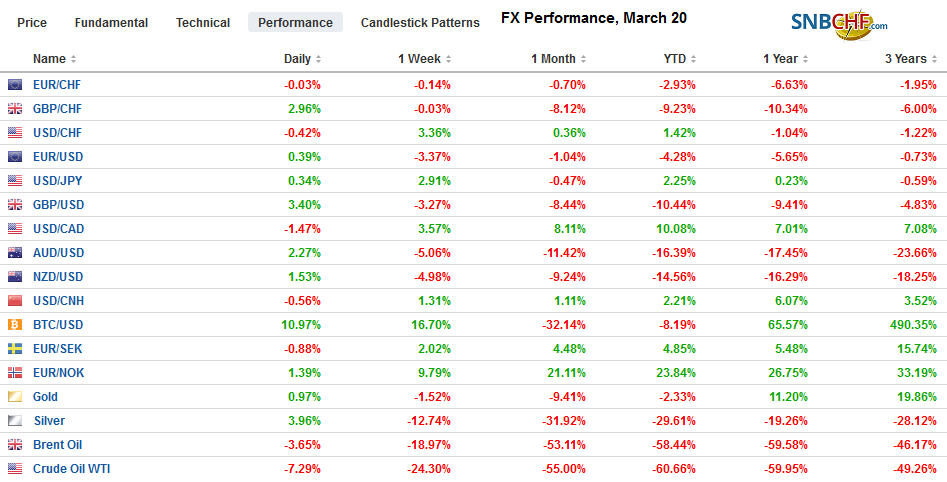

Swiss FrancThe Euro has fallen by 0.08% to 1.0531 |

EUR/CHF and USD/CHF, March 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Dramatic price action continues but in the other direction. Stocks and bonds have rallied strongly, and the US dollar is snapping a strong advance with a sharp and broad setback. The immediate trigger is hard to identify. Some accounts linking it to fears that the California shutdown will be repeated throughout the country, deepening the coming downturn. Others suggesting investors are responding to the wide-ranging official efforts to provide liquidity and loans, and other supports. Japanese markets were closed for the spring equinox, and missed a large rally in Asian markets, with Korea up 7%, Taiwan 6%, and Hong Kong gaining 5%. Australia’s rally faded, and it was the major market in the region to rise less than 1%. Europe’s Dow Jones Stoxx 600 is up around 3.5% in late morning turnover, following yesterday’s 2.9% advance. For the week, it is off less than 0.5% after plummeting by more than a third over the past four weeks. US stocks are building on yesterday’s small gains. The S&P has not closed higher in back-to-back sessions in over a month. Bonds are also being bought, and the yields in the peripheral of Europe are down double digits. After soaring last week, partly on miscues from ECB officials, Italian bond yields have fallen almost 60 bp this week. The US 10-year yield is paring this week’s gain by about 11 bp. Around 1.03%, it is up a little more than 30 bp this week, despite what appears to be a record purchase by the Fed this week. It may have bought around half of the $500 bln Treasuries it announced before markets opened for the week. The greenback is broadly lower, led by currencies that have been hit the hardest lately–the dollar-bloc, the Scandis, and sterling. Emerging market currencies are also firmer. The JP Morgan Emerging Markets Currency Index was up around 0.4% today after a 0.8% advance yesterday. It is off about 4% for the week. Gold is up 2.5% to cut its loss to nearly 1.5% for the week. Oil is building on yesterday’s record 24.4% gain, and May WTI is up another 7% today to almost $28. |

