|

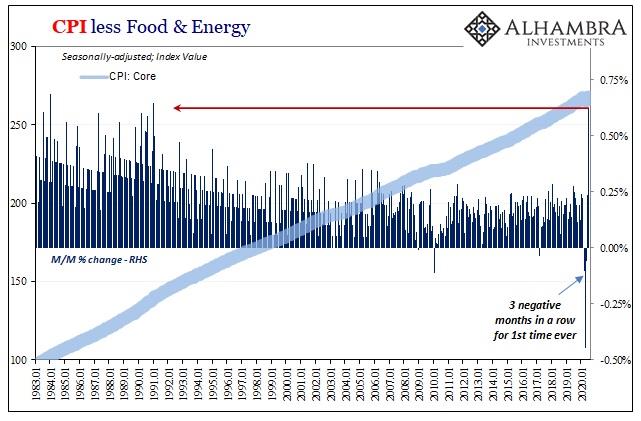

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level. Congratulations to Jay Powell? No. The Fed’s puppet show is a matter for the financial media and the stock market. Actual monetary conditions are an entirely separate issue continuously demonstrated by history and illuminated by empirical facts. The CPI for July instead, in a word, reopening. Things like automobile insurance which contributed heavily to the July number after so many insurers felt they had no alternative but to offer deep discounts during the shutdown. Taking advantage of the rebound, these and other parts of the consumer bucket are moving back toward their previous levels regardless of the quantity of bank reserves and the pace at which the Fed is expanding (or contracting) it. That was the other thing which Eugene Fama said a few days ago which has invoked so much mainstream horror (in what few places were allowed to notice). Not only did he state how the Fed is little more than the equivalent of stimulus porn, the natural extension of that fact, yes, fact, is that inflation though a monetary phenomenon must have nothing to do with the central bank. |

CPI less Food & Energy, 1983-2020 |

Here’s what Fama said specifically:

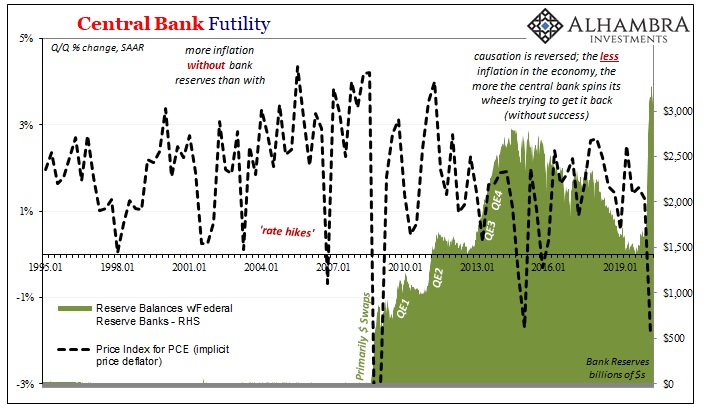

Yep, and you don’t have to be anything more than honestly observant to make this determination. Before 2008, central bankers did everything in their (presumed) powers to keep consumer prices under control. Since 2008, they’ve been increasingly on the opposite side more blatantly (like outright lying on 60 Minutes) trying to invite some or any. What was it, though, about 2008? You know, that first big monetary event in four generations? In the quote I highlighted previously, the Nobel Laureate correctly identified the puppet show for what it was and is – QE is little more than an asset swap (“They are issuing one form of debt to buy another form of debt.”) While that’s true, to make this work according to “classic monetary theory” you have to then blame IOER for it. In other words, by paying interest on these excess reserves created as the accounting byproduct of QE this turns them from being currency, as classic theory treats them, into a form of short run debt; rendering this all an asset swap therefore neutral so far as classic money considers currency. |

Central Bank Futility, 1995-2020 |

| The problem here is what I laid out for our review of the August 9 anniversary. Fama is employing assumptions made a long time ago under the old paradigm that need to be shifted to the modern reality (which became reality before Eugene Fama and his contemporaries had even started their own work). He quite correctly observes the symptom without being able to properly classify the cause for lack of an updated worldview.

