Swiss FrancThe Euro has risen by 0.13% to 1.1032 CHF.

|

EUR/CHF - Euro Swiss Franc, July 13(see more posts on EUR/CHF, ) |

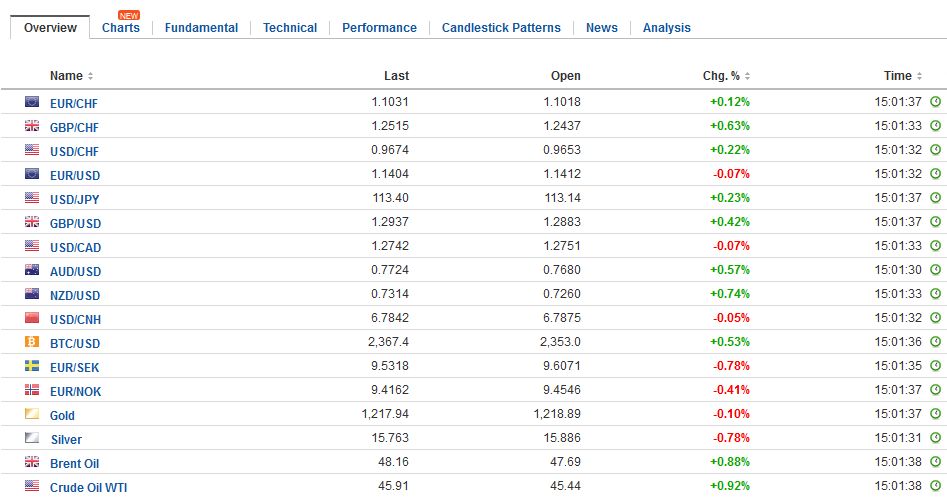

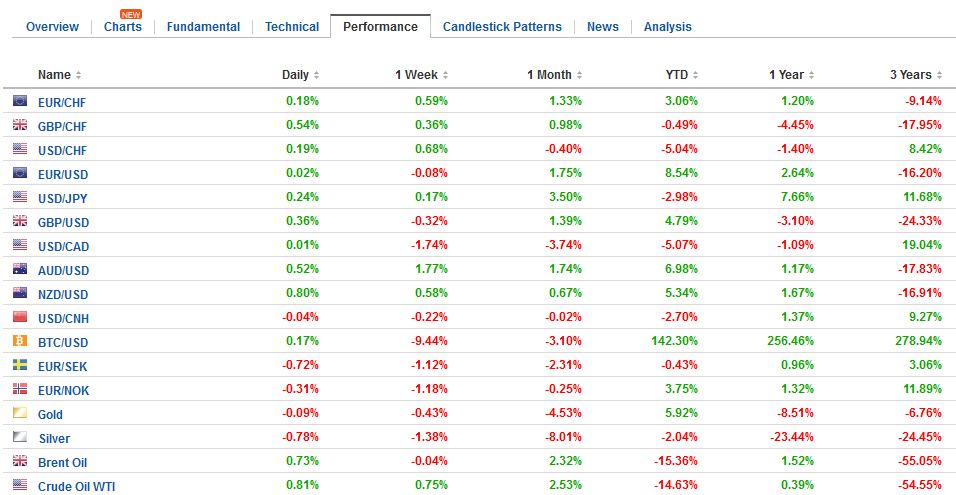

FX RatesThe US dollar is mostly consolidating yesterday’s move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month’s MPC meeting. The Australian and New Zealand dollars are up about 0.6%, gaining nearly twice as much as sterling. The risk-off sentiment, softer yields in the US and Europe, and strong Chinese import data are among the drivers. The Australian dollar surged through the $0.7700 level to challenge a 15-month down trendline that is found near $0.7725. The high for the year was set in March at |

FX Daily Rates, July 13 |

| The euro has built a shelf over the last four sessions ahead of $1.1380. A break of this area is needed to signify anything of importance. It could spur a test on $1.13. About 600 mln euro options struck at $1.14 are cut today and another 1.2 bln euros at $1.1445. Softer US interest rates are offsetting the benefit of rising stocks for the yen. The dollar is unable to recover from yesterday’s slide against the yen. The JPY113.50 area offers initial resistance, with support near JPY112.75. There are around $700 mln in options stuck between JPY112.70 and JPY113 that expire today.

