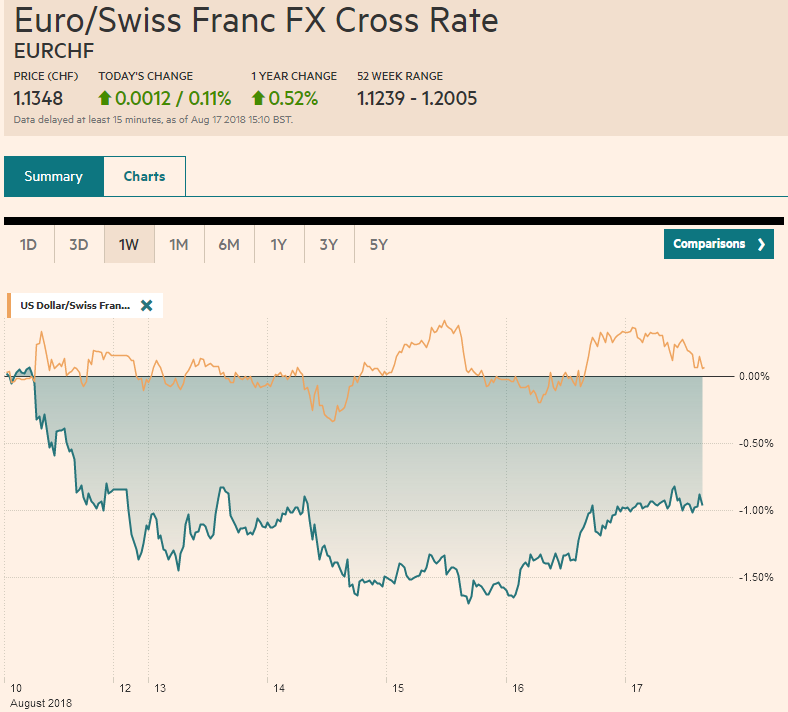

Swiss FrancThe Euro has risen by 0.11% to 1.1348. |

EUR/CHF and USD/CHF, August 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is trading heavily against most of the world’s currencies today. The main exceptions come from the emerging markets where the Turkish lira, Russian ruble, and Mexican peso are the chief exceptions, and their losses are modest. This week’s dollar gains are being pared in largely corrective activity and amid a light news stream. The threat of more sanctions on Turkey if it does not release the American pastor is helping the dollar recoup yesterday’s losses and puts it back near TRY6.0. Turkey has adjusted its policies to make it harder to short the lira, and Qatar signaled it would invest $15 bln. However, the unorthodox policies have not been addressed, and even if the lira were to stabilize here, the effect of the dramatic slide would work its way through the economy. Nearly three-quarters of its current account deficit, for example, is energy and the cost has surged in lira terms. Without corrective policy, domestic demand will suffer, and inflation will rise. The external sector will improve over time, as the weak domestic demand curbs imports and the weaker lira boosts exports. The PBOC fixed the yuan higher today (~50 pips), ending a six-day streak of weaker fixes. It is the second consecutive session the yuan is firmer. Some observers are linking efforts to stabilize the yuan as part of the preparation for a resumption of trade talks in Washington. We are less convinced that that is their motivation. If the US strategy is maximizing pressure even as negotiations are announced ( and the US issued a new threat that China itself could be subject to sanctions if it does not respect the US oil embargo against Iran starting in November), then it does not make sense to look for China to seem soft. |

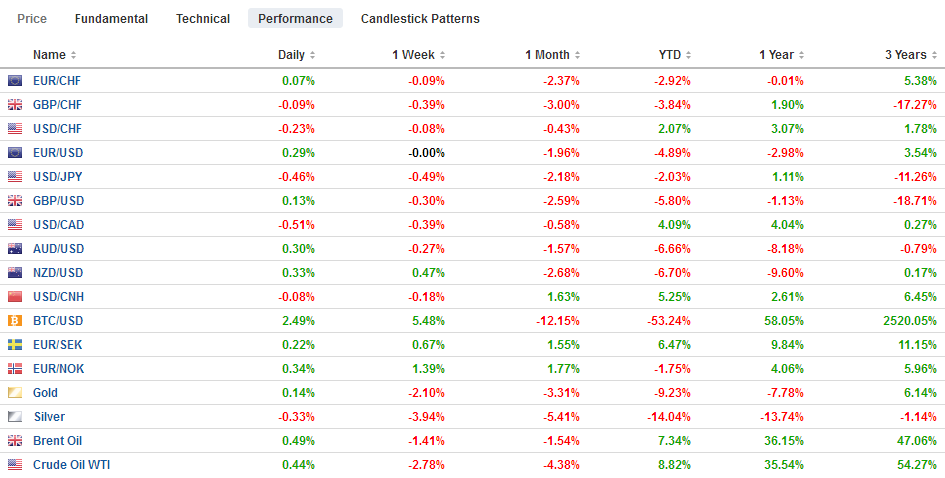

FX Performance, August 17 |

Efforts to moderate the yuan’s decline began before the trade talks were announced. Lower Chinese rates seemed to have encouraged yuan weakness. China’s 10-year government bond yield rose for the second consecutive week, and the 19 bp increase puts the yield at its highest level in two months. Short-term Chinese rates are also stabilizing, which may also help take some pressure off the currency. Three-month SHIBOR edged higher for the fourth sessions today. Before this run three-month SHIBOR had eased every day since mid-June.

