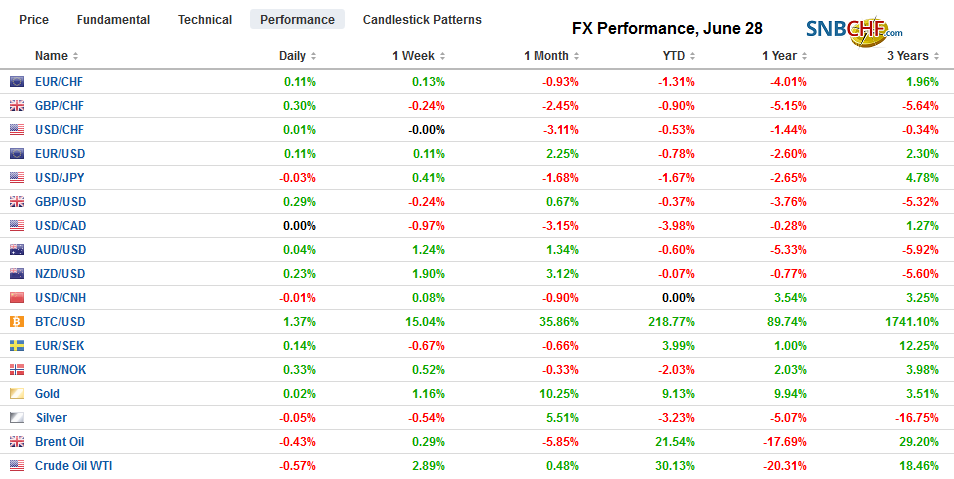

Swiss FrancThe Euro has risen by 0.05% at 1.1106 |

EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Quarter-end positioning seems to dominate today’s activity. The outcome of bilateral talks at the G20 gathering partly reflects the influence of the US President who eschews multilateral efforts as a hindrance to its sovereignty. Equities in Asia Pacific slipped today but held on to modest gains for the week. The MSCI Asia Pacific Index rose every week this month for the first time since January 2018. The Dow Jones Stoxx 600 is little changed and is off a little more than 0.5% this week but like Asian and American benchmarks, will close the month higher after falling in May, when the first monthly decline this year was posted. The S&P 500 is nursing almost a 0.9% decline for the week coming into today, and US shares are trading with a firmer bias in Europe. Asia Pacific bond yields fell, dragged low by yesterday’s drop in US yields, which are little changed today. Italian bonds are leading European peripheral bonds higher today amid talk that the EC may delay a decision on the country’s debt until the 2020 budget is submitted in a few months. The dollar is slightly lower against most of the major currencies. The Dollar Index is off nearly 1.7% this month, which is the largest decline since January 2018. Oil is softer on the day but is up over 10% this month. Gold is firm near $1410 and is poised to extend its advance for the sixth consecutive week. |

