Financial markets often move in cycles where enthusiasm drives prices higher, sometimes far beyond what fundamentals justify. As discussed in last week's #BullBearReport, leverage and speculation are at the heart of many such cycles. These two powerful forces support the amplification of gains during upswings but can accelerate losses in downturns. Today’s market environment shows growing signs of these behaviors, particularly in options trading and leveraged single-stock ETFs.

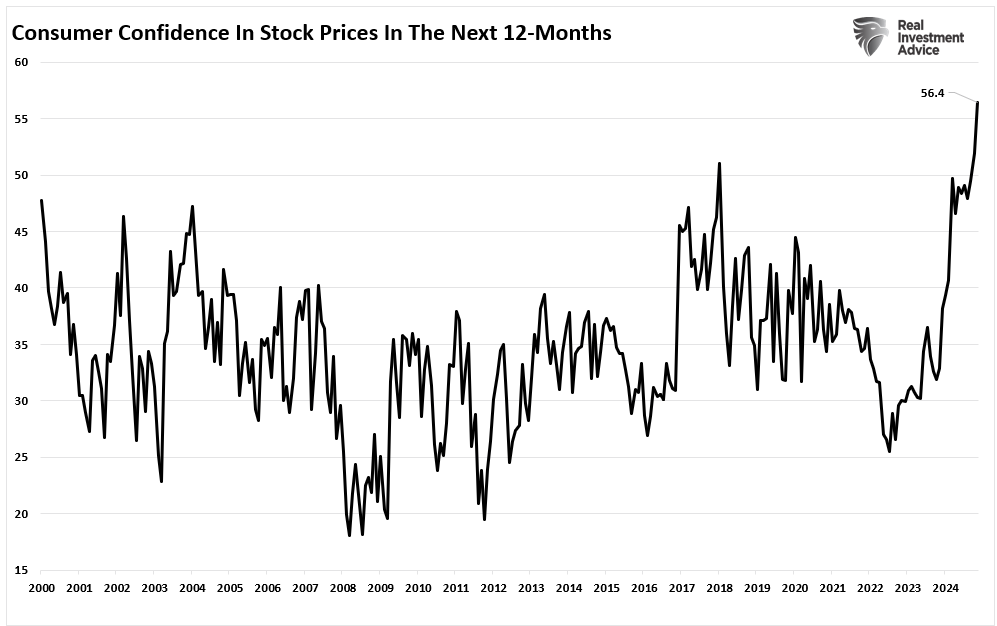

While leverage and speculation are not new to the financial markets, they manifest investor exuberance. We made this point in a recent post on "Exuberance," as consumer confidence in higher stock prices has reached the highest level since President Trump enacted sweeping tax cuts in 2018. However, that was before his re-election in November; since then, investor confidence has soared to record levels.

