Let’s start with Frederic Bastiat’s 170-year old parable of the broken window. A shopkeeper has a broken window. The shopkeeper is, of course, upset at the loss of six francs (0.06oz gold, or about $75). Bastiat discusses a then-popular facile argument: the glass guy is making money (to which all we can say is, “plus ça change, plus c’est la même chose”). Bastiat says it is true, and this is the seen. The glazier does make money.

Then he introduces the concept of the unseen. The shoemaker does not earn the 6 francs he would have earned, had the shopkeeper not had to replace his window. The shopkeeper himself has the same window as before, but he is poorer by 6 francs. The unseen are the consumer, and the other producer. The consumer must consume less, and thus is impoverished. The other producer’s business shrinks in proportion to the gain in the glassmaker’s business.

Bastiat does not stop there. He adds that a government-imposed restriction can be thought of as a partial destruction.

Does anyone else feel as we do—that there should be a day to commemorate Bastiat?

Anyways, let’s take Bastiat’s parable into the modern era of central banks and monetary policy. We will tackle one of the leading proposals of the otherwise-free-marketers: nominal GDP (nGDP) targeting. In nGDP targeting, monetary policy attempts to cause GDP to grow at the right rate, as opposed to inflation targeting where consumer prices rise at the right rate, unemployment targeting where people can’t find work at the right rate, interest rate targeting where interest rates are set at the right rate, or even gold price targeting where the price of gold is fixed right.

What is the right number for each of these statistics? We don’t know—and neither do the dirigistes! But it makes for great opportunities to publish papers, not to mention the political power one could have, to be put in charge of administering the economy…

And even if there were a right price, it would be right for one moment only. And then on to the next price. That’s how markets work in reality (as opposed to nominally—sorry, we couldn’t resist).

And even if they always knew the right price, their mechanism for setting it is not equivalent in any way to how a market sets the right price. This was the topic of topic of our essay a few months back, What They Don’t Want You to Know about Prices. It is one of our more important essays.

Anyways, in nGDP targeting, the central bank is supposed to enact policies to grow GDP. And this leads us to the key question: how is a central bank to make GDP go up?

To answer, one must understand what is included in GDP and what is not. To make an analogy to financial statements, GDP is a cash-basis measure. In the cash basis, you book revenues when you deposit a check. And you book expenses when you write a check. Cash basis may work for a small business with no capital and no long-term contracts, such as a pizza restaurant that rents its premises. Every day it buys ingredients. And every day it sells pizzas. If the gozzinta is greater than the gozzouta, it is making money. Any child with a cash basis ledger can see it.

However, more substantial businesses must use the accrual basis. This is because cash basis does not paint an accurate picture where there is financing, capital, long-term contracts, etc. For example, suppose an insurance company wrote a one-year policy that paid $1,000 when the year ends in “0”, and receives a premium of $100 today. Can it book a $100 profit in 2019?

No, it cannot.

Accrual basis accounting requires the company to book that $1,000 payment that will be due in six months. You cannot just book a cash deposit and ignore the corresponding liability.

It is obvious that writing such a policy is a recipe to lose money. And the books should reflect this fact.

GDP is a cash basis measure. That is, it looks at only current activity and ignores changes to the balance sheet. It ignores capital.

That leads to an essential question. What if it were possible to induce a conversion of capital to income? What if the people could be incentivized or deceived or otherwise nudged or manipulated into eating their seed corn?

That would make GDP go up.

Back to Bastiat for a moment, reaking a window adds to GDP. At least in our modern era, with ubiquitous credit, one can borrow to repair the window with no impact to one’s consumption. This is not a recommendation to break windows. Bastiat’s point remains valid. It is a damning indictment of GDP as a measure of the economy.

And more germane to this discussion, there is no need to break windows to stimulate GDP. That is not what central banks do. They push down interest rates. And asset prices are inverse to rates.

An endlessly-rising asset market is a process of conversion of one party’s capital into another’s income, to be spent. Every seller has a profit, which he can spend. That profit comes from the capital of the buyers. And the buyers are increasingly borrowing that capital, which they fork over so eagerly to the sellers. And endless bull market is a process of liquidation of capital.

In a poor society, no one (except a conqueror or tyrant by arms) is able to consume without producing. And everyone was acutely aware of the consumption of the conqueror. But in a rich society, with a much more complex economy, it is not so obvious. How is the guy who sells bitcoin for $9,000 (which he bought not long ago for $4,000) to know that his Las Vegas vacation is paid for by consuming someone else’s hard-earned accumulated wealth? One ought to be able to assume that a profit is good, that one has earned it, and that profit is creative not destructive. In a free market, these things are true.