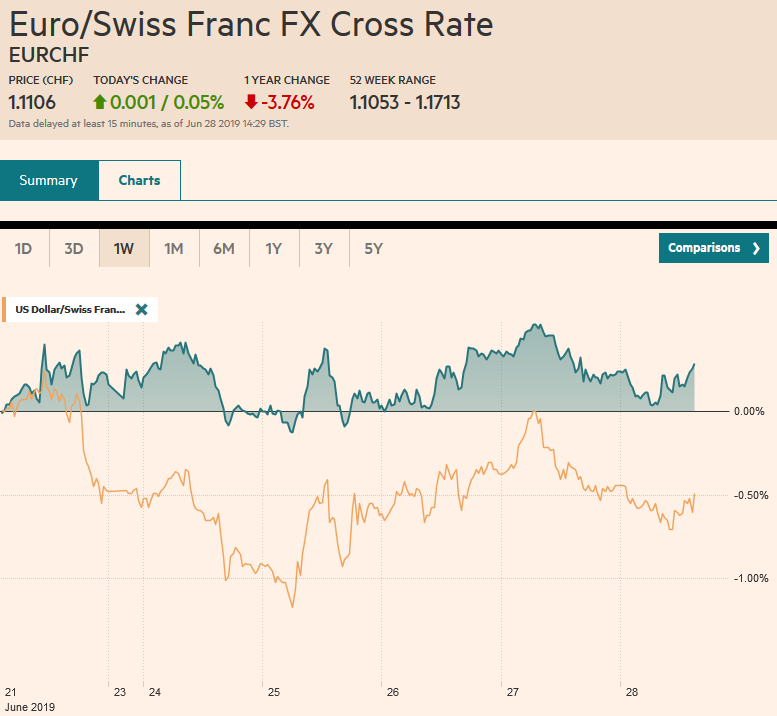

FX Performance, June 28 |

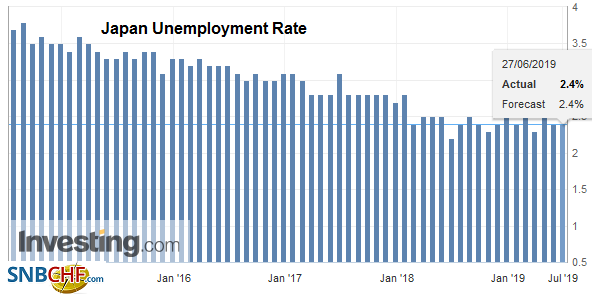

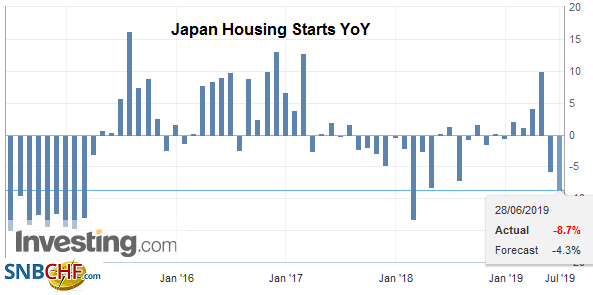

Asia PacificJapan’s May industrial output surprised to the upside, rising 2.3% in the month, more than three times the gain the median economist forecast in the Bloomberg survey. It is the strongest since February 2018. Separately, Japan reported 2.4% unemployment in May, unchanged from April. |

Japan Unemployment Rate, May 2019(see more posts on Japan Unemployment Rate, ) Source: investing.com - Click to enlarge |

| The jobless rate of women eased 0.1% to 2.2%, while the rate for men was flat at 2.5%. The job-to-applicant slipped to 1.63 from 1.62, which points to a tight labor market. The number of people working in Japan (67.32 mln) is the most in over 50 years, despite the shrinking population. The percentage of working age (15-64 yrs) with jobs stood at 77.6%, up 0.6% in the past year. For men, it was 84.2%, and for women, it was 70.8%, the highest since 1968. These are impressive participation rates. That said, business sentiment is not strong, and the BOJ’s Tankan survey will be released early Monday in Toyko and is expected to have softened. |

Japan Housing Starts YoY, May 2019 Source: investing.com - Click to enlarge |

South Korea’s industrial output fell 1.7% in May, and this was enough to drag the year-over-year rate back into negative territory (-0.2% vs. +0.2% in April). The international climate remains a challenge, and this will be evident in the trade figures Seoul will report at the start of next week. Exports are expected to have fallen more than 13% year-over-year in May from near -9.5% in April. South Korea’s exports have been falling on a year-over-year basis since last November. Imports are forecast to have plunged by more than 9% year-over-year. It would be the biggest slide in February.

The dollar is consolidating at lower levels against the yen after briefly trading above the 20-day moving average yesterday (~JPY108.10) for the only time this month. It has been confined to about a 15-tick range on either side of JPY107.70. A few expiring options seem to help define today’s range. JPY108 holds a $1.1 bln option that will be cut today and JPY107.50 is where $2.2 bln in options have been struck. There is a more modest $580 mln option at JPY107.75. The Australian dollar is trading firmly after closing above $0.7000 yesterday for the first time since June 7, but it is in less than a fifth of a cent range. We suspect the market will turn cautious now ahead of the central bank meeting early next week that is widely expected to result in a rate cut and a signal that the easing cycle is not over. Stops are likely just above the month’s high near $0.7025. The US dollar slipped against the Chinese yuan for the second consecutive session, for the first time this month and the second straight week for the first time since the end of February/early March. The price action this month reinforces the importance of the CNY7.0 level.

