| As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic. Families affected by COVID either through the disease or as a result of job loss due to the coronavirus have been protected from landowner actions including eviction as a final means to reclaim rental properties from non-conforming tenants.

There are, of course, severe challenges to this authority already being planned especially given how broad the guidelines are. Basically, if your income is less than $99k (or $198k as joint filers) you merely have to “demonstrate” somehow that you’ve attempted to receive some kind of government assistance before then affirming (by simple word) that you can’t pay rent due to some kind of COVID “hardship” before finally affirming (by simple word) that without this relief you will be left homeless. The reason the CDC, of all agencies, has issued the suspension order against ostensibly an economic transaction is the federal government making this a health issue; the feds are, they claim, worried about further spread of the disease. Better to harm landlords financially for a time than to let property owners get back to a paying basis by pushing potentially contagious people into the streets leaving them open to infect everyone else. |

Pro forma CES HH Survey, 2020-2021 |

| I’m sure some of that is true, but we all know what’s really going on here as early November fast approaches. As the pandemic continues to fade (it was very likely over with a month ago if not two), with no other way around it there’s no other option than to make this economic disaster a piece of the short run status quo; meaning, kick the can down the road and hope that recovery actually does show up soon enough.

Implicit in this action is how recovery hasn’t, and concerns are growing that it might not. Thus, a “health” related moratorium on what may be Americans numbering multiple millions, maybe ten million or higher, who haven’t been paying rent. Even though it’s now September, the robust job market we keep hearing about in the media hasn’t even reclaimed half the jobs lost. And with more data over recent weeks (including the most recent labor figures) suggesting upward momentum might’ve been exhausted entirely… And the longer this goes, despite this era of gigantic positives, the more durable, perhaps permanent economic damage sets in along the way. People seem to be confused about what that means. This is the part I want to be very clear about; what our base expectation is for the economy moving forward as we see more and more of these kinds of signs which (strongly) suggest that the “V” isn’t dead, rather it never had a chance. What does it mean if there doesn’t end up being one? It sounds kind of like another recession, but we’ve already experienced the recession. We’re in it right now! |

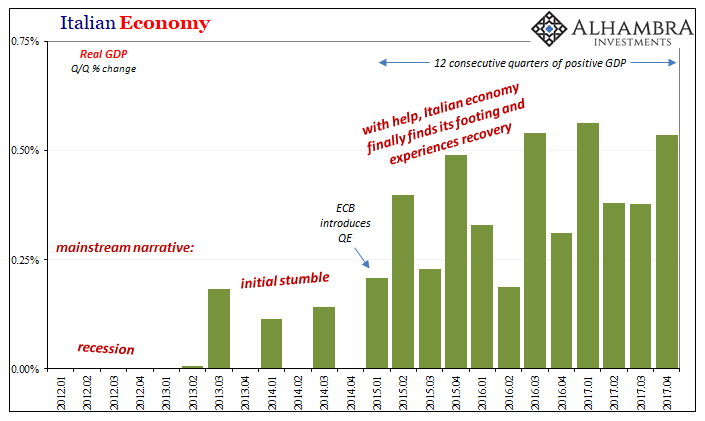

Italian Economy, 2012-2017 |

| The truth of the matter is that a second recession over the coming quarters is almost immaterial to the bigger picture; the global economy has already suffered the major body blow, and what’s left to factor is something like the Italian case.

To demonstrate my utter contempt for globally synchronized growth as anything other than an ill-conceived bumper sticker slogan, in presentations late in 2017 and into early 2018 I would often use Italy as a very clear and deliberate example of what that really had been. It wasn’t growth – but because it did look like growth it had ended up breeding widespread confusion and delusion (something about inflation). The point was how easy to demonstrate the difference, and then its enormous short and long run significance. All the elements were present for being misled: an initial recession which officials quickly moved on from without ever explaining or making sense of; a key stumble into the initial rebound which officials quickly moved on from without ever explaining or making sense of; the inevitable big show of monetary policy, QE in this case, which just so happened to time perfectly (or appear to) with what sure seemed like acceleration into robust growth. It appeared to show all the necessary elements for recovery. By the end of 2017, Mario Draghi and all his compatriots were patting themselves on the back, declaring full and complete success while lustily looking forward in 2018 to unwinding everything before the parades would begin. |

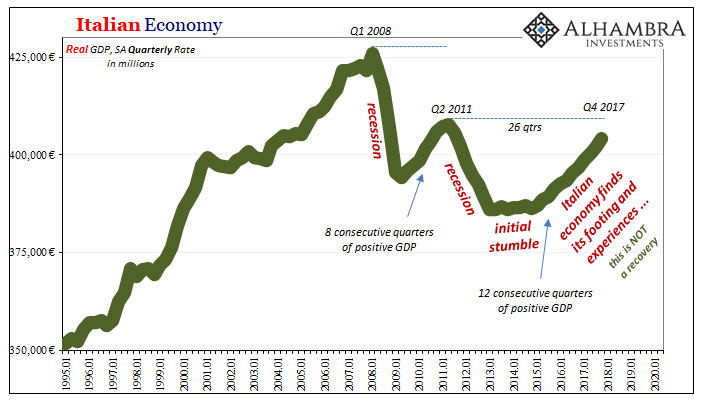

Italian Economy, 1995-2020 |

| And it was all a huge lie because positive numbers are not the full story. There was no boom. To the contrary, Italy had experienced instead the worst possible case due to the biggest factor there is.

