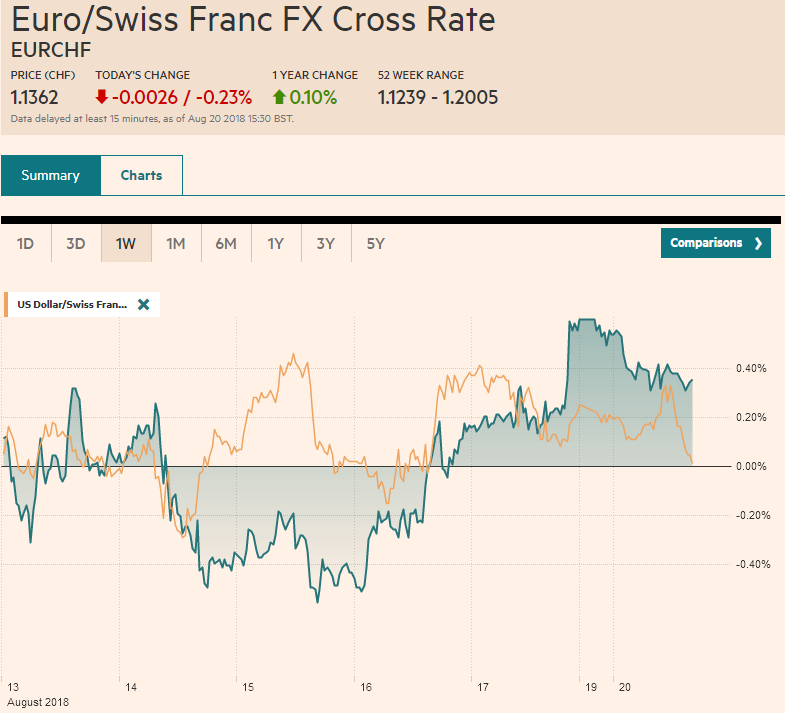

Swiss FrancThe Euro has risen by 0.11% to 1.1348. |

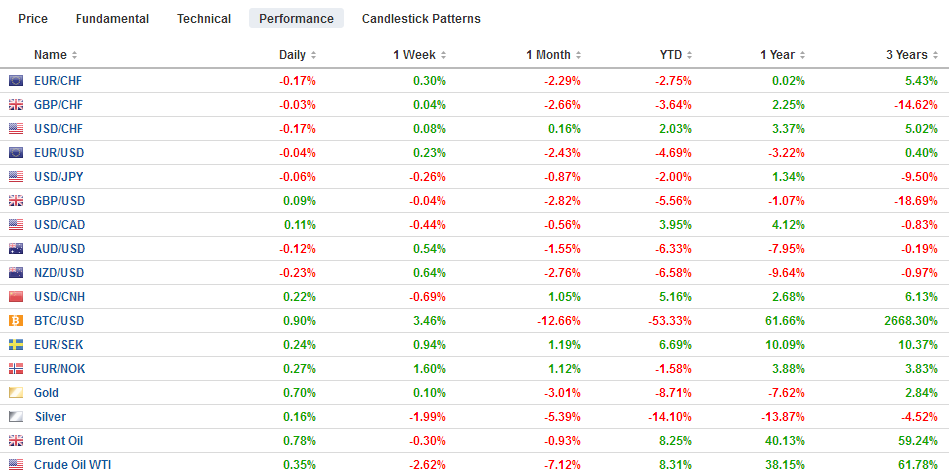

EUR/CHF and USD/CHF, August 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is slightly firmer against most of the major currencies, as the light participation and lack of fresh news see a consolidative tone emerge after the pullback at the end of last week. Although markets in Turkey are closed for a nearly week-long holiday, it has not prevented the lira from weakening. After closing a little below TRY6.02 before the weekend, the greenback has moved to TRY6.15 in the European morning. Turkey reported signed an fx swap agreement with Qatar but whatever support for sentiment that this may have generated was offset by news that the US rejected the offer of Turkey to released the pastor in exchange for dropping the investigation into Halkbank for violating sanctions against Iran. The TRY6.4665 is the 50% retracement of last week’s dollar pullback, and the 61.8% retracement is nearer TRY6.65. The euro’s three-day advance is at risk. It was unable to extend last week’s recovery and met a wall of sellers ahead of $1.1450. There are options for 674 mln euros struck in the $.1445-$1.1450 area that expire today and correspond to the cap seen in Asia. Europe has followed suit and pushed the euro to session lows near $1.1400. Support is seen ahead of $1.1380. The dollar is about a quarter of a yen range, less than a 15 tick range on either side of JPY110.55. It consolidates in the lower half of the pre-weekend range. Resistance is seen in the JPY110.70-JPY110.80 area. Large options expiring today ($1.6 bln at JPY110 and $1 bln at JPY111) makes the broader range. Japanese shares slipped a third of a 1%, while most of the region, including China, advanced. The MSCI Asia Pacific Index nearly 0.4%. |

FX Performance, August 20 |

The Shanghai Composite rose 1.1% to snap a five-day 4.5% slide. The index has slipped below the end of 2016 levels before state-backed funds reportedly entered the market. Turnover in China’s mainland equity markets fell to the lowest level in six months today. Given that the market is dominated by retail investors, the low volume is thought to reflect the negative psychology. The yuan rose in China for the third consecutive session. The PBOC again strengthened it at the fix and yuan rose 0.5% today. The offshore yuan were it easier to speculate is off 0.15%. Recall that last Thursday there had been talk of official action in the offshore market and the offshore yuan (CNH) jumped more than 1.2%, the most in more than 18 months, and there was a nearly 0.4% rise on follow-through buying ahead of the weekend.

