Home › 1) SNB and CHF › 1.) SNB Press Releases › SNB reports a profit of CHF 5.1 billion for the first half of 2018

Previous post

Next post

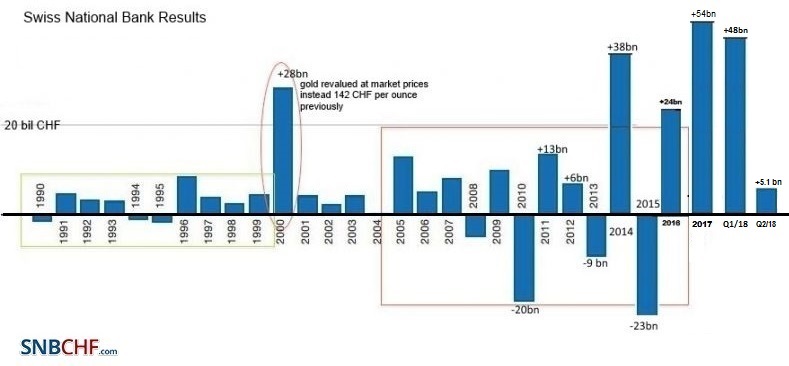

SNB reports a profit of CHF 5.1 billion for the first half of 2018

The increasing volatility of SNB Earnings

Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings.

But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse.

Good years of the Credit Cycle

This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now.

Franc will rise again with crisis or inflation

With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again.

And this at an exchange rate that is not digestible for the SNB.

We considered that after an inflationary period the

- EUR/CHF will fall to 0.90

- and USD/CHF to 0.75.

And this will lead to a massive SNB loss around 150 billion CHF. |

SNB Results Longterm Q2 2018 - Click to enlarge |

Some extracts from the official statement.

