Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Yes, 2008. Also everything after.

The Chinese have followed closely this style having realized what took Bernanke too long. That is, the real goal isn’t so much to move the markets or the system like a puppet master directly, that’s just not possible, rather to feed an over-complaint media what’s necessary to try to fool the public into some sort of indirect pressures.

You know what they say about rocks and hard places. For China, the rock is the global economy which is decidedly un-inflationary and only getting more so by the month. The hard place is that pesky eurodollar system which deprives the Chinese more than anyone of economic vitality as well as the necessary monetary resources just to stay afloat in it.

Over the weekend, the People’s Bank of China formed an alliance via the BIS where it convinced five other central banks – Indonesia’s, Malaysia’s, Chile’s, Singapore’s monetary authority, and the HKMA (obviously) – to put in toward what Western media outlets have described as an RMB liquidity pool.

Where they might have gotten such an idea is my point.

China’s central bank on Saturday signed an agreement with the Bank for International Settlements (BIS) to establish a Renminbi Liquidity Arrangement.

The arrangement aims to provide liquidity support for participating central banks during future periods of market volatility by creating a reserve pool, according to the People’s Bank of China (PBOC).

The PBOC then was quoted as saying this was, “conducive to meeting the reasonable international demand for the renminbi.” Yeah, but lie of omission.

The mechanics of the pool were uniformly described as just that; an RMB liquidity pool whereby these six central banks contribute a modest RMB 15 billion towards its fund. Each central bank would be able to draw on funds under certain circumstances, maintaining, supposedly, top-flight liquidity for cross-RMB trading.

Another if modest checkmark on the road to yuan internationalization?

What was left out from most descriptions was the key phrase which, to its credit, wasn’t hidden by the PBOC. Just from most media accounts. On its own website, China’s central planning central bankers admitted:

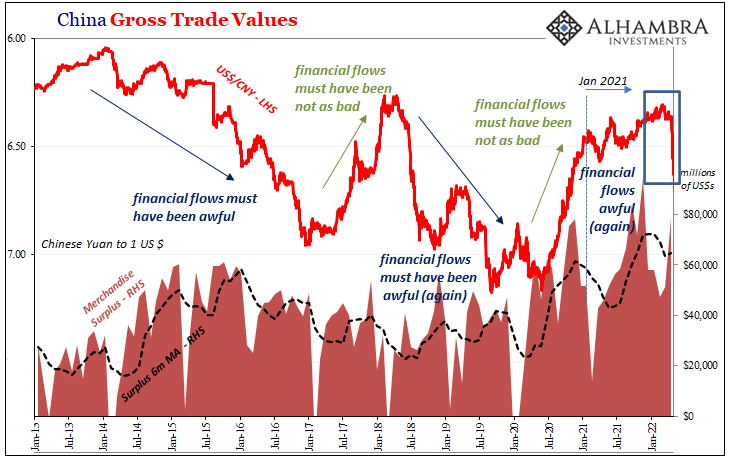

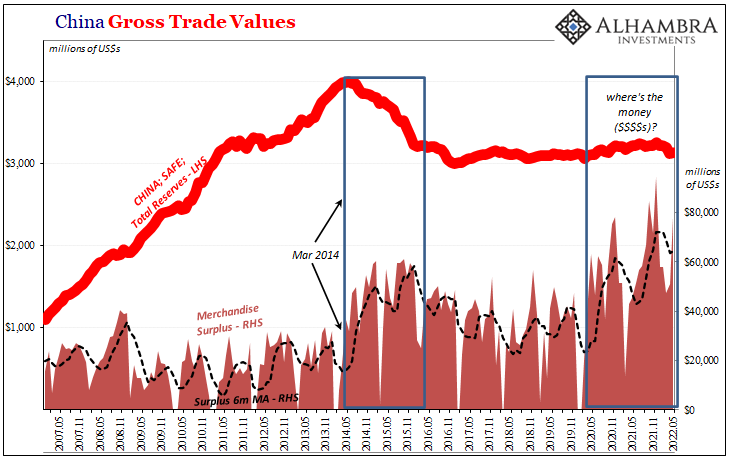

It’s not an RMB liquidity pool at all, rather a eurodollar insurance policy for these clowns and their close Chinese trading partners. Get the media to report one thing that it is not; produce the impression of proactive RMB liquidity when it is something else entirely. Why might this be? Perhaps when CNY might plummet again as dollars grow even more scarce – in and around China and its closest allies. And why might that be? |

|

| Let’s say that for some reason, the Chinese aren’t going to be importing as much raw materials from some of these other countries and therefore they might not be forwarding as payment as many dollars that China already doesn’t have.

