See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

Mystery NosediveThe price of gold dropped from $1,241 as of Friday’s close to $1,219 on the close Monday, or -1.8%. The price of silver fell from $16.58 to $16.11, or -2.9%. It is being called a gold and silver “smash” (implication being that one party or a conspiracy is doing the smashing). Our goal is to help you develop a clear understanding. The move was no mystery. Monetary Metals makes an intensive study of the spread between the spot market — where metal is bought and sold — and the futures market. Much analysis treats these market moves as mysterious, literally inexplicable except by reference to nefarious actors who are variously trying to make illicit profits or who act not-for-profit to somehow protect the dollar. Which they do by somehow pushing down “paper” gold. Which they do by sheer size, size being the critical characteristic to manipulate markets. However, ask anyone who has ever run a multi-billion dollar fund and you will get the opposite picture. Size is a disadvantage, because when you buy, you end up with a higher price and when you sell you get a lower price. At least if you are trying to make money. In this conspiracy view, people who hold gold are long suffering, waiting for the “signal failure” when the banks can no longer hold the price down. And then it will be a moonshot to $13,000 gold (or whatever the magic number is supposed to be). |

|

Lines in the SandThis same story has been used to explain market moves when the price was $250 and when it was almost $2,000 and today at $1,220. Don’t hold your breath. Instead, use your faculties of critical thinking. Does this make sense? And which is it, anyway? Are these conspirators supposed to be a for-profit racket? Manipulating gold and silver for their gain (in dollars) and your loss? |

|

| Or are they not-for-profit, acting without regard to their own balance sheets simply to protect the dollar… protect it from what? What bad thing, exactly, was supposed to happen when gold reached $1,000?

That was the topic of conversation in the late 1990’s, $1,000 was a line in the sand and far away. What happened when gold hit nearly $2,000? And what is the mechanism of this manipulation? Do they sell metal or futures? If futures, then what happens at contract expiry? If they were truly naked short, they would have to buy back the expiring contract and sell the next one. That would have a distinct signature, with each contract rising sharply into a great contango as it neared expiry (the opposite of what actually happens). And this brings us back to the market action on Monday July 3, and the spread between spot and futures. Let’s take a look at the price of gold overlaid with the basis. |

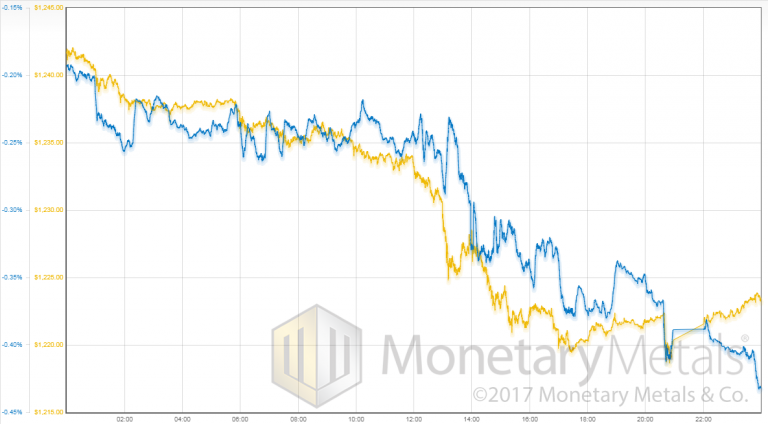

Gold Price vs. Gold Basis, Monday July 03(see more posts on gold basis, gold price, ) |

| We see they are remarkably correlated. As the price drops, so does the basis from -0.2% to -0.4%, or -20bps.

This is a picture of selling primarily in futures. Speculators got flushed out of their positions, for whatever reason. The price fell, but our calculated fundamental price barely moved from $1,334 to $1,331. Incidentally, at the end of last week the co-basis of the August contract was 0. It is now +0.2%, i.e., there is backwardation. Here is the graph of the silver action. The silver basis fell from -0.36% to -0.92%. Similar to gold, the selling in silver was predominantly in futures. |

Silver Price vs. Silver Basis, Monday July 3(see more posts on silver basis, silver price, ) |

|

A word on this is appropriate. When we say “primarily” or “predominantly” we refer to the market that was leading. The absolute change in the spread is very small relative to price. If there had been no selling in the spot market, and the futures price had dropped by 47 cents, then there would be a 47-cent backwardation. In such a case, we would be bellowing from the rooftops about the broken silver market! Paraphrasing our old buddy Aragorn, the day will come when there is 47 cents of backwardation in silver. But today is not that day! There was plenty of selling of metal also. It’s simply that the selling of metal was trailing the selling of futures, pulled along by arbitrage and lagging behind. It makes sense that most big price moves are driven by the futures market. Futures are made for trading: they have low costs, great liquidity — and leverage. The silver co-basis was also 0 on Friday. It is now at +0.6%. Our calculated fundamental price of silver is up 9 cents to $17.94. |

Full story here Are you the author? Previous post See more for Next post

Tags: gold basis,gold price,newslettersent,Precious Metals,silver basis,silver price