Numbers from Bizarro-WorldThe past few months have been really challenging for anyone invested in gold or silver; for me personally as well. Despite serious warning signs in the economy, staggering debt levels and a multitude of significant geopolitical threats at play, the rally in risk assets seemed to continue unabated. In fact, I was struggling with this seeming paradox myself. As I kept looking at the state of the markets, I couldn’t help but wonder “what if they just keep kicking the can down the road for the next 20 years, or even longer?” Since the peak in 2011, gold and silver have been in a strong correction period and overall, prices haven’t benefited from all the trillions that have been injected into the markets since 2008. Total credit growth was approximately $80 trillion, climbing from $160 trillion to around $240 trillion in a mere 10 years. |

|

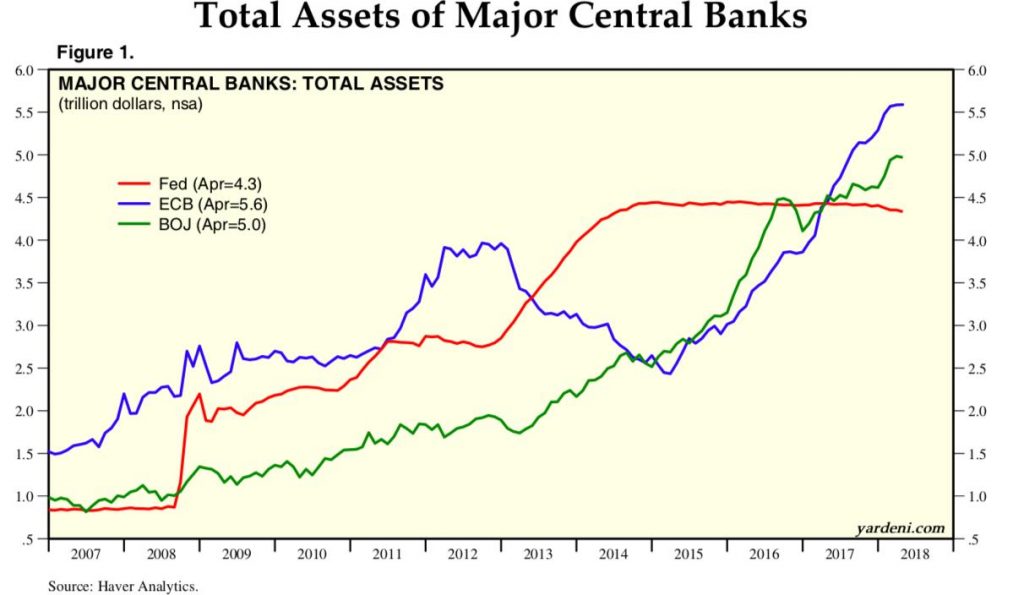

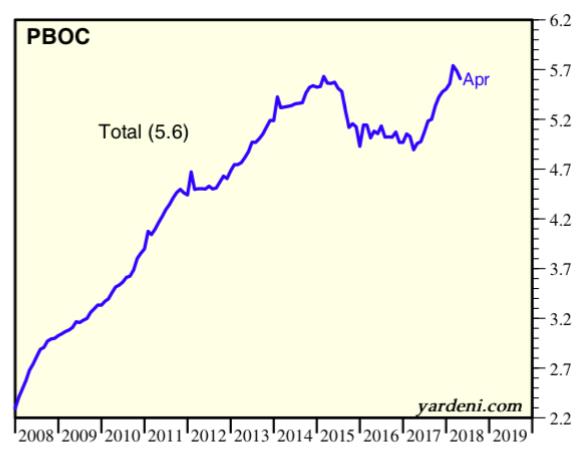

| The major central banks combined increased their balance sheet by buying government and institutional debt from $6 trillion to $21 trillion (FED, ECB, BOJ, PBoC), but none of it went into gold. However, even though these days we read and hear these numbers so often, it is still almost impossible for the true meaning of these sums to really sink in. |

Total Assets of Major Central Banks 2007-2018 |

| A trillion is hard to truly take in and understand; $80 trillion in debt is something already so far beyond our grasp that it might as well be $100, $200, or $300 trillion and it would almost make no conceptual difference. A good way to correct this dissonance is just think about the fact that 1 million seconds are 8 days, 1 billion seconds are 35 years and 1 trillion seconds translate into 32,000 years – bringing us back to the Stone Age. |

