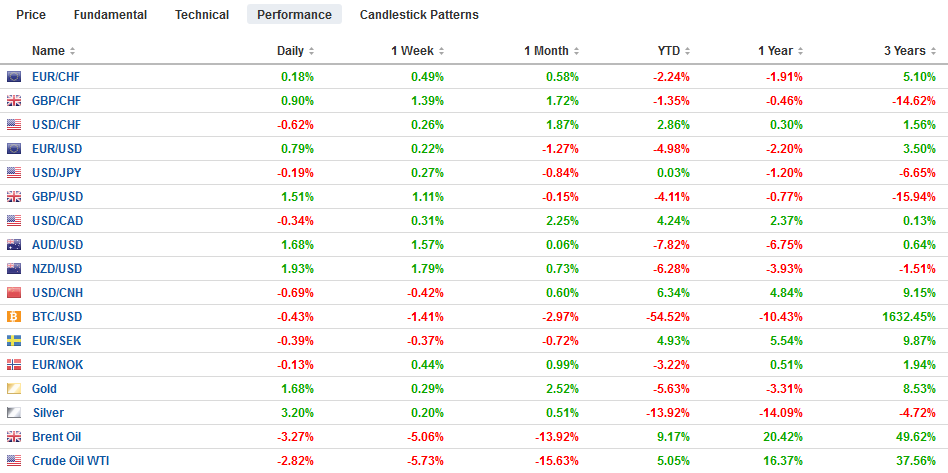

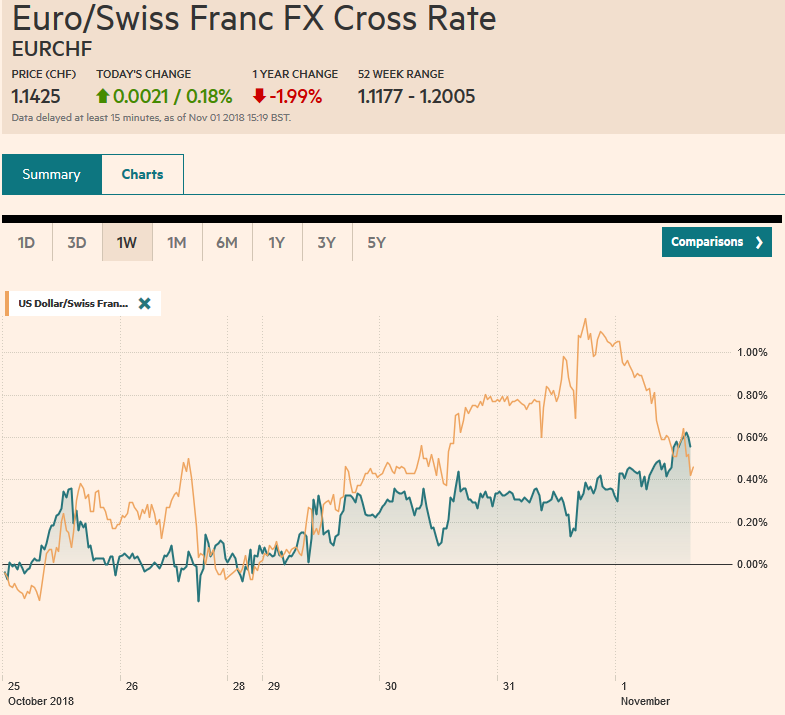

Swiss FrancThe Euro has risen by 0.18% at 1.1425 |

EUR/CHF and USD/CHF, November 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It appears that month-end considerations deterred the dollar selling that the technical indicators warned was coming and as the new month starts, the dollar is offered. It is weaker against all the major currencies and most of the emerging market currencies. The two main developments include progress on the EU-UK Brexit negotiations that will allow UK banks to have access to EU markets after the end of next March and China’s Caixin manufacturing PMI held above the boom/bust 50-level and the Politburo agreed yesterday on new stimulus, and Chinese shares both the mainland and H-shares in Hong Kong were among the strongest performers today and record amount of Chinese stock (~$1.2 bln) was bought through the HK-link today. In Europe, the Dow Jones Stoxx 600 is extending its advance for a fourth consecutive session, but the currency-sensitive FTSE 100 is being weighed down by sterling’s sharp rally today, ahead of the Bank of England. Core bond yields are edging higher, while European peripheral yields are lower, led by the continued recovery of Italy. Oil prices are trading lower for the fourth session and WTI for December delivery is below its 200-day moving average (~$65.40) for the first time this year. January Brent is holding just above its 200-day moving average. |

FX Performance, November 01 |

Asia-Pacific

Nothing, in particular, sparked the dollar’s setback in Asia. The S&P 500 gapped higher yesterday and did not fill it, but the upside momentum was not sustained. It is set to open near the middle of yesterday’s range. At the end of last week, the dollar probed the JPY111.40 support area. Yesterday it traded near JPY113.40, matching its highest level since October 8. While most Asian manufacturing PMIs were softer, Japan’s final estimate was reported, and although it was not as strong the flash reading, the 52.9 reading was the highest since May. India’s manufacturing PMI also bucked the regional trend, rising from 52.2 to 531. China’s Caixin manufacturing PMI edged to 50.1 from 50.0.

