|

One small silver lining to the current situation, while Jay Powell is busily trying to sell you his inflation fantasy, he’s actually undermining it at the very same time. No mere challenge to his own “money printing” fiction, either, the Fed’s Chairman is actively disproving the entire enterprise. While he says what he says, pay close attention instead to what he’s done. |

Federal Reserve: Liabilities & Capital, 2019-2020 |

|

The Powell Panic lasted in total just twelve weeks. Stunning as it may have been, which was the point, starting in early March the level of bank reserves exploded upward by a record $1.65 trillion. That absolutely blew away Ben Bernanke’s stint at the “printing press” in October 2008. It is this massive increase that even today is being deployed to keep up the fiction on inflation expectations.

Going back to the week of May 20, however, the level of bank reserves has actually declined pretty significantly. Not that it matters one way or the other, of course, but Powell has purposefully let it drop by more than $450 billion since. The pace of QE has been materially reduced at the same time the federal government has built up its massive war chest of cash (equivalent) on the Fed’s balance sheet. That’s weird given what we are supposed to make of “money printing.” All the bad stuff, the liquidations and fire sales, these took place while the Fed was expanding its balance sheet supposedly creating and adding new “money.” And things since mid-May seem so much less chaotic if not downright calm by comparison, all the while with bank reserves shrinking. |

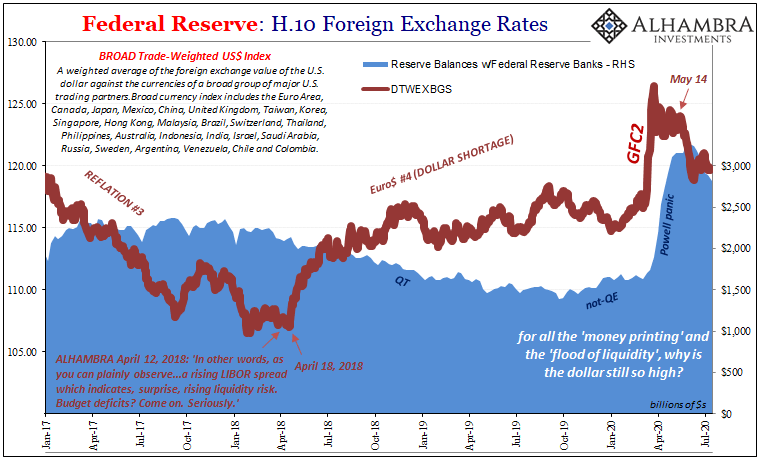

Federal Reserve: H.10 Foreign Exchange Rates, 2017-2020 |

| Isn’t that backward? What gives? If the Fed actually was flooding the system with its money printing, why wouldn’t that flood of money printing immediately push the dollar downward?

The Federal Reserve isn’t actually doing any of those things, but Jay Powell thanks everyone who keeps the fairy tale alive. It’s a pleasant sort of story, one that makes it seem like wise monetary stewards are at the helm of a technocratic wonder, a marvel of modern science that can work wonders at the flip of a switch (assuming, obviously, you believe they can see trouble coming). The evidence proves the situation very different. The FOMC is a reactive policy-making body at the top of a bureaucratic agency which time and again has displayed little to no technical proficiency. Monkeys throwing darts have a better chance of hitting upon an effective idea.You can see exactly what I mean by using the dollar’s exchange value. Unlike mainstream convention, we know what a rising dollar truly represents – global monetary shortage denominated in US currency (which is a fancy way of saying US$ bank liabilities, not physical notes printed up by the Treasury Department or the central bank). Notice above the same pattern as I’ve described it, now adding the US$. When everything was chaotic and illiquid around the world, the dollar’s exchange value went almost straight up; the dollar funding squeeze. After the major part of GFC2 was over (mid-March bottleneck), the dollar stayed up despite what everyone and their brother (including goldbugs) said was this massive “money printing.” The dollar didn’t actually begin to significantly reduce until May 15. |

Unemployment Insurance, Continued Claims, 2017-2020 |

| Following mid-May, the dollar’s been lower as the Fed shrinks bank reserves. That’s backward, too.