Sterling is extending yesterday’s recovery. The $1.2950 area represents a 61.8% retracement of this month’s decline. Roughly GBP215 mln $1.30 option expires today. Sterling gains seem to be mostly a function of the cross rate adjustment. Yesterday, the euro reversed lower after surging to almost GBP0.8950. It finished yesterday near GBP0.8860, and today is testing GBP0.8800. The near-term risk extends toward GBP0.8750. The UK government presents the Great Repeal bill that begins the process of converting EU law into UK law. This begins a protracted debate, and without an outright majority in Parliament, the government will be challenged from all sides. Two elements are politically charged. The first is China’s steel and aluminum exports. Steel exports slipped to 6.81 mln tons from 6.98 mln in May. Unwrought aluminum and aluminum product exports were unchanged at 460k tons. The second is a trade with North Korea. Chinese figures point to an 11.3% decline in imports from North Korea in H1, which includes the period before sanctions were implemented. Chinese exports to North Korea rose by nearly 30%, but note that not all goods are sanctioned, and these are consumer goods, like textiles. |

FX Performance, July 13 |

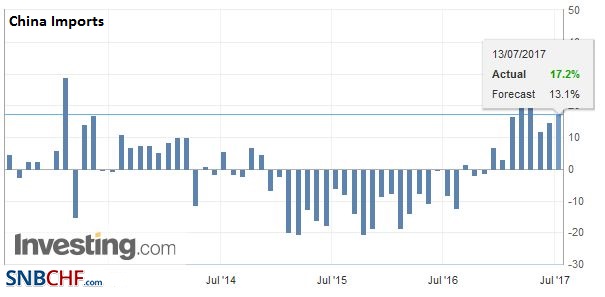

ChinaChina reported a 17.2% year-over-year increase in imports. The median forecast in the Bloomberg survey was for a 14.5% pace after 14.8% in May. |

China Imports YoY(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

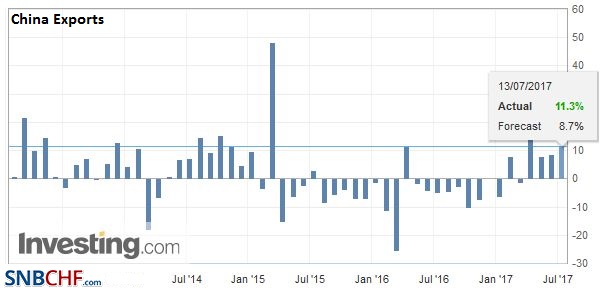

| Exports rose 11.3%, up from May’s 8.7%, and stronger than expected. |

China Exports YoY, June 2017(see more posts on China Exports, ) Source: Investin.com - Click to enlarge |

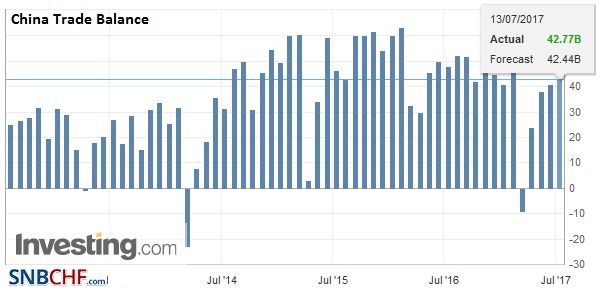

| The trade surplus rose by more than a third from a year ago to $42.8 bln. China’s surplus with the EU is 60% larger at $11.4 bln, while the trade surplus with the US is nearly 90% larger at $25.4 bln. |

China Trade Balance, June 2017(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

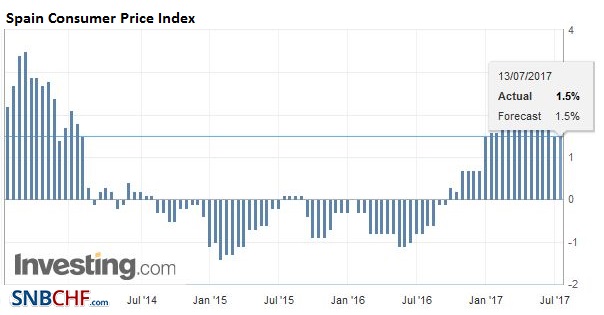

Spain |

Spain Consumer Price Index (CPI) YoY, June 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