Australia reported strong trade figures. The September trade surplus widened to A$3.0 bln, nearly twice what economists expected and the August surplus was revised almost 50% higher to A$2.3 bln. The terms of trade were also favorable in Q3, with the index of export prices rise 3.7% (after 1.9% increase in Q2). The index of import prices rose 1.9% (following 3.2% increase in Q2). The Australian dollar’s 1.2% bounce could be the biggest advance of the year if it is sustained. The Aussie is testing the $0.7170 area, the main obstacle in front of $0.7200 and the October highs near $0.7250.

Stronger house prices in New Zealand allowed the Kiwi to track the Aussie higher. It has bounced a cent from yesterday’s lows near $0.6515. It has not closed above $0.6600 since October 1. The next technical objectives are found near $0.6670 and then $0.6700.

Europe

The Bank of England will not change rates today, but it will adjust its economic forecasts. Growth projections may be shaved while inflation may be lifted. However, optimism over Brexit is overshadowing a standpat BOE. The UK and EC have been moving toward an agreement, and the UK’s chief negotiator suggests a deal could be struck within three weeks. Prime Minister May first wanted a consensus among her cabinet, but this proved elusive, and she shifted gears to securing EU deal first. However, the problem, as we have noted, is the closer May and the EU positions become the more strained is the domestic support. This is what we suspect will play out in the coming months. Just like the UK chose one person to wage WWII and another for peace, similarly, May could negotiate the divorce and then another is chosen to negotiate the new relationship. Sterling is enjoying the single biggest daily advance in more than two months. It was up a little more than 1% as it tested the $1.29 area before consolidating ahead of the BOE meeting. The UK manufacturing PMI was softer than expected (51.1 vs.53.6 in September revised from 53.8) and is the lowest in two years. This too encouraged some intraday longs to book profits. Resistance is seen in the $1.2965 area.

The euro is also enjoying a bounce after the year’s low near $1.13 held. News from the eurozone has been light. Italy still has two weeks to formally respond to the EC’s demand for a revised budget. News that the economy stagnated in Q3 before the full impact of the rise in yields is felt seems may have sparked harsh words by the Bank of Italy Governor, who is risking a confrontation with the government. Meanwhile, many observers are still digesting the news from Germany earlier this week that Merkel will not seek re-election as head of the CDU next month nor a post in the EU when her term a chancellor is complete. When her predecessor (Schroeder) divided the roles in the SPD, Merkel at the time recognized the weakness that it signaled. It depends on who heads up the CDU whether it is likely Merkel completes her term.

A battle will be waged at the $1.1400 level for the euro. The short-squeeze has lifted the euro toward $1.1390. There is are 4.1 bln euros in options struck at $1.14 that expire today and another 2.6 bln euros in at the same strike tomorrow.

Americas

The US has a full calendar of economic reports today. They include the ISM and PMI, construction spending, and weekly initial jobless claims. The US also reports Q3 unit labor costs and productivity, which while typically not market movers, offer insight into the competitiveness of the economy. Perhaps the most important data point ahead of tomorrow’s jobs report is October auto sales. After a 17.4 mln unit pace in September, mos to observers are looking for moderation to 17.0 mln. Vehicle sales have averaged 17.04 mln a month this year and 17.16 mln last year.

Markit reports Canada’s manufacturing PMI, but market participants are more familiar with the IVEY survey. Ahead of tomorrow’s trade and jobs data, the Canadian dollar may be at the mercy of the general US dollar direct. After encountering offers near CAD1.3170, the US dollar has backed off and is being pressed below CAD1.31. Initial dollar support is now seen near CAD1.3060.

The S&P 500 gapped higher yesterday. The gap is important from a technical perspective. It is found roughly between 2685 and 2705. Technicians recognize different types of gaps. A normal gap is closed relatively quickly. It could be a break-away gap that signals a beginning of a new move. Alternatively, it could be a measuring gap, that often takes place near the middle of a move, which in this case could signal an advance toward 2800.

The Mexican peso is recovering from yesterday’s shellacking following Fitch’s cut in Mexico’s credit outlook to negative. It cited policy uncertainty following the cancellation of the partly built airport. Moody’s downgraded the airport bonds, and S&P put it on negative watch. The MXN20.00-MXN20.04 area marks the initial technical retracement objective. Many investors are skeptical of the fiscal discipline of the AMLO’s administration, but many institutional investors were long peso-denominated paper and speculators were net long pesos in the futures market. AMLO does not take office for another month.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,$JPY,EUR/CHF,MXN,newsletter,SPY,USD/CHF