PBoC balance sheet 2008-2019 |

Massive Trading VolumeThe volume of paper contracts on gold and silver spiked massively and reached absurd levels, i.e. 500 paper claims leverage per oz ready to be delivered in physical form. On average, the paper gold traded in London in a single day exceeds the entire global production of the metal for that day by 600 times. Looking closely at the leverage in the gold market, it becomes clear that this has been one of the most liquid markets with the highest trading volume for decades. This just proves that the mainstream narrative proclaiming that gold is dead is wrong. On the contrary, one wonders just why this “barbaric relic” commands such incredible trading volume? Unless, of course, those trading it understand that “gold is money, everything else is credit”, to quote JP Morgan. The graph below shows the coverage ratio of the USD monetary base vs US gold reserves. As you can see, the coverage ratio is much smaller than it was back in 1999, meaning that in these terms, gold price is in fact cheaper today than it was at end of the 1990s. Those who missed the last bull market can probably be quite confident that now and in coming months is a good time to buy. |

Gold to Monetary Base 1950-2018 |

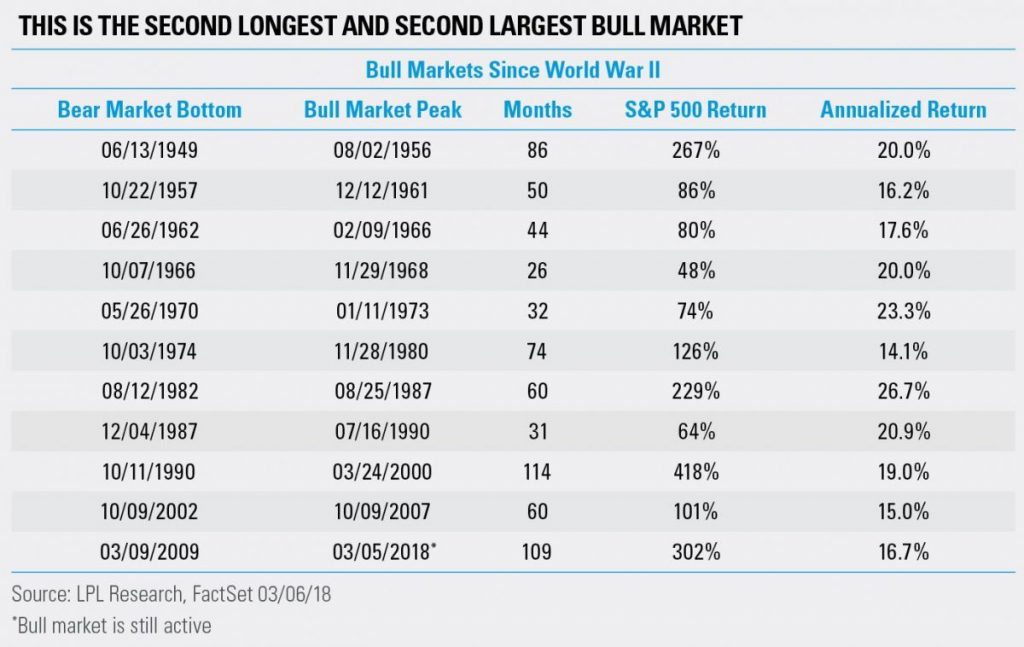

The Importance of CyclesAn incredibly widespread mistake that many people make, even seasoned investors, is buying when prices are rising instead of when prices are still low. This “herd mentality“ or “bandwagon effect” is triggered by the fear of missing out on profits they assume other people will make. The reverse, i.e., panic-selling when prices are hitting rock bottom, instead of holding and waiting, is easily understood as the result of a base instinct to “cut your losses and run”. Attitudes like this have little to do with rational evaluation, or with appreciating the bigger picture. An objective analysis and any worthwhile effort to plan ahead, should take into account the cyclical nature of the markets and the economy under the current system. We have regular booms and busts, fueled by aggressive monetary policies and trillions in debt and thus, it is of the utmost importance to develop an understanding of cycles.From a historical perspective, we have a long-term cycle that is approaching its end: the credit bubble that was kick-started in the US by moving away from the gold standard from 1914 – 1971 and switching to the petrodollar. At the same time, we are also standing at the end of a paper bull market (short-term debt cycle), inflated by trillions in fiat money injections over the past 10 years. The current bull market in equities is by now the second longest in history. lasting for 110 months (the longest one from 1990 – 2000, lasted for 114 months). There may still be some way to go, but the bust phase is definitely drawing closer. The correction in October served as a useful reminder that things may be changing. I believe that this was a signal of transition and that we have now entered the next phase in the cycle, switching from a “managed bull market” to a “managed bear market”. There is no doubt that the FED and other central banks try to avoid hitting the iceberg this time, however, the outcome will lead to losses for