The massive dollar eruption in the middle of 2014 altered everything. We’ve talked quite a lot about what Euro$ #3 did to China; it sent that economy into a dive from which it wouldn’t escape. And in doing so convinced the Chinese leadership to give growth one more try before changing the game entirely once stimulus inevitably failed.

In many other places around the world it has been the same. Not just developing economies, either. You wouldn’t have known from how the last few years have been described, but the US economy was pulled down into the same quagmire as China.

|

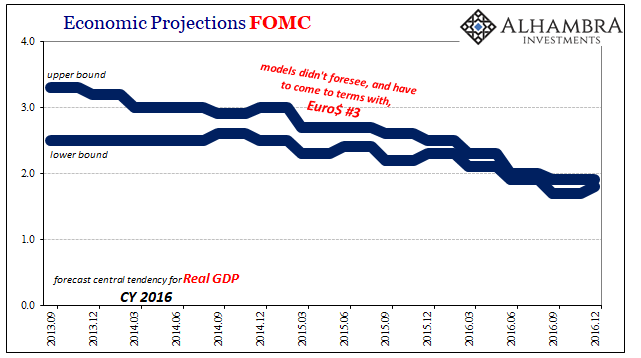

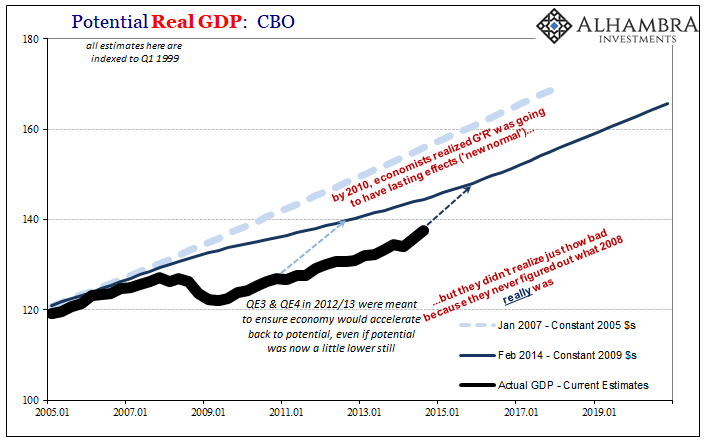

That’s never how it was publicized, of course, particularly in late 2017 and early 2018 while inflation hysteria raged. The US economy was always characterized as a choice between strong, strongly booming, and the strongest boom in American history. It was, in fact, none of those things. Back before Euro$ #3, right about at its origins and six months before it would break out into the open, the FOMC believed that US economic acceleration was still in the cards. An actual recovery. That was the whole point of QE3 and QE4; insurance so as to make sure it still happened. By December 2013, it was widely believed that it was happening. The FOMC voted to taper both QE’s in that month given the way the unemployment rate was sinking. The central bank’s models therefore foresaw GDP growth somewhere around 3% and better starting in 2015 and lasting for several years thereafter. |

Economic Projections FOMC, 2013-2016 |

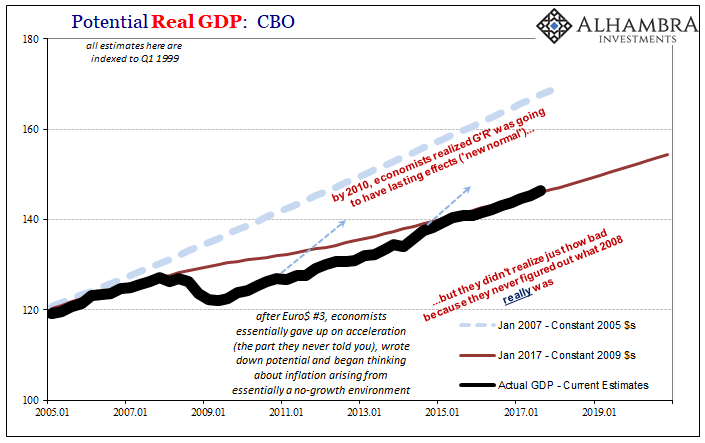

| This was already a letdown, though, not that you would have known it, either. The earliest recovery predictions were more like actual recoveries than these; the models thinking of 4% GDP growth and better (around 2011 and 2012) on a sustained basis. Euro$ #2 first interrupted those predictions and then left Economists to begin questioning more long run considerations.

