On Monday the dollar had a ferocious rally, moving up from 15.87mg gold to 16.77mg and from 1.21g silver to 1.32g. In mainstream terms, the price of gold dropped about a hundred bucks, and the price of silver crashed $2.20.

One notion we’re hearing a lot now is, “there is no alternative to stocks.” Certainly, stocks have been rallying. They were up in Sunday evening (as we reckon it here in Arizona) trading. Then Pfizer announced good news for its COVID vaccine, and that seemed to be the signal to bid up stocks even more.

Many in the mainstream believe that stock prices are linked to the economy. Many of the rest would quibble slightly, and say that stock prices predict the economy.

However, we argue that stocks and other assets trade inverse to interest rates. A stock has a yield (well, most do) based on its earnings. This is the inverse of the famous P/E, i.e. the less famous E/P ratio. When the interest rate moves down, then so does E/P. This has nothing to do with the economy (falling interest goes with weakening the economy, but that is an argument for a different day).

Quoting stocks as an annualized yield is useful, because then you can compare to bonds. As Zero Hedge writes, the yield of stocks has been falling even relative to bond yields.

The difference between S&P 500 earnings yield and the yield on a 10-year Treasury is down now to about 2.5%.

It should be noted that this is based on reported earnings. This is not what investors take home in the form of cash. Not to mention that earnings can include whole categories that should not be counted as earnings. For example, capital consumption.

What Do The Investors Get?

Dividend yield is what investors take home. Dividends are less subject to creative financial engineering (though too often since 2009, they have been paid with borrowed funds).

Dividend yield is a whole point lower than earnings yield. So the spread to Treasurys is more like 1.5% (compared to 2.5% for earnings yield).

Whether or not there is an “alternative” to stocks, when the crowd has not gone mad, they are regarded as riskier than bonds. And should trade at a discount in price (i.e. a higher yield) to provide a safety margin against the risk of adverse changes to the business.

And right now, investors would rather own stocks than bonds, and damn the torpedoes along with the risks. They could benefit from a lecture by economist Russel Napier, who quipped at a talk in London a few years ago that, “Equity is the thin line of hope between the asset and the liability.”

Debt certainly rose during the COVID lockdown (companies borrowed to keep running, while revenues were lower or zero).

So that thin line is even thinner. But investors keep bidding it up. For now.

One thing stocks are not a signal of: the degree to which the president believes in free markets. The president does not have that much effect on stocks anyway, not being in charge of either monetary or fiscal policy. But, if anything, the stocks of the 500 biggest corporations should do well in an environment of onerous regulations and punitive taxes. Why?

Big vs Small

The biggest threat to an incumbent major corporation is a disruptive startup. If an Amazon is allowed to grow, it could eventually wipe out B Dalton, K-Mart, and JC Penney.

If a Skype is allowed to grow, it could wipe out AT&T (at least the long distance business part of it).

Regulations impact small companies harder than big corporations. And startups most of all, as the legal costs can be greater than their ability to raise capital. Compare to major corporations, whose lobbyists help Congress draft the new law and then help the regulators draft the new regulations called for by the law. The regulation works out well for them, facilitates their business model—if not petrifying it by disallowing innovation.

Taxes, also, prevent innovative young companies from threatening major corporations. This is because growing companies reinvest their earnings.

The higher the tax rate, the less they can reinvest. A dollar of earnings would allow $0.90 of reinvestment at a 10% tax rate. But only $0.50 reinvestment at 50%.

In other words, the higher the tax rate, the more that a dollar of capital already invested is worth in terms of new dollars of earnings.