Annual result of the Swiss National Bank for 2017

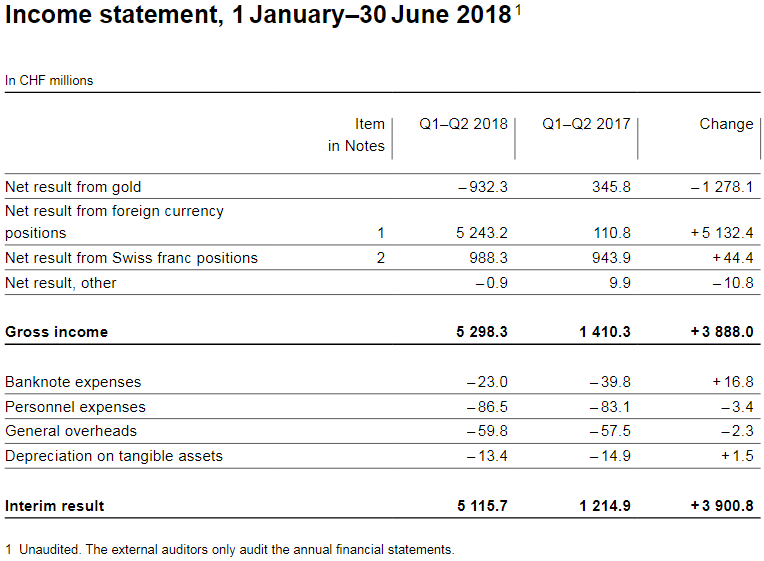

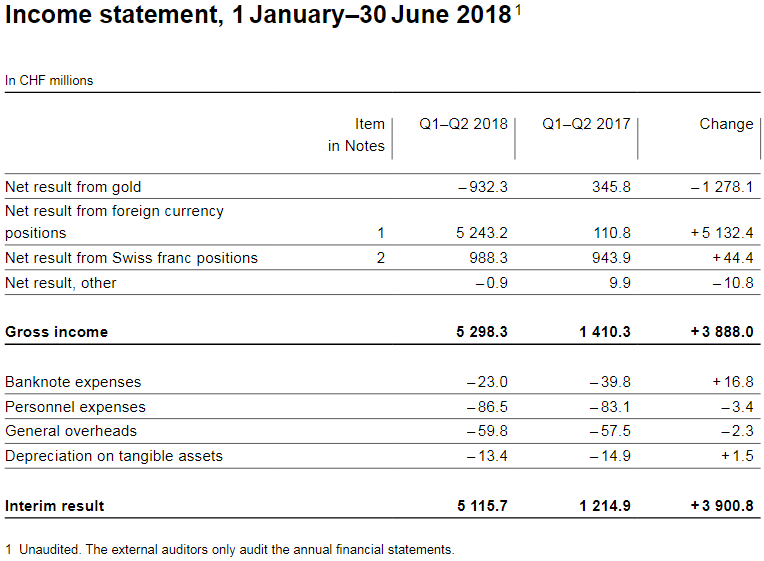

The Swiss National Bank (SNB) reports a profit of CHF 5.1 billion for the first half of 2018.

A valuation loss of CHF 0.9 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.2 billion. The profit on Swiss franc positions was CHF 1.0 billion.