But contra the protestations of the otherwise-free-marketers, monetary policy is not a feature of free markets. It is central planning, socialism in the monetary realm that undermines capitalism. And under central planning, profit is not necessarily creative. If one is given spoils taken from someone by force (or that he was incentivized to fork over), it is destructive. And, to reiterate something we say from time to time, we blame the Fed for this destructive game, not the traders who are deprived of a yield and forced to play.

Keynes saw it. And intended it. We blame Keynes. And to the extent a modern-day economist accepts Keynes’ ideas or methods, we blame them too. GDP is a perfect instrument for Keynesianism. What would Bastiat say about GDP, if he saw it used to justify the equivalent of window-breaking?

And now we can see that GDP targeting is just a different form of restriction, hence a new flavor of the same old destruction about which Bastiat wrote nearly two centuries ago.

At the risk of beating a dead horse, we want to address something we have seen in lectures on nGDP targeting. Proponents do realize that they must address the question of which activities are stimulated. We have seen them discuss this in terms of efficiency. In other words, GDP targeting may not be 100% efficient, if it does not create 100% good activities (which notion is conceived and framed in central planners’ terms).

Well, yeah, breaking a window is not good activity. But no one would say that the rock is not an efficient economic stimulus tool! That’s because the issue is not efficiency. The issue is that central planning does not work, has never worked, and cannot ever work. If the USSR proved anything, it is this. Central planning necessarily fails. They could not even centrally plan corn, which is simple and has an annual cycle. Money is complex, and its cycle is decades.

Central planners cannot know the right activity any more than they know the right price. And even if they could know it, they have no mechanism to target it. They have a blunt instrument, the way a truck is a blunt instrument to hit a mosquito on someone’s forehead.

They lower the interest rate. Good projects, for which there is real demand, get financed. Though it is hard to tell how much of that demand is, itself, artificially stimulated by, e.g. rising asset prices—the so-called wealth effect, which is not wealth the way processed American cheese food is not cheese. And marginal projects get financed, for which there is tepid demand, and so the project can only be financed on a downtick of the interest rate. And downright inefficient bad projects get financed, because capital is too cheap and risk is mispriced. And outright consumption of capital as such as incentivized. And many other destructive things.

Yeah, you could say that Stalin and Mao showed the world that socialism is not an efficient way to conduct economic activity. But this misses the mark. The way that drinking a glass of potassium cyanide solution is not an efficient way to stay hydrated.

It matters little whether the central bank does its central planning by discretion or by rules. It matters little whether the rule is inflation-, gold-price-, unemployment-, or GDP-targeting.

It is just Bastiat’s partial destruction.

One thing is for sure. The central planners will not be setting the interest rate of the first gold bond, which Monetary Metals is working to bring to market.

Supply and Demand Fundamentals

Wow! What a week for dollar! It dropped a whole milligram from 23.2 to 22.2mg gold. The dollar is now at its lowest level in years, and on the verge of breaking down.

We insist that the dollar cannot be measured in terms of its derivatives, such as euro or pound. These currencies depend on the dollar, not the other way around. When all the dollars are sucked out of them (when they are fully de-dollarized) they will be worth exactly zero. Well, though in a more abstract sense, the dollar is derived from gold. When all the gold is sucked out of the dollar, then the dollar (and any dollar-derivative currencies that may have survived until that point) will be worth zero. This is Keith’s permanent gold backwardation thesis.

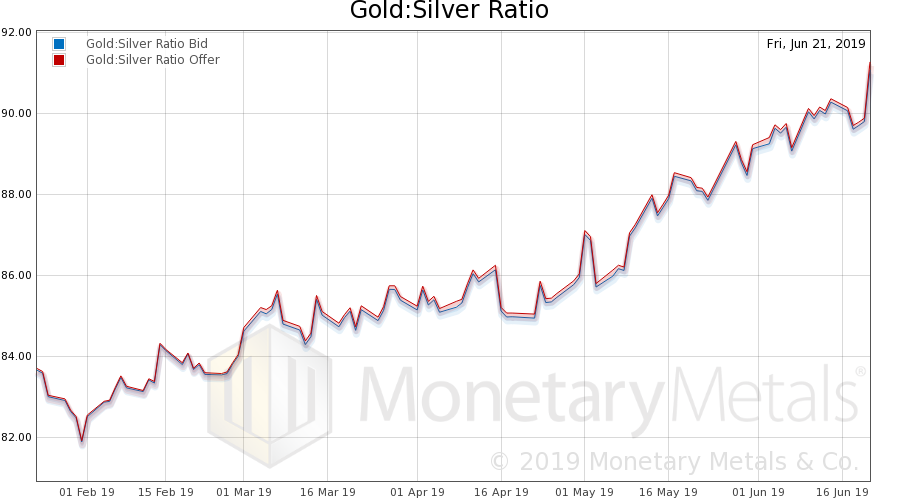

Anyways, on a more pedestrian note, the price of gold shot up $58 and the price of gold rose rather less by proportion, ¢47. That brings the gold-silver ratio to a new high.