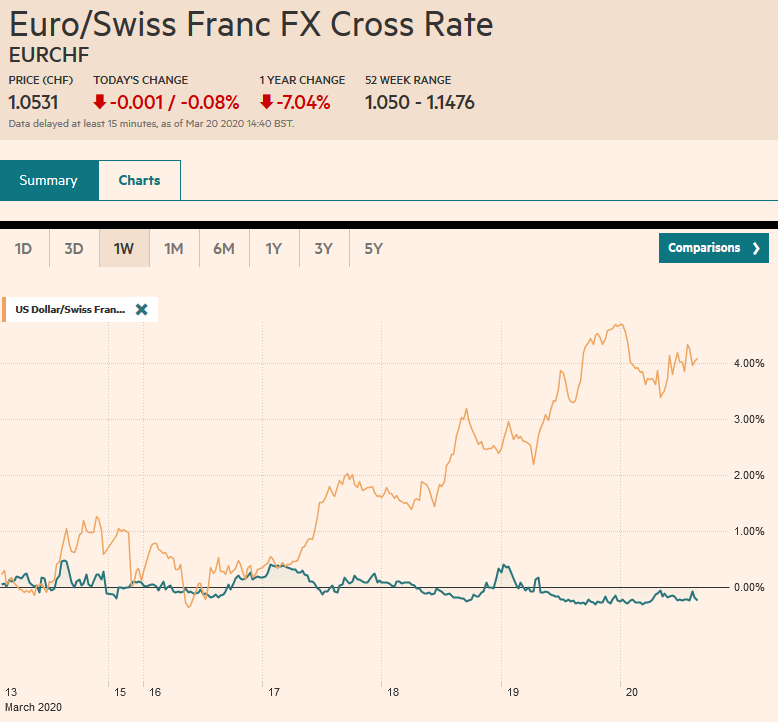

FX Performance, March 20 |

Asia Pacific

The PBOC surprised by not cutting its one-year prime loan rate (4.05%). On the other hand, the repo rate, flush with cash from the reserve requirement reduction, has fallen to record lows near 78 bp.

Australia is putting together another fiscal package, which it says will be larger than last week’s A$17.6 bln (~$10 bln) effort. New Zealand’s central bank offered 12-month loans to banks and injected liquidity via fx swaps.

On March 9, the dollar reached JPY101.20. Today it reached its best level since February 24 as it briefly traded above JPY111.30. It has reversed to trade low, reaching JPY109.30 in late Asian turnover. It is consolidating in Europe around JPY110 were an $875 mln option is set to expire. The Australian dollar approached $0.5500 yesterday and approached $0.6000 today. A close above there today could lift the technical tone into next week. The dollar gave back yesterday’s gains against the Chinese yuan. It held above CNY7.05. The dollar is finished the week about 0.8% stronger against the yuan.

EuropeReports indicate that ECB’s Lagarde overcame opposition by German and Dutch members to pledge “no-limits” within the mandate of action. Lagarde promised to remove self-imposed limits (e.g., the 33% issuer limit) to its bond purchases. While some advocated corona bonds to be issued by the ESM, it was recognized to be a government decision. There was also talk of Outright Market Transactions (OMT), but it rejected. It was a facility designed to provide support but with conditions and may be needed in the future. German officials are moving away from the “black zero” fiscal balance. Top German officials, including from the Bundesbank, recognize that the emergency requires modification. A German report today suggests the government is considering a 500 bln euro loan package to support businesses. |

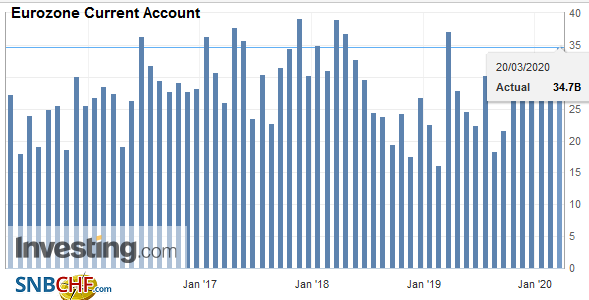

Eurozone Current Account, January 2020(see more posts on Eurozone Current Account, ) Source: investing.com - Click to enlarge |

| In a counter-intuitive development, Denmark raised rates by 15 bp to minus 60 bp. Denmark opted not to join the monetary union, but it has effectively outsourced its monetary policy to the ECB. The goal of its monetary policy is to keep the krone steady against the euro. It was falling to the weak side of the narrow band. It does not have broader implications. Elsewhere in the region, Sweden’s Riksbank said it will include corporate bonds and commercial paper in its bond-buying program. It also announced it would auction $10 bln of the new fx swap line with the Fed and will offer dollar loans itself to banks. Norway’s Norges Bank surprised many with a 75 bp rate cut today, leaving the key rate at 25 bp. The krona gained following the rate cut though is still off more than 14.6% over the past month and is the worst performer among the major currencies. |