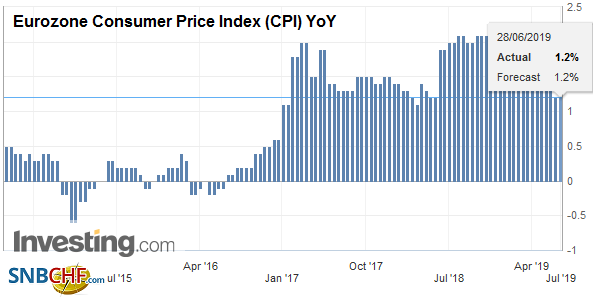

EuropeThe eurozone’s preliminary June inflation report may be of some comfort to the ECB. Headline inflation was steady at 1.2%, but the core rate was firmer than expected at 1.1%, up from 0.8% in May. The ECB meets July 25, and although, given the rotating voting system, Bundesbank President Weidmann does not formally vote, it may be too soon to expect a fresh initiative. |

Eurozone Consumer Price Index (CPI) YoY, Jun 2019(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| However, the market has brought forward the rate cut expectations to September from next year. That said, there the derivative’s market is implying almost a 1 in 3 chance that it moves next month. Separately, there is speculation in the press about Merkel’s health after she was seen with a second bout of “shakes,” but there are no fresh details and officials are playing it down as the Chancellor maintains her busy schedule. |

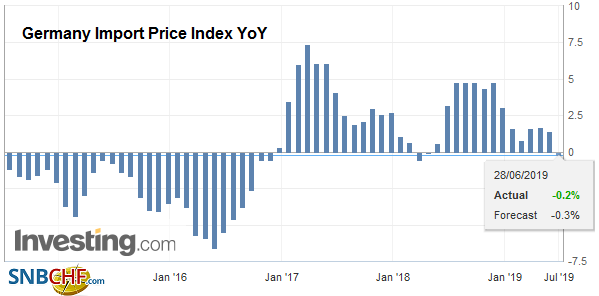

Germany Import Price Index YoY, May 2019 Source: investing.com - Click to enlarge |

| Contenders for the Tory leadership post and next UK Prime Minister Johnson and Hunt continue to lay out their Brexit. With Parliament appears opposed to a no-deal exit, Johnson refuses to rule out a parliamentary tactic (“proroguing”) that would allow for the dissolution of parliament to force a no-deal exit. Separately, Johnson is said to be drawing up an emergency budget plan in case of such a departure from the EU, which would include substantial tax cuts and a review of the stamp duty (financial transaction tax). Sterling is the worst performing major currency this month, gaining less 0.25% against the dollar and falling about 1.75% against the euro. |

U.K. Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on U.K. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

For the third session, the euro remains confined within the range set on Tuesday (~$1.1345-$1.1410), though it has a firm tone in Europe today. It has met sellers in front of $1.14. There is an option for a little more than 555 mln euros at $1.1385 that expires today. Sterling is trapped in a little more than a 10 tick range around $1.2675. It has built a base in recent days near $1.2660, but it has not been able to distance itself much from it.

America

Month and quarter end considerations and the series of bilateral meetings Trump is holding on the sidelines of the G20 meeting may dampen the market’s reaction to a slew of economic news from the US and Canada today. The US reports personal income and consumption figures for May, which will impact Q2 GDP forecasts. The market may be most sensitive to the PCE deflator, which the Fed formally targets. It is expected to be unchanged at 1.5%. The core deflator, which Fed official also acknowledge is important, but do not target it, may slip to 1.5% from 1.6%. The market is already pricing in a rate cut at the end of next month, and officials have cautioned against expected a larger move, despite Kashkari’s call. The University of Michigan’s consumer confidence and inflation expectation survey is also on tap, as is the Chicago PMI.

Canada reports the monthly GDP for April. A 0.2% gain is expected after 0.5% in March. The soft patch that saw the monthly GDP contract three times from November 2018 through February 2019 has ended. The 1.6% year-over-year pace would be the strongest since January and the second consecutive acceleration. The Bank of Canada will also report its survey of senior loan officers, which often gives insight into the credit outlook, as part of its monthly business survey. The BoC is one of the few major central banks without an easing bias.

The US dollar is poised to end a four-month uptrend against the Canadian dollar with more than a 3% loss here in June. It is approaching the low for the year set on February 1 near CAD1.3070, just above the lower Bollinger Band. It is straddling the CAD1.31 area in the European morning, where a roughly $755 mln option is struck that expires today. The US dollar has fallen every day but one against the Canadian dollar over the past two weeks, leaving the technicals stretched. In contrast, the Mexican peso is on the defensive. It has fallen every day but one this week. The week’s high was set near MXN19.27. It requires a move above MXN19.33, which is the highest since the US suspended the tariff threat to grab the attention of the levered accounts, which are sitting on long peso positions and picking up a hefty carry.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Canada,EUR/CHF,Eurozone Consumer Price Index,Japan,Japan Unemployment Rate,newsletter,South Korea,U.K. Gross Domestic Product,USD/CHF