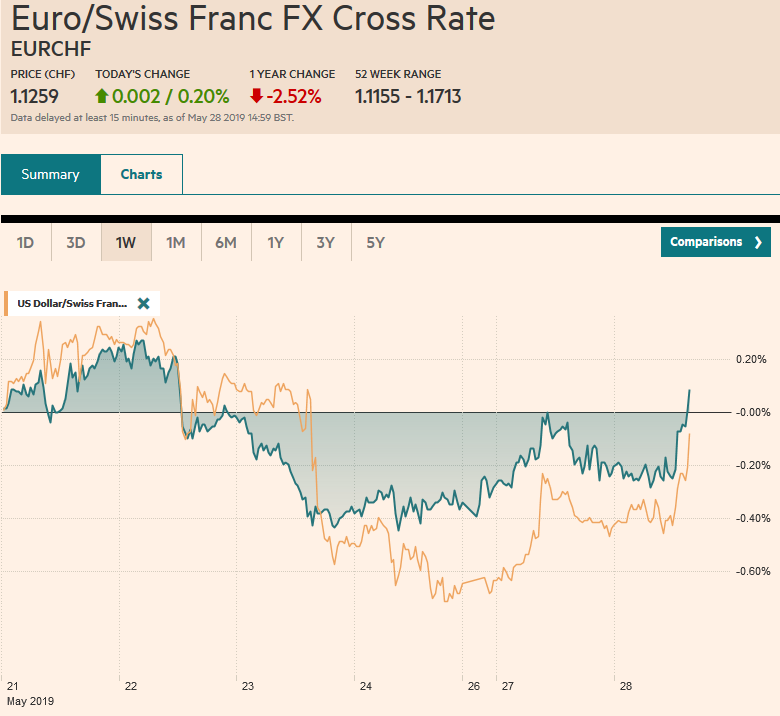

Swiss FrancThe Euro has risen by 0.20% at 1.1259 |

EUR/CHF and USD/CHF, May 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The euro initially reacted positively to the EU Parliament elections. The populists did not do quite as well as many expected. The two main groupings failed to secure a majority, but with the help of the Liberals, and possibly the Greens, that did well throughout Europe, a new European Commission will be forged. The heads of state meet later today, but no real decisions are likely. The horse trading will likely take most of the next few months. With the PP securing the most seats in the new EU Parliament, its candidate Weber is the odds-on favorite to succeed Juncker, but Macron is pushing Barnier’s candidacy. Still, the likelihood of a Germany EC Presiden means that Weidmann, who with a fortnight of the next ECB meeting, where details of the next TLTRO is expected, said there was no need for additional measures, is unlikely to replace Draghi in October. France is pushing for one of their own (either the current Governor of the French central bank Villeroy De Galhau or ECB board member Coeure. Two other developments saw the dollar strengthen: President Trump indicating he was not ready to make a deal with China and news the that EC may take action against Italy as early as next week for its excessive debt. The dollar is narrowly mixed against the major currencies. Sterling has been the worst performer, shedding about 0.4% between yesterday and today amid fears of a no-deal Brexit. The MSCI Asia Pacific index edged higher for the third consecutive session, the longest advance in five weeks. Europe’s Dow Jones Stoxx 600 gained both last Friday and yesterday but in the early going toward is struggling to extend the advance. US shares are trading with a heavier bias in Europe. Meanwhile, the bond market rally continues. The US 10-year yield is pushing below 2.30%. The 10-year German bund yield is minus 15 bp, while Japan’s benchmark is near minus nine bp. Italian bonds are the notable exception. The 10-year yields are a couple basis points higher to bring two-day rise to 15 bp. The prospect of Syriza being turned out of office and a return of the conservative New Democracy lifted Greek bonds yesterday, with yields tumbling over 20 bp yesterday. The Greek bonds a bit heavier today. |