The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

|

Income statement, 1 January–30 June 2018 Source: snb.ch - Click to enlarge |

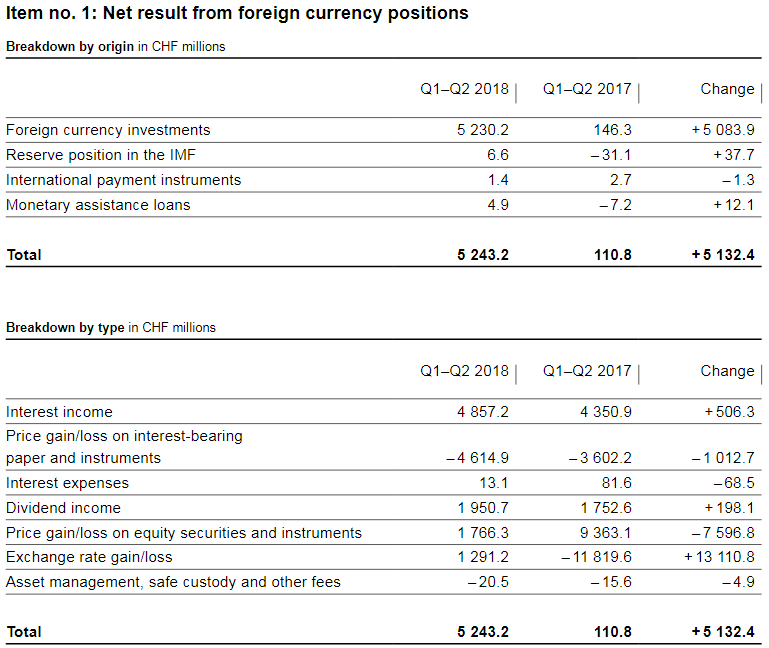

Profit on foreign currency positions

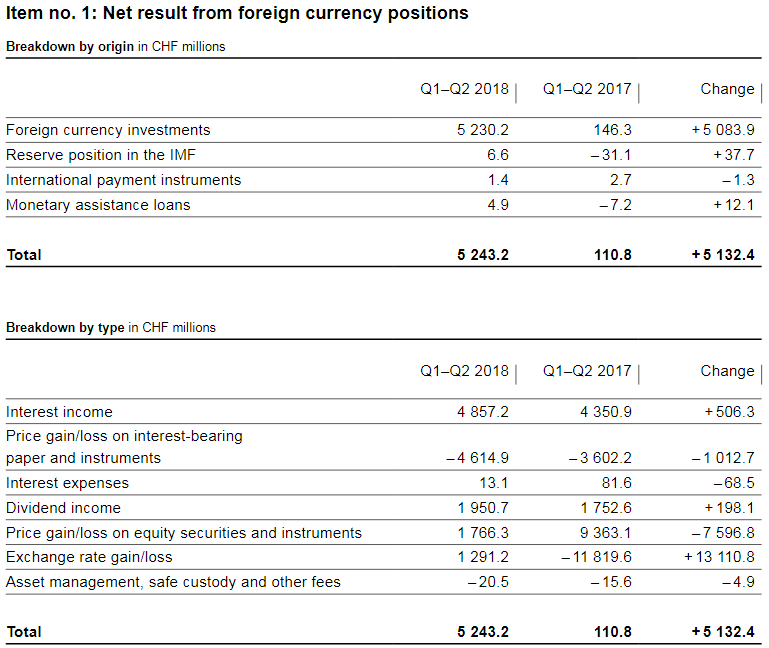

The profit on foreign currency positions amounted to CHF 5.2 billion.