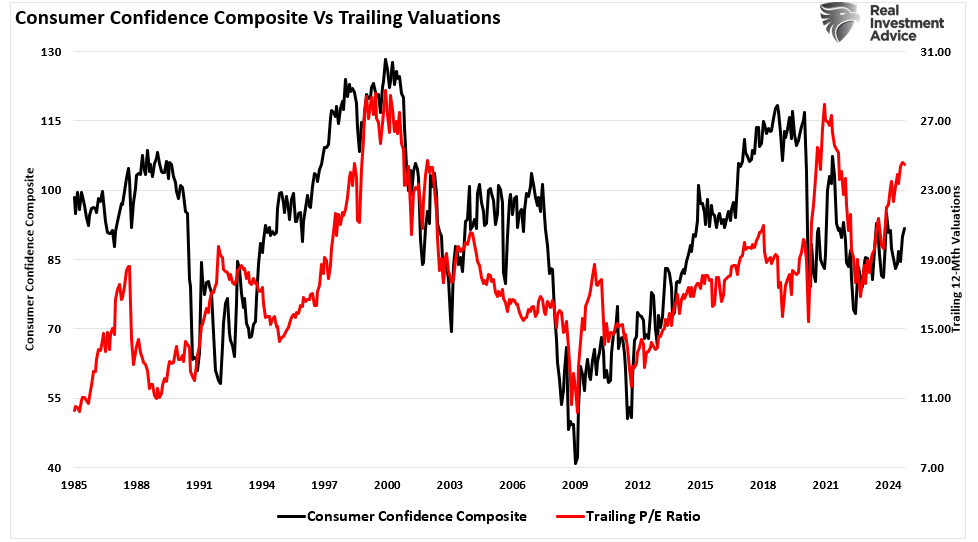

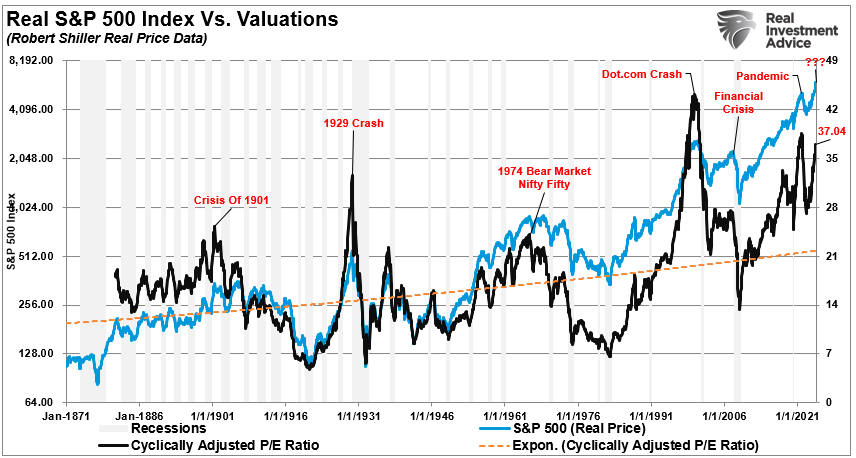

Notably, confidence and the desire to increase leverage and speculation in the markets are represented in current valuations.

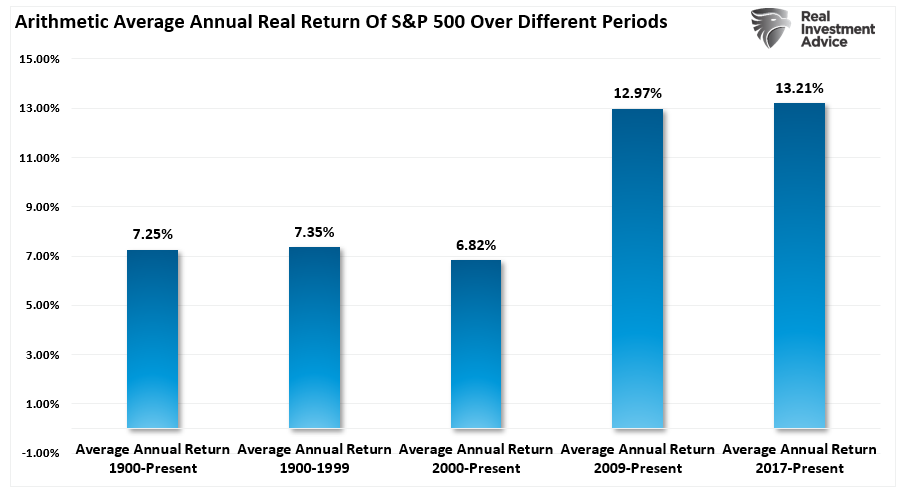

Of course, the rise in investor confidence should be unsurprising, given nearly 15 years of abnormally high market returns. The chart below shows the average annual inflation-adjusted return of the S&P 500 over different periods. Note that since 1900, the average real market return has been 7.25%. However, since 2009, that annual real return has increased by more than 50%, even more so since President Trump enacted the TCJA in 2017, reducing corporate tax rates.

