EurozoneLast week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling’s gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December. Speculation that the Reserve Bank of Australia would be forced to cut interest rates saw the Australian dollar punch through $0.7100. For its part, the yen was sidelined. The dollar stalled at JPY110 and has remained above JPY109.30 for the past three sessions. The focus in the days ahead may turn back to the US, where the highlights include the FOMC meeting and the January employment report. Still, Europe requires attention. The German manufacturing PMI falling below the 50 boom/bust level for the first time in four years and the ECB offering a change in its risk assessment for the first time without staff forecast update underscores the seriousness of the economic challenges of the euro area. Some of the political fallout may be seen in the European Parliament elections in May, which often favor the smaller and more passionate parties. Draghi speaks to the European Parliament and investors will look for any elaboration for his press conference after the ECB meeting. Although Draghi argued that ECB has numerous tools at its disposal, it appears a consensus is forming around a new Targeted Long-Term Refinancing Operation (TLTRO) and possibly in its forward guidance pushing out the first hike into 2020. Investors will get the first look at Q4 18 EMU GDP. Economists mostly expect it to match the 0.2% of Q3 after 0.4% in the first two quarters and 0.7% each quarter in 2017. The risk is on the downside. Although the Bundesbank says German narrowly escaped a second consecutive quarterly contraction, Italy may not be as fortunate. The economy is expected to have contracted by 0.1% as it did in Q3. The ECB’s survey of professional forecasters reported before the weekend saw 2019 GDP forecasts cut to 1.5% from 1.8%. They put 2020 GDP also at 1.5%, which seems match trend growth and if it is somewhat optimistic, so are officials. The IMF’s new forecasts are for 1.6% and 1.7% growth this year and next respectively. |

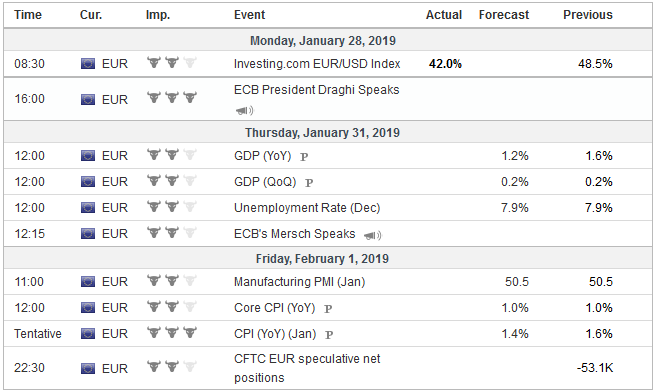

Economic Events: Eurozone, Week January 28 |

United KingdomThe next act of the Brexit drama has begun. May’s Plan B to limit the backstop may draw more support by her own allies under the threat of a possible second referendum that might see the Brexit ditched all together or an election in which the opposition could win. However, by its nature, the backstop cannot be so limited. It defeats the purpose, which is to prevent a hard border between Northern Ireland and the Irish Republic. And EC negotiators and Ireland have made this point many times. We fear this is a non-starter and the market, which has taken sterling to its best levels since last October-November is getting ahead of itself. If May’s Plan is defeated, it is back to square one. If it is approved, the EC will respond, and if there is no change in its position, the risk of a no-deal Brexit would seem to increase, and sterling would likely be sold. There still is another card to be played, but that is later in February when Parliament asserts its authority. |

Economic Events: United Kingdom, Week January 28 |

United StatesThe week ahead is jammed packed with events in the US that will command investors attention. The highlights include the next round of trade talks between the US and China, the first look at Q4 18 GDP, and FOMC meeting, and the January jobs report. The most that should be expected from the trade talks is a positive spin, progress is being made, but no breakthrough. It is arguably unreasonable to expect an agreement before the last minute if a deal is to be struck. Any earlier would lead many to conclude a better deal could have been reached. Brinksmanship may sometimes seem hardwired into the negotiations and not simply a tactic of gamesmanship. Thus far, it appears that Trump Administration is forgoing the simple fix of the bilateral balance, having rejected as insufficient Chinese offers to buy more US goods and close the deficit completely in a few years. Leaving aside how the preferential treatment of the US could violate WTO rules, the US is seeking deeper changes in China including the end of state subsidies for business, some kind of meaningful monitoring of enforcement. It may come down to how much will satisfice (“good enough”) for the Trump Administration. The partial shutdown of the US government has denied market participants and policymakers with much of the high-frequency economic data. Economists are looking for Q4 GDP of around 2.5%-2.75% after 3.4% in Q3 and 4.2% in Q2. It will likely have averaged about 2.9% in 2018 after 2.5% in 2017 and 1.9% in 2016. The more important question is how the economy is faring at the start of the New Year. The economic disruption caused by the partial government shutdown will likely be unwound by the end of the quarter, leading to only modest impact on Q1 GDP (estimated around half a percentage point of annualized growth), provided that it is indeed over. The irony that it was air traffic controllers that shut down NY’s LaGuardia airport that was the final straw in the drama. Many will recall the firing of air traffic controllers was one of the historical events associated with the beginning of the Reagan era. The labor market data is available, and it has been strong. Weekly initial state claims and continuing claims fell to new cyclical lows. Federal workers are in a different program, and there has been a surge (to around 25k) of such claims. In January, the US grew 312k net new jobs. It was the most since last February, which itself (324k) was the most since July 2016. These are outliers and frequently followed by a dramatically weaker report, like a mean reversion process. The same is true for manufacturing, where the US added 32k net new positions in December, the most in a year and well above the 24k average. The risk here too is for considerably slower growth. Hourly earnings need to have risen by 0.3% to maintain the 3.2% year-over-year pace. New cyclical lows in the underemployment and unemployment rates are also not consistent with an imminent recession. |

