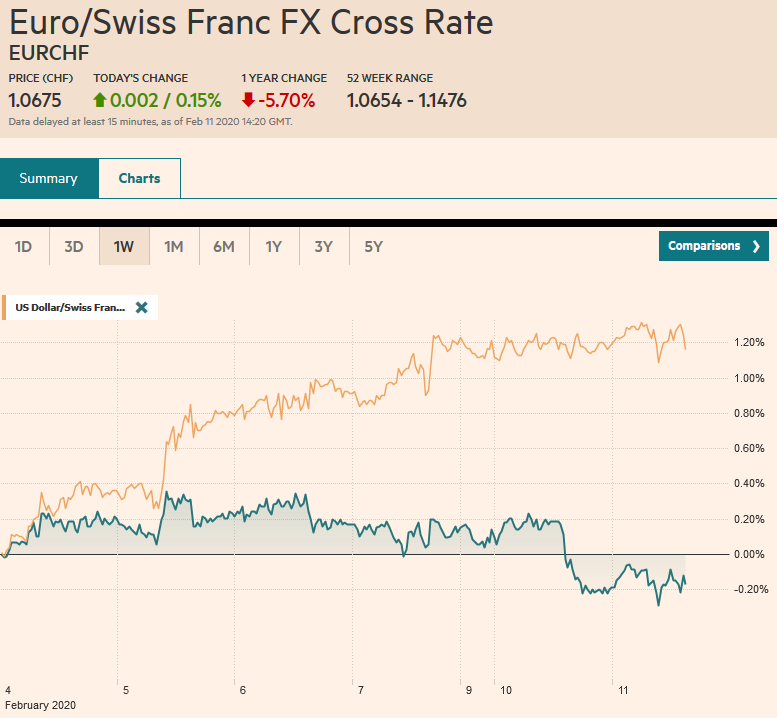

Swiss FrancThe Euro has risen by 0.15% to 1.0675 |

EUR/CHF and USD/CHF, February 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South Korea, Australia, and China rose for the sixth session. The Dow Jones Stoxx 600 gained a little more than 0.6% in morning turnover in Europe to a new record high, for its sixth rise in seven sessions. US shares are trading slightly firmer. The S&P 500 left a gap from last Wednesday’s higher opening unfilled. It is found between roughly 3306.9 and 3313.8. A US court cleared the for T-Mobile to takeover Sprint for around $26.5 bln. Benchmark 10-year bonds are paring recent gains and yields are up 1-3 bp. The US 10-year remains below 1.60%. The dollar is trading with a heavier bias. Only the Swiss franc and Japanese yen (Tokyo markets were closed for a national holiday) were struggling. Emerging market currencies are also mostly higher, though the Turkish lira is the notable exception despite official efforts to discourage selling. Meanwhile, gold is consolidating its four-day advance, and WTI for March delivery is mainly within yesterday’s range +/- 50 cents around $50 a barrel. In addition to less demand from China, the mild US winter has driven natural gas to four-year lows. |

FX Performance, February 11 |

Asia Pacific

South Korea reported trade data for the first ten days of February. It is one of the first reports that shed light on the economic fallout from the coronavirus. The headline of an almost 69.4% jump in exports, though, is a bit of a statistical quirk. It is flattered by the number of working days, and when the adjustment is made, it looks like a small decline. Average daily exports fell a little more than 3.%. Still, auto exports rose 114.5%, and semiconductor shipments rose almost 38%. Exports to China increased by about 36%, and shipments to the US rose by nearly 69%. Imports rose by 23%. Despite what appears to be an indication that South Korean exports held up better than feared, speculation is increasing that the central bank could cut rates when it meets on February 27. The benchmark rate is set at 1.25%, and about 10 bp of easing appears to be discounted. Note that CPI jumped to 1.5% in January from 0.7% in December as it continues to recovery a soft patch last August-October.

China’s central government is encouraging businesses to resume, though local governments are mixed. Some reports estimate that about a third of companies have re-opened. The virus may promote a shift in some consumption habits, such as expediting the shift toward grocery deliveries, for example. It appears China’s oil imports are off about 180k barrels per day since the Lunar holiday began.

The dollar is trading quietly in the quarter of a yen below JPY110, where a $500 mln option is struck that expires today. Yesterday’s low was near JPY109.65, and before the weekend, the low was just below JPY109.55. The daily technical indicators suggest the market will continue to press for a break above JPY110. The Australian dollar is recovering from the multi-year low seen yesterday near $0.6660. It has risen to almost $0.6720 to recoup about half of what it lost over the past week. A move above pre-weekend high near $0.6735 would help it carve out a low and lift the technical tone.

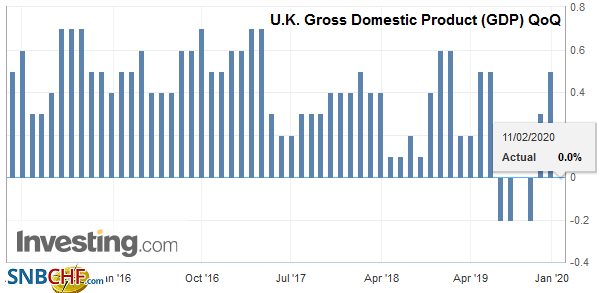

EuropeThe UK economy stagnated in Q4, and that was with a 0.3% gain in the December figure alone. Exports (non-monetary gold) and the largest increase in government spending since 2012 helped overcome the biggest decline in business investment since 2016 and paltry growth in consumption (01%). |

