On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out.

Even after all that supposed “stimulus” starting in the middle of last year it’s time to acknowledge how ineffective it has been. But in doing so, the immediate instinct is to suggest it be increased with new “stimulus.” If the RRR’s and (small) fiscal spending bump didn’t do it, if the tax cuts weren’t enough, then the Chinese must now be depending upon the currency to rescue them.

They have to be, right?

It’s as if 2015 never happened. From the Wall Street Journal yesterday:

China’s abrupt devaluation of the yuan this week is an acknowledgment from Beijing that its domestic economy needs help, a vulnerability that Chinese policy makers have played down during the escalating trade conflict with the U.S.

You would think that the Chinese along with anyone writing for the Wall Street Journal would’ve realized before today how there isn’t any correlation. It’s not like CNY is just now getting going, this “devaluation” showing up only in recent days. It was April last year when the currency first tanked – and it hasn’t improved anything despite more than a year of such wartime “stimulus.”

I wrote instead a few days ago, these currency wars seem to produce only losers.

What’s going on in China is a very good example of this being all wrong. Yesterday, we went through (only some of) the details behind what it is that’s really moving CNY lower. For the past year and a half, we’ve also chronicled how despite a lower CNY China’s economy (including exports) has only descended further into dangerous questions.

In short; if the Chinese are purposefully engineering a lower currency exchange value, they haven’t done their country any favors. It isn’t working.

| The big drop in CNY came in April 2018 – not coincidentally right around the time the global economy shifted toward downturn. CNY DOWN is only bad.

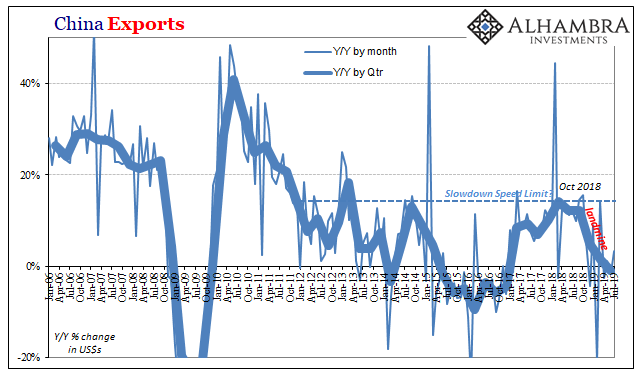

There remains no export growth heading out of China despite a significantly weaker currency. The Chinese manufacturing sector was dragged down with the rest of the world as global trade struck the same landmine as we find everywhere. That’s wasn’t a few billion in potential tariffs. |

China Exports, 2006-2019 |

| The numbers don’t at first seem terrible. In the latest data figured for July 2019, China’s General Administration of Customs estimates total exports actually rose by 3.3% from July 2018. That’s better than the 1.1% contraction reported for June.

In reality, those two figures are the same – and you can see above how zero growth is pretty much among the worst cases for China’s export sector. A system that was created to service regular 30% growth and had been stuck at half that rate following the sustained contraction during Euro$ #3 four years ago now has to contend with more shrinking. At best, the lack of growth. |

Dollar Correlations, 2016-2019 |

| Small wonder that on the other side of the ledger, Chinese imports are falling more consistently and at a greater average rate. In the month of July 2019, imports were down 5.6% year-over-year. The rolling 3-month cumulative change, smoothing out some of the short-term monthly fluctuations, is now -7.13%. |

China Imports, 2008-2019 |

| Like external demand for Chinese goods, internal Chinese demand for foreign commodities and goods ran into the same landmine late in 2018. The global economy has noticed in 2019.

Thinking more CNY DOWN is going to help China, or anyone for that matter, that’s just willfully ignoring a ton of easily available data. It takes zero account of the currency history of 2014-15 which produced that first sustained contraction in Chinese trade – both sides – as well as how the currency “devaluation” in 2018 proved instead to be a warning to guard against what has now become an entrenched downturn in China and beyond. Some of it is laziness, but mostly it is just the lack of an alternate theory in the mainstream. Economics has done the world a tremendous disservice by relying on outdate myths and legends, assuming the world hasn’t changed the way it does global business since 1950. Why else would CNY be falling if not for an intentional act? |

Globally Synchronized Central Banks, 2002-2019 |

If you don’t see the eurodollar, there’s no frame of reference which could explain all the facts. Isolated in only the one shorthand, it otherwise has to be currency wars else there’s no answer.

Just like 2015, as CNY plummets seemingly out of control the mainstream still unaware of how anything fundamentally works will try to explain all this as competitive devaluation. This time, we are being told, it is President Trump’s fault for trade wars. The Chinese are just manipulating their currency in response to that.

China is manipulating its currency, alright, but as a passenger on the eurodollar train. The fact that it keeps to a regular schedule doesn’t suggest control; quite the opposite.

There are only losers in what is the eurodollar’s war on global growth. A weaker CNY does acknowledge that the Chinese really do need help, but it most certainly is not the help they need.

Tags: $CNY,China,currencies,Currency Wars,economy,EuroDollar,exports,Federal Reserve/Monetary Policy,global trade,imports,Markets,newsletter,PBOC,stimulus