Summary:

Market opinion on the next Fed chief is very fluid.

BOE Governor Carney sticks to view, but short-sterling curve flattens.

New Bank of Italy Governor sought.

A second term for Kuroda may be more likely after this weekend election.

The market is fickle. It has jumped from one candidate to another as the most likely Fed Chair. Until his belated and mild criticism of the President dealing with race issues, economic adviser Cohn was regarded as the most likely successor to Yellen at the head of the Fed.

When Cohn fell out of favor, it was seen as a contest between Yellen and former Fed Governor Warsh. Powell’s stock rose recently, and there have been reports that Treasury Secretary Mnuchin favors him. Yellen had slipped in the betting markets, as president-as-disrupter has little time for tradition or the fact that Yellen has steered the Fed quite remarkably through tapering, rate hike and now balance sheet reduction with very little drama. Today she has moved back into second place behind Powell.

Yesterday, reports suggesting that Trump was enthusiastic after meeting with Taylor saw his stock rise in the betting websites and may have prompted a reversal in the yields. The US 10-year yield closed higher, and the December futures contract surrendered the gains scored in the wake of the disappointing CPI report before the weekend. The 2-10 curve did not change; yields rose nearly uniformly by three basis points. We caution against reading too much into the process whereby Trump meets the different candidates for the post that his staff has identified. Also, although the Taylor rule would suggest higher rates may be appropriate, Taylor himself is opposed to blindly following any model. Nevertheless, many see Taylor as being more hawkish than Yellen or Powell.

PredictIt has Powell as the most likely nominee, with a little more a one-in-three chance. A week ago, his chances were even-money. The new new thing is that Taylor. His odds improved to improved to one-in-five from one-in-ten yesterday, but have eased back to about one-in-six. It is pretty much a dead heat between Taylor and Warsh, with Yellen in second with a one-in-five chance.

Bank of England Governor Carney testified today, affirming that a rate hike may be appropriate in the coming months. He did not seem to break any new ground in his first testimony before Parliament’s Treasury Select Committee since the June election. Carney did acknowledge that inflation is close to a peak, which is why many participants were did not anticipate the hawkish turn by the MPC. In early September, a Bloomberg survey found a little more than 20% of its survey respondents expected a hike this year. Now full three-quarters do.

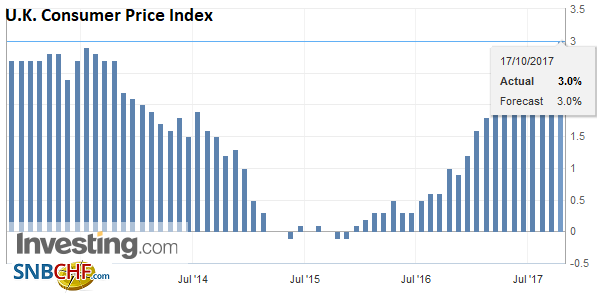

United KingdomToday’s UK CPI data was in line with expectations. The new preferred measure CPIH ticked up to a 2.8% year-over-year pace from 2.7%, while CPI rose 0.3% for a 3.0% year-over-year pace. |

U.K. Consumer Price Index (CPI) YoY, Sep 2017(see more posts on U.K. Consumer Price Index, ) |

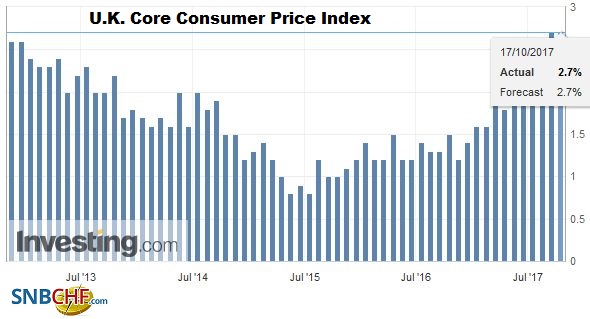

| The core rate was unchanged at 2.7%. |

U.K. Core Consumer Price Index (CPI) YoY, September 2017(see more posts on U.K. Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

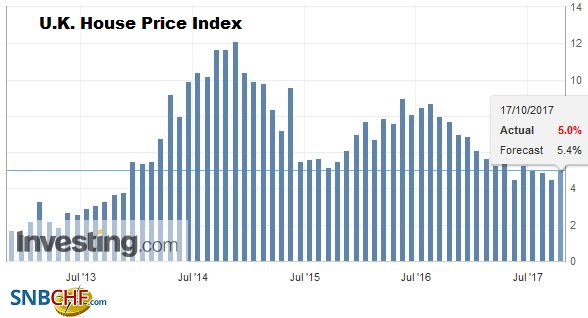

| Separately, the government’s house price index rose 5.0% in August from a year ago, which is up from a revised 4.5% pace in July (initially reported at 5.1%). |

U.K. House Price Index YoY, September 2017(see more posts on U.K. House Price Index, ) Source: investing.com - Click to enlarge |

The message the market heard from Carney is that the rate hike that is likely in the coming month will likely be a one-off as last year’s cut is unwound. Short-sterling futures flattened at lower yields. That is to say that interest rates fell with deferred contracts seeing sharper declines in interest rates than the nearby contracts. However, sterling’s roughly 0.5% decline today owes itself just as much to politics as economics.