Except, not really. This is perfectly consistent with all the evidence gathered up for decades. Mainstream convention is backward, not the evidence. The Fed doesn’t (it just doesn’t!) print money nor add liquidity; monetary policy is merely a reflexive response to what’s otherwise happening in this shadow system. Thus, as dollar-denominated bank liabilities are destroyed (dollar shortage) the Fed (belatedly) reacts to the awful and disruptive symptoms of that hidden destruction you don’t directly see by creating bank reserves which you do. The myth of money printing. And once the dollar system, the shadow money system reaches an equilibrium state where destruction is no longer the determining factor, the dollar starts lower again which takes the pressure off Jay Powell. He responds to that symptom, too, once more reactive, by reducing his own activities (not that the stock market notices one way or the other). The Fed neither prints money nor takes it away, but it does react to when shadow money is destroyed and then stops being so destructive. So, why mid-May?The “flood” of “money” from the Fed’s “printing press” (sorry, I couldn’t resist with the scare quotes by stacking so many myths in one sentence clause) wasn’t the reason for this relatively more peaceful situation. Instead, in a word, reopening (no quotation marks needed). The first week continued claims started lower was the same week the dollar did (the week of May 16). If the situation in global dollars seems a little less dire, and less immediately dire, forget Jay Powell since it was the potential for mitigating economic and therefore financial damage presented by the opportunity for maybe starting the global system back up again. |

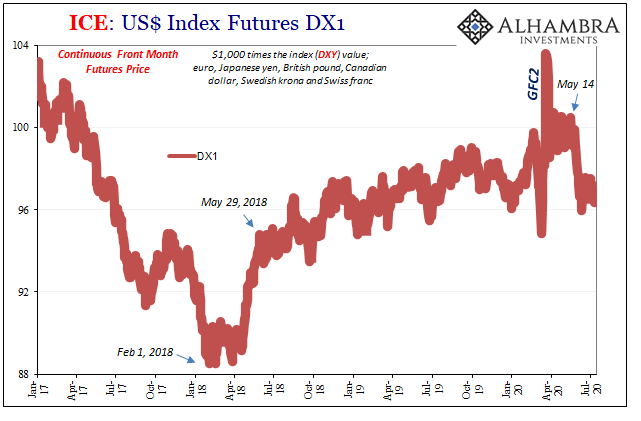

ICE: US$ Index Futures, DX1 |

| And, to be clear, I’m not claiming the entire global monetary system reacted to the publishing of the continued jobless claims figure shown above, rather that figure as well as the relative change in dollar stance are both corroborating the significance of the global economy hitting bottom at that time (the continued claims estimate wasn’t published until late in May). The slightly lower dollar therefore consistent with what that estimate suggested must have happened in the US labor market also in mid-May.

But, and here’s the thing, a little less dire isn’t the same thing as good. Or even back to even. Notice how the dollar’s exchange value remains elevated by every comparison, including with where it had been before March 2020 (it’s a little different, though not meaningfully, if you use DXY, which is more heavily influenced by the euro or yen). Reopening, in other words, represented a chance of the system getting better, no thanks to the Fed, not a foregone conclusion. Wariness remains the key factor, especially since the dollar’s exchange value (whether DXY or trade-weighted) has more or less tread sideways after that initial, happier drop. Concerns remain, and remain valid (i.e., initial jobless claims). For the Chairman’s part in all this, the Federal Reserve simply doesn’t matter except to the audience of his tired, laborious puppet show. The only help its balance sheet provides is in signaling what must be going on everywhere else; when the level of bank reserves shoots up, that isn’t a hopeful sign it’s a really bad one. |

US Treasury & Auction Rates, 2018-2020 |

|

Balance sheet expansion is directly proportional to how bad it already must be where it counts in shadow money.

So, while Powell continues to try to sell you on his “money printing” and its inflationary outcome, his own actions demonstrate how it really is the opposite. The Fed is along for the ride like everyone else. Reopening made the ride a little less frightening since mid-May; but therein lies the dangers – only a little less despite what everyone seems to believe had been a flood of liquidity. Taking some risks, therefore, based on the emptiest, most hollow fiction. Like I wrote yesterday, it’s yet another way of describing the interest rate fallacy. This time, with a direct assist from the dollar as well as Mr. We Saw It Coming. |

Hand pouring water in a leaking bucket |

Full story here Are you the author? Previous post See more for Next post

Tags: bank reserves,Bonds,currencies,dollar,DXY,economy,Featured,Federal Reserve/Monetary Policy,GFC2,jay powell,jobless claims,Markets,money printing,newsletter,QE