Monthly Archive: August 2019

FX Daily, August 16: Markets Take Collective Breath Ahead of the Weekend

Overview: The global capital markets are ending the tumultuous week calmly, but it is far from clear that is will hold long. Next week's flash PMIs have potential to disappoint, and there is risk of new escalation in the US-China trade conflict as the PRC threatens to take action to countermeasures to the new US tariffs.

Read More »

Read More »

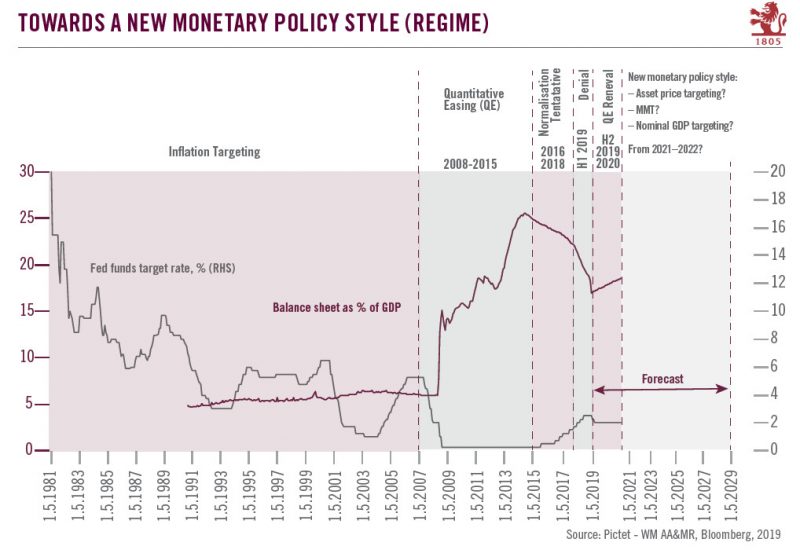

New monetary policies for new challenges

As central banks try (yet again) to bolster faltering growth and inflation, it is important to grasp how the ‘style’ and aims of monetary policy-making have changed over time and how they need to evolve in the future.The world is being disrupted by structural trends such as populism, demographic and climate change and technological innovation.

Read More »

Read More »

Swiss taxis Europe’s most expensive

In a recent comparison of taxi fares across Europe, Geneva and Zurich were the most expensive. In the study, which focused on the total cost of a taxi journey from the airport to the centre of town, Geneva (€36 – CHF40) and Zurich (€63 – CHF70) fared better than Milan (€105) and London (€104), which had the highest total journey costs. However, this is only because Zurich and Geneva airports are close to the city centre.

Read More »

Read More »

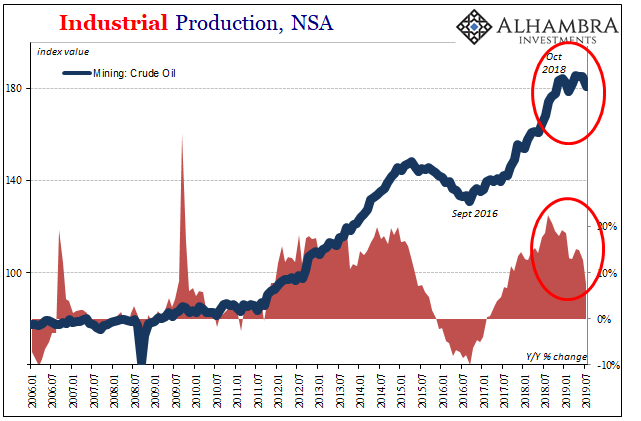

US Industrial Downturn: What If Oil and Inventory Join It?

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one.

Read More »

Read More »

FX Daily, August 15: Animal Spirits Lick Wounds

Overview: It took some time for investors to recognize that the scaling back of US tariff plans was not part of a de-escalation agreement. There was an explicit acknowledgment by US Commerce Secretary Ross that there was no quid pro quo. The US tariff split was more about the US than an overture to China.

Read More »

Read More »

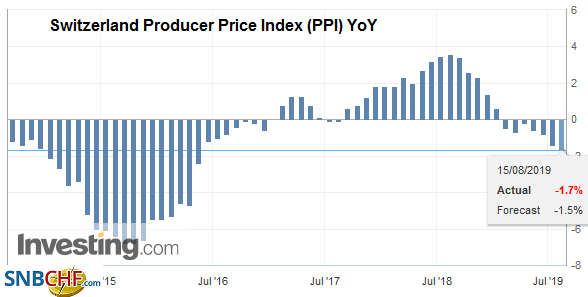

Swiss Producer and Import Price Index in July 2019: -1.7 percent YoY, -0.1 percent MoM

15.08.2019 - The Producer and Import Price Index fell by 0.1% in July 2019 compared with the previous month, reaching 101.6 points (December 2015 = 100). The decline is due in particular to lower prices for scrap as well as petroleum and natural gas. Compared with July 2018, the price level of the whole range of domestic and imported products fell by 1.7%.