That nearly the major currencies are trading heavily against the US dollar today, make take some of the sting from sterling’s decline, but it is one of the heavier major currencies today. Prime Minister May’s trip to Brussels seemed not to have broken the logjam. The effort and then failure weighs on fears of the UK being amputated from the EU without a new deal. The next window of opportunity to shift the negotiations will take place at December Summit. The EU seems to be clear on what it needs from the UK, but the UK officials are reluctant to do what is required seemingly in the hope of striking a better deal. Perhaps, it is my own lack of imagination, but it is difficult to imagine a better deal than the UK had, with its numerous opt-outs and rebate.

Sterling’s decline brought it within spitting distance of the 61.8% retracement objective of its rally from approaching the $1.3025 area on October 6 to the high at the end of last week near $1.3340. That retracement is found near $1.3145 and today’s was near $1.3155. Initial resistance is seen in the $1.3200 area and then $1.3240-$1.3250.

Italy’s central bank is in the news today. There seems to be an agreement between a couple of opposition parties, including the Five-Star Movement, and the main governing party, the PD that the Bank of Italy should have a new governor when the Visco’s term is complete at the end of the month. Following the reforms at the Bank of Italy, Draghi was the first new governor. He took the job at the ECB before his term was complete. Visco is the first governor to complete his term under the new rules. Many had expected Visco to be appointed to a second term.

Visco has been blamed for Italy’s banking woes, even though the banking systems challenges pre-date his tenure and important steps have been taken over the past several quarters to begin addressing the sector’s challenges. When fully taking into account the amount of non-performing loans, the reserves put aside to cover them, the amount on average of residual value, we suspect that Italy’s banking system may be in better shape than the popular press recognizes in its focus on only the amount of NPLs.

Meanwhile, with the LDP fortunes looking better in the coming weekend election, there is heightened speculation that BOJ Kuroda could be reappointed to a second term. His current term ends in mid-April 2018. It is unusual for a BOJ Governor to serve a second term. It has not happened in a generation. While Kuroda’s reappointment would signal continuity of policy, we suspect that if Kuroda is not reappointed, someone with his activist monetary policy commitment would be named. The Party of Hope did not offer an alternative to Abenomics in general or Kuroda’s monetary policy in particular. The two main differences are over the 2019 retail sales tax and nuclear power.

Japan’s election this weekend is the next important political event. Next week’s ECB meeting is the next key central bank meeting. It is particularly important because the ECB is expected to provide details of its asset purchases starting next year. Investors are particularly focused on the length of the program and the amount of assets that will be purchased.

A new twist to the plot was suggested this week. A report citing “central banker officials familiar with the matter” suggest that some beginning with the maximum they are willing to see the ECB’s balance sheet expand. The limit is said to be 2.5 trillion euros. Where this number comes from or what it is to signify is not clear. It is suggested as if there was a meeting of the minds, so to speak at the beginning of the operation.

At the end of this year, the Eurosystem’s balance sheet would stand near 2.28 trillion euros. This in turn implies that next year’s purchases may be around 200 bln euros. If the drawn-out over nine months, this is about 22 bln euros a month, down from 60 bln currently. A clear advantage of the smaller amount is that it eases the concern of shortages under the current rules. And to our earlier point, the ECB could add its reinvesting of maturing proceeds, estimated at 10-15 bln euros a month in 2018 to the net new purchases, and announce its gross purchases target.

We recognize that there are important periods in which interest rate differentials do not drive the euro-dollar exchange rate, but over time we have not found a better anchor. We have noted that the US two-year premium has been trending higher for the last couple of months. It has not been below 2.00% for two months and reached almost 2.38% today, the highest since 1999. When the euro peaked against the dollar on September 8, the US premium was 2.02%.

The 10-year premium has also trended higher. Today, the US 10-year yield was 195 bp above a similar German Bund. It is the most in three months. It is moving above its 200-day moving average (~193 bp) for the first time since May.

The euro frayed the lower end of the band of support we identified at $1.1750. A convincing break of this area would signal a return to the low near $1.1670 seen after the recent US employment data, with the August lows set near $1.1660. The topping pattern that the euro appears to have carved out projects toward $1.1600. The $1.1680 area also may correspond to the neckline of a larger topping pattern that would project toward $1.1280 (more on that soon).

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$EUR,$TLT,Bank of England,Bank of Japan,ECB,Federal Reserve,newslettersent,U.K. Consumer Price Index,U.K. Core Consumer Price Index,U.K. House Price Index