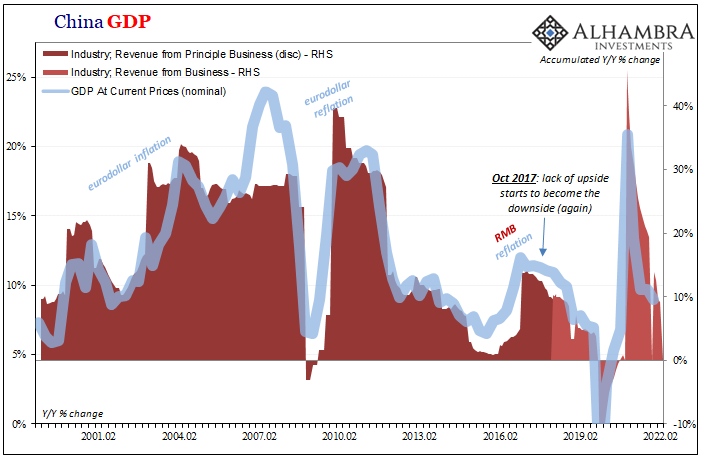

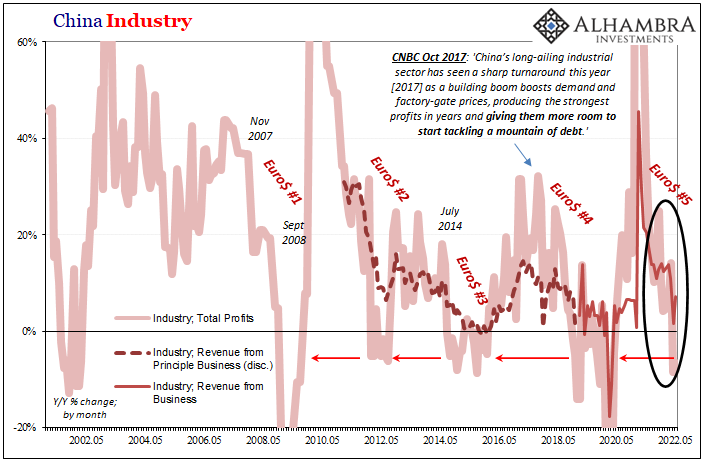

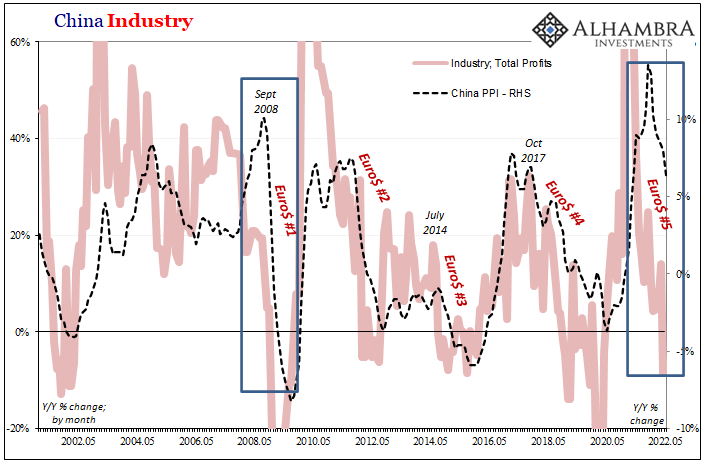

One more “why” to ask, not just dollar shortage weighing on China imports but also China economy. For one, that country’s NBS reported more disappointing estimates over the weekend, this time industrial profits and revenues. Revenues across the industrial sector continue to be quite weak despite the ongoing price illusion; you can clearly see the close correlation between nominal GDP and these industrial revenues. Still downhill ahead. |

|

| Profit-wise, Chinese industry isn’t able to make them even though prices otherwise seem to be favorable. Meaning, they aren’t fully passing input costs along up the chain to their customers. Revenues up but profits down at the same depths as prior downturns.That’s not good for future business; China or those in its orbit.

And while Shanghai’s Zero-COVID experiment has been blamed for all these bad economic misses, here’s another month of May “shocking” disappointment where the anticipated rebound didn’t happen. On an accumulated basis (which is how the Chinese like to report data like this), industrial net profits were expected to rise from 3.5% in April representing a low point, instead they only managed 1% establishing a new one. On a monthly basis, for May 2022 along profits dropped 6.5% year-over-year when compared to May 2021. |

|

| That’s indistinguishable from April’s -8.5% which suggests global downturn if not recession now and ahead. |

For price pressures, with Chinese industry in such a bad way we should expect these to continue declining worldwide. Again, both a dollar problem for others around the globe was well as a macro problem eating into demand.

Copper now nickel, iron and steel. The industrial commodity space and more (not energy, not yet) is moving the way China’s producer and factory gate prices (above) have been for months. Perhaps inevitably, these negative pressures were going to catch up even for those high-priced commodities still sporting some of the best supply-side fundamentals.

If you can’t make money at a certain level of output, history shows more setbacks on top of cutting back ahead. And when money is at the center of the drag, it’s a doubly tricky time to be so closely connected.

Pay attention to what central banks actually do, never what they say. And many times that also means what they really say in the fine print.

Full story here Are you the author? Previous post See more for Next post

Tags: $CNY,Bank of international Settlements,China,currencies,dollar,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,global trade,industrial profits,Markets,newsletter,PBOC,RMB