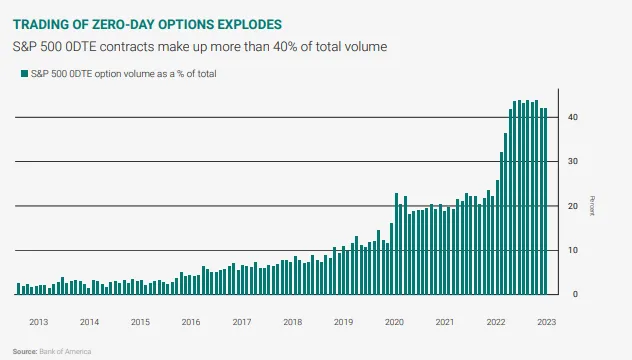

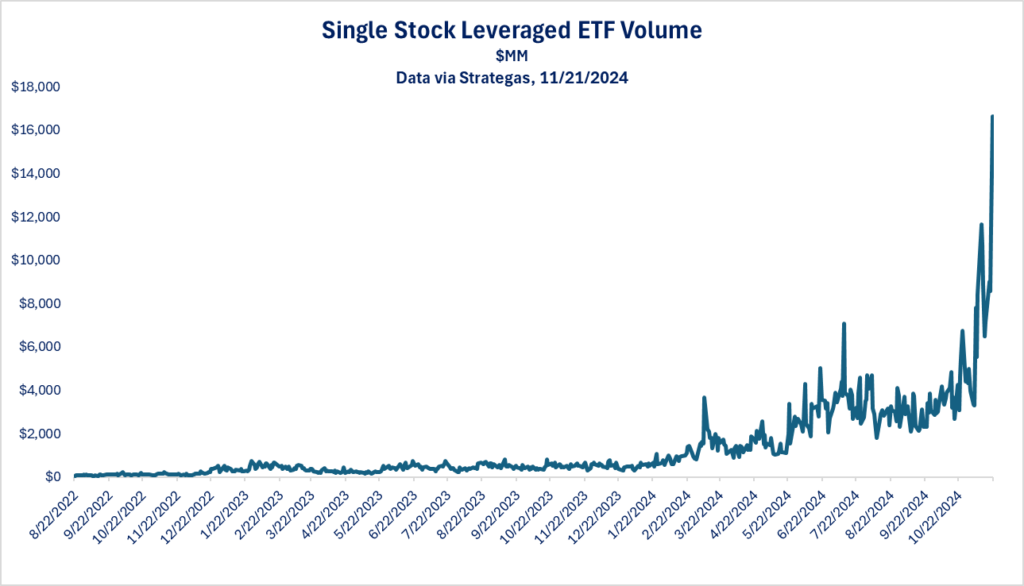

Given the level of high consistent returns, combined with an extended period of low volatility, and continued monetary and fiscal interventions, it is unsurprising there has been an explosion in speculation and leverage. That activity is seen in options trading, especially short-dated call options, and the surge in single-stock levered ETFs.

The question for investors is what this means for future market returns, and the risk of when, not if, something goes wrong.

Speculation in Today’s Markets: A Closer Look

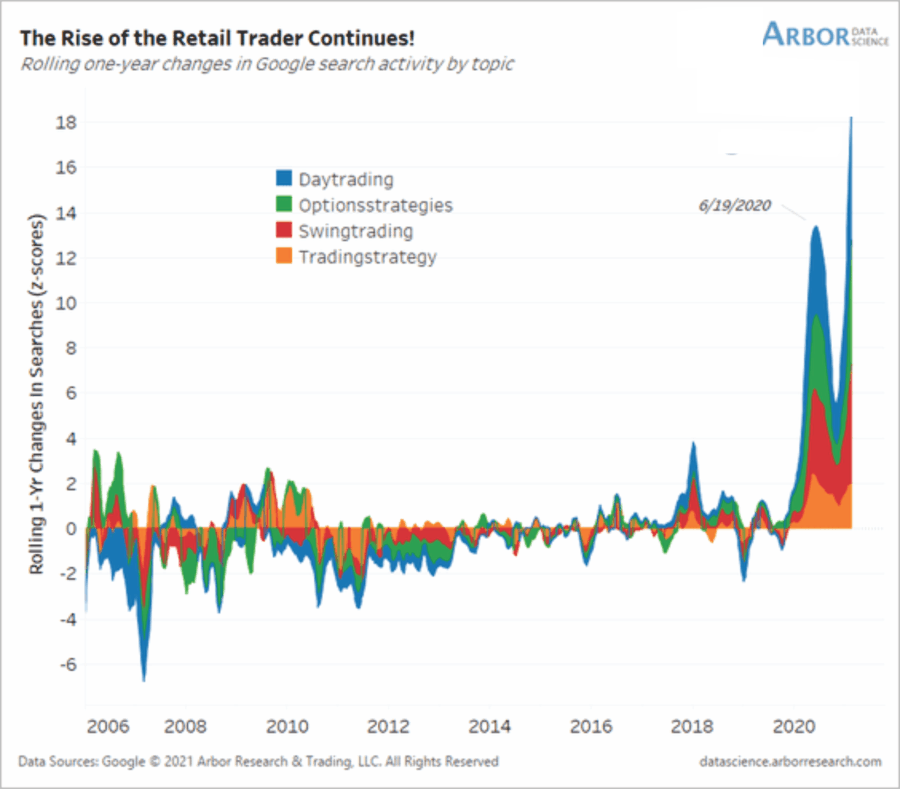

In March 2021, I wrote an article titled "Long On Confidence And Short On Experience" about how retail investors flooded the market.

