Now that the possibility of a war between the US and North Korea seems just one harshly worded tweet away, and the window of opportunity for a diplomatic solution, as well as for the US stopping Kim Jong-Un from obtaining a nuclear-armed ICBM closing fast, analysts have started to analyze President Trump’s military options, what a war between the US and North Korea would look like, and what the global economic consequences would be. Needless to say, this is a challenging exercise due to the countless possible scenario, event permutations and outcomes, not least because China and Russia may also be sucked in, leading to a true world war.

“Realistically, war has to be avoided,” said John Delury, an assistant professor of international studies at Yonsei University in South Korea. “When you run any analysis, it’s insanity.”

Insanity or not, as Capital Economics writes in a May 17 note, while the most important impact of a full-scale conflict on the Korean peninsula “would be a massive loss of life” but added that there would also be significant economic consequences. While we focus on the latter below, first here are some big picture observations courtesy of Bloomberg, including an analysis of whether all out war can be avoided:

- Can’t the U.S. try a surgical strike?

It probably wouldn’t work well enough. North Korea’s missiles and nuclear facilities are dispersed and hidden throughout the country’s mountainous terrain. Failing to hit them all would leave some 10 million people in Seoul, 38 million people in the Tokyo vicinity and tens of thousands of U.S. military personnel in northeast Asia vulnerable to missile attacks — with either conventional or nuclear warheads. Even if the U.S. managed to wipe out everything, Seoul would still be vulnerable to attacks from North Korea’s artillery.

- Why might Kim go nuclear?

“Even a limited strike” by the U.S. “would run the risk of being understood by the North Koreans to be the beginning of a much larger strike, and they might choose to use their nuclear weapons,” said Jeffrey Lewis, director of the East Asia nonproliferation program at the Middlebury Institute of International Studies. Somehow, the U.S. would need to signal to both North Korea and China — Pyongyang’s main ally and trading partner — that a surgical military strike is limited, and that they should avoid nuclear retaliation.

- Is regime change an option?

New leadership wouldn’t necessarily lead to a new way of thinking among North Korea’s leadership. Kim’s prolonged exposure to Western values while at school in Switzerland led some to speculate that he might opt to open his country to the world — until he took power and proved them wrong. Moreover, if Kim somehow were targeted for removal, the ruling clique surrounding him would have to go as well — making for a very long kill list. China, fearing both a refugee crisis and U.S. troops on its border, would likely seek to prop up the existing regime.

- Does that mean all-out war is the best U.S. option?

A full-scale invasion would be necessary to quickly take out North Korea’s artillery as well as its missile and nuclear programs. Yet any sign of an imminent strike — such as a buildup of U.S. firepower, mobilization of South Korean and Japanese militaries and the evacuation of American citizens in the region — could prompt North Korea to strike preemptively. China and Russia may also be sucked in. “Realistically, war has to be avoided,” said John Delury, an assistant professor of international studies at Yonsei University in South Korea. “When you run any cost-benefit analysis, it’s insanity.”

- How might North Korea retaliate?

The most immediate reaction would likely be massive artillery fire on Seoul and its surroundings. North Korean artillery installations along the border can be activated faster than air or naval assets and larger ballistic missiles that can target South Korean, Japanese or American bases in the region with nuclear, chemical and biological weapons. Those countries have ballistic-missile-defense systems in place but can’t guarantee they will shoot down everything. Japan has begun offering advice to its citizens on what to do in the event a missile lands near them — essentially try to get under ground — and U.S. firms are marketing missile shelters. While it’s unclear if North Korea can successfully target U.S. cities like Denver and Chicago with a nuclear ICBM, it’s similarly unknown if U.S. defense systems can strike it down — adding to American anxieties.

- What options remain on the table?

Many analysts say it’s time to start talks to prevent the situation from worsening. Stopping North Korea from obtaining a thermonuclear weapon, or more advanced solid-fuel missiles, is a goal worth pursuing, according to Lewis. However unpalatable it may seem, that means offering rewards to entice North Korea back to the negotiating table. Lewis suggested one reward could be to scale back U.S.-led military drills around North Korea. The question of what can be offered to the North Koreans “is a conversation that should be happening both with the public, with Congress and with the North Koreans, instead of having this imaginary conversation about war scenarios,” said Delury. “The realistic option is a diplomatic one that slows this thing down. And that’s going to require a lot of talks.

* * *

Assuming appeasement and containment are off the table, and a diplomatic solution fails, what would the impact on the regional and global economy be from a worst case scenario – one in which conventional war breaks out? Here are the salient thoughts from Capital Economics on this increasingly sensitive topic:

- North Korea’s conventional forces, which include 700,000 men under arms and tens of thousands of artillery pieces, would be able to cause immense damage to the South Korean economy. If the North was able to set off a nuclear bomb in South Korea, the consequences would be even greater. Many of the main targets in South Korea are located close to the border with the North. The capital, Seoul, which accounts for roughly a fifth of the country’s population and economy, is located just 35 miles from the North Korean border, and would be a prime target.

- The experience of past military conflicts shows how big an impact wars can have on the economy. The war in Syria has led to a 60% fall in the country’s GDP. The most devastating military conflict since World War Two, however, has been the Korean War (1950-53), which led to 1.2m South Korean deaths, and saw the value of its GDP fall by over 80%.