But 3.5% for a forward year like 2016 seemed not only reasonable (as a top end) but more than enough to put the Global Financial Crisis finally behind everyone. While “the best jobs market in decades” soon followed in 2014, so, too, did Euro$ #3 and its rapidly rising dollar. |

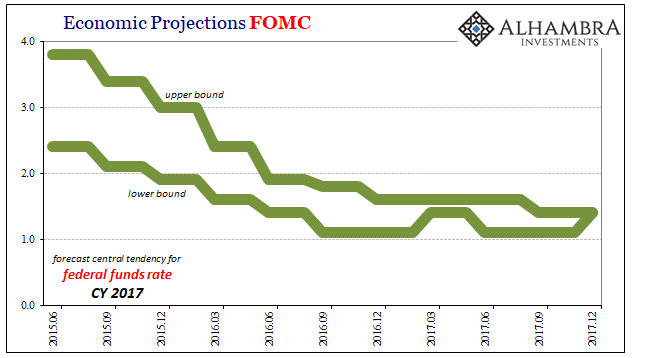

Economic Projections FOMC, 2015-2017 |

| The collision between those two seemingly titanic factors was no serious one at all; the dollar won by knockout in the first round. The unemployment rate was irrelevant, as was the Establishment Survey hype. The already-downgraded recovery never got off the ground, limited to just two quarters in the middle of 2014.

It was the recovery’s final straw. Rather, the recovery fiction’s. The entire nature of the “booming” economy had to be rewritten in light of yet another false dawn. Like everyone else’s, even the FOMC models have had to adjust. |

Potential Real GDP, 2005-2019 |

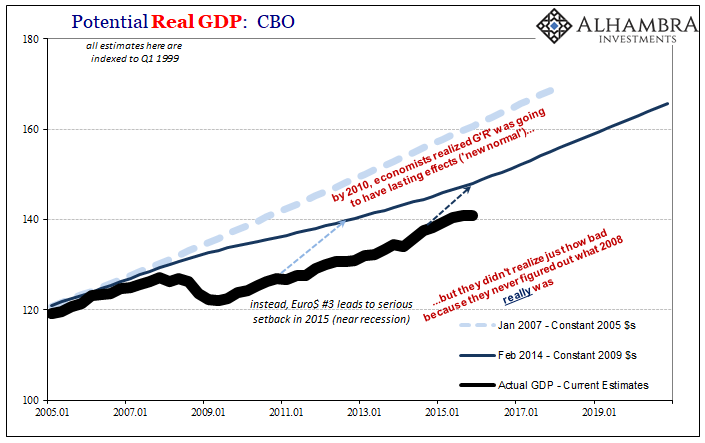

Potential Real GDP, 2005-2019 |

|

| Where once interest rates were thought normalizable (for lack of a better term), they, too, would have to be redrawn along very different lines. Remember, Janet Yellen’s FOMC in 2016 took a whole year off, unexpectedly, from rate hikes.

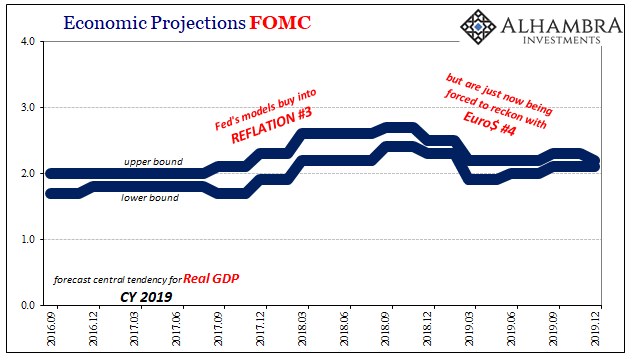

What emerged from that year in the wilderness of global dollar bewilderment in 2017 wasn’t so much a boom as it was hollow hyperbole and hyperbolic slogans. Globally synchronized growth and the hysteria over inflation, both of which were crafted under very different conditions than their names would otherwise have had you believe. The Fed’s projections for 2016 were the last to even think about 3% growth – and those were only in the earliest years. |

Economic Projections FOMC, 2016-2019 |

| Moving forward, they’ve been stuck around 2%. At best, early in 2018, the models picked up Reflation #3 and pushed up their estimates for growth and inflation but only very modestly. It was in no way consistent with the rhetoric (hooray for temporary 2.5%?!) |

Economic Projections FOMC, 2017-2019 |

| In short, the very idea of recovery died, in the United States as everywhere else around the world, during Euro$ #3. Officials have quite purposefully avoided any head-on questions about the subject, preferring instead to cloak any minimized discussion under the unnecessary, and absurd, conduct of R*. Everything was miniaturized from that point forward; from the upper level of where fed funds might be able to get, to what counts as sustained above-trend growth (the term Powell uses trying to get you to focus on the qualifier “above” rather than what actually might be the real trend).