Last week’s alternating gains and losses in European equities spills into this week. Before the weekend, the Dow Jones Stoxx 600 slipped 0.1% after gaining almost half a percent the day before. The benchmark is up 0.6% in late morning turnover. Nearly all sectors are higher, led by the 1.5% gain in materials and 1.15% gain in energy. It has fallen for the past three weeks, during which time it has lost almost 3%.

Italian bonds, which underperformed last week are leading peripheral yields lower today. The 10-year Italian benchmark yields are off 3.5 bp, while Spanish and Portuguese yields are off a little more than two basis points, and Greece, whose third aid package officially ends today, is off less than almost two basis points. However, Italian bank shares are under mild pressure, extended their losing streak to an eighth consecutive session, and Italian stocks more broadly are not participating in today’s firmer equity tone.

Sterling has been confined to about a 30 point range. It continued to encounter selling pressure as it did in the last couple of sessions a little above $1.2750. Technically, there appears to be scope for a limited push through there soon. Brexit negotiations resume tomorrow, and preparations for a Brexit without an agreement continue to weigh on sentiment. Meanwhile, Rightmove reported the sharpest drop in house prices (asking) this year (2.3%) and is the second consecutive monthly decline. The year-over-year pave of 1.1% matches the lowest of the year and has only been lower once since early 2012.

There is little on the calendar for North America today. In lieu of economic data, the market may give some attention to the Fed’s Bostic speech on the economic outlook. He is a dove among the regional Fed Presidents. The Bundesbank’s Weidmann also speaks during the North American time zone. The highlight of the week is the Jackson Hole symposium, where Powell will speak Friday morning. The confab’s theme this year is Changing Market Structure and the Implications for Monetary Policy. No ECB executive board members are expected to present.

The Canadian dollar was boosted before the weekend by the firmer than anticipated headline CPI reading (3.05). It is consolidating those gains today. The US dollar to where it had found bids earlier in the week (~CAD1.3050), and it remains above there today. Initial resistance is seen in the CAD1.3080-CAD1.3100 area. Although the core rates of inflation were mostly flat, the market’s confidence in a Q4 rate hike was boosted by the CPI.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD $GBP,$CNY,$EUR,$JPY,EUR/CHF,newsletter,USD/CHF