With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever the day brings.

The S&P 500 has averaged a 7% gain during U.S. presidential election years since 1952. While a 7% gain is far from disastrous, it is also well short of the 22% gain this year. Of course, investors need to remember that past performance does not guarantee future returns, and there have only been 18 presidential elections since 1952.

Notably, this is the best election-year stock market of the 21st century, which is interesting given the potential for post-election chaos given the deep political divisions. Therefore, as investors, we likely need to focus on previous years where the outcome of the election was disputed,

2000 Election: Bush vs. Gore

- Dispute: The 2000 election is the most infamous modern example of a contested outcome. The result hinged on Florida’s vote count, triggering a legal battle until the U.S. Supreme Court resolved it on December 12, 2000.

- Market Reaction:

- Initial Decline: The S&P 500 fell roughly 5% in the month following Election Day (November 7) as uncertainty grew over the legal proceedings and recounts.

- Volatility Surge: The VIX (Volatility Index) spiked during this period, reflecting heightened fear among investors.

- End-of-Year Performance: By year-end, the market remained subdued, reflecting concerns about a slowing economy that eventually entered a recession in 2001.

2016 Election: Trump vs. Clinton

- Election Night Volatility: Although the 2016 election did not result in a legal dispute, Trump’s unexpected victory caused panic in overnight futures trading.

- Market Reaction: Futures for the Dow Jones Industrial Average dropped more than 800 points overnight, reflecting investor uncertainty about the unexpected outcome. However, markets quickly reversed course, rallying on tax cuts and deregulationexpectations. The market rose sharply by the end of the following trading day.

2020 Election: Biden vs. Trump

- Dispute: The 2020 election saw widespread concerns about mail-in ballots, delayed results, and legal challenges, especially in swing states. The uncertainty weighed on the market outlook.

- Market Reaction:

- Initial Volatility: The S&P 500 rose slightly the week after Election Day, anticipating stimulus packages regardless of the outcome.

- Volatility Spike: The VIX remained elevated through November, reflecting ongoing uncertainty over lawsuits and recounts in battleground states.

- December Rally: Once results solidified, markets rallied through the end of the year, buoyed by optimism about vaccine rollouts and fiscal stimulus.

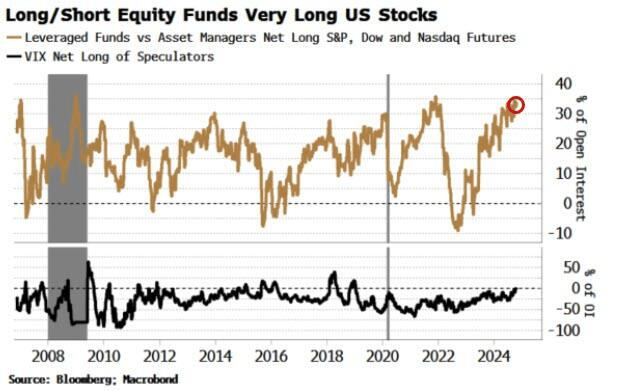

Investors face an outsized risk that volatility could increase sharply post-election if chaos erupts between political opponents. This is particularly true if the election is close but Donald Trump wins the electoral college. In that event, Vice-President Kamala Harris will need to certify the election, which increases the possibility of a delay. Investors currently have very long equities, which opens the door to a downside reversal if “something happens.”

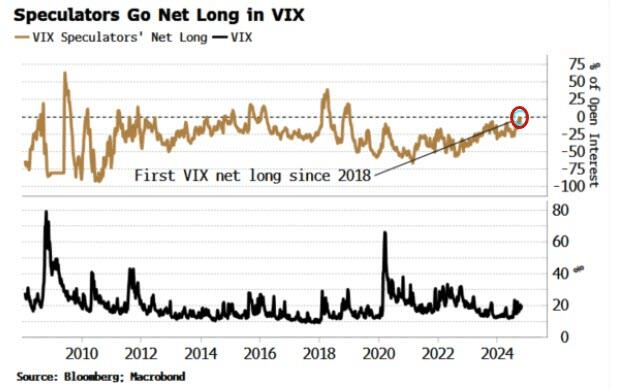

Interestingly, traders are also heavily positioned in the volatility index. The previous times that happened, the stock market was in a downtrend or a correction. It is uncommon, if not unprecedented, to see it happening when equities are near all-time highs.

So, with today being election day, what should we expect and do?

Election Day And Potential Volatility: What to Expect

With the rush of voters to the polls today, there are already warnings that several key states may not report results for several days. As Yahoo News reported:

“For this election, some swing states, including Nevada and Michigan, have new laws and policies designed to expedite ballot counts. But others, including the battlegrounds of Pennsylvania and Wisconsin, still don’t allow the counting of absentee and mail-in ballots until Election Day — which could prolong the process of declaring a winner, especially in such a tightly contested presidential election.”

Therefore, delaying certainty in the election outcome could increase short-term market volatility. However, history suggests market performance has been fairly reliable despite short-term uncertainty. Markets tend to dip the day after the election, with historical data showing that the S&P 500 drops by an average of 0.66% following Election Day. This reflects both disappointment when expected outcomes don’t materialize and uncertainty about the policy direction under a new administration. However, markets typically recover by December, with the S&P 500 posting gains in about 61% of election years. However, these gains are often muted compared to non-election years, with average year-end increases below 1%

As we have stated, the risk is a contested election. Contested elections, such as in 2000 and 2020, have historically prolonged market volatility. Following the Bush-Gore election in 2000, the S&P 500 fell 5% over the next month as the legal battle dragged on. In 2020, delayed vote counts and legal challenges heightened volatility, keeping investors on edge for weeks.