In terms of current income, interest and dividend income contributed CHF 4.9 billion and CHF 2.0 billion respectively. There was a divergence between bond and equity valuations. Price losses of CHF 4.6 billion were recorded on interest-bearing paper and instruments. By contrast, price gains on equity securities and instruments came to CHF 1.8 billion. Exchange rate-related gains totalled CHF 1.3 billion.

SNB results Q1-Q2 2018

(in bn CHF) |

Profit |

BalanceSheet |

Profit in % |

| Total Profit on foreign currencies |

5.2 |

836.2 |

0.62% |

| Interest income (coupons) |

4.9 |

836.2 |

0.59% |

| Dividend income |

2.0 |

836.2 |

0.24% |

| Price changes in bonds |

-4.6 |

836.2 |

-0.55% |

| Price changes in equities |

1.8 |

836.2 |

0.22% |

| Exchange Rate Gains |

1.3 |

836.2 |

0.16% |

|

SNB Profit on Foreign Currencies Source: snb.ch - Click to enlarge |

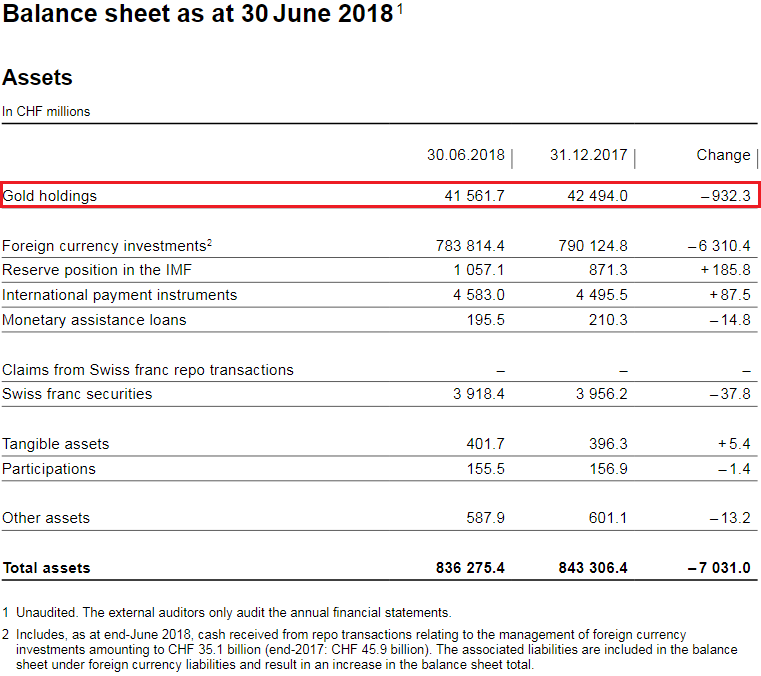

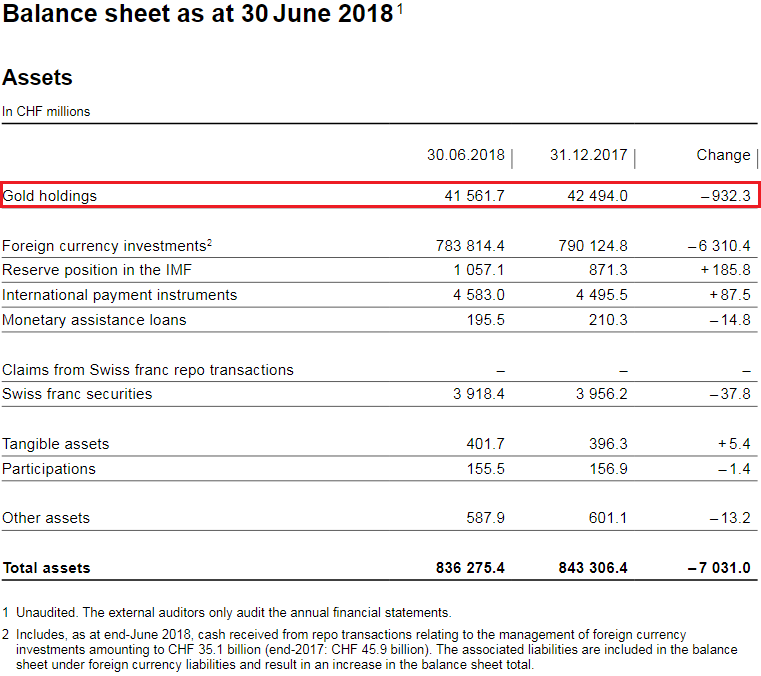

Valuation gain on gold holdings

A valuation loss of CHF 0.9 billion was registered on gold holdings, which remained unchanged in volume terms. Gold was trading at CHF 39,963 per kilogram at end-June 2018 (end-2017: CHF 40,859).

SNB Results 2017

(in bn CHF) |

Profit |

Balance Sheet |

Profit in % |

| Total Profit on Gold………………………….. |

-0.9 |

836.2 |

-0.11% |

Percentage of gold to balance sheet

The percentage of gold compared to the total balance sheet is falling.

SNB Balance Sheet items

(in bn CHF) |

2018 Q1-Q2 |

2017 |

2016 |

2015 |

| Gold……………………………………… |

41.5 |

42.5 |

39.4 |

35.5 |

| Total Balance Sheet |

836.2 |

843.3 |

746 |

640 |

| Gold in % of Balance Sheet |

4.96% |

5.04% |

5.28% |

5.55% |

Balance Sheet

The balance sheet has expanded by over 68.3 bn. francs by 8.81%.

|

2018 Q1-Q2 |

2017 |

Increase in % |

| SNB balance sheet in CHF………………. |

836.2 |

843.3 |

-0.84% |

| Swiss nominal GDP in CHF |

668.1 |

659 |

1.38% |

| % of GDP |

125.1% |

127.97% |

|

|

SNB Balance Sheet for Gold Holdings for Q1-Q2 2018 Source: snb.ch - Click to enlarge |