Economic Events: United States, Week January 28 |

Switzerland |

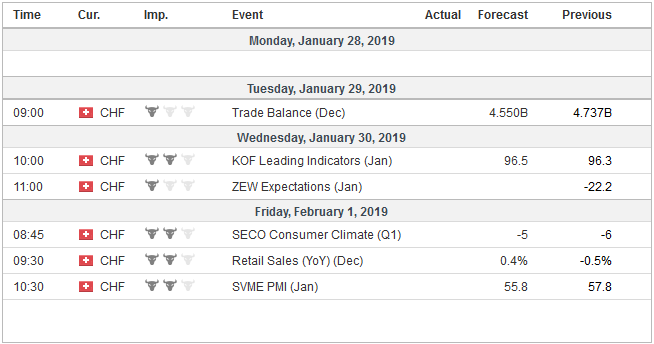

Economic Events: Switzerland, Week January 28 |

The contrast between US economic performance and other major centers is stark. To our discussion on Europe, we note the BOJ revised down its growth and inflation forecasts for Japan. China’s January PMI may be released next week. There seems to be a cottage industry to debunk its data. Investors can make some judgments based the policy response–the various, almost daily announcement of new stimulative measures as a convincing sign something is amiss regardless of what the data may say. President Xi’s hard political line in a recent speech may be understood as backhanded admission (“affirmation through negation”) that the social contract in China, whereby people defer to the Communist Party political authority in exchange for rising living standards may be strained.

This renewed divergence between poses a challenge for the Federal Reserve, whose two-day meeting ends on January 30. There is no doubt that after hiking rates every quarter in 2018, the Fed will not raise rates here in Q1. That is what it means to be patient. Many market participants believe the tightening cycle is over. Yet many economists expect the Fed to raise rates once or twice. The current effective Fed funds rate is 2.40%. The July futures contract implies a yield of 2.46%. That means six basis points of an expected 20 bp has been discounted, or 30% of a hike in H1. It is not that the Fed will not tip its hand at the FOMC meeting, there is no hand to tip. That is what it means to be flexible.

The market has become more interested in the Fed’s balance sheet. At the end of 2017, the Fed began not reinvesting the proceeds from the maturing bonds it bought during its QE. While the S&P was climbing to record highs, recorded in September, most investors and analysts seemed to ignore it. The Fed told us there was no policy signal intended. After rallying for six consecutive months through September, the S&P 500 turned south in October recovered a bit in November and dropped nearly 10% in December.

A culprit was needed. Other things were happening, like analysts downgrading earnings forecasts, trade tensions between the two largest economies, a slowing of the world economy in Q3, with Germany, Italy, Switzerland, Sweden, and Japan all reporting contractions. These were given secondary roles in the narrative that emerged. Even President Trump tweeted that the Fed should not only stop raising interest rates but stop shrinking its balance sheet by now $50 bln a month.

The Federal Reserve has not said very much about its balance sheet. It has not indicated the terminal size, but officials have suggested that it will be larger than before and likely only Treasuries. To once again remove or reduce it as a market factor, it may have to share more of its thinking. What are the considerations that determine the appropriate size of the balance sheet? If a larger balance sheet is needed in the post-regulatory environment, then is there an operational need outside of any monetary policy signal?

Using some conservative assumptions and rough figures, it seems that by the end of this year, or maybe early next year, the balance sheet would around the level that might be sufficient. How it reaches that point and whether it “tapers” as it did with the asset purchases remains open questions. By giving some sense of the endpoint of the balance sheet unwind, the Federal Reserve would be adding to its forward guidance and may help reassure investors that there are still excess reserves in the banking system beyond what is needed or anticipated. The Fed still seems committed to removing these without creating a shortage.

The Powell Fed appears to have interpreted the disconnect with the market as one of communication not one of substance. The median dot plot long pointed to less tightening in 2019 than in 2018. Individuals change their views and the median changes. The fact that the median forecast went from three to two this year shows the adaptive thinking. Patience and flexibility a more attractive package for the substantive action that the Fed is taking.

Tags: #GBP,#USD,Brexit,ECB,Federal Reserve,newsletter,Trade