Overview: The Fed's hawkish hold and signal that it may raise rates two more time this year sent ripples through the capital markets. Risk appetites have been dealt a blow. However, China's rate cut and likely additional supportive measures after disappointing data, helped lift the CSI 300 by 1.6%, the most this year. The Hang Seng rose by nearly 2.2%, the most in three months. Europe's Stoxx 600 is snapping a three-day advance and US index futures are trading lower. European bond yields are mostly 4-7 bp higher ahead of the ECB meeting, which is expected to deliver a rate hike and confirm its intentions to lift rates more. The US 10-year yield is up a couple of basis points to a little below 3.81%, while the two-year yield is up almost four basis point to nearly 4.73%.

Rising US rates helped lift the dollar to a new high for the year against the Japanese yen, and the second quarterly contraction in New Zealand (-0.1% in Q1 23 after -0.7% in Q4 22) weighed on the Kiwi. More broadly, the greenback is mixed now mostly inside yesterday's ranges. Most emerging market currencies, outside of a few central European currencies and the Chinese yuan, are sporting softer profiles today. Rising yields took a toll on gold, which slipped below $1930 to its lowest level since late March. A large build of US crude inventories is helping to keep WTI on the defensive. July WTI traded below $68 a barrel today before stabilizing. It has not settled above $70 a barrel this week.

Asia Pacific

The BOJ meetings concludes tomorrow. Although previously many expected a change in policy as this meeting, it has been pushed back due to the patience expressed by BOJ Governor Ueda. That means a hike in the overnight cash target from minus 0.10% is unlikely. It also means that an adjustment to the yield curve control under which the 10-year yield is allowed to move in a 50 bp in either side of zero is likely to be sustained. If there is going to a surprise, we have suggested that the BOJ may eschew if easing bias for a neutral stance. Separately, Japan reported May trade figures earlier today. True to the seasonal pattern, the balance deteriorated in May (as it has done in all but two years in the past 20). Still, exports were stronger than expected, rising by 0.6% increase rather than fall by 1.2% as projected. Imports tumbled by 9.9%, a little less than expected. It was the second consecutive decline, and it reflected a decline in fuel prices. Earlier this week, Japan reported a 0.7% decline in May producer prices. Japanese producer prices have fallen at annualized rate of a little more than 1.4% in the first five months of 2023. In comparison, US producer prices are falling at an annualized pace of almost 0.5% through May. Eurozone producer prices have collapsed at an annual rate of nearly 25% through April. Separately, Japan reported core machinery orders in April were stronger than expected (5.5% vs. 3.0% median forecast in Bloomberg's survey). Lastly, standout development in last week's portfolio flows was Japanese investors buying of foreign equities (~JPY1.3 trillion), the third most this year.

The PBOC delivered a small cut in the benchmark one-year medium-term lending facility. The 10 bp cut brings the MLF rate to 2.65% and the PBOC also increased the volume to CNY237 bln from CNY125 in May. This was widely anticipated after the banks cut their deposit rates (in response to official requests) and the PBOC cut the seven-day repo rate. There is still scope to reduce reserve requirements as well. The government is believed to be working on other measures to support the economy and property market. Separately, China disappointing industrial output figures (unchanged at 3.6% year-to-date, year-over-year) and while retail sales improved, it was by less than expected. Fixed asset investment was weaker than expected and residential property sales contracted at a faster pace.

Australia's May jobs report was considerably stronger than expected and boosted the prospects of additional rate hikes. After losing 28.6k full-time positions in April, Australia reported a 61.7k increase in May, and an increase of 75.9k jobs overall. The unemployment rate slipped back to 3.6% from 3.7% and the participation rate jumped by to 66.9% from 66.7%. Previously, the futures market had about a one-in-four chance of ha hike next month discounted. It is now 50/50. The current cash rate target is 4.10% and the futures market now sees the year-end rate at almost 4.60%, nearly 10 bp higher on the and 15 bp on the week.

We had suggested that the consolidation pattern in the dollar-yen rate like a continuation pattern. And bolstered by the jump in US rates, the dollar broke higher and reached JPY141.50, a new high for the year. It has pierced the upper Bollinger Band (~JPY141.10). A pullback may find initial support around JPY140.80. Despite the strong Australian jobs report and interest-rate adjustment, the Australian dollar is trading inside yesterday's range, which saw a nearly four-month high (~$0.6835). The next upside target is near $0.6900. A close below $0.6800 would be disappointing. The US dollar made a new high for the year against the Chinese yuan (~CNY7.1805) but pulled back toward yesterday's low, slightly below CNY7.15. The PBOC set the dollar's reference rate at CNY7.1489, weaker than the CNY7.1509 median forecast in Bloomberg's survey.

Europe

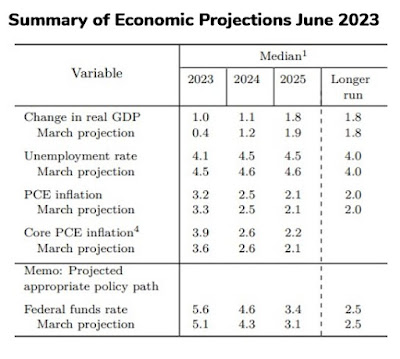

ECB President practically committed to hiking rates today at last month's meeting. The market has a quarter-point hike nearly fully discounted, which would bring the deposit rate to 3.50%. The swaps market has about an 80% chance of another hike by early Q4 discounted. Yet, by early Q2 24, the market is pricing in a cut. The Federal Reserve's new economic projections also see rate cuts next year, perhaps as much as 100 bp.