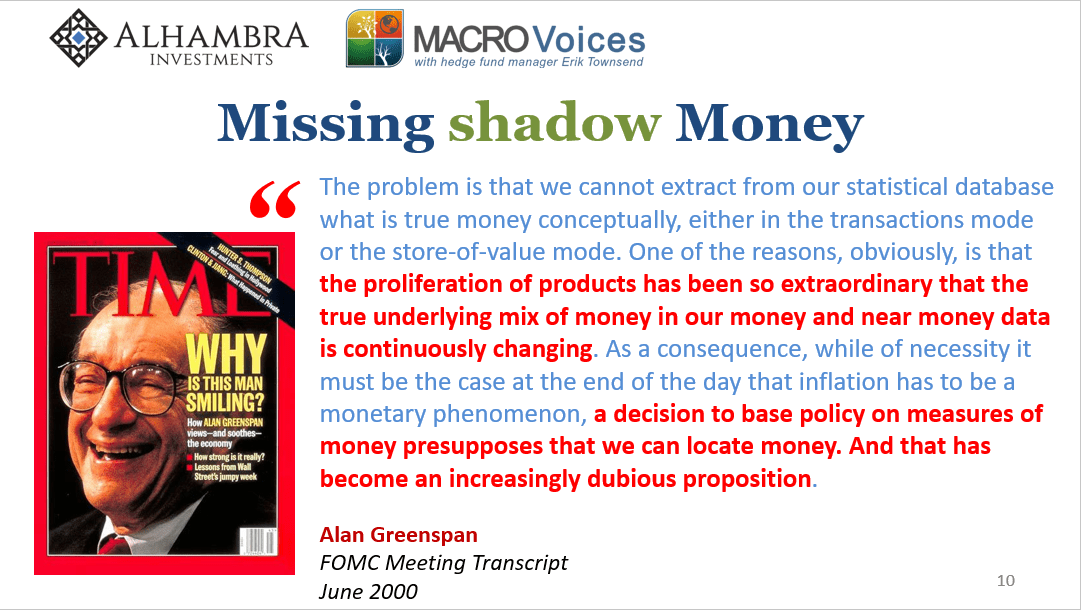

It isn’t IOER which has rendered bank reserves useless; “There is no control over the stock of what qualifies as money” because the very nature of money evolved a very long time ago. Not that anyone in the Economics profession, including Fama, seems to have noticed (they all stopped paying attention decades ago). Only central bankers, and they’ve done everything (repeated QE’s, for one) to avoid having to admit to what’s really a huge hole in the intellectual foundation of that previous paradigm. Alan Greenspan’s (in)famous 1996 irrational exuberance speech, to which Fama refers in part of this interview, was an admission against both classic money theory as well as efficient markets. What the “maestro” had said was that because they could no longer define let alone measure the money supply, how the hell could anyone reasonably determine if stocks were behaving rationally or irrationally? Exuberance wasn’t the main the message. And if the Fed isn’t actually in control of the money supply (it’s not), and that was true a long, long time before IOER, then what’s really going on? There are other parts that need to fit together in order to create a comprehensive, and ultimately workable, view of the world and how it came to be this way. What Eugene Fama said recently is that he can easily observe the one part; the irrelevance of the Federal Reserve (“the central banks don’t do anything real……That’s why I use to say that the business of central banks is like pornography: In essence, it’s just entertainment and it doesn’t have any real effects.”) But since there’s no actual money (or currency) in monetary policy, then what in the name of Bachelier must be going on in stocks? Bonds, unlike equities, they are actually very straightforward (interest rate fallacy). |

Missing shadow Money |

| If it’s not actual currency, and, according to the classic money paradigm, it’s not some form of stimulus porn bias (the Greenspan put), then the stock market’s behavior can only be described as looking forward to a much, much better future – way, way forward. After all, it’s been thirteen years and we’re still waiting for the recovery from the last big drop.