participants in the stock market and negative consequences for the economy. The formerly bubbling real estate market is already showing clear signs of the deleterious effects of cheap credit, which is nothing more than a financial illusion. Significantly lower prices are more likely than the other way around. It is essential for investors to understand what a bubble is and to be able to identify it in due time. Once clarity on this issue is achieved, it is easier to adopt a contrarian approach, i.e., to sell the bubble and buy what is undervalued and cheap. This case can be very confidently made for gold today. The current bull market in stocks is approaching a cliff edge. Every bubble is followed by a downswing and based on the historically unprecedented amount of credit in the system a massive, equally unprecedented bust is in the cards. We may not know when exactly it will happen and trying to divine the future on this level of detail or to time the market with precision has largely been proven to be a fool’s errand. However, the uptrend in the stock market seems to be running out of steam. Volatility is back with a vengeance and even the most complacent stock market speculators are starting to have doubts over how much longer the party on Wall Street can last. What can be said with certainty is that once a reversal is underway, it will be characterized by a massive shift away from a wealth creation toward a wealth preservation attitude. The risks are enormous and precious metals are among the few things that offer accessible, straightforward and reliable protection from the eventual fallout. |

Historical bull markets in the S&P 500 Index. |

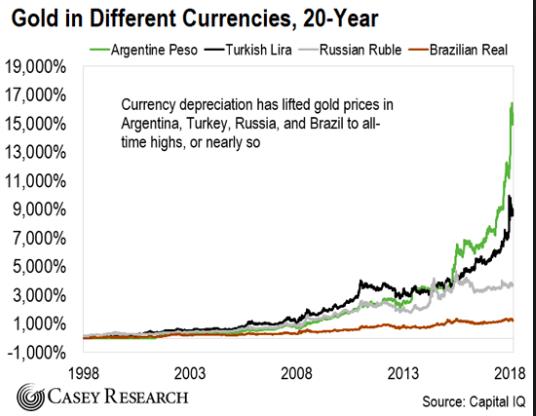

A Sea of Troubles – What to ExpectThe graph below paints a very telling picture, perhaps foretelling one as well. In a nutshell, it simply illustrates what happens when people lose faith in their currency. The devaluation in a number of emerging market currencies is only the latest confirmation of the historical relationship between fiat money and gold. People might be persuaded to forget about precious metals for some time, but when their fiat money crumbles, as is its wont, gold prices rise, as one would Gold always prevails over fiat money during times of financial stress and currency devaluation. The USD is still the predominant world reserve currency, with 65% of global central bank reserves held in USD, as most countries are still backing their local currencies with the Dollar. However, USD dominance on this scale also means it is the biggest bubble of all and most likely will be the last one to pop before we enter into an era of hyperinflation and the destruction of the current debt-based monetary system. |

Gold in Different Currencies, 20-Year |

| As Ray Dalio noted in this context in a recent interview:

|

Gold vs SPX over the past month |

| Nevertheless, it is also a well known fact that shares and bonds are inversely correlated; when one rises, the other decreases and vice-versa. For a while, bonds lost their attraction for investors, but now that stock prices are close to an all-time high and market participants are starting to feel uncomfortable with their valuations, a move back into bonds may be in the offing.