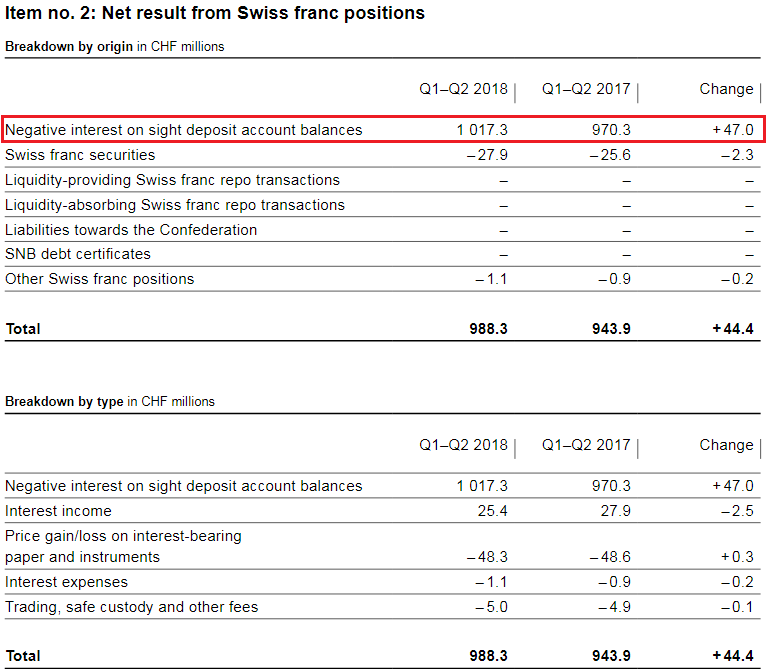

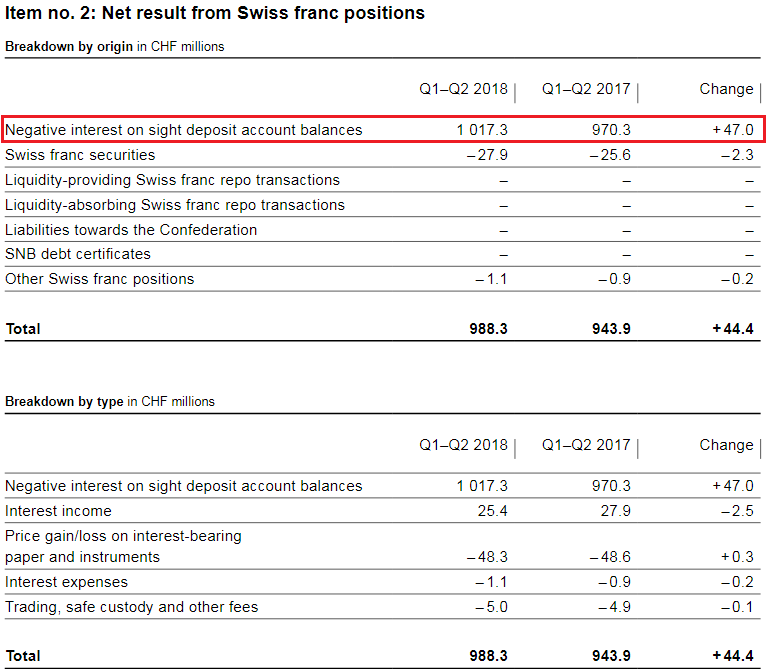

Profit on Swiss franc positions

The SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

The net result from Swiss franc positions, which totalled CHF 1.0 billion, largely resulted from negative interest charged on sight deposit account balances.

Negative Interest rates

Furthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

2018 Q1-Q2 |

2017 |

Change in % |

| Income through negative interest rates |

1.0 |

2.02 |

-50.50% |

| SNB balance sheet |

836.2 |

843.3 |

-0.84% |

| in % of balance sheet |

0.12% |

0.24% |

|

|

SNB Result for Swiss Franc Positions for Q1-Q2 2018 Source: snb.ch - Click to enlarge |