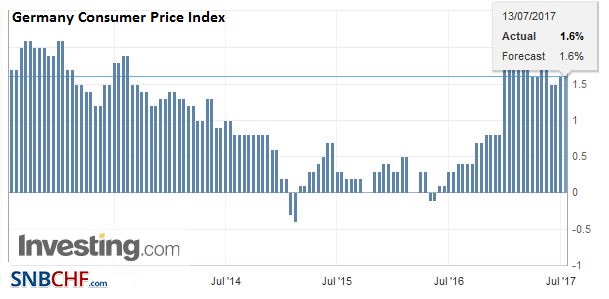

Germany |

Germany Consumer Price Index (CPI) YoY, June 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

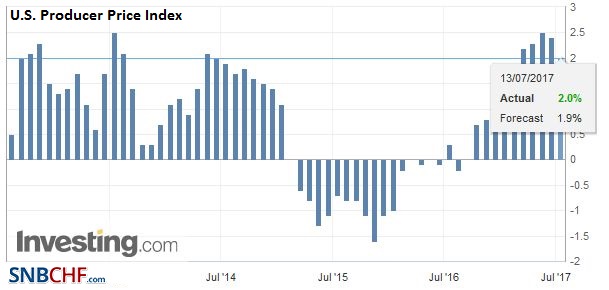

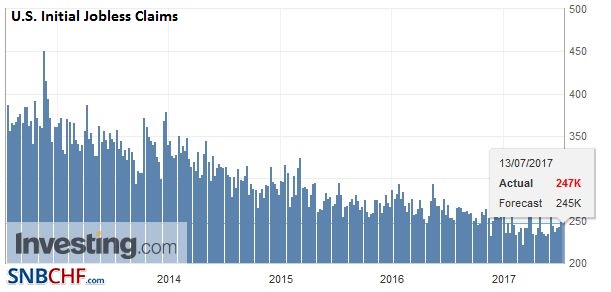

United StatesIn addition to the second leg of Yellen’s testimony, investors will get the latest weekly jobless figures and the June PPI from the US. Canada reports house prices. Tomorrow the US reports CPI and given the larger context, are particularly important. There is a reasonable chance that core inflation snapped its four-month down draft. |

U.S. Producer Price Index (PPI) YoY, June 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

U.S. Initial Jobless Claims, June 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Many observers looked at the decline in US bond and note yields and concluded Yellen was dovish. However, we note that the best guide for Fed policy is not the coupon curve but the short-end. The cleanest is the Fed funds futures. The September contract was unchanged for the third consecutive session. It is unchanged since the US jobs data last Friday, and the implied rate is half a basis point lower than it was at the end of June. It is also at the same level it was at from June 16 through June 29. There has been no real change in the market’s expectation.

The December contract tells the similar story of stable expectations. The implied yield on the December contract finished June at 1.26%. For the past two sessions, it finished at 1.245%. It was unchanged yesterday. The claim in the media that Yellen signaled that the Fed would not rush to tighten policy is misdirection. She and the Federal Reserve have never implied anything but a gradual increase.

Other reports said she emphasized the uncertainty over inflation. It did not seem emphasized to us, but in the context of her remarks, was used as an example of the uncertainty in that she said was always present in macroeconomic forecasts. The FOMC minutes were clear on this. Most officials saw the softer core inflation readings as temporary. That said, of course, Fed officials would feel more comfortable if core prices began slowly rising again, especially if spurred by stronger wage growth.

However, through the cycle, the Fed has not been in a hurry. It can take its time now too. It has hiked rates twice this year and anticipated three. There are four meetings left in the year, and two of them are live for all practical purposes (Sept and Dec). Official comments suggest a greater consensus has emerged to begin reducing the balance sheet before hiking rates again. We see this most likely being announced in September, leaving a rate hike for December. The idea that year-end considerations deter the Fed from acting then has been refuted over in both 2015 and 2016.

Brazil

Lastly, we note that the Brazilian real reacted positively to the news that former President Lula was convicted for graft and money laundering. The apparent logic is that it removes his chances of running for president again. The political situation in Brazil remains fluid, but emerging markets and high yields remain very much in vogue for many investors.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,China,China Exports,China Imports,China Trade Balance,EUR/CHF,FX Daily,Germany Consumer Price Index,newslettersent,Spain Consumer Price Index,U.S. Initial Jobless Claims,U.S. Producer Price Index