- South Korea accounts for around 2% of global economic output. A 50% fall in South Korean GDP would directly knock 1% off global GDP. But there would also be indirect effects to consider. The main one is the disruption it would cause to global supply chains, which have been made more vulnerable by the introduction of just-in-time delivery systems. Months after the Thai floods had receded in 2011 electronics and automotive factories across the world were still reporting shortages.

- The impact of a war in Korea would be much bigger. South Korea exports three times as many intermediate products as Thailand. In particular, South Korea is the biggest producer of liquid crystal displays in the world (40% of the global total) and the second biggest of semiconductors (17% market share). It is also a key automotive manufacturer and home to the world’s three biggest shipbuilders. If South Korean production was badly damaged by a war there would be shortages across the world. The disruption would last for some time – it takes around two years to build a semi-conductor factory from scratch.

- The impact of the war on the US economy would likely be significant. At its peak in 1952, the US government was spending the equivalent of 4.2% of its GDP fighting the Korean War. The total cost of the second Gulf War (2003) and its aftermath has been estimated at US$1trn (5% of one year’s US GDP). A prolonged war in Korea would significantly push up US federal debt, which at 75% of GDP is already uncomfortably high.

- Reconstruction after the war would be costly. Infrastructure, including electricity, water, buildings, roads and ports, would need to be rebuilt. Massive spare capacity in China’s steel, aluminium and cement industries mean reconstruction would unlikely be inflationary, and should instead provide a boost to global demand. The US, a key ally of South Korea, would likely shoulder a large share of the costs. The US spent around US$170bn on reconstruction after the most recent wars in Afghanistan and Iraq. South Korea’s economy is roughly 30 times larger than these two economies combined. If the US were to spend proportionally the same amount on reconstruction in Korea as it did in Iraq and Afghanistan, it would add another 30% of GDP to its national debt.

* * *

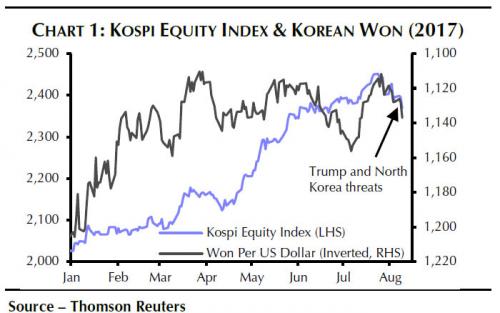

| Finally, a look at the market impact, with the immediate attention falling on South Korea. It has been the market’s persistent refusal to even contemplate a worst-case scenario that perplexed Goldman, as we discussed this morning. In a note from the bank’s chief credit strategist, Charles Himmelberg said that “our sense is that investors have grown comfortable with the view that geopolitical tensions invariably result in diplomatic talks, in which case the right trade is to buy any dips. The result is a market psychology that is relatively resistant to the pricing of geopolitical risk.”

As Capital Economic follows up in a daily note this morning, despite the trading of combative statements over the past two days between the US and North Korea, “movements so far have not been very large, and we suspect that this will remain the case so long as military conflict is avoided.”

|

Kospi Equity Index and Korean Won |

The good news for market bulls is that even if tensions escalate further from here, CapEcon thinks that the implications for equities in South Korea and elsewhere “will remain limited”, assuming of course that war does not actually break out. As proof, the advisory boutique shows the example of the 1962 Cuban missile crisis, when the world came closest to outright conflict between two nuclear-armed powers, and its impact on the S&P.

|

S&P 500 and Cuban Missile Crisis, Mar 1962 - Dec 1962(see more posts on S&P 500, ) |

| One notable difference from 1962 is that back then the world’s central banks were not “all in” in the effort to keep equity markets stable, so one can argue that it would take an even greater “shock” to the system to have an adverse and lasting impact on stocks. In fact, stocks may even forego the initial dip and proceed straight to the inevitable rally which central banks will do everything in their power to unleash, even if it means making the current bubble which now has virtually every asset manager worried, even greater.

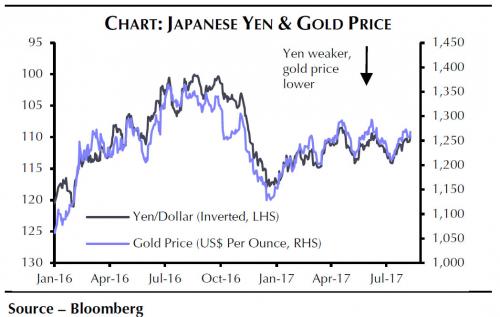

And then there is the worst case scenario in which war does break, and where not even central banks can deflect the avalanche of selling. What asset should be owned in that scenario? According to CapEcon, the best answer (our earlier discussion about ethereum notwithstanding) may be gold:

|

Japanese Yen and Gold Price, Jan 2016 - Aug 2017(see more posts on $JPY, gold price, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: $JPY,Afghanistan,central banks,China,Congress,Donald Trump,Equity Markets,Global Economy,gold price,Iraq,Japan,National Debt,newslettersent,North Korea,Politics,S&P 500,South Korea,SP,Switzerland,US government,Yen