If you believe in the efficient market hypothesis, there’s no other alternate explanation left. Rather than leaving this to a process of elimination, though, we have in our updated paradigm the ability to assess plenty of evidence for each segment of the theory. We can easily agree on the fact central banks aren’t central even if for different reasons (including the wrong interpretation of bank reserves and IOER); the evidence for lack of recovery now stretches into the fourth year of its second decade, so, sorry Dr. Fama that can’t be what’s driving stocks which can only be looking ahead to earnings growth in the 2030’s maybe. That leaves the bias, the puppet show as the most meaningful imprint upon expectations. This is also evident pretty much everywhere – even in the Fed’s biggest critics. Who are they? Not those like myself or Eugene Fama who aren’t dazzled by the display. Instead, if there is any critique of monetary policy “allowed” in the mainstream it’s the whole other direction; that the money printing will end up being too much! The notion of deflation (disinflation) despite QE has never really been explored inside of the conventional, orthodox venues even though it’s what has happened. No, all the public has ever heard (and all the financial services industry wants to hear) is that the Fed will either get it just right, or that it already has (unemployment rate), despite no empirical basis and corroboration for those positions; or, the inflationary money printing will get out of control, crashing the dollar and leading to a bunch of other stuff that never happens, either. Funny how both scenarios are always interpreted as share price positive (despite the generally accepted premise of the 1970’s) in the 21st century. |

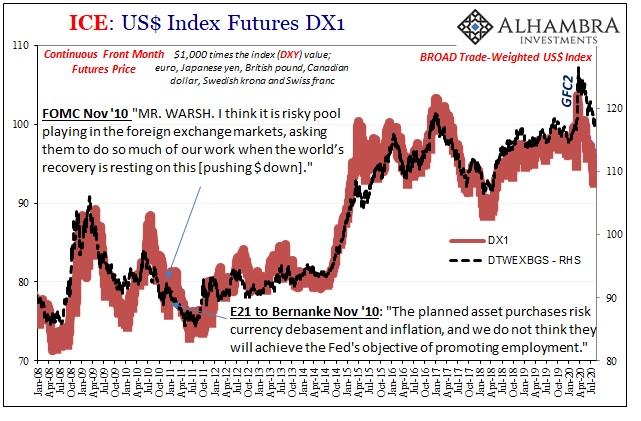

ICE: US Index Futures DX1, 2008-2020 |

Even that fatuous baloney about currency wars and QE destroying the dollar has been proved false – yet it still persists to this day! Like today. Bias.

Honest observers can plainly see that there’s nothing at all behind the modern central bank, certainly not a printing press, even when using the outdated, primitive existing monetary paradigm that Fama employs as he sees the shadows dance on the interior of the cave wall. The effect is plain and noticeable while the cause beyond classic money theory’s ability to grasp.

We can also easily correlate the lack of real economic growth and how, with more than enough time having passed, it is wholly inconsistent with higher and higher stock market records.

Which leaves us shaking our heads in disbelief of efficient markets while simultaneously pointing the empirical finger at that stimulus porn bias. No currency required because there is none offered anywhere.

The paradigm shift I was talking about is the only way to put all the pieces together where they make consistent sense, and thus accurately describe our actual surroundings and the world we really live in; where the Fed prints way too much money but somehow the dollar only rises and interest rates continue to fall. All while share prices are magically boosted by something other than actual currency toward a bright future that we’re still waiting on.

In the final analysis, the NYSE “V” isn’t irrational exuberance so much as the unmet paradigm shift we desperately need to happen.

Full story here Are you the author? Previous post See more for Next postTags: Alan Greenspan,Bonds,CPI,currencies,dollar,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,inflation,Markets,Monetary Policy,money printing,newsletter,QE,stocks