We talked a bit about this last week, noting that the demand for both gold and silver is monetary reservation. The difference being who demands silver as compared to gold.

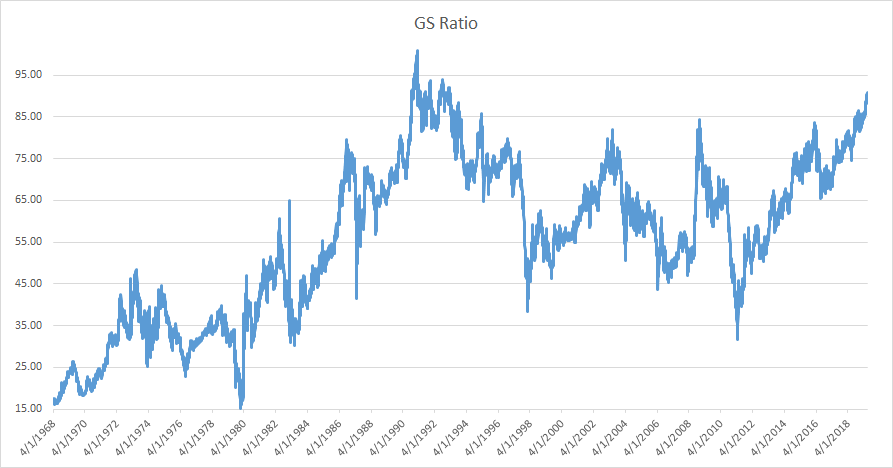

| In the modern era, the ratio has only been higher than this in the episode from 1990-1993. Here is a graph showing the ratio from 1968-present.

The first question is: is it cyclical? What if it isn’t? This would mean silver has been demonetized, silver stocks are rapidly being consumed, and silver could crash or shoot the moon depending on facts specific to events in the mining sector and automotive or solar utilization. We do not believe this to be the case. And we would add that, unlike stocks and bonds, there is no credit risk. Silver cannot default. A bar of silver today is the same quality as it was in 2011 when the ratio was around two thirds lower than today (i.e. silver was three times more valuable in gold terms). Gold has long been called the “money of kings” as it was held by governments and the wealthy. Silver, by contrast, was used by wage-earners. One might think that the difference between the two metals is just price (or value). Gold is more expensive, and the not-so-wealthy cannot afford it. That is true. But it’s more than that. Gold is the most marketable commodity in the large. One can do large transactions, without fear of moving the gold market. There are economic reasons for this, but suffice here to say that gold has such high specific value (value per cubic centimeter, or value per kilogram) that it is practical to move it anywhere in the world. The major depositories and refineries are all within 24 hours by airplane from one another. So the supply or demand of gold is not just local, it is global. This is not true for silver. At today’s ratio of around 90, it takes 90 ounces of silver to convey the same economic value as one ounce of gold. In other words, the same value in silver weighs 90 times as much. Silver is also less dense than gold. These 90 ounces of silver take up 166 times as much volume. It is much harder to justify putting silver on a plane. The price differential between the locality where the silver currently is, and the destination would have to be that much greater. |

GS Ratio, 1968-2018 |

| Silver serves a different purpose than gold. For those saving a portion of their weekly wages, gold is impractical. The amount of gold one would get for $50 would be a tiny chip. And one would pay a big premium to manufacture something so small and precise. But in silver, one could get 3 one-ounce coins. Silver is the most marketable commodity in the small. Silver offers the least losses (to get in and out) to small savers.