U.K. Gross Domestic Product (GDP) QoQ, Q4 2019(see more posts on U.K. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

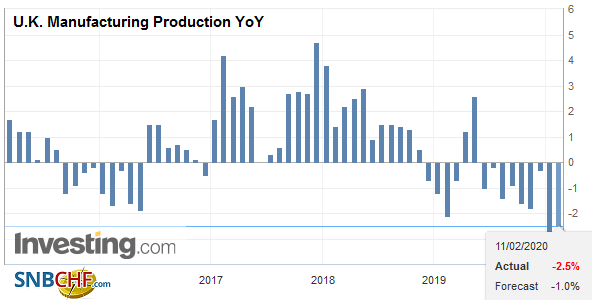

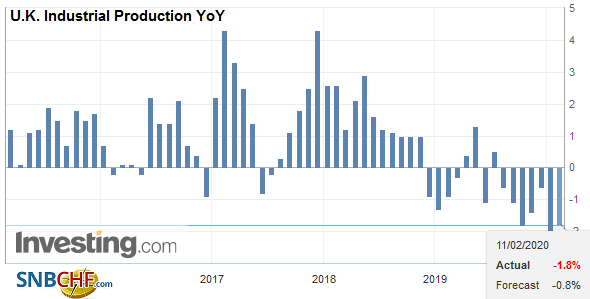

| Unlike the continent that reported dreadfully disappointing December industrial production figures, the UK took the hit in November (-1.1%). |

U.K. Manufacturing Production YoY, December 2019(see more posts on U.K. Manufacturing Production, ) Source: investing.com - Click to enlarge |

| Industrial output eked out a 0.1% gain, aided by a 0.3% rise in manufacturing output. The index of services rose 0.3% in December, a bit better than expected. Sterling rose to session highs (~$1.2940) but remained inside yesterday’s range. |

U.K. Industrial Production YoY, December 2019(see more posts on U.K. Industrial Production, ) Source: investing.com - Click to enlarge |

Turkish interest rates remain firm and the lira soft following the central bank’s decision over the weekend to defend the currency, against which the dollar rose above TRY6.0 for the first time in seven months. Officials try to deny foreign entities the liquidity necessary to short the currency by reducing the among of fx swaps that banks can offer (to 10% of equity from 25%). This has not been immediately effective, and the dollar is firming through TRY6.0450.

The euro edged closer to $1.09 before edging up. Still, the range is extremely narrow, less than 15 ticks through the European morning. There is an expiring option for almost 850 mln euros at $1.0915, which seems to be stymying the upside. The euro needs to resurface above $1.0950 to take the immediate pressure off it. Recall last year’s low was set at the start of Q4 near $1.0880. It is the third session that sterling largely rangebound between $1.2870 and $1.2960, though lower highs are being recorded for the fourth consecutive session.

America

President Trump presented his budget proposals for the fiscal year that begins in April 2021. The president’s budget proposals carry little weight, and not only because it is an election year, but because the power of the purse is invested in the legislature, not the executive. Knowing this, Trump’s budget is particularly aggressive because it violated the two-year spending agreement struck last year between Treasury Secretary Mnuchin and House Speaker Pelosi. Keeping in mind that Congress is unlikely to finish the budget until after the November election means to accept that the spending proposals are a political statement to his party and base. It is aspirational, and this is evident too in the growth forecasts that are assumed. The White House projects growth will be 3.1% in Q4 20 year-over-year, and then 3% for the next few years. The non-partisan Congressional Budget Office forecasts 2.2% this year, and the Fed’s (median) projection is 2%.The private sector is more downbeat and, according to a recent Bloomberg survey, the median private-sector economist forecast growth of 1.8% this year and 1.9% next.

Fed Chair Powell begins his two-day testimony before Congress today. Three general issues appear to be the focus. First is the economic impact of the coronavirus. Yesterday, both Daly (non-voter) and Harker (voter) still were emphasizing the “good place” that the US economy was in, suggesting no change in their stance. However, Powell may be a bit more balanced and highlight the international risks, which were the basis of the argument for easing last year. Second, Powell may discuss the Fed’s operations aimed at ensuring a smooth transmission of its policy, which has resulted in repo operations and $60 bln a month of T-bill purchases. Powell may help explain why this is not QE, and the actions have kept financial market conditions broadly stable and supportive. Third, there may be some follow-up to comments by Vice-Chair Quarles that suggested the Fed may be open to some changes in how minimum reserves are calculated, such a shift toward average holdings rather than the end of period (year) positions.

The dollar has made higher highs against the Canadian dollar for four sessions through yesterday, but it still has not convincingly taken out the CAD1.33 level. It is straddling that area today. It did push through last November highs, but the October highs (~CAD1.3350) remain intact. The technical indicators continue to suggest the greenback is likely carving out a top. A break of CAD1.3280 may be the first indication that it is, in fact, rolling over. The dollar is trading heavily against the Mexican peso after holding below resistance yesterday. Mexico reports December industrial production figures today (a flat report is expected after a 0.8% rise in November). Today’s reports are unlikely to dissuade investors from anticipating a 25 bp rate cut on February 13. While a case can be made for a 50 bp move, Banxico seems comfortable with quarter-point steps. Even with a cut, Mexico’s real and nominal rates, among the highest in the world and in the low-vol environment may continue to draw financial flows. The dollar found selles in front of MXN18.83 and appears poised to retest support near MXN18.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,EUR/CHF,federal-reserve,newsletter,South Korea,U.K. Gross Domestic Product,U.K. Industrial Production,U.K. Manufacturing Production,USD/CHF