It is one thing, though, to realize how the US and global economy had experienced two false dawns. It is quite another to then blame the economy itself for them, as officials have done. Were these recovery attempts unrealistic and impossible, or were they short-circuited and interrupted by some unknown, undiscovered factor? Rather than try to answer that question, the conventional position went right for the former and hasn’t looked back. Central bankers, in particular, despite the experience of 2008, the dollar, and now repo, continue to convince themselves they know everything that is worth knowing no matter how many times what they do know proves not worth anyone’s time and effort. |

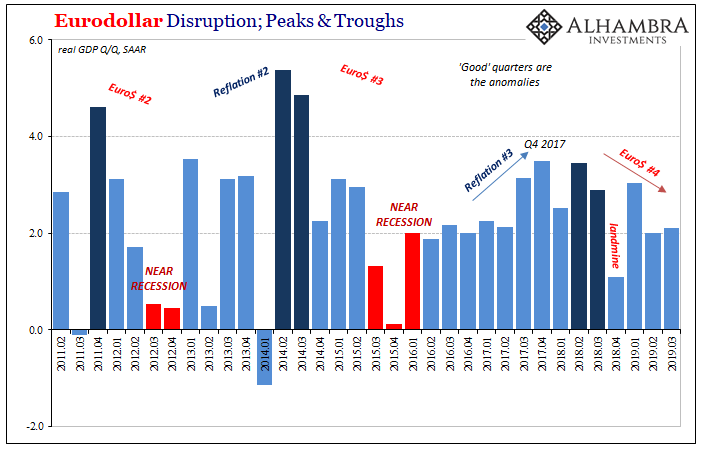

Eurodollar Disruption; Peaks & Troughs, 2011-2019 |

| But if Euro$ #3 ended the recovery fantasy, what does Euro$ #4 do? If the first boom/recovery was believed to be a few years sustained 4%, and the prior “boom” at least managed a couple of consecutive quarters of near 5% real GDP expansion, the current one barely managed a few scattered periods of slightly better than 3%. The very notion of upside has been significantly deflated to the point of being indistinguishable.

It isn’t just one more false dawn added to the list. In other words, if Euro$ #2 brought up the issue, and Euro$ #3 convinced them of a broken economy, then Euro$ #4 will only seal the deal in conventional thinking. There can be no real boom. This will mean even more talk about how R* is the real problem, and that interest rates really are stuck forever near the zero lower bound. They will not say it, but this describes only one thing. Japanification. |

Potential Real GDP, 2005-2019 |

And that is not what you think, either. Japanification wasn’t zombie banks fumbling around in the aftermath of a collapsed bubble. That country’s lost decade(s) was expired on the stubborn actions of recalcitrant central bankers (and politicians) who will not countenance even the possibility they have no idea what they are doing – and what they are doing to everyone by refusing to listen to the ever-growing mountain of evidence showing only this to be the case.

Like what we’ve seen over the last decade pretty much everywhere, the 1990’s in Japan were one false dawn after another. Given a decade of them, what followed was the inevitable next (lost) decade of constant zero interest rates and QE’s. And then more QE’s, even an extra Q to QE. Jay Powell’s Fed has already begun to consider what letter might go in front of his next QE.

As I’ve tried to say lately, recession risk is the wrong focus (though an understandable one). China’s newly crowned Emperor Xi declared in October 2017 how the global economy had already arrived at in a no-growth world, having no luxury of fooling himself about the diminishing, disappearing upside. It took the FOMC a few years to catch up, but that they have.

The Fed’s models, following three – and only three!! – rate cuts, now uniformly project the same thing as what pushed the Communist leadership on the other side of the Pacific into their authoritarian bunker.

Euro$ #4 welcomes everyone, including the unanimous FOMC, to this world where no-growth and boom are the same thing.

Full story here Are you the author? Previous post See more for Next post

Tags: cbo,currencies,economic potential,economy,Euro$ #4,federal funds,Federal Reserve/Monetary Policy,FOMC,jay powell,Markets,newsletter,rate cuts,real GDP