wings people’s party (in German: SVP), Christoph Blocher, a strong critic during the failed SNB interventions in April/May 2010 (for us a similar risk-free, guaranteed-return situation), agreed with Grübel:

“The SNB must be aware that the floor of 1.20 is not enforceable in the long term. At some point you must let the free market determine the exchange rate… Therefore Oswald Grübel is basically right. .. When the right moment has come to let the price fluctuate freely again, must ultimately decide the National Bank”.

Both the Swiss minister of economics Schneider-Amman and Economie Suisse, the main representative of the Swiss employers and exporters, want to maintain the floor. In order to sustain his wishes, Economie Suisse chief economist Rudolf Minsch speaks of risks of a big recession in Europe and lowers the 2013 growth estimation for Switzerland to 0.8%, considerably lower than the expert consensus, a game that some already played in summer 2011. Nonetheless he speaks out against capital controls and negative interest, measures to be reserved only to the absolute extreme case, an uncontrolled break-up of the euro zone.

Daniel Lampart, economist of the Swiss unions, who last November demanded a EUR/CHF of 1.40, agrees this time with the wishes of the employers and wants the SNB to maintain the floor at 1.20. In April Mr Hess of the industry organization Swissmem admitted that he was wrong with his forecast that a EUR/CHF of 1.20 would cost 10’000 jobs in his industry. But now a drop of the floor would cost 300’000 jobs !

It is interesting to see that according to estimates of Swiss Statistics local companies did not need to cut salaries in response to the strong franc and lost competitiveness, but wages would rise in Q1/2012 by 1.2% YoY. Furthermore, a KOF study has proven that Swiss exports depend a lot more on the global economic situation than on exchange rates.

A finance professor from the university of Zurich, Martin Janssen, demands a crawling peg, an alternative we have also proposed. According to Janssen, a complete drop of the floor would mean that the EUR/CHF could dip to 0.90, which would imply that the SNB had a loss of 75 bln. in her books. Continuing euro purchases would imply an SNB loss of 100 bln. francs, if the euro crisis intensifies. These 100 bln. CHF equal to 2 1/2 months of Swiss GDP, and Switzerland could do more useful things than giving it as gift to speculators and foreign investors. Therefore he insists that Switzerland needs an exit scenario from the floor and he reckons that the SNB is already studying some proposals. His idea is to lower the EUR/CHF by 0.01 per quarter, a so-called “crawling peg”. Thanks to the interest parity and the lower inflation in Switzerland, exporters would not have an issue with this approach. He claims that it is not possible to violate such a big market like the currency market for a longer time.

The UBS currency analyst Thomas Flury suggested that people should invest into the US dollar, the British pound and the Australian dollar. These were big currency areas and a good alternative to Switzerland. Marcus Hettlinger of Credit Suisse, claimed that the SNB can print without limits and if the floor is not broken, there will be no losses. An economist of the third biggest Swiss bank, the Zurich ZKB, David Mermet doubts that the SNB is forced to buy now every month euros for 50 billion francs and reckons that the storm will calm down soon.

For us it is interesting that the officials of the big Swiss banks are often obliged to buy in the official SNB position, but once a banker like Grübel is retired, he can express his real opinion. After Bernanke ruled out an early Quantitative Easing last week and many investors closed their EUR/CHF Long positions, we also think that SNB forex purchases will be lower in the coming weeks, but we still expect inflows of at least 30 billion francs per month, a negative surprise in the Greek elections will add more.

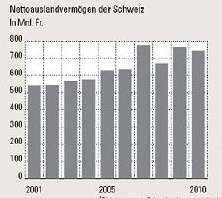

In an attempt to counter Prof. Janssen’s 100 bln. possible SNB losses, the floor-friendly NZZ wrote: Prof. Cédric Tille of the Geneva University demonstrates that the Swiss foreign investment position would have losses of an equal 100 bln. CHF, if the EUR/CHF falls to parity.

However, the EUR/CHF had already fallen from 1.60 to 1.20 since 2007, but the Swiss international investment position did not fall a lot, why should it shrink now with a stronger franc ?

The NZZ forgets to mention their own article, namely that Swiss companies used the strong franc to buy stakes in foreign firms. A strong trade balance and value increases of Swiss investments lifted the Swiss net investment position again by 90 bln. despite currency losses of 110 bln. CHF. A total loss of 20 bln. CHF in 2010 was the result.

The Handelsblatt reckons that all Swiss can be happy that the SNB did not peg to 1.40 or similar, a measure that would have been a lot more expensive.

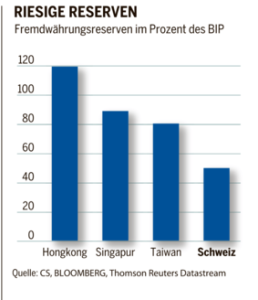

The right-wing politicians Spuhler and Kaufmann (also SVP) want the SNB forex reserves to be invested into a state fund similar to the ones in China, Singapore or Norway.

Recently the object has turned even aggressive: Economie Suisse Rudolf Misch and the ministers Schneider-Ammann and Leuthard urge the Swiss to stop talking about the floor, the conservative Hans Gruber even wants the German Grübel to be deported from Switzerland….

The “anti-floor” newspaper Der Sonntag, in which Grübel publishes, has raised doubts about Jordan’s credibility: As researcher Jordan strongly voted against a Swiss currency peg against the euro and now he does the complete opposite. The summary of Jordan’s 1999 paper was:

“… It is argued that the claimed advantages of a fixed peg reduction in exchange rate volatility and the elimination of an appreciating trend are only marginal. However, the costs of a pegging strategy the effects arising from higher interest rates and the National Bank’s lost reputation are substantial. Furthermore, successful implementation of such a strategy may be difficult. The article concludes by arguing that the current strategy of a flexible and independent monetary policy is preferred to the option of pegging the exchange rate.”

And Der Sonntag describes what Jordan thought in 1999, what we have already uttered several times and what hedge funds have learned just now: Namely that Swiss inflation will one day pick up again and destroy any dreams of a EUR/CHF peg and honor the smart money and that central banks never win.

As first big player, Morgan Stanley bets on a breach of the floor. They have renewed their February stance that the EUR/CHF floor will be broken in Q3, 2012. We have shown that in August/September 2012, Swiss YoY CPI may top at 1.5%, perhaps an argument for the SNB to lower the floor.

The English-speaking press is mostly opposed to currency manipulations. Izabella Kaminska of the FT estimates that “keeping the structurally undervalued franc is becoming costlier than ever” and Switzerland seems to be a new China. An argument quickly taken over again by Swiss papers showing that Switzerland had still less Forex reserves vs. GDP than others.

Disclosure: We are short EUR/CHF

Full story here Are you the author? Previous post See more for Next post

Tags: Capital Controls,Credit Suisse,Euro crisis,Fair Value,floor,franc,international investment position,Jordan,negative interest,peg,Purchasing Power Parity,Swiss National Bank,Swissmem,Switzerland,Switzerland KOF Economic Barometer,UBS