Read More »

Read More »

SNB sicher&solvent? Ja, meint Bern, und verweist auf Fussnote von Fussnote

Der Bundesrat behauptet, es bestehe bei der SNB kein Solvenz-Risiko. Er begründet das in seiner Botschaft an das Parlament mit einer Fussnote zu einer anderen Fussnote, die es in einer Festschrift so gar nicht gibt. Das ist liederliche Arbeit in Bundesbern; und das zu einem Thema, das staatspolitisch von grösster Tragweite ist.

Read More »

Read More »

The Path Clear For More Rate Cuts, If You Like That Sort of Thing

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months.

Read More »

Read More »

FX Daily, August 14: Markets Paring Exaggerated Response to US Blink

The US cut its list of Chinese goods that will be hit with a 10% tariff at the start of next month by a little roe than half, delaying the others until the mid-December. This spurred a near-euphoric response by market participants throughout the capital markets. However, as the news was digested, it did not seem as much of a game-changer as it may have initially.

Read More »

Read More »

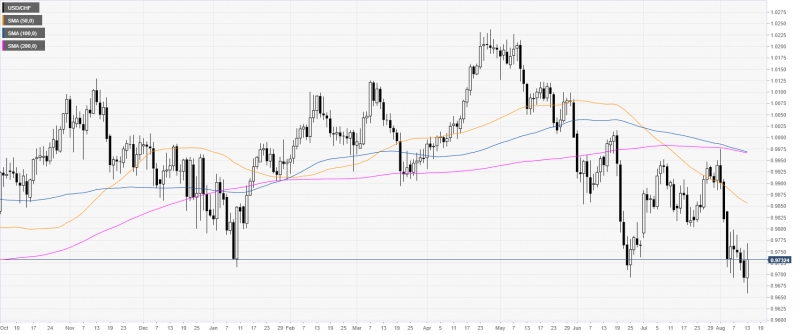

Nationalbank unter Interventionsdruck

Der Schweizer Franken wurde zuletzt deutlich stärker gegenüber dem Euro. (Bild: Pixeljoy/Shutterstock.com)Die Zinssenkunkung der US-Notenbank Fed und die von der EZB angekündigten Massnahmen zur Lockerung der Geldpolitik sowie die jüngsten Ereignisse im Handelskonflikt zwischen den USA und China haben den Druck auf den Franken erhöht. Die Schweizer Währung wurde zuletzt deutlich stärker.

Read More »

Read More »

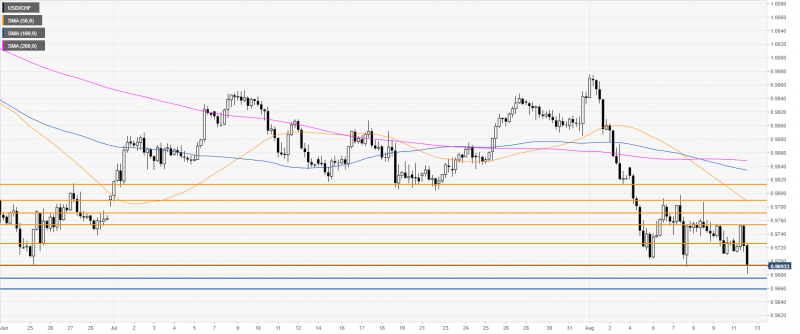

USD/CHF technical analysis: Greenback jumps and settles above 0.9726 as tariffs gets delayed

USD/CHF is trading off 2-month lows below the main daily simple moving averages (DSMAs). US equity markets are rising sharply as US tariffs are to be delayed to December 15. The news was perceived as risk-on, sending safe-haven CHF, JPY and gold down.

Read More »

Read More »

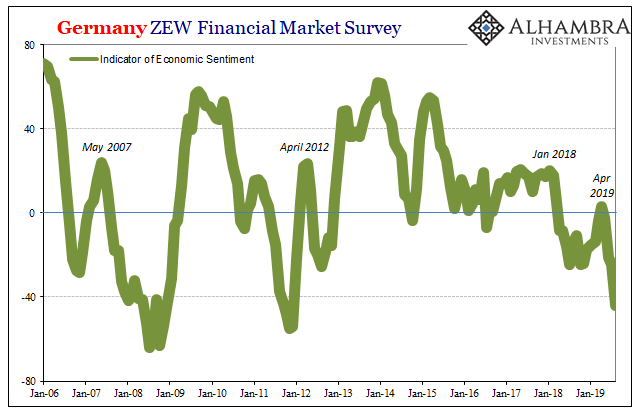

Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else.