The point is that there is not necessarily a great overlap between the gold owners and the silver owners. Institutions (those which will touch precious metals at all) own gold, almost exclusively. Small savers have a heavy preponderance of silver, especially those who keep the metal at home. Market conditions have generally been pushing the gold price up since the start of 2016 (with some drops). Silver, by contrast, almost looks like a bear market since July 2017. And, arguably, a tepid bull market since last September. Central banks, institutional investors, intergenerational wealth planners, and the wealthy have been favoring their metal for a few years. While the workers of the world have not been uniting around theirs. One or both of the following things will change. The wage-earners will increase their savings, not in the banking system (which we predict will soon be charging them negative interest in certain countries) but in precious metal. And those institutions with flexibility, not to mention wealthy individuals, will increasingly favor silver, as the relative bargain. As always, when the trend gets going, the trend followers jump in, and extend it further. Other than that very brief spike to 100, even during silver’s darkest days the gold-silver ratio did not stay above the level where it now sits. There is no guarantee that today won’t be different, but if one believes that this ratio is cyclical, then it is a no-brainer to shift some of one’s gold into silver. No one knows how long this relative dearth of silver demand will last. But this is a no-brainer trade for value. Monetary Metals is excited to be bringing the first gold bond to market. Please contact us if you are interested in investing. Gold and Silver PriceNow let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose further. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

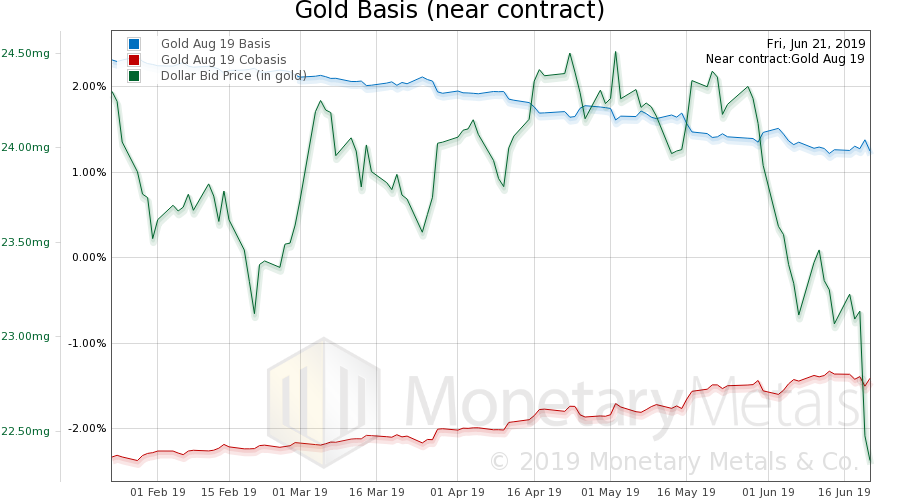

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. In light of this epic drop in the dollar (i.e. rise in the price of gold in dollar terms), the drop in gold’s scarcity (i.e. cobasis) looks modest indeed. The Monetary Metals Gold Fundamental Price rose another $38 to $1,440. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

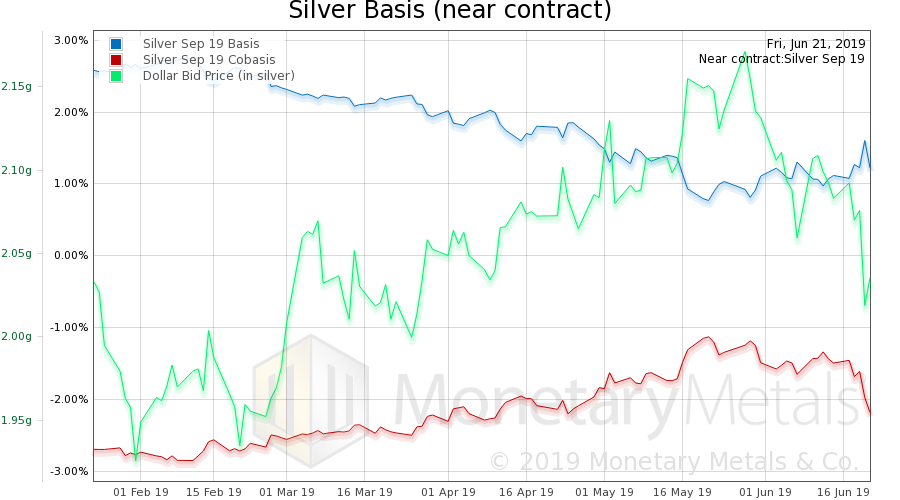

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Note that we have switched from tracking the July contract, and now show September. Silver’s price move was smaller, but alas its scarcity fell more. The Monetary Metals Silver Fundamental Price rose 2 cents to $15.51. Astute readers will do the math, and note that the calculated fundamental gold-silver ratio is now up to 92.8. This suggests that Friday may not be the top. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2019 Monetary Metals

Full story here Are you the author? Previous post See more for Next postTags: Basic Reports,capital consumption,capital destruction,central planning,dollar price,GDP,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,silver basis,Silver co-basis,silver price