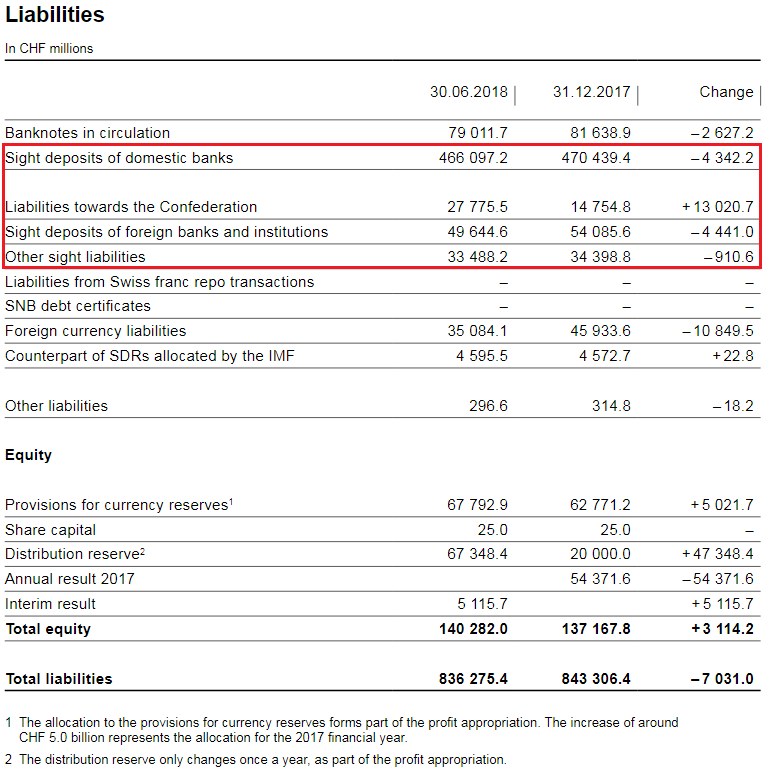

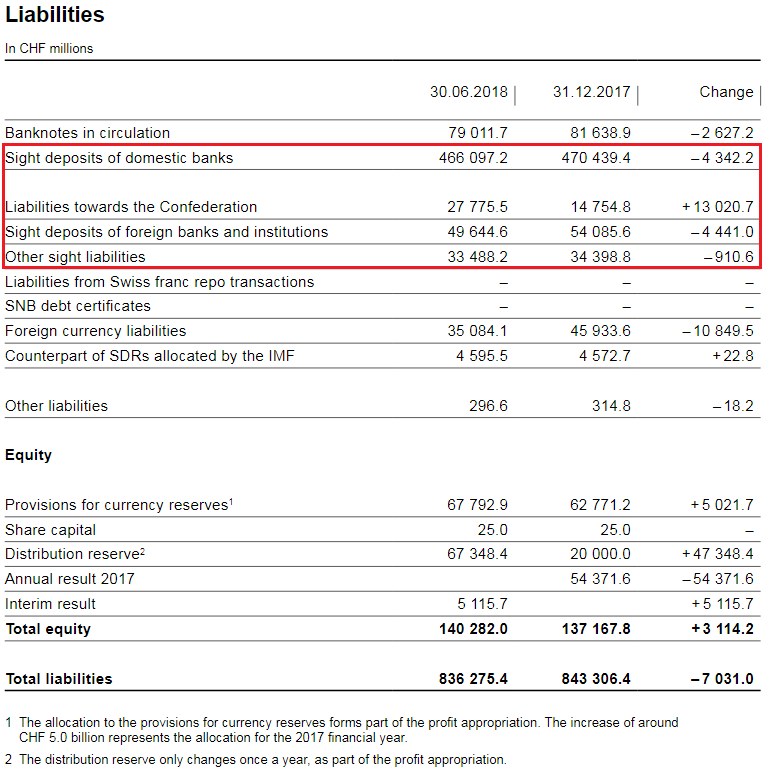

SNB Liabilities

Electronic Money Printing: Sight Deposits

Sight deposits is the biggest part of SNB interventions.

|

2018 Q1-Q2 |

2017 |

Change in% |

| Total Sight Deposits |

576.9 |

573,7 |

0.56% |

| Balance Sheet |

836.2 |

843.3 |

-0.84% |

| % of balance sheet |

68.99% |

68.03% |

|

Paper Printing

Banknotes in circulation: -2.6 bn francs to 79 bn. CHF

The old form of a printing press, today a less important form of central bank interventions.

Provisions for currency reserves

As at end-June 2018, the SNB recorded a profit of CHF 5.1 billion before allocation to the provisions for currency reserves.

In accordance with art. 30 para. 1 of the National Bank Act (NBA), the SNB is required to set aside provisions permitting it to maintain the currency reserves at the level necessary for monetary policy. The allocation for 2018 will be determined at the end of the year.

|

SNB Liabilities and Sight Deposits for Q1-Q2 2018 Source: snb.ch - Click to enlarge |

Full story here

Are you the author?

George Dorgan (penname) predicted the end of the EUR/CHF peg at the CFA Society and at many occasions on SeekingAlpha.com and on this blog. Several Swiss and international financial advisors support the site. These firms aim to deliver independent advice from the often misleading mainstream of banks and asset managers.

George is FinTech entrepreneur, financial author and alternative economist. He speak seven languages fluently.

Previous post

See more for 1.) SNB Press Releases

Next post

Tags:

newslettersent,

SNB balance sheet,

SNB equity holdings,

SNB Gold Holdings,

SNB profit,

SNB results,

SNB sight deposits,

Swiss National Bank

Permanent link to this article: https://snbchf.com/2018/07/snb-interim-results-q2-2018/