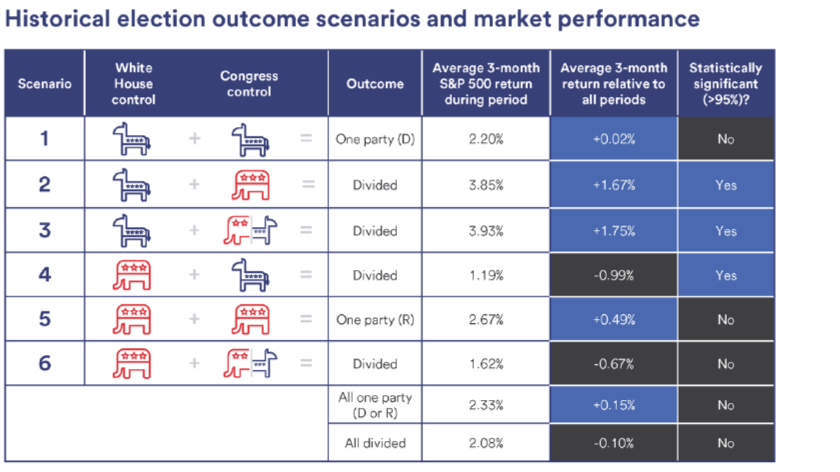

While the Presidential election is important, market participants will watch the House and Senate races the closest. The financial markets love “gridlock” in Washington. Therefore, regardless of the presidential election’s outcome, a split of control between the House and Senate will ease concerns about policies that could negatively impact economic growth.

Treasury Bonds as a Key Hedge Today

One thing investors should consider is potentially hedging portfolios with Treasury bonds. In a highly contested election, Treasury bonds could act as a “safe haven” if an unexpected election outcome sparks a market sell-off. Historically, bonds perform well when the Federal Reserve is in a rate-cutting cycle but also perform well during periods of heightened uncertainty.

For example, during previous election cycles with rate cuts—such as in 2008 and 2020—Treasuries benefited as investors sought safe assets amid heightened market uncertainty. Lower rates reduce bond yields but increase bond prices, making them attractive in volatile environments.

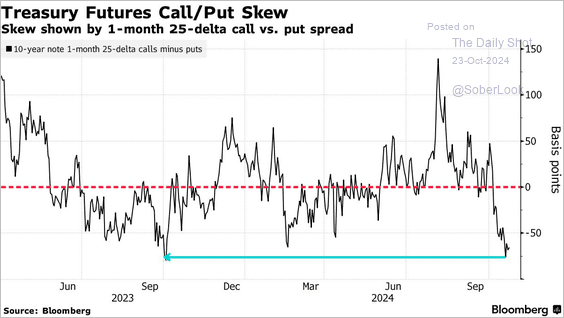

Furthermore, the options skew on Treasury futures is exceptionally lopsided, while, as shown above, traders are incredibly long equities. If today’s election outcome is disputed or delayed, Treasury bonds could rise as investors retreat from equities. In 2000, 10-year Treasury yields dropped steadily throughout the contested election period, reflecting growing demand for safe assets. While I am not suggesting such an event will occur, the setup for an unexpected election outcome favors hedging portfolios with Treasury bonds.

Portfolio Moves to Make

In our opinion, Investors should brace for potential volatility as we head into the close of the polls tonight. Such is especially the case this year, given the potential for a contested outcome. Historical precedent shows that markets struggle when elections are disputed, such as in 2000 and 2020, triggering sell-offs and heightened volatility as legal challenges unfold.

If the election result remains unclear or legal disputes arise, sectors tied to policy shifts could experience sharp fluctuations. Additionally, the Federal Reserve’s next rate cut decision, which is tomorrow, may further compound uncertainty, making defensive assets like Treasury bonds appealing as safe havens.

As such, given the potential for volatility, here are actionable strategies to protect your portfolio today and in the days ahead:

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against significant market declines.

- Take profits in positions that have been big winners

- Sell laggards and losers

- Raise cash and rebalance portfolios to target weightings.

While we have discussed these simplistic rules over the last several weeks, we continue to reiterate the need to rebalance risk if you have an allocation to equities.

Keep moves small for now. As the markets confirm their next direction, we can continue adjusting accordingly.

Final Thoughts

Will we have a new President on Wednesday? Maybe, maybe not. Crucially, who will control the Senate and the House will either support or crush a new president’s ability to enact policy decisions. How will the market respond? What will the Federal Reserve do next?

Unfortunately, neither we nor anyone else knows how these events will unfold. These questions will be answered soon enough, and we must deal with the market response accordingly. We know that the market often does the very thing we least expect. We suggest remaining nimble, holding extra cash, and hedging existing positions.

Remember, we should carry an umbrella in case it rains. Do not try to find one after the shower has started.

The post Election Day! Plan For Volatility appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Bear Market,Featured,Investing,Lance Roberts,newsletter,recession,S&P 500