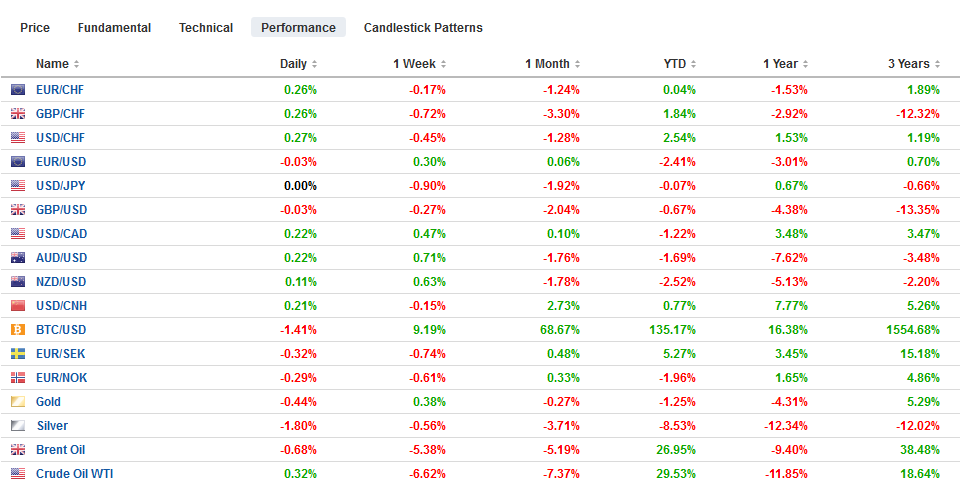

FX Performance, May 28 |

Asia Pacific

Somewhat belatedly, the US recognized that Japan’s Prime Minister Abe is in no position to make trade concessions ahead of the July upper house election. US officials had sought a quick agreement to extend the agriculture deal that had been negotiated with the TPP and EU to US farmers, who are being hurt by the retaliatory tariffs. However, with steel and aluminum tariffs still levied on Japanese producers and threats of auto tariffs unless Japan violates the WTO and agrees to “voluntary export restrictions,” there is a limit on Abe’s ability to satisfy Trump. Separately, and more stridently, the EU also rejected quotas, voluntary or otherwise on auto exports to the US.

There are three Chinese developments to note. First, contrary to speculation that China would devalue the yuan to ostensibly offset the US tariffs and provide economic stimulus, officials continue to resist pressure on the yuan in both word and deed. The head of regulation of banking and insurance in China warned that if speculators “shorting the yuan will inevitably suffer huge losses/” The warning comes amid interest in options that would benefit if the dollar rose through CNY7.0. The yuan edged higher. Second, for the first time, Chinese officials included economic issues as a “core interest.” These are red lines for China, so to speak, that in the past, included strategic issues, like Taiwan and Tibet). This represents an escalation and hardening of China’s position. Third, as the consequences of the US action against Huawei ripple through supply and distribution channels, China is drafting legislation that blocks doing business with foreign (US) tech companies on national security grounds.

For a third session, the dollar remains on JPY109-handle. A break of JPY109 would signal a move toward JPY108.50-JPY108.60. Resistance is now seen in the JPY109.65-JPY109.75 area. There is no significant option expiry today, but there are options for around $2.2 bln that will be cut tomorrow, which are struck between JPY109.75 and JPY110.00. The Australian dollar seemed to carve out a floor near $0.6865 last week and reached $0.6930 today before meeting sellers. It returned to its session lows near $0.6915 in the European morning. Nearby resistance is seen near the 20-day moving average (~$0.6945). It has not traded above the 20-day moving average in a little more than a month. The Chinese yuan firmed against the dollar before the weekend and yesterday but surrendered these gains today. The dollar finished the onshore session at a seven-day high near CNY6.9125.