Rising rates may help the yuan but it does nothing for Chinese stocks. The MSCI Asia Pacific Index followed the US lead and advanced today by 0.5% (to pare this week’s loss to about 2.15%). Chinese stocks bucked the regional trend, and the Shanghai Composite fell 1.35% to cap a week in which it fell in every session for a 4.5% drop. It closed at its lowest level since March 2016, which is when it bottomed from the dramatic sell-off that began in June 2015.

European shares are narrowly mixed, and this is reflected in a flattish Dow Jones Stoxx 600. The benchmark is off about 1% for the week, and this would be the third weekly decline after rising every week last month. Italian shares have underperformed this week. The 3% fall brings the index to its lowest level since April 2017. Italy’s bank share index fell 5.3%, bringing the three-week downdraft to about 12.5% to break out of two-month consolidation. Italy’s 10-year bond yield is edging up today and for the week and the fifth consecutive week to establish a hold above the 3.0% threshold.

A handful of weeks ago, President Trump decried the currency manipulation of Europe and China that was producing a strong dollar. Six months ago, Treasury Secretary Mnuchin was understood to have talked the dollar down. It seemed reasonable then to be on guard for another headline bomb as the dollar was surging to new highs against a wide array of currencies of developed as well as emerging market economies.

Sure enough, the tweet came, but it seemed like a complete about-face. Trump wrote,” Money is pouring into our cherished DOLLAR like rarely before.” Shortly thereafter economic adviser “King Dollar Kudlow” recognized that the dollar’s strength reflected confidence in US policies. What to make of this?

At the risk of being too cynical, can we suggest that perhaps the President did not write this tweet? It seems out of character for him to qualify his superlative “like rarely before.” The US President does not do that. The qualification recognizes that we have seen dollar rallies in the past, and the last time Kudlow was in the White House, Reagan was President. The policy mix was similar (looser fiscal policy and tighter monetary policy), and the dollar had its first post-Bretton Woods rally. The implication of this is that less supportive dollar comments may still be forthcoming, perhaps as some businesses begin cautioning that the strong dollar is eroding their overseas profits and is boilerplate stuff for business journalists.

The euro is nudging higher against the dollar for the third consecutive session, but it struggles to sustain upticks above $1.1400 and sellers seems to be lurking ahead of the week’s high a little above $1.1430. Given the dearth of fresh news, the option expires may influence the price action. There are options in the $1.1400-$1.1405 for 1.56 bln euros that will be cut today. There is are a little more than 550 mln euros at a $1.1425 strike, and 1.1 bln euros struck at $1.1450 that expire today.

The dollar cannot make much headway against the yen. Like yesterday, it remains within Wednesday’s range (roughly JPY110.45-JPY111.45). There is a JPY110.50 option for $2.2 bln that will be cut today which is particularly relevant. A $1.2 bln option stuck at JPY110 seems too far away as is the $750 mln in options struck in at PY110.80-JPY110.90.

Sterling remains pinned near its lows and remains within about half a cent band either side of $1.27. Outside of a brief dip in early Asia, sterling has held above $1.27 today, but there seems to be little appetite to drive it higher. Given the technical condition, we would not be surprised to see some limited range extension to the upside.

The US dollar has been meeting offers this week around CAD1.3170. After the US dollar rallied from CAD1.3050 to CAD1.3175 in the middle of the week, it has been consolidating in the upper end of that range. A $570 mln option is struck at CAD1.3170 that expires today. Also, CAD1.3145-CAD1.3150 hold $1.71 bln in an option that expires today. Canada reports July CPI figures today. A 0.1% increase, the same as in June, would keep the year-over-year pace steady at 2.5%. The common core measure may tick up to 2.0%. A second rate hike this year remains likely in Q4.

The US economic calendar is light, featuring the Leading Economic Indicator, which is expected to rise by about 0.4% after a 0.5% rise in June. The preliminary August University of Michigan consumer sentiment survey will also be released, and the inflation expectations will be watched (and compared with July’s 2.9% one-year outlook and 2.4% for the longer-term).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,newsletter,USD/CHF