"In a “market mania,” retail investors are generally “long confidence” and “short experience” as the bubble inflates. While we often believe each 'time' is different, it rarely is. It is only the outcomes that are inevitably the same. A recent UBS survey revealed some fascinating insights about retail traders and the current speculation level in the market. The number of individuals searching “google” for how to “trade stocks has spiked since the pandemic lows."

For anyone who has lived through two “real” bear markets, the imagery of people trying to learn how to “daytrade” their way to riches is familiar. From E*Trade commercials to “day trading companies,” people left their jobs to trade stocks. Of course, about 9-months later, it ended rather badly as we wrote in detail in "Retail Traders Go Bust."

What is interesting is that after that painful lesson, just 24-months later, retail investors are again "long on confidence." The painful lesson of losing large amounts of money has morphed into the "fear of missing out" on further gains. It is quite remarkable, but the signs are undeniable.

One sign of leverage and speculation we are watching are options. Options provide a leveraged way to bet on stock movements, requiring relatively little capital for potentially outsized returns. In November, US stock options volume hit nearly 70 million contracts on average per day; that is the second-highest on record, and trading activity has DOUBLED over the last two years.

As long as the market rises, those bets will pay off handsomely. The problem is that leverage works excellently on the way up but quickly turns into massive losses when markets decline.

Options trading has become a focal point for modern speculation. The accessibility of trading platforms and low costs have made it easier than ever for retail investors to engage in speculative bets. Short-dated call options, also known as "zero-day" options, which expire in less than 24 hours, are attractive for speculators hoping to capitalize on short-term stock price movements. These contracts allow investors to control large positions for a fraction of the cost of owning the underlying shares outright, effectively providing leverage.

For example, the surge in options volume on tech giants like Nvidia and Tesla has coincided with sharp moves in their stock prices. This speculative activity feeds into a cycle where dealer hedging magnifies stock volatility, detaching prices from fundamental values.

Don't understand how to trade options? No problem, as Wall Street has got your back, or rather, your wallet. The newest speculation and leverage tool of choice is leveraged single-stock ETFs. These funds, designed to amplify the daily performance of a single stock, were developed to meet investor demand for an easy-to-understand product. For example, GraniteShares’ NVDL offers 2x exposure to Nvidia and has seen soaring trading activity. While the ETF can double the returns of Nvidia on any given day, it also doubles the losses. Such instruments are inherently risky, especially in volatile market conditions. Their popularity reflects an increasing appetite for speculative investments, often at the expense of prudent, long-term decision-making.

These trends are not unprecedented. Historically, periods of excessive leverage and speculation have driven markets to dizzying heights before sharp corrections followed. Investors today must understand these dynamics, learn from history, and adopt strategies to safeguard their portfolios.

Lessons from History: What Excessive Leverage Teaches Us

Periods of extreme leverage and speculation are not new, and the outcomes have consistently been painful for unprepared investors. The late 1990s dot-com bubble serves as a prime example. Speculative bets on internet stocks drove valuations to extraordinary levels, with investors leveraging margin accounts and options to chase gains. When the bubble burst, the Nasdaq lost nearly 80% of its value, leaving leveraged traders especially vulnerable to devastating losses.

Similarly, the 2008 financial crisis highlighted the dangers of leverage on a systemic scale. Banks, hedge funds, and individuals had layered debt onto overvalued housing assets, creating a fragile structure that crumbled when housing prices fell. What began as a localized issue in the U.S. housing market cascaded into a global financial meltdown.

More recently, the GameStop frenzy of 2021 showcased how speculative trading, often fueled by leverage, could drive wild price swings.

“Young investors are taking on personal debt to invest in stocks. I have not personally witnessed such a thing since late 1999. At that time, ‘day traders’ tapped credit cards and home equity loans to leverage their investment portfolios. For anyone who has lived through two ‘real’ bear markets, the imagery of people trying to ‘daytrade’ their way to riches is familiar. The recent surge in ‘Meme’ stocks like AMC and Gamestop as the ‘retail trader sticks it to Wall Street’ is not new.“

Retail traders on platforms like Reddit’s WallStreetBets used call options to amplify their bets, forcing institutional investors to cover short positions. While some traders enjoyed massive gains, the stock’s eventual collapse left many with significant losses.