Time. When you look at it in context, Italy (and Europe’s) 2017 boom simply melts away into it never happened. QE’s, NIRP, LTRO’s, etc. Worse, the official word on Italy was that it had healed; that it had finally recovered. But since officials either believed it or were too corrupt to admit otherwise, what followed 2017 instead was an “unexpected” globally synchronized downturn which hit almost immediately at the beginning of 2018. |

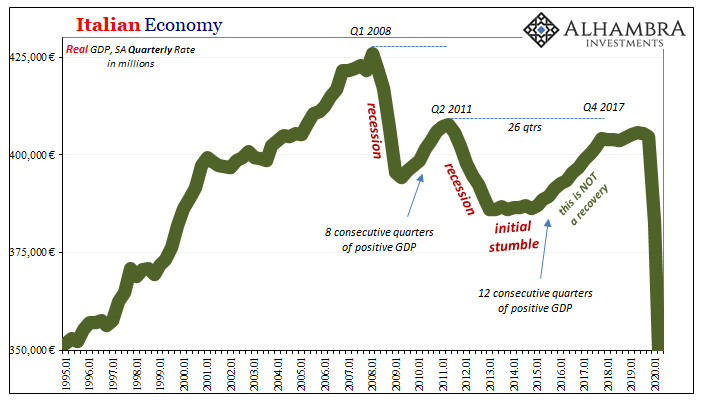

Italian Economy, 1995-2020 |

| Italy’s weakened economy was knocked off stride and would actually peak again in Q2 2019 – squandering two more years the country (as well as all of Europe) couldn’t afford on the wrong side of recovery long before anyone had heard of COVID. Positive or negative, the resulting mix of both ended up the same way: no recovery, a condition which now spans more than a dozen years. Take that, Japan!

The re-recessions are not the problem; they are each the symptom of the problem. Every time the economy gets knocked down again, more time is lost which isn’t consistently represented by the fixation on quarterly GDP especially when the are strung together consecutively. Worst of all, when that does happen it is extrapolated as if it does mean something substantial. |

Real GDP Pro forma, 2014-2022 |

| In the past, this may have been the case. But the Italian case, as shown here, demonstrates that Italy, at least, has been an exceptional case ever since Q1 2008.

In other words, what makes an “L” is time. The “L” shape scenario graphically actually looks more like a “V” than an “L”; in reality, it is, at least, a backwards check mark (see below). There is a downturn and then an upturn; it’s just that the upturn falls well short of full recovery because not every upturn is the same. Gradation applies. |

Real GDP Pro forma, 2005-2023 |

Right now, we are in an upturn after having (totally unnecessarily) suffered one of the worst downturns in history. Even if each and every quarter from here on is a positive one so far as GDP and other economic accounts are concerned, that doesn’t necessarily mean recovery. In fact, the Italian case was only a more extreme example of what has otherwise become globally common (now if only to figure out why that has been).

And the more we see this government – or any other – acting in a way like what’s described above, the more we have to realize it’s not really about re-recession risk, it’s about “L” risk. The upturn isn’t shaping up to be a big enough turn upward.

As noted back in June, America’s National Association for Business Economics (NABE) had put out almost a blind stab forecast for how the US economy might proceed after the initial downturn shock in April and May. Their first figure for that downside was practically right on.

Over the interim, just recently, the NABE has conducted another survey of its members and it found pessimism has risen substantially since June. In this era of mega-positive numbers, these Economists are noticing how they aren’t gigantic enough.

Almost half the respondents expects inflation-adjusted gross domestic product to remain below its fourth-quarter 2019 level until the second half of 2022 or later. And 80% of panelists indicate there is at least a one-in-four chance of a ‘double-dip’ recession. emphasis added

The US (and global) economy is set to lose more time for lack of real recovery. Even if every single quarterly GDP report from now to then is firmly on the plus side, that still adds up to the worst case. It doesn’t matter if we go in a straight line from here, or if there are further ups and downs, if by the end of next year (or the year after that) the economy is still in a shortfall, the consequences will be enormous.

As it is, these Economists are already thinking about re-recession anyway – a shallow recession in Q4 2020, for example, would be no different than if Q4 turns out to be a small positive; neither would be a huge positive following the one huge positive (in Q3) to be followed by several more.

We’ve already (unnecessarily) suffered the big downturn blow, so all that really matters moving forward is pure acceleration vs. lack of acceleration. The same problems the economy has been wrestling with since August 2007. Low positives or low negatives over the coming quarters, there’s no real difference between them. It’s either sustained massive growth, or Italy.

The question to ask right now isn’t if there is some risk GDP will be negative again, it’s why GDP might not be more positive. The answer, we’re learning, is coming back to us written in Italian.

Full story here Are you the author? Previous post See more for Next postTags: currencies,economy,Featured,Federal Reserve/Monetary Policy,GDP,Italy,Markets,newsletter,recession,recovery