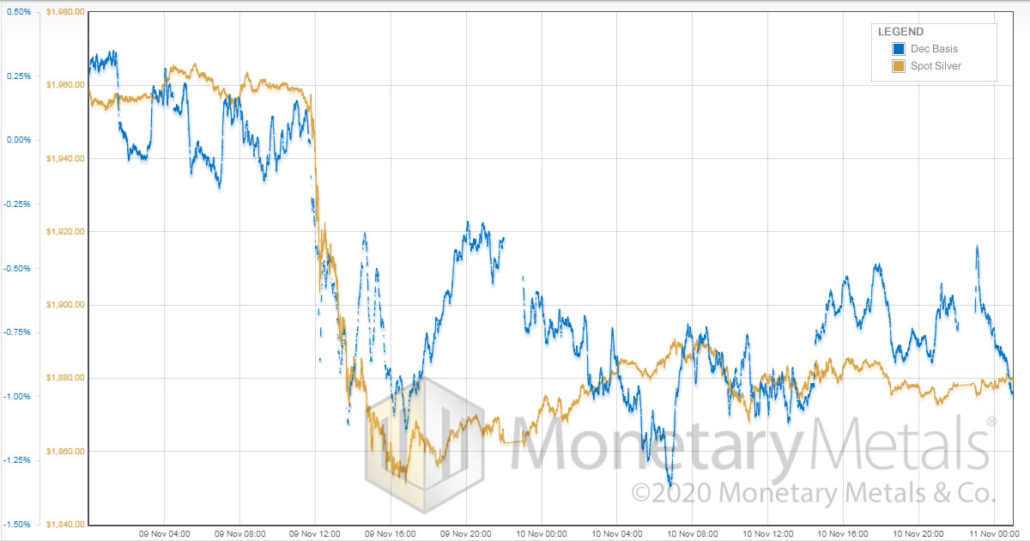

Massive Monday & Tepid TuesdayAnyways, if gold is the asset people turn to when they don’t like the risk-reward ratio of investments, it means something when the price of gold drops. At least if it drops durably. So we look at the supply and demand fundamentals to see if that is likely. Here are two-day graphs showing the massive Monday price drops of both gold and silver, and the tepid Tuesday rallies. A few features of this chart are striking. The basis follows the price over the cliff. Indeed, we can see when backwardation likely starts. Strictly speaking, backwardation is not merely a negative basis, but a positive cobasis. However, the drop in basis is so precipitous around noon (London time), from just under +0.2% to below -1% around 14:00, that we assume the cobasis spiked above zero at the same time. Keep in mind this is the December contract, which is heading into expiry so it will have a lower basis which is prone to temporary backwardation, and which is more volatile too. When basis tracks price, it means that the move is led by leveraged speculators in the futures market. Once again, they believe they know what is supposed to happen when there is good economic news and stocks are bid up to the sky. Gold is supposed to go down. So they sell. However, notice those little drops in basis before the price dropped. They are around 01:30, 05:00, and 08:00. Futures speculators were selling at those times, but robust demand for physical metal held the price steady until just before noon. Then once the price is down, we see a hesitant spike in basis around 15:00 and then a bigger one starting around 16:30. These were attempts by futures traders to predict a price rally after so big a crash. Or perhaps closing short positions opened hours earlier to bet on the move. |

Gold Basis and the Dollar Price |

| There was not much buying of physical during these times, so basis decouples from price.

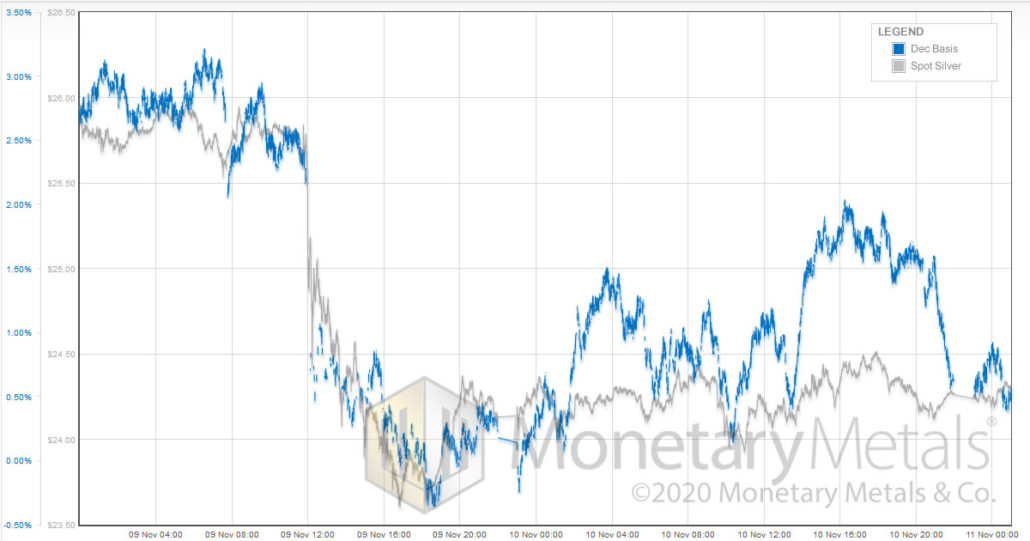

Then around 20:00 (which is 15:00 in New York), futures traders were not particularly active, but physical metal buyers bid up the price from around $1,870 to $1,885 by 07:00 the next morning. And the basis fell below -1.3%. After that, futures traders made a few more bids on gold, but the price moved sideways around $1,880. Here’s silver. Overall, it’s the same pattern as gold, though with some minor differences (as always). Notably, the basis drops from around 3% to below zero, and ends around +0.5%. There are a few attempted rallies by the futures speculators, but the basis correlates to the price a bit better than in gold. The next few weeks are sure to be interesting. Of course, regardless of market changes during that time, Monetary Metals will continue to deliver clients a yield on gold, paid in gold. And silver, too! |

Silver Basis and the Dollar Price |

Full story here Are you the author? Previous post See more for Next post

Tags: Basic Reports,Featured,Gold,newsletter