While this time certainly "feels' different, particularly with Wall Street analysts ramping up market predictions for 2025, several warning signs warrant caution. First, valuation metrics, particularly in the technology sector, have reached more extreme levels. Stocks like Nvidia and Tesla are priced for perfection, with their valuations reflecting speculative enthusiasm rather than underlying fundamentals.

Second, the widespread use of leveraged products amplifies market volatility. Options trading and leveraged ETFs can cause rapid price swings, especially when market sentiment shifts. For example, a sharp decline in Nvidia’s stock could force a cascade of selling in instruments like NVDL, exacerbating broader market declines.

Finally, the systemic risks of leverage should not be overlooked. While today’s risks may not resemble the subprime mortgage crisis, the interconnectedness of financial markets means that unwinding leveraged positions in one area can ripple through the system, creating broader instability.

What Investors Should Do Now

Prudent risk management is essential in a market increasingly driven by speculation. Investors should begin by reassessing their portfolios to ensure they align with long-term goals and risk tolerance. High-risk assets, particularly those with stretched valuations or heavy reliance on speculative flows, may warrant trimming.

Diversification remains a cornerstone of effective risk management. Allocating across a mix of asset classes, sectors, and geographies can reduce the impact of a sharp downturn in any single area. Investors should also focus on quality, prioritizing companies with solid fundamentals, strong cash flows, and sustainable growth prospects.

Hedging can be a valuable tool in speculative markets. Simply increasing bonds or cash allocations can protect against downside risk. While these strategies may dampen potential near-term upside, they can mitigate risk during an unexpected reversion.

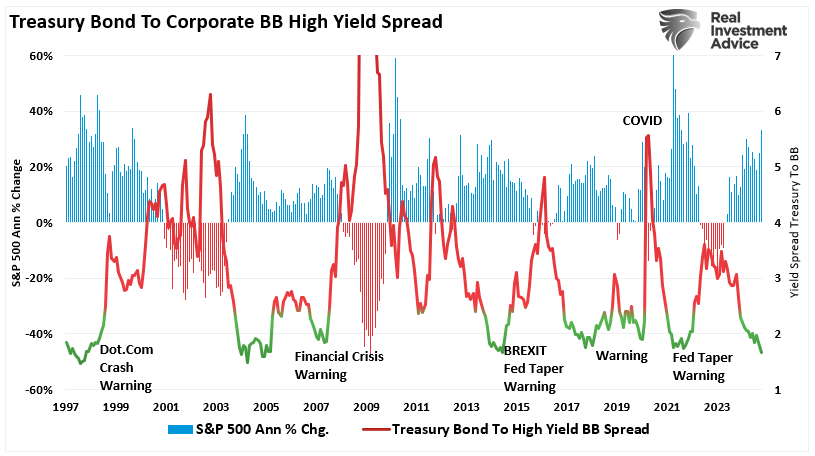

Finally, staying informed about market dynamics is critical. Monitoring speculative indicators, such as options volume and leveraged ETF flows, can provide early warning signs of frothy conditions. As discussed recently, pay attention to "Junk Bond To Treasury Spreads," which have consistently been a leading indicator of financial risk.

"As investors, we suggest monitoring the high-yield spread closely because it tends to be one of the earliest signals that credit markets are beginning to price in higher risks. Unlike stock markets, which can often remain buoyant due to short-term optimism or speculative trading, the credit market is more sensitive to fundamental shifts in economic conditions."

Conclusion

The market remains extremely bullish, and leverage and speculation continue to play a crucial role in driving extraordinary gains. However, as with everything, good times do not last forever. The current speculative environment is leaving investors exposed to significant risks when this current trend eventually reverses. The surge in options trading and leveraged single-stock ETFs reflects a speculative environment that requires vigilance. While markets may continue climbing in the near term, history shows that excesses often end with sharp corrections.

Investors can navigate these challenging conditions. A focus on fundamentals, managing risk, and maintaining a disciplined approach without succumbing to speculative temptations are required.

Those steps sound easy, but are difficult in a rising and speculative bull market where gains are easy to make. However, the benefit avoiding a bulk of the losses helps win the long game.

For more actionable insights on protecting and growing your portfolio, visit RealInvestmentAdvice.com.

The post Leverage And Speculation Are At Extremes appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Bear Market,Featured,Investing,Lance Roberts,newsletter,recession,S&P 500