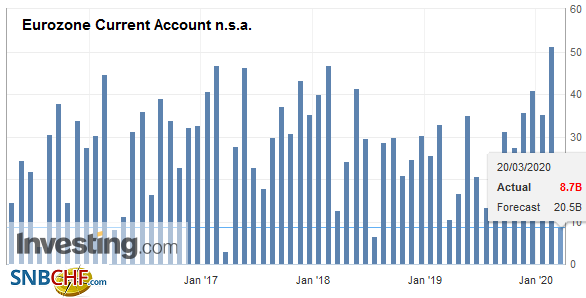

Eurozone Current Account n.s.a. January 2020(see more posts on Eurozone Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The UK is offering another fiscal package that will include employee subsidies and income tax payment freezes. Prime Minister Johnson indicated that London will not be locked down and that if people follow the advice of the medical experts, the tide against the virus could be turned in 12 weeks. Meanwhile, both the EU’s chief negotiator Barnier and the UK’s negotiator Frost apparently have contracted the virus. The UK still insists on exiting the standstill agreement with Europe at the end of the year.

The euro popped from near $1.0650 yesterday to $1.0830 in late Asia today. The upticks have been sold by early European traders, and the single currency is more than a cent off its highs before the North American session. Sterling was initially sold to new lows near $1.1410 before a squeeze lifted it to almost $1.1880. It has traded now on both sides of yesterday’s range. It, too, though, has come off more than a cent from its earlier highs. Initial support is seen near $1.16

America

There are two big stories today. The first is the shut-in of California. The fear is that as other states could follow suit, the economic impact will grow. The other story is the fiscal package being worked out will include conditionality. The cash payment to households will be mean tested. And aid to businesses will require limits on executive pay and high severance agreements. Airlines, which could receive $58-$60 bln in aid, would have to guarantee services to certain (no unspecified) destinations. President Trump himself and his leading economic adviser Kudlow have argued for taking an equity stake too, but it is not clear whether it will make the final version. Also, some Democrats are pushing to bar stock-buybacks from companies that get assistance.

Yesterday’s non-weather-related jump in weekly initial jobless claims was just the tip of the iceberg. Sharp increases are likely in the coming weeks. One large US bank sees its rising over 2 mln. The unemployment rate peaked at 10% in the Great Financial Crisis, and will likely surpass it in the coming months. After consistently putting a positive spin on developments, Kudlow acknowledged that the US economy may be headed for a sharp 10-15% contraction, but is irrepressible optimism poked through as he suggested a strong V-shaped recovery.

Oil prices were helped by a few factors. President Trump suggests mediating the Saudi-Russian conflict. The US will buy 30 mln barrels of American crude oil for the Strategic Petroleum Reserves. Saudi Arabia and Iraq effectively nudged prices higher by reducing rebates for freight costs. Also, the Saudis seemed to exaggerate how much and for how long Aramco can boost output.

The greenback pushed above CAD1.4665 yesterday and retreated to about CAD1.4150 today in the European morning, which meets the minimum retracement (38.2%) of this month’s advance. Below there, support is seen around CAD1.40. After rising to a new record near MXN24.65, today’s retreat in the US dollar has seen a test on MXN23.50, a little below yesterday’s lows. It may be difficult to substantially extend the move ahead of the weekend.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,ECB,EUR/CHF,Eurozone Current Account,Eurozone Current Account n.s.a.,Germany,newsletter,USD/CHF