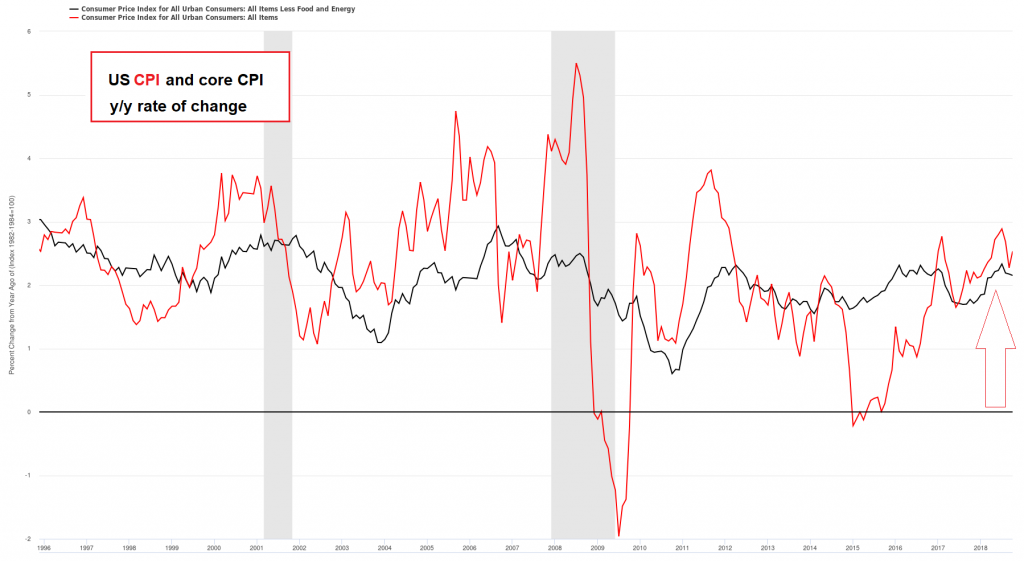

Central banks meanwhile understand that they have to increase interest rates even further to keep price inflation from picking up. |

US CPI and Core CPI 1996-2018(see more posts on U.S. Consumer Price Index, ) |

This leads us to a potentially deflationary environment for all countries except for the US. Global liquidity is tightening further with higher interest rates and a potential dollar shortage. These conditions are bound to finally expose the illusions in the stock market and may accelerate bond purchases – especially of US treasury bonds.

The biggest and only market which can absorb huge capital flows will be the US, as the ECB keeps postponing interest rates hikes. Therefore, the US might benefit in the short-term, while emerging markets as well as the EU will suffer. As money flows out of these markets and into the US, the missing liquidity in the euro zone will have a strong impact on the banking system that has few buffers in place and is built on dangerously fragile foundations.

Right now, we are down to a mandatory 1% of reserves for banks within the euro zone, meaning the fractional reserve system theoretically has been and still is able to print an additional €100 million for every €1 million deposited in the banking system.

There is an abundance of additional risks for the monetary union. Political friction continues unabated, social and economic tensions persist in dividing the population within member states and throughout the EU. The new government in Italy, Angela Merkel’s weakening leadership, Brexit and the ticking time bomb that is the Visegrad group currently make for a toxic cocktail.

Trade wars will only add to the problem, and so will the sustained geopolitical tensions with the East. Eventually, the combined pressures will inevitably lead to a shrinking economy. Higher interest rates could even lead to credit defaults among large multinationals. Think for example about AT&T and the impact of steadily rising interest rates on its $250 billion debt burden.

Today numerous so-called “Zombie companies” exist around the world, which are only viable due to cheap credit and low interest rates. Approximately 10% of all companies in the euro zone are falling under that description.

Conclusion

As is historically the case, the biggest bubbles are generated and perpetuated by governments. This time is no different, with the US being the main driver. Whenever a system over-centralizes, the periphery breaks apart first. Repayment of US debt is extremely difficult with a stronger dollar and refinancing is becoming a problem.

Of course, a rising USD will put pressure on the gold price in the short-term. However, short-lived fluctuations like this don’t really matter when one considers the big picture. If anything, they present a rare buying opportunity, as long as one doesn’t fall into the timing trap.

Waiting on the sidelines, trying to predict the right time and attempt to buy exactly when gold reaches its bottom can turn out to be a costly mistake. When the USD-centric system breaks apart, you may be surprised how fast it will go and how hard it will become to buy physical gold or silver. Therefore, preparation rather than futile prediction is a wiser approach.

This is an edited version of an article by Claudio Grass that originally appeared at the Pro Aurum Newsroom and is reprinted with permission. ProAurum is a leading precious metals company in Europe with an independent subsidiary in Switzerland. All rights remain with the author and ProAurum.

Charts by Haver Analytics/Ed Yardeni, macrotrends.net, LPL Research/Fact Set, Casey Research, stockcharts, St. Louis Fed

Editing and chart & image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: central-banks,Chart Update,newsletter,On Economy,On Politics,Precious Metals,U.S. Consumer Price Index