Europe

May led the Tories into a third electoral defeat, each more stunning the previous one. She first lost the Conservative majority in the House of Commons. Most recently, the Tories took a drubbing in the local elections. In the EU Parliament elections, the Tories came in fifth place. The lesson many, if not all, the Tories are drawing is the UK should leave the EU with or without a deal by the end of October. The inability of Labour to capitalize on the Tories’ woes and its dismal showing in the EU Parliament election is unlikely to topple Corbyn, but it may push him further toward a second referendum. However, Northern Ireland voted for parties that want to remain in the EU, making it difficult for the DUP to support Tory PM that would leave with an agreement. Without the DUP’s support, national elections seem more likely than the Tories finding another coalition partner. If national elections are necessary, the end of October deadline puts the new government in a bind, even if the EC was willing to negotiate. While speculation of Draghi’s successor is in full bloom, May’s resignation may change who replaces Carney at the end of January 2020. The nominations close at the end of next week.

The populists in Europe did not show the surge that many had expected. Overall, they got a fraction less of the larger turnout than in 2014. From a political vantage point, Europe is in tatters. The Austrian government, racked by corruption in its anti-immigration coalition partners, collapsed over the weekend. Belgium who held national elections on May 26 will take some time to form the next government. Spain, where the Socialists did well, are struggling to form a government and is Finland. The Greek government has been widely trounced in local and EU Parliament elections is bringing forward its national election. The likely return of the New Democracy was cheered by investors on Monday. The Yellow Vest demonstrations continue in France, and Le Pen edged ahead of Macron’s En Marche. Italy’s populists, as represented by the Five Star Movement, have been outflanked by the anti-immigration nationalists in the League. Salvini-led the League to more than 30% plurality. Their share of the vote nearly doubled from 2014. The further-right Brothers of Italy took 6% of the vote. This may embolden Salvini to precipitate a political crisis. He no longer needs the M5S, and indeed, it is preventing him from being Prime Minister. At the same time, Salvini is feeling his oats, the EU is contemplating fining Italy for the lack of progress on its debt, which it had agreed.

After an impressive recovery from almost $1.11 to $1.1215 before the weekend, the euro has drifted lower. It reached almost $1.1175 in the European morning. There is a 540 mln euro option at $1.12 that will be cut today and may be deterring the upside. Last week’s short-covering rally appeared to have been led by US accounts, and their leadership is awaited now. In that short-covering squeeze, sterling recovered about a cent and a half from testing $1.26. Between yesterday and today, sterling has shed two-thirds of its gain to return to the $1.2650 area. Resistance is now seen near $1.2680. Before last weekend, the euro’s streak against sterling was stopped at 14 sessions, during which time it rose from GBP0.8500 to GBP0.8850. It rose yesterday and more today to return to the highs. The GBP0.9000 beckons.

America

The recent string of US data has been particularly dour. One US bank cut its growth forecast for Q2 to 1%. The New York and Atlanta Fed trackers are a little higher. This week’s April trade, inventor,y, and personal consumption expenditures see further adjustments. While China’s tariffs will be increased on June 1, Canada and Mexico are lifting their counter-tariffs as the US ended its steel and aluminum tariffs on them.

One way that the Federal Reserve bolsters its case to be patient is that it suggests the decline in inflation is temporary. That warns of an asymmetrical reaction to the PCE deflator to be reported on May 31. A soft report will be looked passed given the Fed’s bias. A strong report can see a more dramatic market reaction.

The Bank of Canada meets on May 29. There is little doubt that policy is on hold. The Q1 GDP that will be released two days later will illustrate why Canada is not easing rates. While the market is aggressively pricing in Fed cuts, it has the Bank of Canada steady. The economy likely validates the central bank’s confidence. The median forecast is in the Bloomberg survey calls for a 0.7% increase after a 0.4% expansion in Q4 18.

The US dollar remains rangebound against the Canadian dollar on the CAD1.34-handle. A little less than a third of the sessions have seen the range violated on an intraday basis only to return back into the range by the end of the day. In the short-term, the broad risk appetite (proxy S&P 500) seems to be the key to the Canadian dollar’s direction, within the range. At the end of last week, the dollar found support near MXN19.00. It is testing the MXN19.10 area now and could test the MXN19.20-MXN19.25 area if equities head south.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Brexit,EUR/CHF,Europe,newsletter,Trade,USD/CHF