Read More »

Read More »

Developed market equities update: a fairly reassuring reporting season

There is an ongoing tug-of-war between trade tensions and fundamentals Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.

Read More »

Read More »

Swiss financial sector shines in international survey

Switzerland’s financial centre has a positive reputation abroad, despite a string of scandals in 2018, according to a 19-nation survey conducted by Presence Suisse. The reputation and quality of Swiss banks were rated as “good” to “very good” by most respondents in the international poll of 12,767 people. The ethics and responsibility of the Swiss banking sector are also well regarded.

Read More »

Read More »

FX Daily, August 13: Investors Remain on Edge

Overview: The confrontation in Hong Kong and the fallout from the Argentine primary over the weekend join concerns the conflict between the two largest economies and slower growth to force the animal spirits into hibernation. Global equities remain under pressure. Japan's Topix joined several other markets in the region to have given up its year-to-date gain.

Read More »

Read More »

USD/CHF technical analysis: Greenback under pressure below 0.9700 as sellers challenge June lows

CHF is up as Wall Street indices start the week in the red. The level to beat for bears are at the 0.9675 and 0.9660 levels.

Read More »

Read More »

FX Daily, August 12: Yen Remains Bid, While Macri’s Loss in Argentina Weighs on Struggling Mexican Peso

Overview: China again tried to temper the downside pressure on the yuan, and this appears to be helping the risk-taking attitude. Many centers in Asia were closed today, including Japan and India, though most of the other equity markets advanced modestly, including China, Korea, and Australia. Europe's Dow Jones Stoxx 600 opened firmer but is staddling little changed levels unable to stain any upside momentum.

Read More »

Read More »

Nationalbank dürfte erneut interveniert haben

Darauf deuten die Sichtguthaben bei SNB hin, die als Indiz für solche Interventionen gelten und in der vergangenen Woche deutlich gestiegen sind. Die Einlagen von Bund und Banken lagen am 9. August bei 585,5 Milliarden Franken, wie die SNB am Montag mitteilte. Das ist ein Anstieg von rund 2,8 Milliarden gegenüber der Vorwoche.

Read More »

Read More »

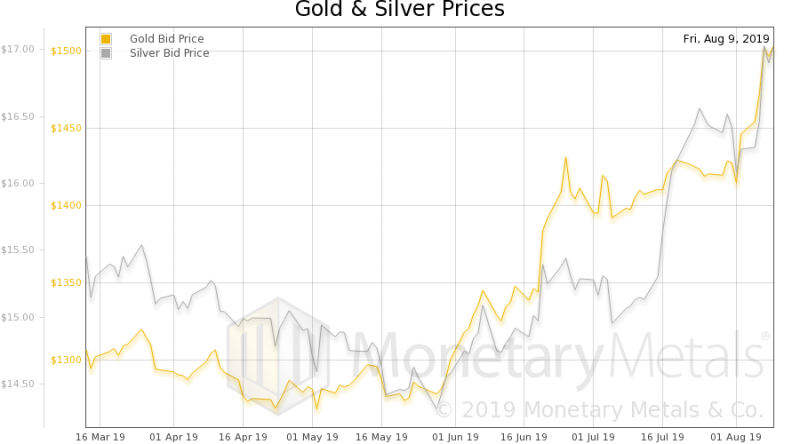

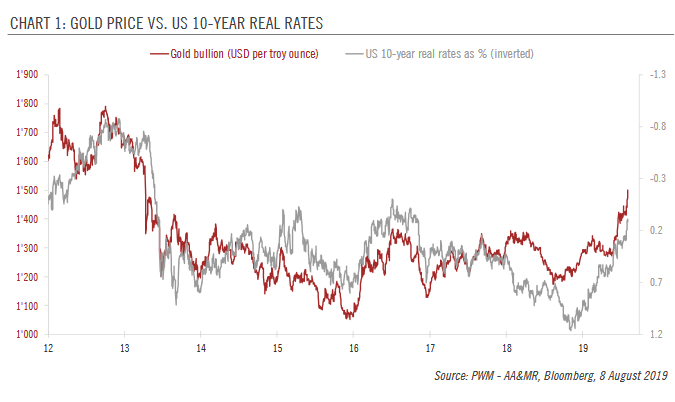

Update on gold – bad news is good news

Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets.

Read More »

Read More »