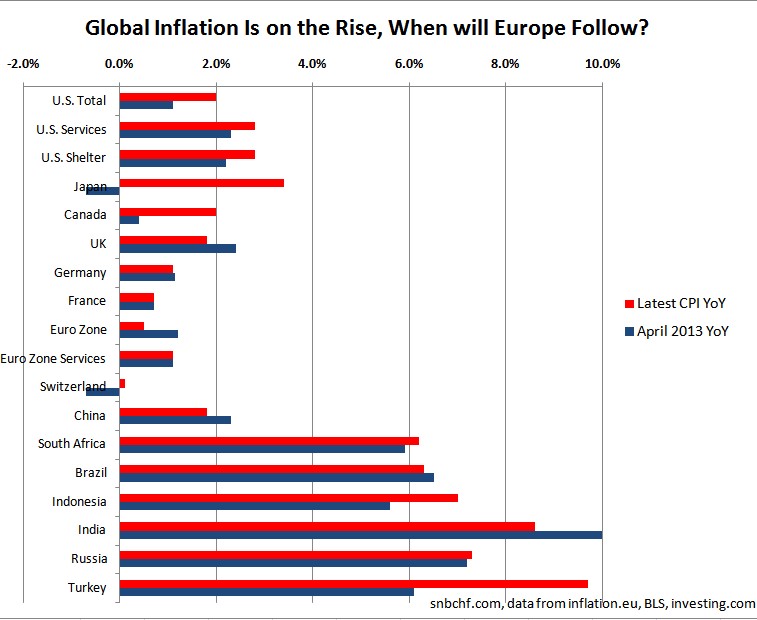

The European Central Bank (ECB) has the habit of reacting late. As seen in July 2008 and July 2011, the ECB is often the last major central bank to hike rates. They hike rates at the moment when others prepare for a recession or a significant slowing. Currently we are witnessing the opposite movement: The world is getting prepared for higher inflation and this strange central bank discusses lower rates; they even speak about negative deposit rates!

The U.S. CPI is at 2.0% YoY compared to 1.1% one year ago. U.S. services cost 2.8% more than one year ago, and wages are taking off. Rents and shelter are up 2.8%. Japanese inflation is 3.4% against -0.7% last year. Canada sees 2% inflation compared to 0.4% YoY one year ago. Not to speak of many Emerging Markets: in the Fragile Five and Russia, inflation rates remain between 6% and 10%. In Germany and France the CPIs are at nearly identical levels compared to one year ago. German unemployment is near record-lows, and participation rates at record-highs despite ageing. German wages were up 2.1% in 2013. Even Swiss inflation is slowly rising.

The U.S. CPI is at 2.0% YoY compared to 1.1% one year ago. U.S. services cost 2.8% more than one year ago, and wages are taking off. Rents and shelter are up 2.8%. Japanese inflation is 3.4% against -0.7% last year. Canada sees 2% inflation compared to 0.4% YoY one year ago. Not to speak of many Emerging Markets: in the Fragile Five and Russia, inflation rates remain between 6% and 10%. In Germany and France the CPIs are at nearly identical levels compared to one year ago. German unemployment is near record-lows, and participation rates at record-highs despite ageing. German wages were up 2.1% in 2013. Even Swiss inflation is slowly rising.

The only countries where inflation is far lower than last year are the ones that – for the sake of competitiveness – urgently needed lower inflation: Italy, Spain, Portugal and Greece. Yes Mr Draghi, you guys did an awfully good austerity and conditionality job; you reduced their wage expectations and consequently peripheral bond yields. Yes, you definitely improved their competitiveness. After the typical initial frictions, unemployment is finally falling in the whole euro zone.

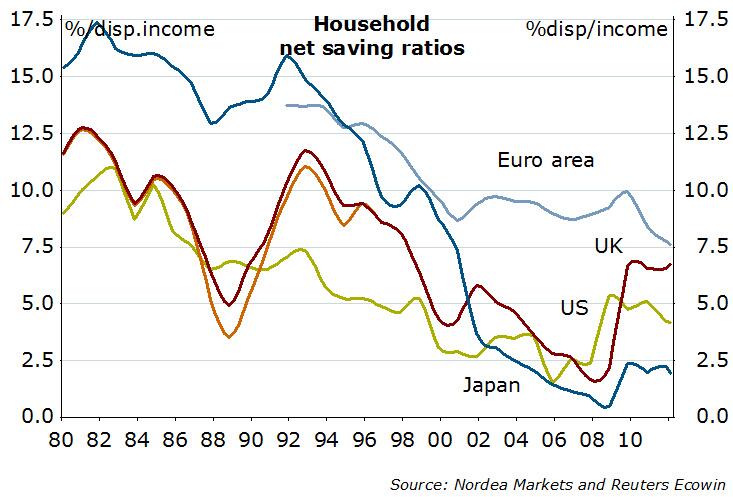

We all know that the Fed is not really interested in those abstract concepts like “competitiveness”: the Fed is mostly interested in wealth. If Americans achieve some higher productivity as the BLS might suggest, then it is only because Americans continuously devalue their currency and reduce household savings rates to values close to zero. Now, the Fed just wants to create inflation with higher wealth, more expensive rents, services and food. Some even claim that the Fed’s only aim is to hand over the profits of the U.S. wealth and asset price inflation to their investment banking friends and obtain some kick-backs.

Having achieved the Fed inflation target with higher wealth and pay rises for the well qualified, the unemployment target is getting out of reach again. The participation rate is shrinking further. Possibly due to the cost explosion, employment sub-indexes of both ISM indices were around 52, and the ADP survey sees new payrolls at only 179K.

Mr Draghi, do not imitate the Fed! Also do not believe that the euro zone is able to remain isolated from the global inflation run-up!

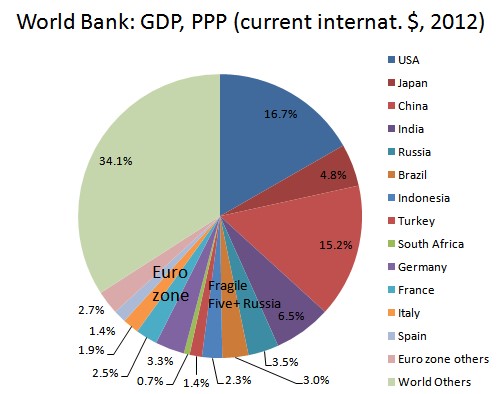

You seem to think that the little euro zone, 12% of global GDP (counted in PPP), will never get affected by the American (17% of GDP) and Japanese (5%) strong desire for inflation, and the ever rising wages in the Fragile Five and Russia (a group with another 17% of global GDP).

Yes, we admit that there is China (15% of global GDP in 2012 and overtaking the U.S. soon); the stronghold of dis-inflation and stability, thanks to its beloved totalitarian government. But this is not enough…

Mr Draghi, do you really think that the euro zone is on planet Earth?

Read also:

Don’t Worry, Inflation Will Come Back! It is already there; just not where you might live!

The World Bank: GDP, PPP (current international $)

Tags: Brazil,China,France,Germany Unemployment Rate,India,Indonesia,inflation,Russia,services,South Africa,Turkey,U.S. Consumer Price Index,United States