There are a couple of moving parts to the ECB's decision today outside of the rate decision proper. First, the staff will offer updated forecasts. The risk is that this year's growth, which was projected at 1.0% year-over-year in March gets shaved and this may drag down next year's forecast for 1.6% growth. The ECB's staff forecast CPI to be at 5.5% at year-end. It has risen at an annualized pace of slightly more than 5% through May. The base effect works in its favor in the second half of the year (unlike the US). The forecast for 2025 CPI was 2.1%, and by placing it above the 2.0% target, the ECB underscored its hawkish stance. This could be pared and if it is below 2.0%, the market will grasp the dovish implications. Second, the ECB will update its balance sheet strategy. Since peaking last June, the ECB's balance sheet has been reduced by about 13% (Fed's is off about 16% since peaking in April 2022). The reduction is due to not fully reinvesting the maturing proceeds from its Asset Purchase Program, which pre-dates Covid, and banks paying back their loans (Targeted Long-Term Refinancing Operations, TLTRO). Toward the end of June around 475 bln euros of TLTRO loans comes do. They account for about 6% of the ECB's balance sheet and around half of the outstanding TLTRO loans.

The euro is firm inside yesterday's range (~$1.0775-$1.0865) and has held above $1.08 so far today. If sustained, it would be the first time in a month that it has managed to do so. The $1.0865 area represents the (50%) retracement from the high set near $1.11 in early May. There are options for around 640 mln euros that expire today at $1.0875 and there are the nearly 2.5 bln euro of options that expire tomorrow at $1.0850 that we noted yesterday. Sterling rose to a new 12-month high yesterday, 1/100 of a cent below $1.2700. It is consolidating today. The session low is around $1.2630, and it has not been above $1.2675. It moves more into focus next week with the BOE meeting and CPI figures. Note that the euro is trading a new high since 2008 against the Japanese yen and sterling is at its best levels since 2016.

America

The Federal Reserve delivered the much-anticipated hawkish pause. It was more hawkish in several aspects, even though there were not dissents favoring a hike. The key was the upgrade in the median year-end forecast of the target rate. It rose from 5.1% in 5.6%. The Fed's forecast still sees rate cuts next year, and the median forecast is for Fed funds to be at 4.6% at the end of 2024 (from 4.2% in March). The median forecasts for the macroeconomic data were consistent with the hawkish signals: growth and inflation were revised up and unemployment data. The year-end rate is now seen around 5.20% up about 10 bp on the Fed's statement and Chair Powell's press conference. The market has not concluded that a July hike is a done deal. Rather, it is now not quite a two-in-three proposition, ironically, the least this month.Recognizing the dependence on the incoming data stream to inform the FOMC decision next month, what is reasonable to expect? First, US headline CPI may fall toward 3.2%-3.3% by the time the Fed meets again in late July. The core rate may slip to almost 5%, the slowest pace in late 2021. Second, economic activity is likely to slow from around 2% growth likely here in Q2 to, perhaps, less than half the pace in Q3. The impact of the resumption of student loan debt servicing, the tightening of financial conditions from the rebuilding of TGA and slowing in bank lending, and fiscal headwinds coming as the cost of lifting the debt ceiling all push in the same direction. Today's data may give a little flavor, with retail sales expected to fall for the third time in four months and manufacturing output to fall for the second time in three months. The June Empire State manufacturing survey is expected to remain in negative territory for the second consecutive month, while the Philadelphia Fed’s business outlook probably deteriorated. The median forecast in Bloomberg's survey is for US GDP to slow to less than half of the Q2 pace. Note that after today's data, the Atlanta Fed's GDP tracker will be updated from 2.2% on June 8.

Canada report May housing starts and existing home sales, and April manufacturing sales. These data points typically do not have much market impact. The US dollar recover from the dip to nearly CAD1.3270 yesterday (just ahead of the year's low set in early February near CAD1.3265) and settled back above CAD1.3300. The greenback reached CAD1.3355 before finding new sellers that drove it back to the session lows in the European morning near CAD1.3320. The lower end of the US dollar's trading range has frayed a bit but has not broken convincingly. There are a couple of chunky option expirations tomorrow: $630 mln at CAD1.3250 and $640 mln at CAD1.3200. The US dollar is consolidating against the Mexican peso have setting a new multi-year low near MXN17.08 yesterday. So far today, the dollar has held above MXN17.10 and briefly poked above MXN17.21. There are options more about $317 mln at MXN17.25 that expire today. A close above MXN17.2070, the five-day moving average, would be the first this month. Separately, note that S&P upgraded the outlook to positive from stable for Brazil's credit rating, which it puts at BB- amid improvement in the fiscal framework. Fitch also assigns a BB- rating to Brazil, but already has a stable rating. Moody's sees Brazil as a Ba2 credit (BB) and a stable outlook.

Tags: #USD,Australia,China,Currency Movement,ECB,Featured,Federal Reserve,Japan,newsletter